Not a buy or sell recommendation. Disc: Bought in the last 30 days

Here is my thesis

Thesis

About the business

Sky gold is a B2B business that manufactures designs for jewellery retailers like Malabar, Kalyan etc.It is a proxy to the gold jewellery and is mainly catering to the domestic market, however they are in talks to produce for retailers in Malaysia and some gulf countries as well.

Revenue growth

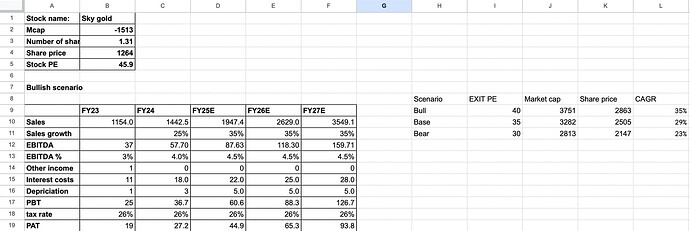

The company produced around 250-300 kgs per month of gold jewellery before the factory, but they have recently moved to a much bigger facility which should produce around 700-800 kgs per month. The company, according to the guidance of the promoters, should reach 5000 crores by FY26, which basically means the business starts functioning at full capacity.

Honestly, I found that number too stretched, however found data point where organised manufacturing only has a 15% market share, which is quite less compared to organised retail and hence this will need to catch up to the organised market share of the retail jewellers. Yet, i did not want to aggressive and have used a 35% growth from FY25( 35% seems big but knowing the story and plans in place by the company, it might just happen)

Ebitda

Since it’s down the value chain, we can’t expect them to have Operating margins of retail businesses we have studied. Due to the fact that they are expanding almost 4x, The company believes a 5%+ margin is possible. However, due to the nature of the business and the fact that competition is only going to get tougher, I am assuming a 4.5% margin which is what they have been doing for the past few quarters

Depreciation and Interest costs

The capex required isn’t much and hence depreciation too won’t be very significant. The interest costs should rise, however not as much as the revenue growth because of a number of measures regarding their contracts with customers, starting the use of Gold metal loan, reducing working capital days and not holding gold bullion inventory by just taking them from customers.

Possible antithesis

• Concentrated customers: top 10 make 70% of their revenue and hence any potential loss of customers could be a big blow. However, they are very close to signing Tanishq and hence it could be negated

• The business has a negative CFO at the moment, however it is mainly due to the working capital pressure which came from the aggressive growth, the promoters said that they should be cash flow positive due to the transition being complete and the measures being taken to reduce working capital. However, I would still wanna observe and see how this aspect turns out.

• The data found is extremely limited, and hence the corporate governance could be questionable.

• Valuations: Even though the growth promised is really good, I would want to wait for at least a 10%-15% correction to increase the margin of Safety.( we got this correction in the recent fall)

| Subscribe To Our Free Newsletter |