This NOTE does NOT delve into KEI Industries specifically but provides an Insightful Sectoral overview of ALL the 20 listed Power Cable companies in India.

![]()

Power Cables are to Electricity, what Roads are to Automobiles.

If we’re going to hit the 5$ Trillion GDP mark, we’re going to need a hell lot more Energy/power/electricity!

Wires & cables being the carriers of Electricity, are fundamental to our growth goals as a nation ![]() So, In this note, we’ll conduct a mostly Quantitative Analysis of 20 Listed Power Cable companies in India.

So, In this note, we’ll conduct a mostly Quantitative Analysis of 20 Listed Power Cable companies in India.

Some (not all) of the Ratios we will be using are :

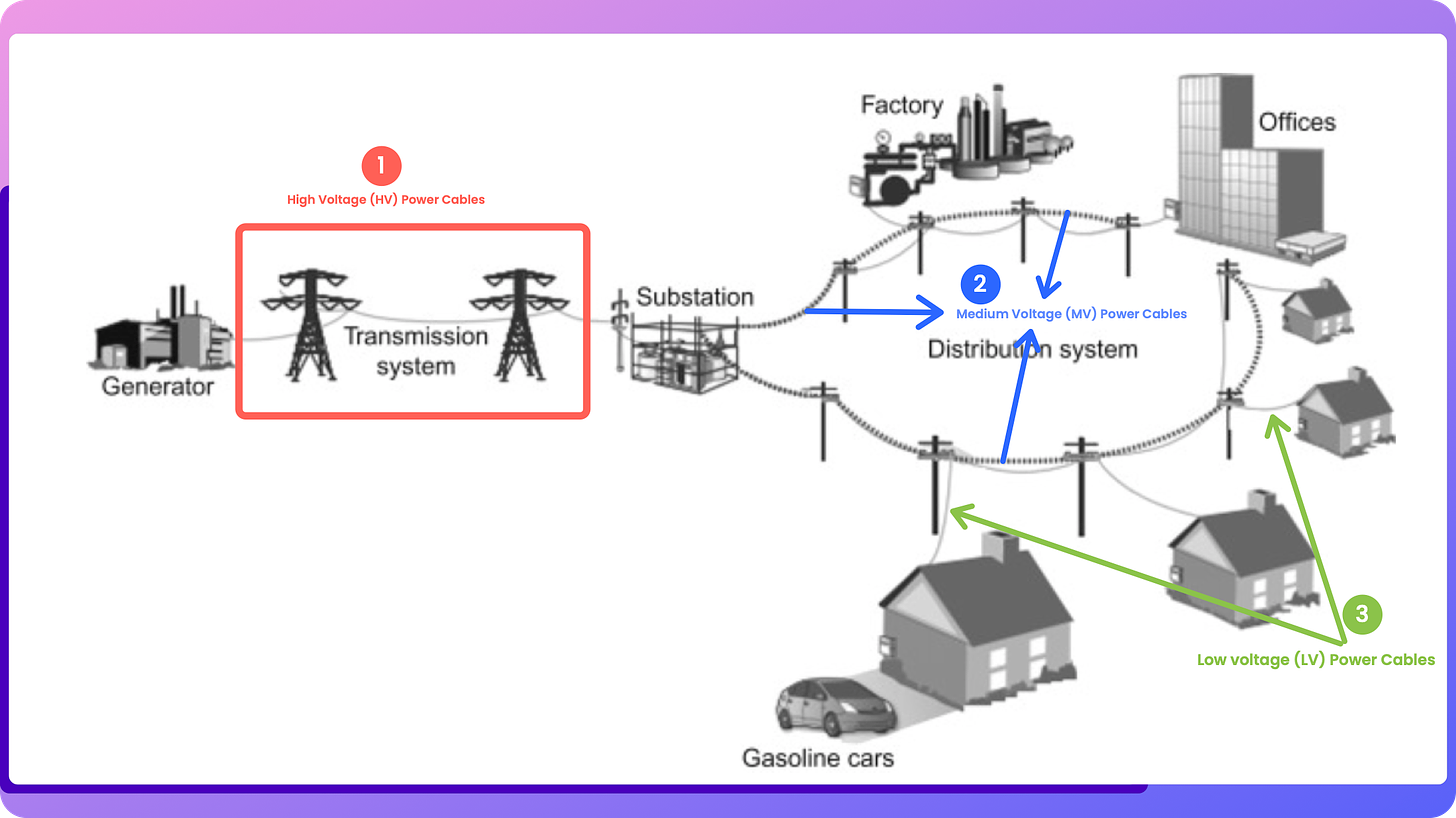

Also, just some ultra-basics: Power cables are usually categorised according to the voltage of the current they can carry.

They are categorised into Low voltage (< 1000 Volts), Medium ( 1 – 36 KV) & High Voltage (36KV+).

Their respective use across the Power Value Chain are illustrated below

With that basic background, Let’s Go! ![]()

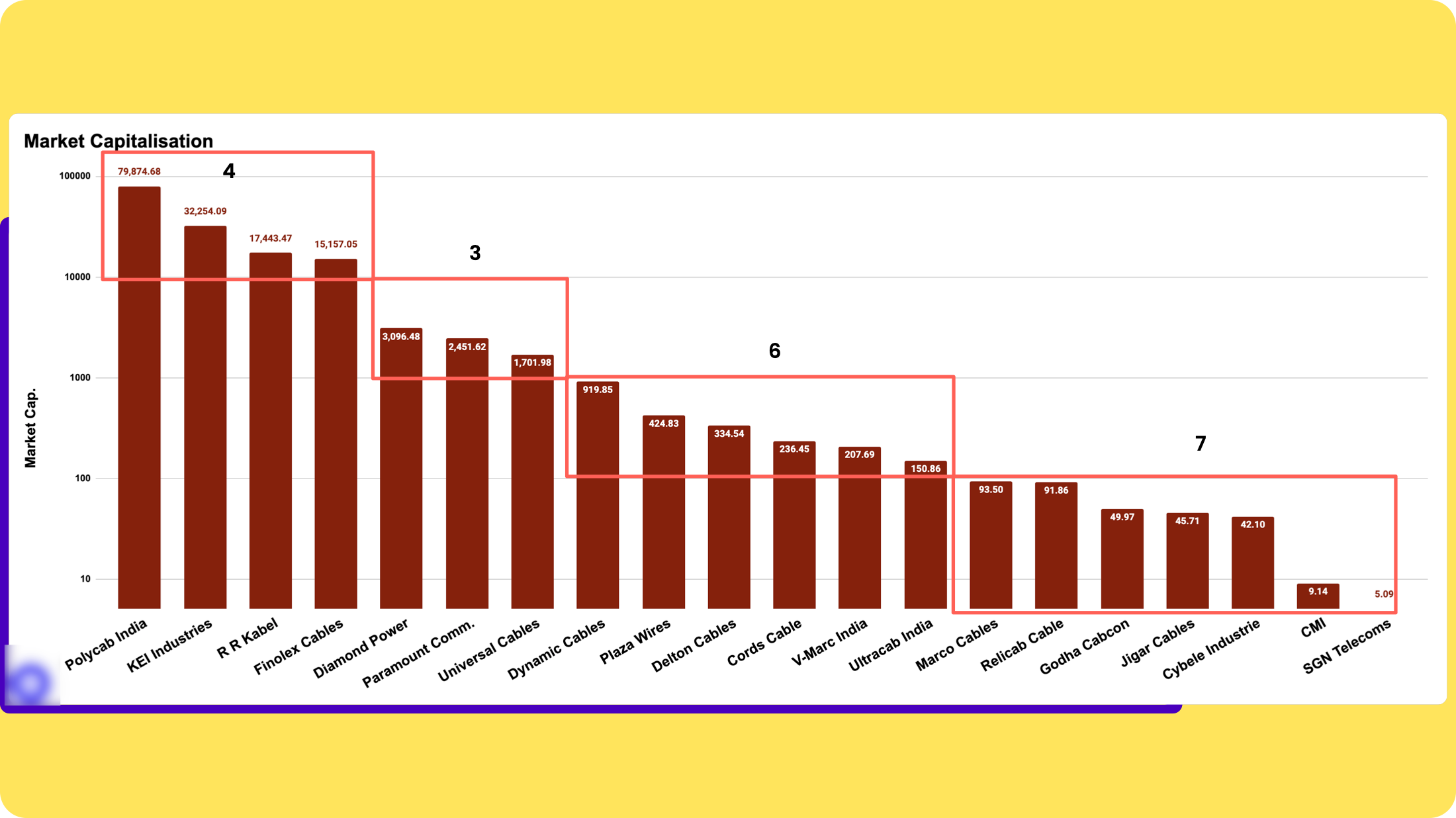

- Market cap distribution: Only 4 (20%) of Companies have a Market Cap of 10,000 Cr+, which is unsurprising. Even between those 4 largest companies, the variance in M.Cap is huge (Pareto’s 80/20 principle)

Log scale (Data as of 5th April 2024)

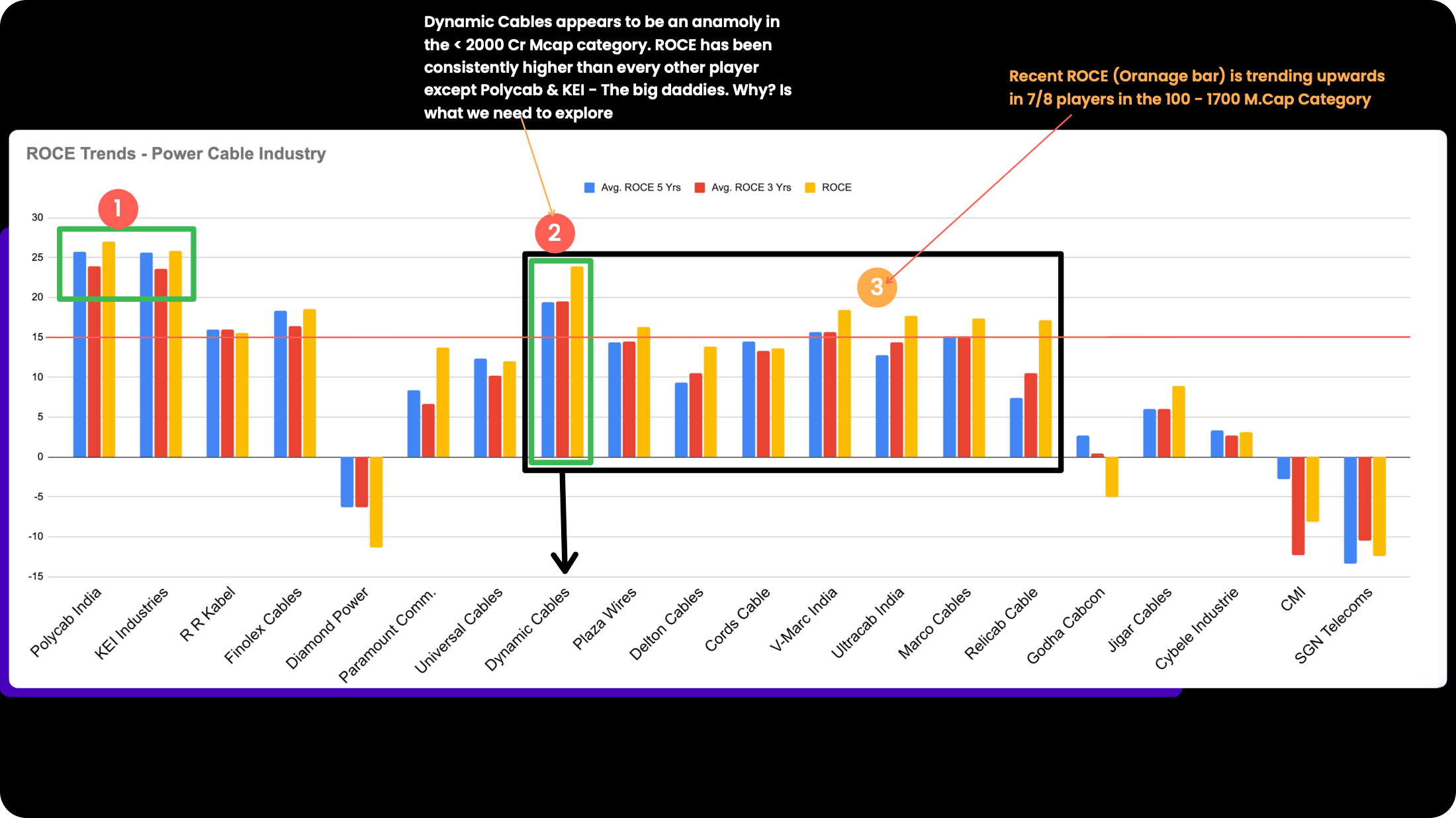

- Does Size Matter? : Data (ROCE last 5 years) suggests that Size matters for the Industry. Larger size begets more efficiencies and economies of scale. There are 3 noteworthy points in the Historical ROCE chart below.

Source: screener.in data | Left to right: Highest Market Cap to lowest.

-

‘Size Matters’! This is evident from the chart below which shows Polycab & KEI seem to have consistently high ROCE, most likely because of their larger size (NOTE: Size should ideally be measured in Gross block terms no M.cap)

-

Dynamic Cables is an anomaly in that it has consistently (last 5 years ROCE) maintained high ROCE vs 18 other peers.

-

The sector is experiencing is positive uptrend (Improving ROCE). Not surprising given the increased spending on the Power/Real Estate/Infra Sectors.

-

Some of the differences in ROCE amongst players may be explained by the Business Models i.e. their B2B vs B2C mix, their product mix etc. That analysis would be a logical next step i.e Performing Deep dive into specific companies

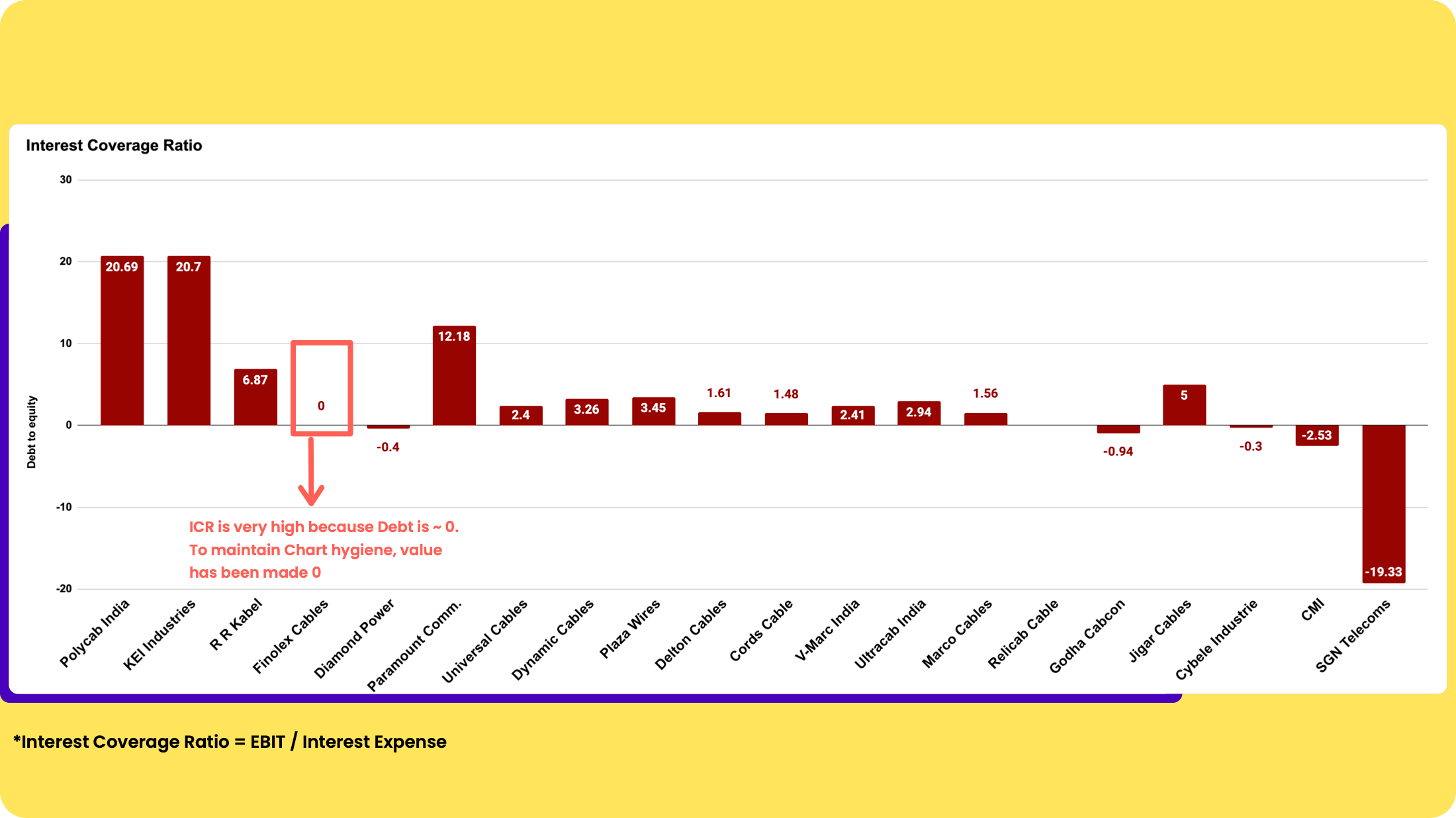

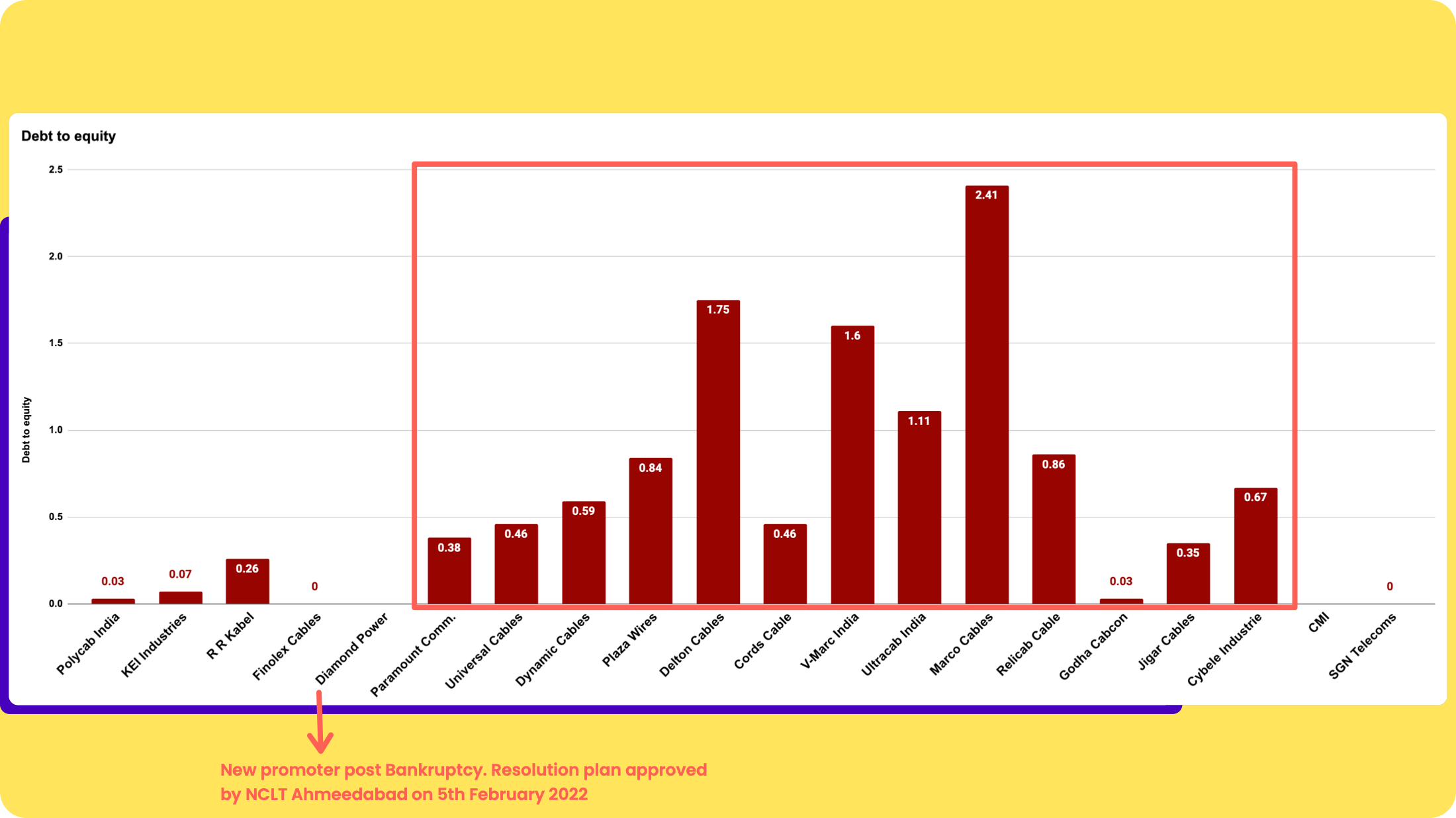

3. Smaller companies have higher Debt & lower Interest Coverage

Left to Right: Highest Market Cap to Lowest Market Cap companies in the sector.

![]() The higher debt for smaller companies is mostly working capital Debt.

The higher debt for smaller companies is mostly working capital Debt.

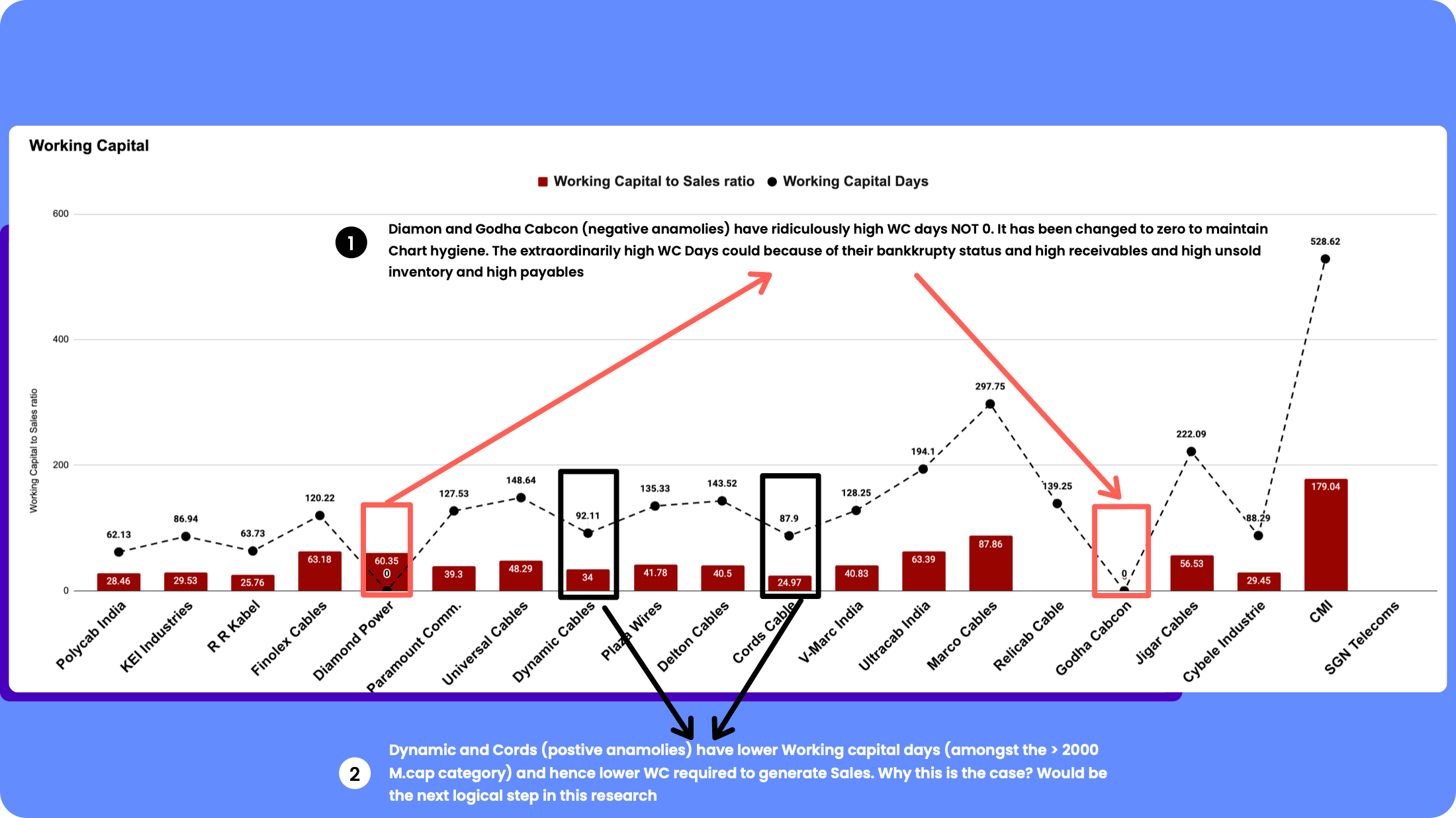

Working capital days (No. of days to convert working capital to sales) for smaller companies tend to be higher (unsurprisingly). Higher WC days would lead to higher Working capital debt (measured as % of WC to Sales)

- Asset Turnover

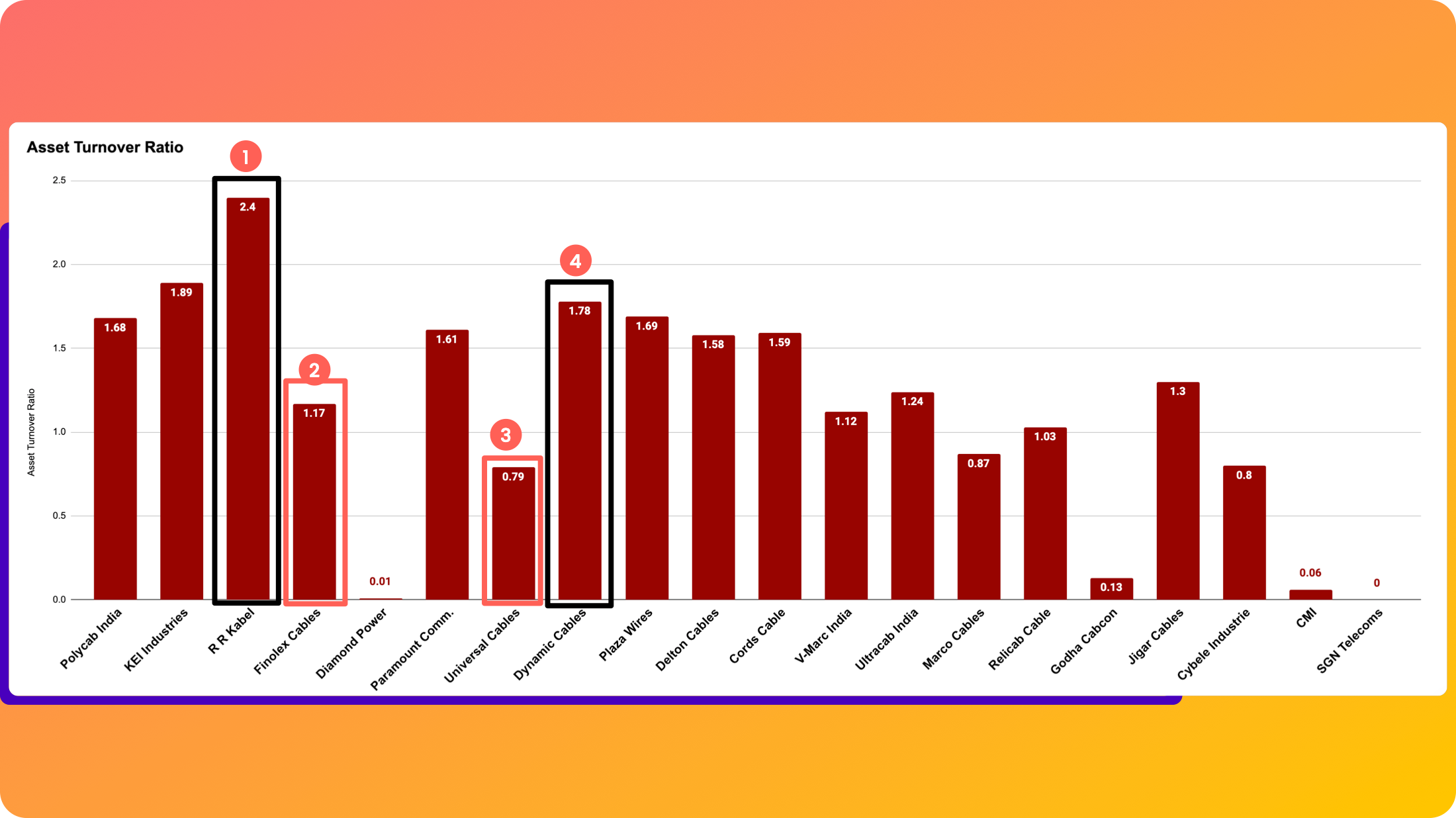

Larger players tend to have higher Asset Turnover (Sales / Assets) which means they’re able to squeeze out more rupees in sales from every rupee of assets held.

There are also positive and negative anomalies amongst the pack, as shown below.

source: Screener.in Data |

RR Kable and Dynamic Cables are examples of positive anomalies.

Finolex and Universal cables are examples of negative anomalies.

At least amongst the top 4 players, FMEG could be the reason why RR Kabel has a notably higher Asset Turnover.

RR Kabel derives 11% of its Revenues from the FMEG Segment – Fans, lights, switches etc whereas Polycab derives ~8% of its Revenue (9MFY24) from FMEG, Finolex (< 5% Revenue from FMEG) whereas KEI is NOT present in FMEG at all.

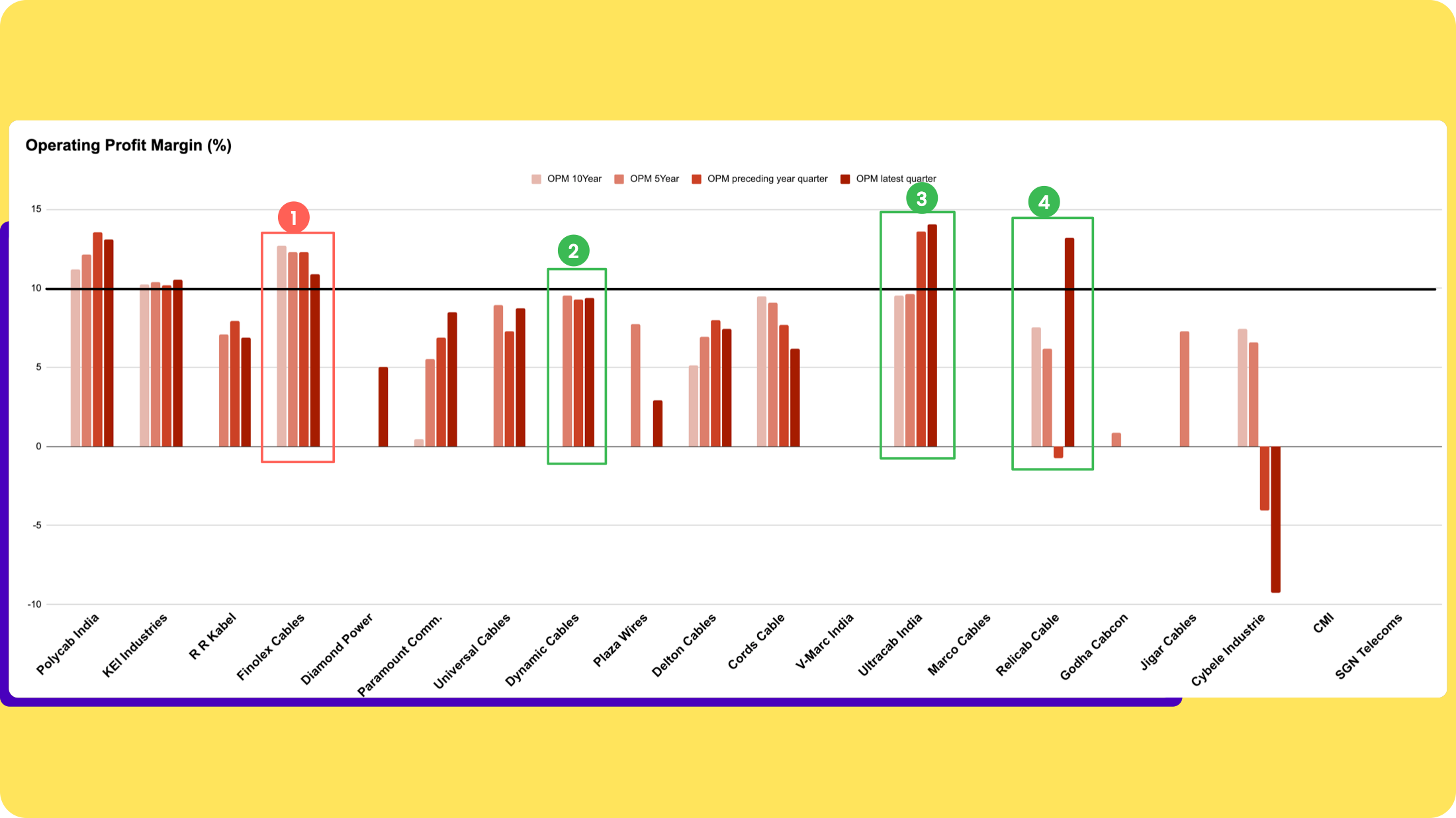

- Operating Profit Margin (%) [EBIT / SALES]

Operating profit Margin (%)

Dynamic cables and KEI Industries have the most consistent margins across timeframes and Ultracab & Relicab (< 200 Cr M.Cap) have shown the sharpest improvements in OPM (%).

Finolex’s shrinking margins could be a sign of shrinking pricing power (assuming it has some, to begin with) or poor operating expenses management etc.

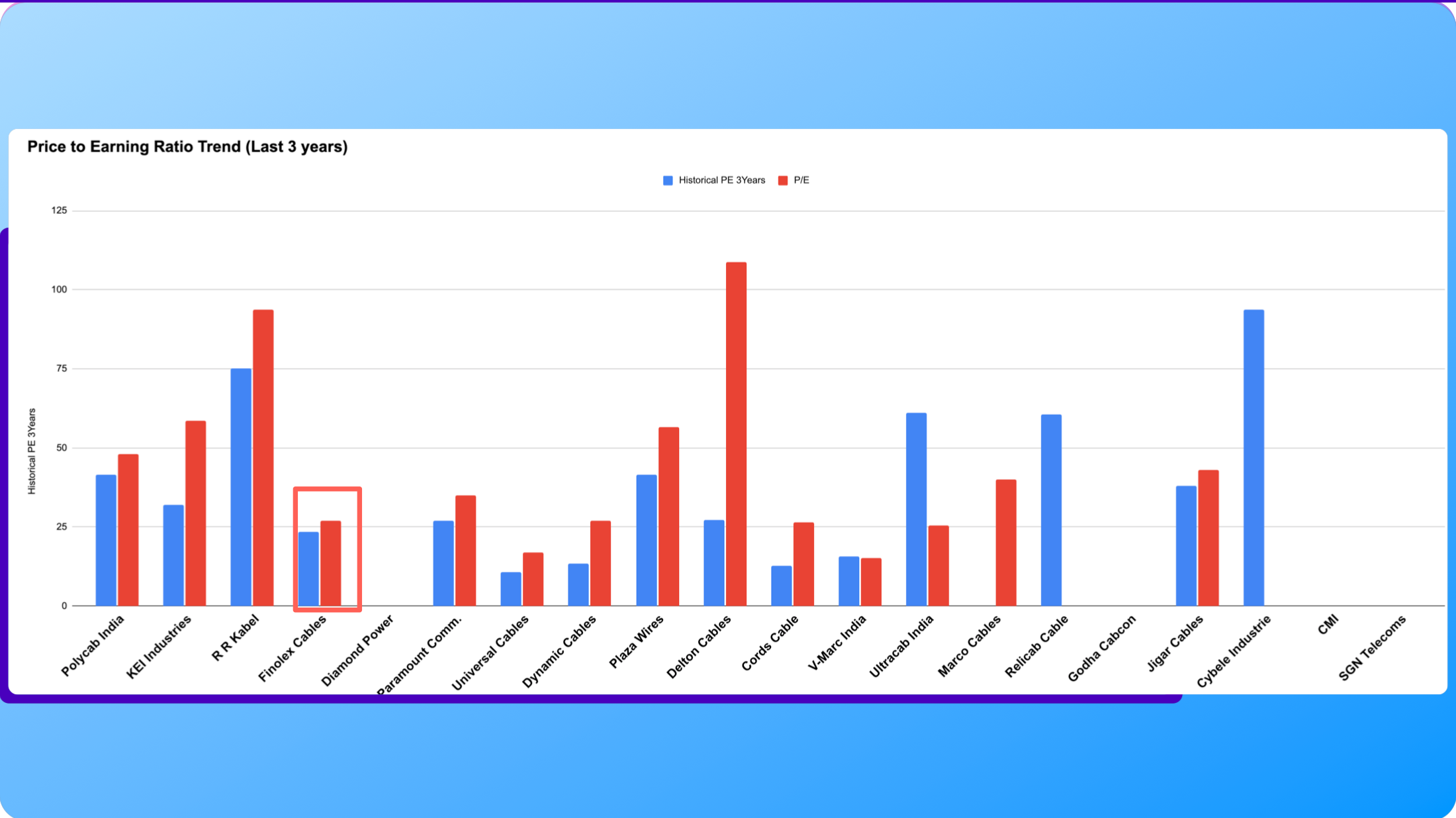

Whatever the root cause, shrinking margins make markets unhappy. This may be one (of the many) reasons why Finolex trades at a significantly lower PEx (< 26X) vs peers.

The above chart also displays one of the hallmarks of Wealth creation in the stock markets: P/E Re-rating. And when it rains, it pours!

Every single (almost) co’ in the sector has undergone significant re-rating (Exceptions: V-Marc & Ultracab) and judging by the the multiples, it’s unlikely there is room for further expansion, at least for most companies in our cohort.

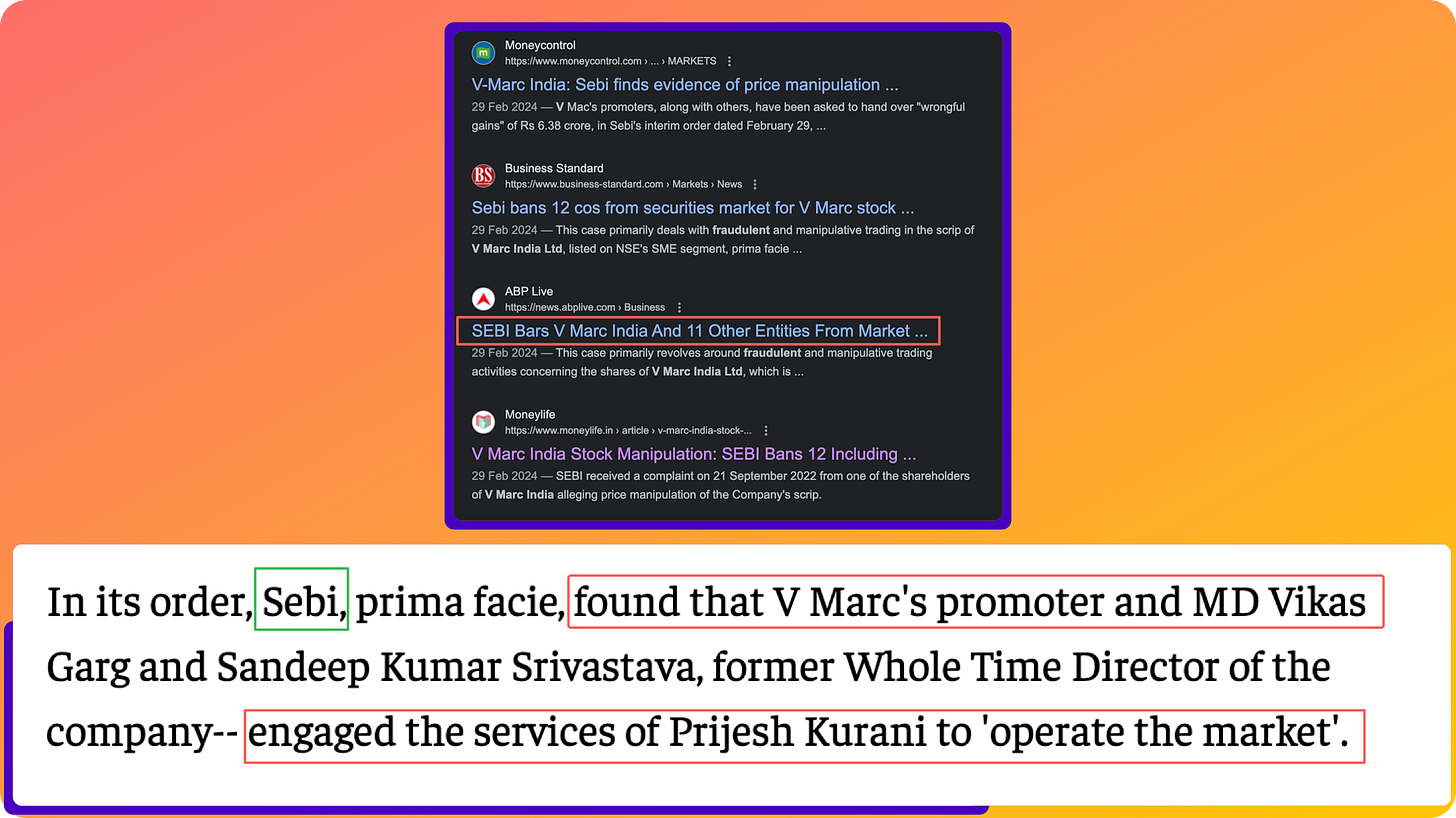

As for Why V-Marc India trades at such a low valuation? It’s just Fraud baby! ![]()

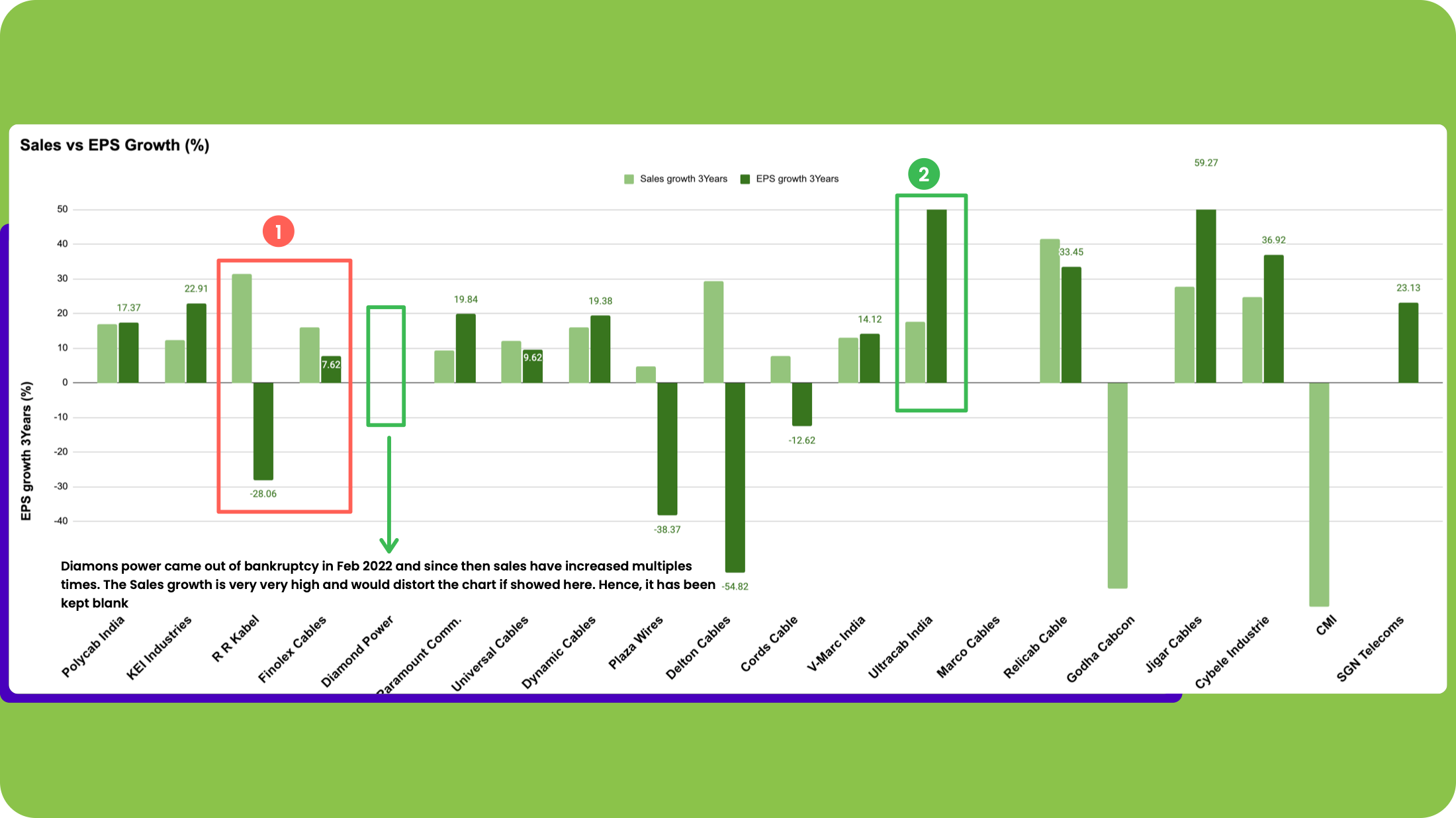

- Sales / EPS Growth

Finally, the growth metrics. Firstly, the last 3 years Avg growth may not be the best metric for visualising/judging the recent change in Sales/EPS, however, using the data below there are 2 key observations we would like to comment on.

![]() RR Kabel and Finolex have not been able to grow EPS as fast as Sales (why? Worth exploring in the next step: co’ wise research)

RR Kabel and Finolex have not been able to grow EPS as fast as Sales (why? Worth exploring in the next step: co’ wise research)

![]() Ultracab has shown EPS growth much significantly higher than Sales (including Jigar cables & Cybele Industries)

Ultracab has shown EPS growth much significantly higher than Sales (including Jigar cables & Cybele Industries)

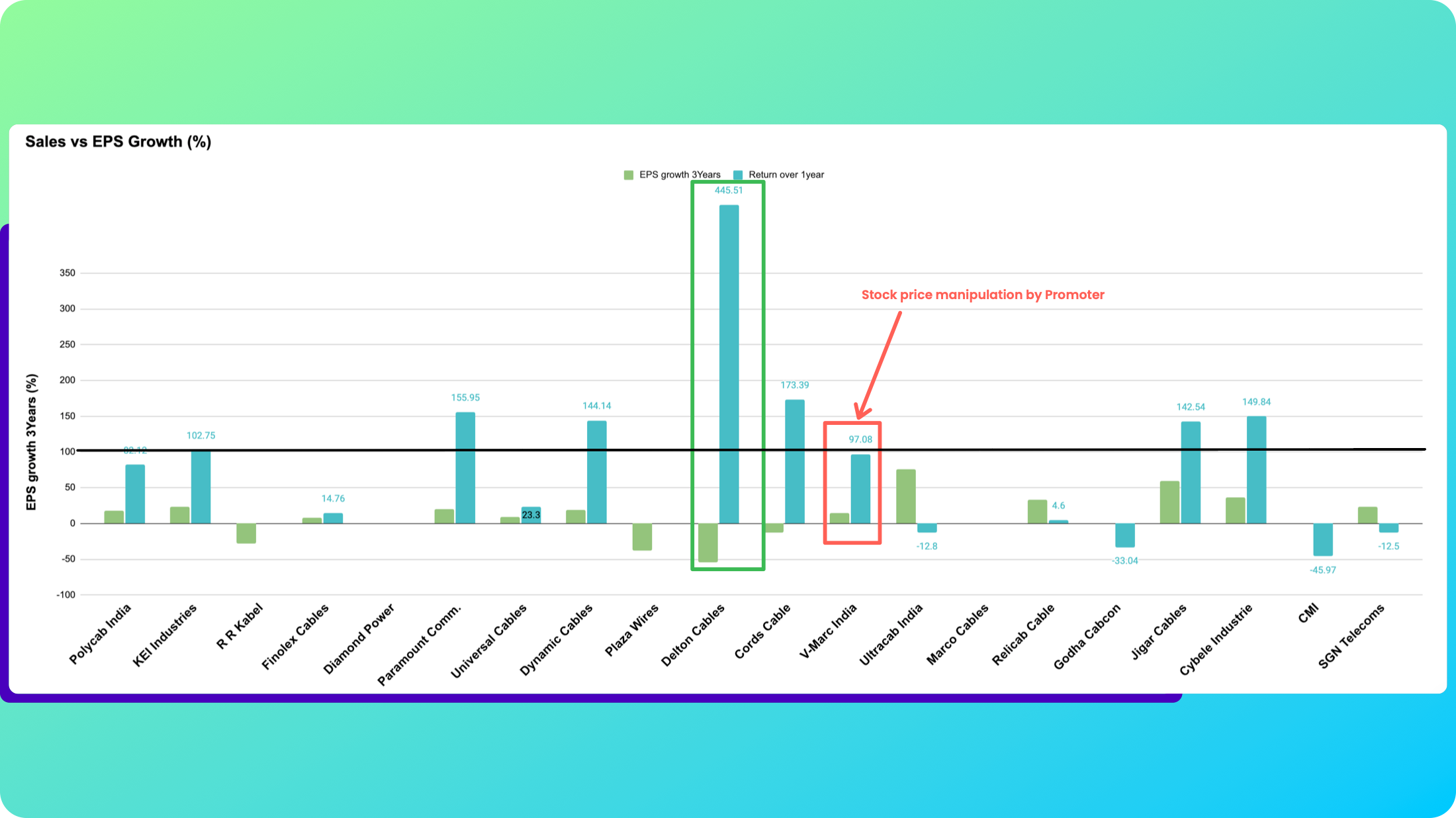

- 1 Year stock price Returns

Want to guess which stocks gave the highest returns in the last 1 year? (Not that it has any predictive value). Here’s the jaw-dropping data :

![]() 7 / 20 Stocks gave a 100% + Return

7 / 20 Stocks gave a 100% + Return

![]() 9/20 Stocks gave an 80%+ Return

9/20 Stocks gave an 80%+ Return

This reminds of some Key lessons we can learn/re-learn from the stock price behaviour of stocks/sectors :

![]() If you get the sector right, the probability of making satisfactory returns goes up!

If you get the sector right, the probability of making satisfactory returns goes up!

![]() When a Sector Turns, the best stocks in the sector rise at first and as the cycle continues, the relatively worse (sometimes smaller) players tend to do better than even the best companies (returns wise) because of the delta-from Shit to hit!

When a Sector Turns, the best stocks in the sector rise at first and as the cycle continues, the relatively worse (sometimes smaller) players tend to do better than even the best companies (returns wise) because of the delta-from Shit to hit!

Delton Cable surely has my attention and curiosity. The question is: Is it another pump or Dump or is it a special business? Should we find out more?

Tell me in the poll below because a logical next step in my opinion (you can share yours in the comments) is doing a deep dive on any 3, under 2000 Cr Market Cap companies and I need your help to decide ![]() which ones.

which ones.

Just name your Top pick ![]() Go !!

Go !!

Hope this was insightful, would love to hear your thoughts

Rahul

![]()

| Subscribe To Our Free Newsletter |