Protean eGOV Technologies Limited (PETL), was incorporated in December 1995 and was previously known as NSDL e-Governance

Infrastructure Ltd. The company is engaged in the business of developing citizen-centric and population-scale e-governance solutions for

more than 2 decades. It has developed & implemented some of the most crucial technological infrastructure in India. The major service

offerings include PAN (Permanent Account Number) issuance, CRA (Central record-keeping agency) for NPS (National Pension System)

and APY (Atal Pension Yojana), e-KYC (Know Your Customer), e-Sign, Aadhar authentication, supporting digital blocks for ONDC (Open

Network for Digital Commerce) platform, improving accessibility to education financing through digitally powering platforms like ‘Vidya

Lakshmi’ and ‘Vidyasaarthi’ amongst others. As of 30th June 2023, it has managed 19 projects spread across 7 ministries & autonomous

bodies.

ABOUT THE COMPANY

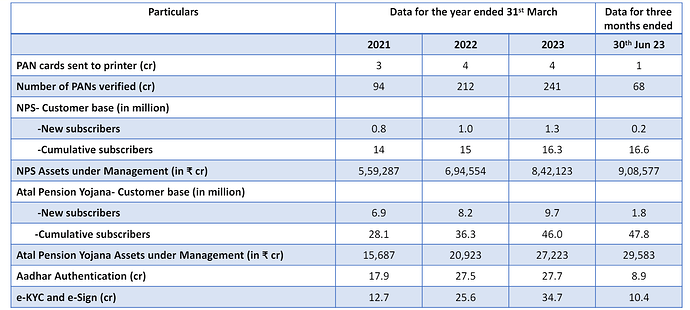

Tax modernization- These include services like implementing the TIN (Tax Information Network), PAN issuance & verification:

The TIN entrusted by the Government since 2004 is a repository of nationwide tax information and creates an electronic ledger for

each taxpayer providing complete details of taxes paid and a 360-degree view of tax collected and deducted at source.

In terms of PAN, it issues & prints PAN cards through its various service centres and provides verification services. Entities who

avail those verification services are mostly housing finance companies, insurance companies, banks, financial institutions,

educational institutions established by regulatory bodies, government agencies, stock exchanges, commodity exchanges and

clearing corporations.

• CRA (NPS)- Since December 2007, the company maintains centralized records of all the NPS subscriber details, provides reports and

dashboards to various stakeholders for effective decision-making, establishes the IT infrastructure, handles administration and

customer service functions for all subscribers of the NPS. It provides all these services to the Central and State Governments

including their autonomous bodies and public sector banks.

• CRA (APY)- APY provides old age income security for the working poor and is focused on encouraging and enabling them to save for

their retirement. To address the longevity risks among workers in unorganized sector and to encourage them to voluntarily save for

their retirement, the company acts as the CRA for managing the administration and customer services for APY subscribers.

National Identification- It provides services like Aadhar registrations, authentication, e-KYC, and e-Sign facilities. It has been

entrusted by the UIDAI (Unique Identification Authority of India) as a registrar for Aadhar cards. Sectors like BFSI (Banking, Financial

Services and Insurance) are their major customer requiring verification services.

• GST Services- It offers GST (Goods & Sales Tax) verification services to validate GST records, monitor GST filing history along with an

API (Application programming interface) based integration to the GST Network. The company’s APIs makes it easier to file for GST

and e-invoicing.

• Education financing solutions- The company developed an online portal for the Government projects like ‘Vidya Lakshmi’ and

‘Vidyasaarthi’. The Vidya Lakshmi initiative is an education loan portal developed under the guidance of Ministry of Finance and

Ministry of Education and the Indian Banks’ Association. Under this, students can avail of education loans through scheduled banks

and the platform acts as a gateway through which students can apply for loan. The Vidyasaarthi initiative provides underprivileged

students financial assistance via corporate-funded scholarships. Students seeking education scholarship can search and apply for

various education finance schemes that they are eligible for on the portal.

• ONDC- The ONDC is a digital project of the government to redefine the e-commerce landscape and to standardize the process of onboarding retailers on e-marketplaces for selling products through an online channel. The company has been an early contributor and

supporter of building the digital landscape of the ONDC platform.

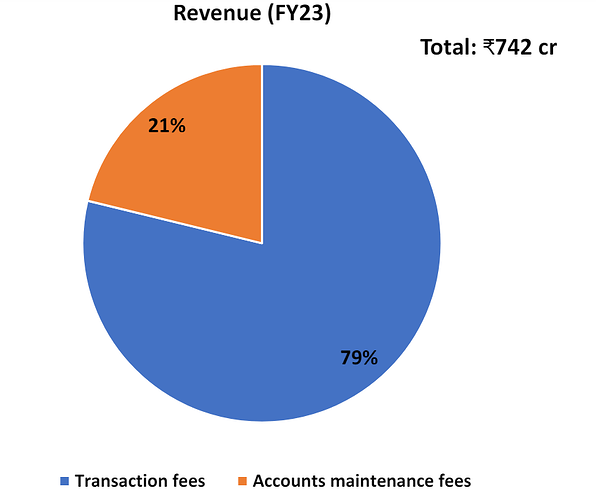

Transaction fees- Majority of the revenue comes from this

segment (~₹584 cr). Whenever the company issues or re-issues

PAN & TIN, any consumer opens an account in the NPS or APY,

it collects fees on the same which could be either in annuity

form or a fixed one-time. It also earns on the total subscriber

base of the pension. In terms of identification, every e-KYC,

verification as well as e-Sign leads to a transactional revenue

for the firm.

• Accounts maintenance fees- Remaining of the revenue (~₹157

cr) comes from the general digital maintenance of its

customers. The repository of taxpayers, pensioners, even the

overall tech data stack of providing data insights, analytics and

digital on-boarding generates income for the company.

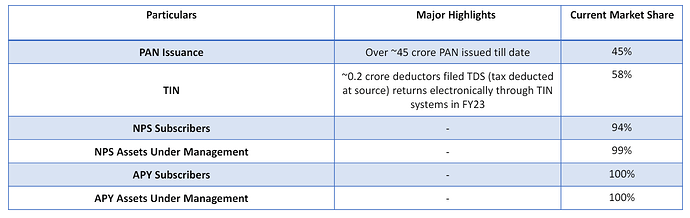

ABOUT THE COMPANY- MARKET SHARE

In terms of the company’s major business of PAN and TIN issuance, as well NPS and APY, it has no listed peers and thus enjoys a high

market share. The rest of the market share belongs with Government entities and portals.

SECTOR OUTLOOK

The domestic IT service revenue would grow by a CAGR of 7%-9% from 2023-2027. The growth would majorly be led by

technology and platform upgradation, and e-governance initiatives of the central and state governments. Further, the government

and its various agencies are expected to remain the largest contributor to domestic IT revenue.

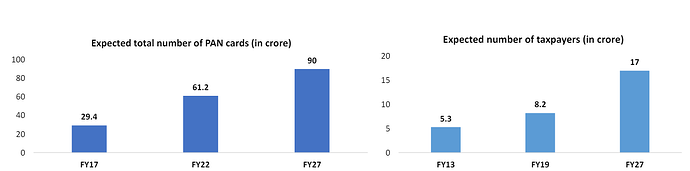

• The PAN Card in India is mandatory to file tax returns in India. The number of PAN cards as of FY22 in India stood at ~61 crore and

is expected to rise annually by ~5-6 crore to reach 88-90 crore of cards by FY27. PAN card allotment is expected to be driven by

expansion in taxpayer base, growth in financial inclusion, thereby mandating the usage of PAN cards, working age population, GDP

growth, and increasing contribution of the formal economy.

The individual taxpayer base in India stood at 8.2 crore as of FY19 and is expected to reach 17 crore by FY27, thereby growing by a

CAGR of 9%-10%. Over 60% of India’s population is in the working age bracket of 15-59 years and this bracket is expected to grow

to above 60% in the next decade. The overall working age population is expected to reach ~94 crore by 2026.

• The number of subscribers for NPS and APY stood at 5.2 crore as of FY22 and is expected to grow by a CAGR of 16%-17% to reach

11-15 crore. The total Assets of NPS and APY stood at ₹7,366 billion during FY22 and the same is expected to grow by a CAGR of

23%-24% to reach ₹20,000-₹21,000 billion by FY27.

• The volume of Digital transactions as of December 2022 stood at 43.4 billion and is expected to grow by a CAGR of 40%-42% to

reach ~425 billion by FY27. As the digital transactions rise, the need for e-authentication, e-signs and others would rise in tandem.

The Government pushing for higher digital adoption with paperless operations would drive growth for digital authentication

services.

• The ONDC platform went live in September 2022 and as of September 2023, it is present in more than 400 cities. It has onboarded

1.8 lakh sellers across the country with some renowned brands like Boat, Dunzo, PayTM, Delhivery and more. India has more than

19,000 e-commerce companies and by 2027 the ONDC platform could add 5.8 crore users to e-commerce, with the overall ecommerce penetration in overall retail reaching 11%.

PROMOTER BACKGROUND

Suresh Kumar Sethi is the Managing Director and Chief

Executive Officer of the company. He holds a bachelor’s

degree in engineering in electronics from Chandigarh. He

has over 30 years of experience in the financial services

industry. Prior to this role, he was the managing director

and chief executive officer of India Post Payments Bank.

Jayesh Waman Sule is the Whole-time director and the

Chief Operating Officer and has been associated with the

company since inception. He holds a bachelor’s degree in

commerce from the University of Bombay. He was

previously associated with NSDL and has over two decades

of experience in capital markets and IT-enabled services.

RISK FACTORS

The company is substantially dependent on the Government entities and agencies for winning contracts, which adds a client type

concentration risk. Any inability of winning projects could adversely impact business operations.

• The company’s business model is manpower intensive, therefore the inability to attract and retain skilled manpower could

impact the operations of the business. The current low employee base of the company could be deemed insufficient in timely

completion of any projects.

• As they majorly deal with the Government, there could be instances of low pricing power which could lead to inaccurate pricing

structures that is not in tandem with the related costs.

• The company deals with highly sensitive data and any security breach could adversely affect the reputation and profitability of

the business.

• The company’s business model requires them to obtain, renew or maintain statutory & regulatory permits, licenses and

approvals, and any delay or inability in obtaining, renewing or maintaining such permits, licenses and approvals could result in an

adverse effect on operations.

• It relies on third-party providers for some of their software and equipment needs and thus any breakdown in such systems could

negatively affect the company’s operations, causing delays or termination of project work.

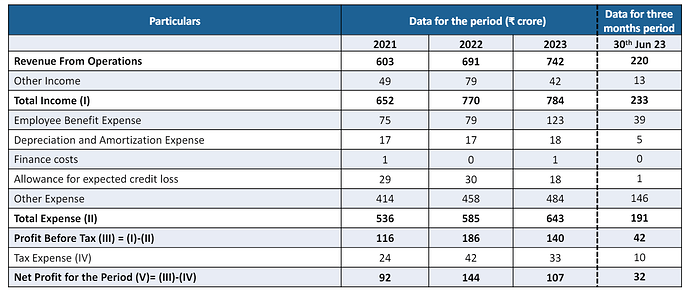

STATEMENT OF PROFIT AND LOSS

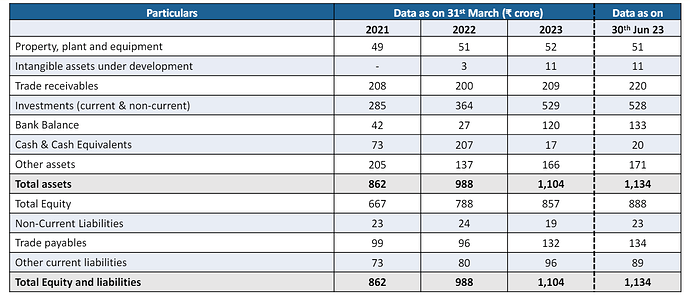

STATEMENT OF ASSETS AND LIABILITIES

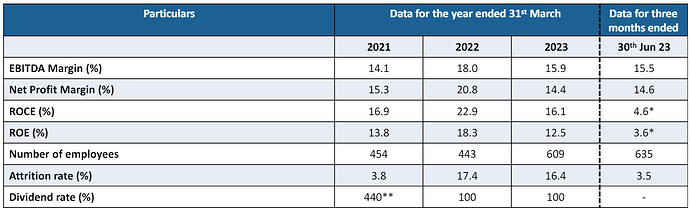

KEY METRICS

| Subscribe To Our Free Newsletter |