Sintex, Shyam Shekar’s “Ugly Duckling” stock recommendation, surges like rocket

First, we have to compliment Shyam Sekhar, the noted value investor, for his timely recommendation to us to buy Sintex Limited.

Shyam described Sintex as an “ugly duckling” because it had/ has been discarded by the stock market.

He soothingly assured us that the stock has all the qualities necessary for it to blossom into a beautiful swan and that we should take advantage of the situation to aggressively mop up the stock.

He also stated that he recommended Sintex because the valuations are/ were at “rock bottom” and that the stock would not fail even in the worst-case scenario.

I usually never recommend. This was an exception as valuations were at rock bottom. I felt nobody would lose money due to my bad judgement.

— Shyam Sekhar (@shyamsek) July 13, 2017

It appears that the wizards at Morgan Stanley agreed with Shyam’s assessment of Sintex.

They landed up on Dalal Street yesterday (and probably today) and launched an aggressive no-holds-barred buying action.

The stock surged 12% yesterday and 17% today.

The gains since Shyam Sekhar’s recommendation amounts to 31% which is massive by any standards.

The nuances of why the stock behaved in this manner and whether there is more scope for gains have been succinctly explained by Darshan Mehta of Bloomberg.

Sintex Industries surges after Morgan Stanley buys stake, reports @darshanvmehta1.https://t.co/1a1tBmthp2 pic.twitter.com/iGxRI303nj

— BloombergQuint (@BloombergQuint) July 13, 2017

Not in favour of Mohnish Pabrai’s “shameless cloning” policy

The amusing aspect is that Shyam Sekhar declared that he is not in favour of Mohnish Pabrai’s policy of being a “shameless cloner”.

Value investing in India stands completely superceded by Idolatry investing.

Buy into a person. Then borrow his ideas.

— Shyam Sekhar (@shyamsek) July 12, 2017

I respectfully disagree. Has never worked for me or most investors I have been closely associated with. It requires a mindset to do it.

— Shyam Sekhar (@shyamsek) July 12, 2017

Prima facie, we have to pay heed to Shayam Sekhar’s advice and learn the ropes of investing instead of piggy backing all the time.

TCPL Packaging is a potential 3x multibagger: Viraj Mehta of Equirus PMS

We are familiar with the profile of Viraj Mehta, the fund manager of Equirus PMS.

In the past, he has recommended stocks like Garware-Wall Ropes, HT Media etc.

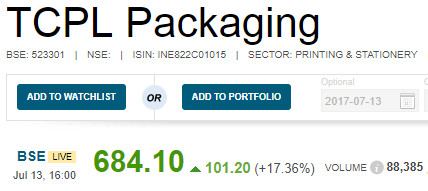

Viraj Mehta’s latest recommendation is TCPL Packaging, the micro-cap (Rs. 600 crore), which is a proxy for the FMCG industry.

The investment rationale is as follows:

(i) TCPL is the leader in paper board packaging. It boasts of a blue-chip clientele which reads like who’s-who of the FMCG industry.

Marquee companies like Hindustan Unilever, Godrej Industries, Dabur, Godfrey Phillips etc swear allegiance to TCPL for their packaging needs.

(ii) There are high entry barriers because though it is easy for anyone to set up a packaging plant, the FMCG companies will not touch the new entrant with a barge pole expect after rigorous testing for quality control standards;

(iii) TCPL has an impressive track record of growth. In the last 5 years, the Company has grown its revenue by 17%, EBITDA by 19% and Net profit by 34%. There has not been a single year of downturn.

The 5 year average RoCE is 19 percent.

The realization per kg has gone up and the Company is able to retain the EBITDA margins.

This is quite impressive when one bears in mind that large buyers like HUL and Godfrey Phillips have the tendency to arm twist their suppliers into giving concessional rates.

This shows that TCPL has its own bargaining strengths and is able to talk in equal terms to its large clients.

(iv) TCPL has competitive advantages. It has setup packaging factories closer to the manufacturing facilities of its key customers. This has helped to reduce costs. At the same time, it deters competitors from making a pitch for the business.

(v) Valuations:

TCPL’s valuations are quite cheap given that it is a proxy for the FMCG sector.

The stock is presently quoting at a PE of 12.9, Price-to-Sales of 0.7, and EV/EBITDA of 7.5.

The EV/EBITDA multiple of 7.5x is low, especially bearing in mind that the company is operating on peak debt and revenue growth over the last 12 months is flat.

(vi) Why will TCPL Packaging be a 3x multibagger?:

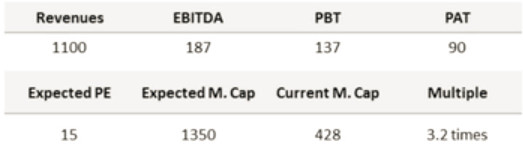

At the end of the analysis, Viraj Mehta opined that if TCPL operates at full potential, the revenues would surge to Rs. 1100 crore with a PAT of Rs. 90 crore.

Assuming that the Company commands a P/E of 15x (which is highly reasonable in the present circumstances), the market capitalisation would surge to Rs. 1,350 crore.

Given that the market cap was then about Rs. 428 crore (presently Rs. 600 crore), we can effortlessly make 3.2 times the investment in the next few years, Viraj Mehta exclaimed with a big smile on his face.

| TCPL PACKAGING LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 595 | |

| EPS – TTM | (Rs) | [*S] | 38.17 |

| P/E RATIO | (X) | [*S] | 17.92 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 62.50 | |

| LATEST DIVIDEND DATE | 01 AUG 2017 | ||

| DIVIDEND YIELD | (%) | 1.07 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 204.51 |

| P/B RATIO | (Rs) | [*S] | 3.35 |

[*C] Consolidated [*S] Standalone

| TCPL PACKAGING LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | MAR 2017 | MAR 2016 | % CHG |

| NET SALES | 145.44 | 157.75 | -7.8 |

| OTHER INCOME | – | ||

| TOTAL INCOME | 145.44 | 157.75 | -7.8 |

| TOTAL EXPENSES | 127.01 | 131.97 | -3.76 |

| OPERATING PROFIT | 18.43 | 25.77 | -28.48 |

| NET PROFIT | 5.49 | 9.42 | -41.72 |

| EQUITY CAPITAL | 8.7 | 8.7 | – |

(Source: Business Standard)

TCPL Packaging is the favourite of Dolly Khanna, Vijay Kedia and Anil Kumar Goel

Viraj Mehta’s recommendation cannot be taken lightly because three eminent stock wizards, Dolly Khanna, Vijay Kedia and Anil Kumar Goel, have parked themselves firmly in the stock, in the expectation of multibagger gains.

As of 30th June 2017, Anil Kumar Goel held a stranglehold of 8,07,000 shares comprising of 9.28% of the total equity capital.

He has been aggressively hiking his stake in the Company.

Vijay Kedia holds 1,19,961 shares as of 30th June 2017.

Dolly Khanna’s present holding is not known. She held 31,131 shares as of 31st March 2016.

The stock has severely under performed with a 20% return over 24 months and a (-) 5% return over 12 months. However, this augers well for us because it implies that there are no expectations from the stock and the risk of a disappointment is low.

A slight uptick in operational performance can send the stock surging like a rocket.

Conclusion

Prima facie, the advice to buy a FMCG proxy instead of an FMCG itself is very sound given the stark difference in valuations. Amongst FMCG proxy companies, TCPL Packaging appears to be the ideal candidate given the quality of its management, marquee clients and cheap valuations. The stock does appear to have the wherewithal to reward us with magnificent multibagger gains in the foreseeable future!

Go for ITC in FMCG space for steady return CAGR of 15%.

TCPL is very much of a growth stock, in long run can deliver incredible results.