I am very optimistic about this business for following reasons. I am looking for opposing views on my thesis and what’s the downside if we invest in it. (I am already an investor and looking to increase my holding).

The company is cheaply valued compared to all its peers. One of the obvious reasons is return ratios. Both can be seen in the below table.

| Company | Mcap Rs. Cr. | ROCE | ROE | PE | PB | P/Sales | |

|---|---|---|---|---|---|---|---|

| Dr. Lal Pathlabs | 21,861 | 25.2% | 20.4% | 61.1 | 11.8 | 9.8 | |

| Metropolis | 9,873 | 15.4% | 12.3% | 77.2 | 9.0 | 8.2 | |

| Vijaya | 8,317 | 21.6% | 20.0% | 69.1 | 12.7 | 15.2 | |

| Thyrocare | 3,253 | 18.6% | 13.8% | 45.7 | 6.3 | 6.2 | |

| Krsnaa | 1,837 | 10.1% | 7.5% | 31.4 | 2.3 | 3.1 |

Source: Screener

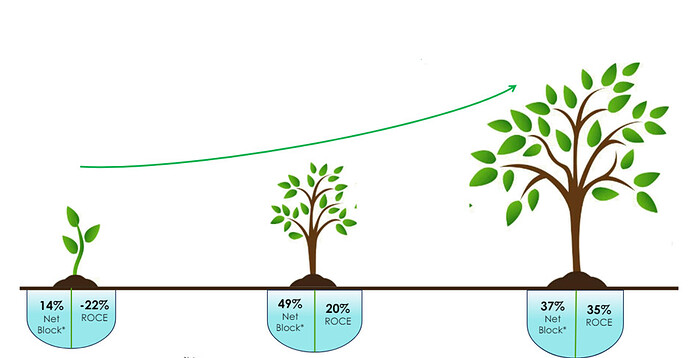

Now the return ratios are poor because the company is new and in high-growth phase. There is huge setup cost for diagnostics centre and income start coming with a lag. So, operating leverage kicks in after 2-3 yrs of operations.

Below is the chart from Q4 FY24 investor presentation. It can be seen only 37% of net block (centres) are mature. They are generating very good ROCE. Once, the newer investments mature, ROCE for them will increase too.

Additionally, the company has huge order bank and they are establishing more centres on an ongoing basis. All the details are available in investor presentation and concall, so not going to flood my post with the same.

They are also venturing into non-PPP segment, i.e. B2B and B2C. I understand this is a competitive segment, but they already have capex (diagnostics centre) in place. They just have to juice it out with more customers which can be fetched through non-PPP route too.

As centres mature, it will increase there ROCE / ROE / Op margin. As they add more centres, business will also growth. So, there is a case of increase in margins and return ratios and also increase in profits. Isn’t it a right scenario to invest in a stock? For e.g. Lal pathlabs is already big. It will be tough for them to grow at 25% via – a – via. Krsnaa for whom it will be relatively easier. Lal pathlabs also has good ROCE / ROE so there is limited upside. For Krsnaa, this upside is also huge.

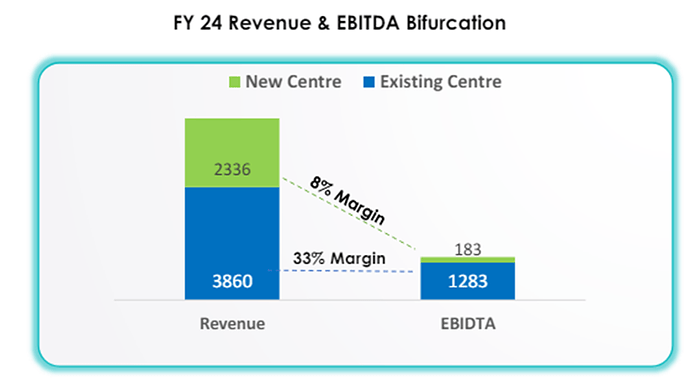

Look at the below table. Mature centres has 33% EBIDTA margin. Let us assume Rs. 234 cr is matured now. They will also have 33% margin instead of 8% margin. i.e. addition of Rs. 58 cr more EBIDTA. This Rs. 58 cr will directly go to PAT, doubling PAT from Rs. 57 cr to Rs. 115 cr. Just the maturity of existing centres can double the PAT. It will also improve ROCE and ROE. PE will reduce to 16 (Rs. 1844 cr mcap / Rs. 115 PAT).

Please provide counter points.

Disc: Invested

| Subscribe To Our Free Newsletter |