These two are not similar businesses though both are in the geospatial space. Ceinsys is more of a services business and Genesys a product business, although that is simplifying it a lot. Ceinsys also has revenues and profits (JV) from AllyGrow and AllyGram which are in the ER&D and manufacturing domain. Even within the geospatial business, genesys is more of an upstream player that builds geospatial assets, mainly digital twins but also street view maps etc. while ceinsys is a downstream player that very likely uses satellite data from 3rd party sources to implement its projects. There’s nothing superior or inferior about either and both businesses have positives and negatives from their respective business models.

Ceinsys is relatively asset-light or so it seems as of now but over time, as Genesys sweats their assets and find more customers across domains, their growth in revenue will flow directly to the bottomline and the growth will be completely disproportionate – but its yet to happen although there are good signs in the last two quarters. Another thing to note is depreciation which is a real cost to Genesys’ business. Maps at higher level of detail (like LiDAR say) would depreciate faster as building level information in Indian cities will change lot faster than a developed nation. They might adjust for this accordingly in charging their clients lot higher for a higher level of detail. The space has to mature and lot of applications for banking, insurance, real-estate, disaster management, smart cities have to come up and Genesys growth is dependent on that. It is lot more futuristic and so market might value it as such.

On ceinsys valuation, there’s a post in the ceinsys thread which captures what the company’s valuer think its worth. I believe these are futile exercises since it captures what the management thinks are future cash flows and is bound to vary a lot based on whether the management is selling or buying its own equity. In this case, they are “buying” their own equity and thus the biases are bound to project the value lower and correspondingly, the value is at 505, 510 or 560 depending on multiple, DCF and market value method. Now accounting for this bias, it could be valued higher. Also another thing to note in Ceinsys case is the dilution at 560 for acquisition. Although it can be open-ended and done any time in the next 3 years, my thought was that it could happen sooner than later since price, dilution, buyers were all decided and this is not an enabling resolution. They even did a EGM specifically for this.

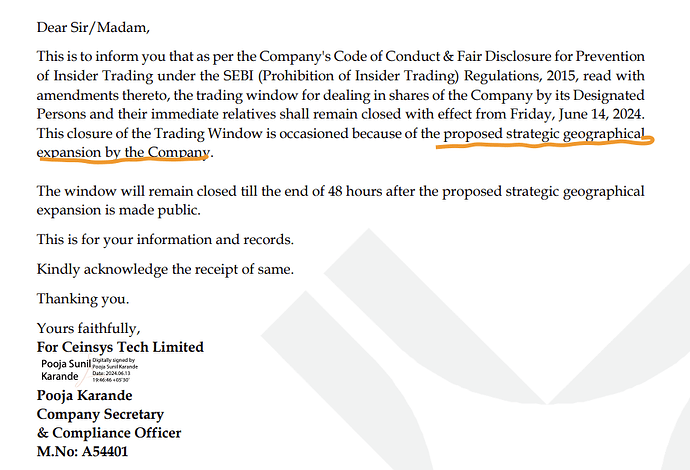

Yesterday’s dispatch from Ceinsys says they are closing the trading window from today until the proposed strategic geographic expansion is made public.

All evidence points to the acquisition target perhaps not being far away. Valuation is not static and an acquisition like this will affect it, depending on what get’s acquired and at what value. When AllyGrow was acquired, Zodius was paid in shares at a value of Rs.160/share or so if am not mistaken and today the value is 3-4x that. If they maintain that track record, 560/share that they are putting in big money at might infact be undervalued but its of course a subjective call.

Disc: Invested in both

| Subscribe To Our Free Newsletter |