Kaveri had a decent FY24, with slow sales growth of 7.5% but margins improved resulting in higher EPS growth by 19.5%.

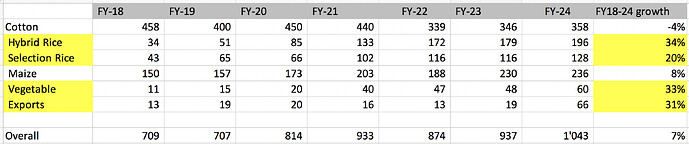

There has been a marked shift in their product mix, where higher margin crops like rice, vegetables have grown significantly whereas lower-margin crops like cotton has degrown. Concall notes below:

FY24Q4

- Incorporated subsidiary in Bangladesh as they want to develop own brand and dedicated research. Currently they are doing white labeling where distributors are selling seeds in their own brand names. Do not plan on entering cotton segment in Bangladesh

- There has been large increase in cost of production of cotton and have not seen commensurate increase in realizations

- Have 7-8% market share in maize (in top-5)

- Vegetable crops contributed 60 cr. and they expect 20%+ growth

- Seeing good traction in all crops except cotton, where their production lags demand. Expect 4-5% decline in cotton volumes in FY25 due to their lower inventory and shortage across industry

- At peak, their cotton market share was 17-18% which has reduced to 12-13%. Cotton market size has also reduced from 5-5.5 cr. packets to 4.5 cr. They have lost market share especially in Andhra where they had 40%+ market share

- R&D expenses: 57 cr. (vs 45-47 cr. in FY23). Includes recurring expenses

Disclosure: Invested (position size here, no transactions in last-30 days)

| Subscribe To Our Free Newsletter |