With all the results out, its a good time to review the trades.

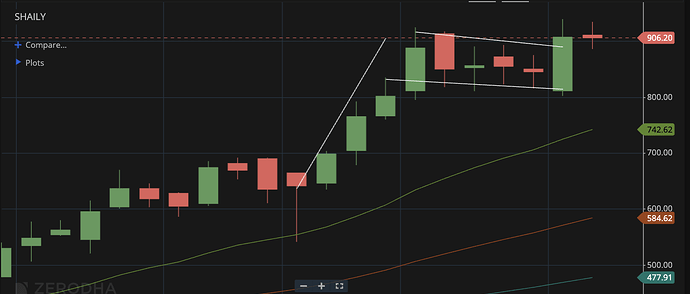

Shaily, Weekly – Has formed a flag sort of formation on the weekly and is trading at near-term breakout levels. Any close above 910 levels should ensure a continuation.

Results here are good and with the 10 million own IP pen insulin order, things are looking very good on the healthcare business. There are signs that there could be more such orders with insulin space opening up after Novo and Lilly leaving it and moving capacities to GLP-1. Considering the base of 11.5 million pens which is fragmented with bulk of it under contract manufactured insulin pens (probably 60-70%) and rest as well under different platforms, mostly for clinical test batches, a single platform doing a 10 million volume should lead to good operating leverage and margins. Valuations don’t appear cheap on P/E basis but the potential here is huge if willing to hold over 2-3 years. The healthcare division growing topline at 50-60% CAGR and bottomline probably at 70-80% can backfill valuations very quickly. The company is also developing two new devices and has guided for 35-40% growth in Shaily UK as well (so new customer contracts should continue). Concall has more detailed info on the business.

Wockhardt, Monthly – At crucial levels around 8 year highs. Getting into 4 digits would be a big psychological boost (doubt if there are buyers from 2016/2018 still sitting here selling – its more a theoretical barrier than anything)

Results here are very good as well with standalone PAT turning positive and losses narrowing considerably on the consol. Though this was never a play on existing business, sometimes when things go right, they tend to go really right (munger’s lollapalooza). The insulin shortages mentioned above should also benefit Wockhardt’s insulin business. Any good news on the base business would be a big boost to valuations. 422 patients recruited for 5222 global trials and 33 compassionate usage cases with 100% recovery. The meropenem resistance trial also has 15 patients recruited as per the update on the press release. So looks like everything is on track so far.

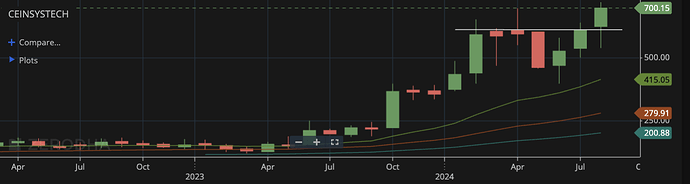

Ceinsys, Monthly – After consolidating and failing to take out 620-650 levels for 6+ months, its trading above those levels.

Results are very good though geospatial has been a big drag on the numbers. Despite that the numbers are good because of AllyGrow. As per the concall, geospatial business had issues due to elections code of conduct but some of the costs are booked. Between Q2-Q4, this should turnaround and have lumpy profits that make up for it. On a whole year basis, management thinks both the geospatial and allygrow business should have 20-25% margins and should grow ~25% over next 2-3 years. A potential doubling of topline with margin expansion from 17% to 22% can mean a 3-4x from here if execution is good, considering starting valuations aren’t too demanding for the growth.

Orchid – Broke out last month and is trading at or around those levels of monthly close (~1400). Expansion in oral capacity and better utilisation in sterile would help base business grow, while cefiderocol would start contributing from FY26 and 7-ACA from FY27. DLL merger and Enmeta royalty is more near-term in FY25. Overall there are enough triggers for growth here to sit tight for a couple of years. Re-entry in US business should bolster margins in base business while volume growth in emerging markets will help improve operating leverage as it has done so far. The numbers are bit depressed for the quarter since the AMS division has had 50+ hires in sales and marketing so employee cost (to the tune of 2.5 Cr) is more a longer term investment in developing distribution.

Genesys – Good numbers though here too I think they have been affected by elections (As mentioned in the ceinsys call) and also the weather (as mentioned by Sajid in couple of tv interviews post NNG partnership). The numbers here should pick up steam H2 onward going by those interviews as he says that the payoff for last 2-3 years of product development will start contributing from H2. The press release also talks about several favorable market developments across sectors like renewables, urban planning, real estate, land records and disaster management. Technically taking out 750 on a monthly close is essential for continued strength.

Among smaller positions – Eimco, Tarachand, Strides, Garware, Sharda and Pix have all had good numbers as well. Garware especially was a blowout quarter with IPD turning out as well as better margins across value-added products and improved volumes. Sharda am not certain can sustain growth on the base of the last 4 quarters – i feel next lever of growth is a bit in the future with TREM-V (but valuations aren’t super demanding, so it might trade sideways?).

Disc: Invested and likely to be biased. I write to gather my thoughts and this is not advice and I am not qualified to advise. Please do your own due diligence

| Subscribe To Our Free Newsletter |