Notes from Concall and Presentation Q1 Fy2025

(1) Relatively Strong Execution against a timid backdrop

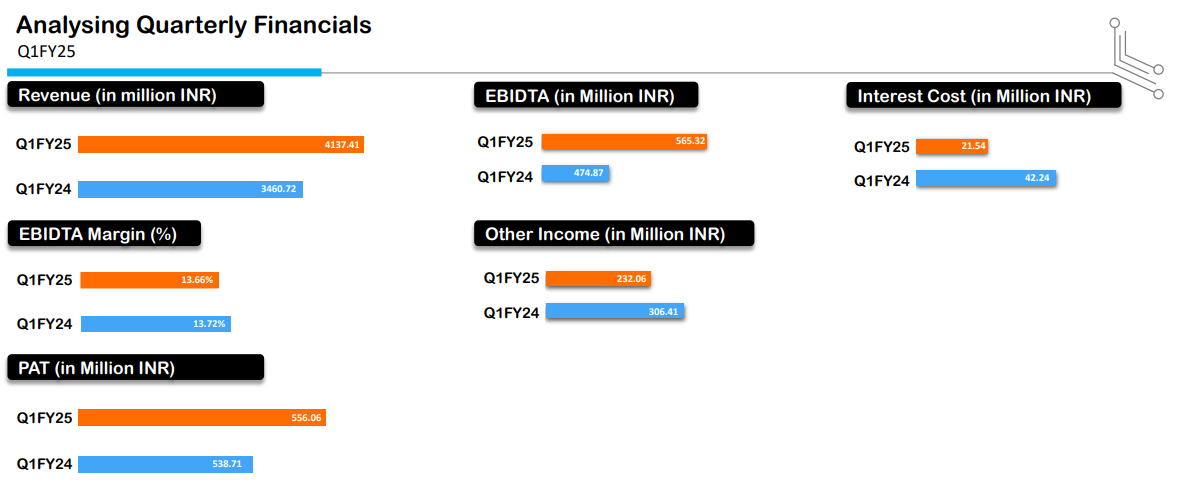

The numbers are good against the economic activity slowdown in EPC space during the election period. The above are stand-alone numbers. Consolidated numbers are less than standalone as it includes the data center SPV.

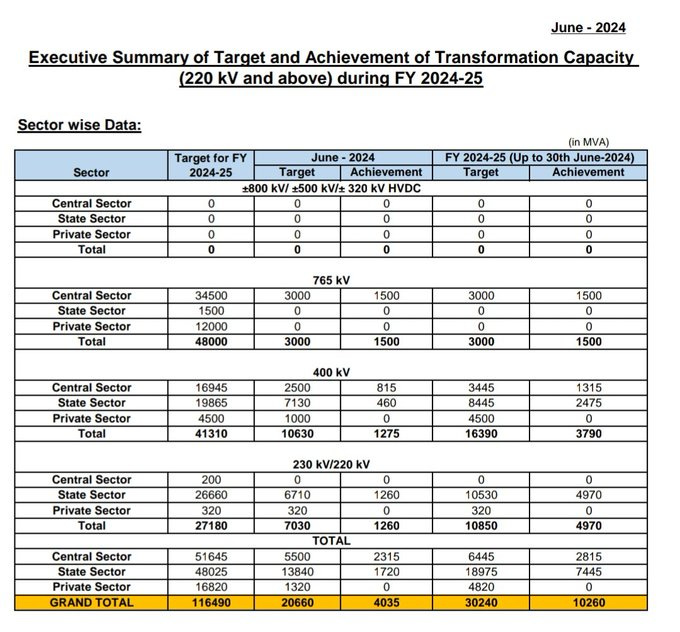

In Q1 FY 2025, the Substation capacity addition ( 220 KV and above) was 10260 MVA – 30% of the target. The whole year’s target is 116490 MVA. This entails that the upcoming quarters can witness good traction in execution.

Credit: GanatraNandan

Q1<Q2<Q3<Q4

Quarter One is generally 15% of full year turnover, followed by 20% in Quarter two, 30% in Quarter 3 and 35% in Quarter 4

So we can expect strong growth in the coming quarters.

Revenue guidance: FY 25: 2500 Cr. : 35 EPS FY 26: 3500 Cr : 50 EPS FY 27: 5000 Cr : 75 EPS ( Pure EPC ) ( Data Centre EPS will be over & above this )

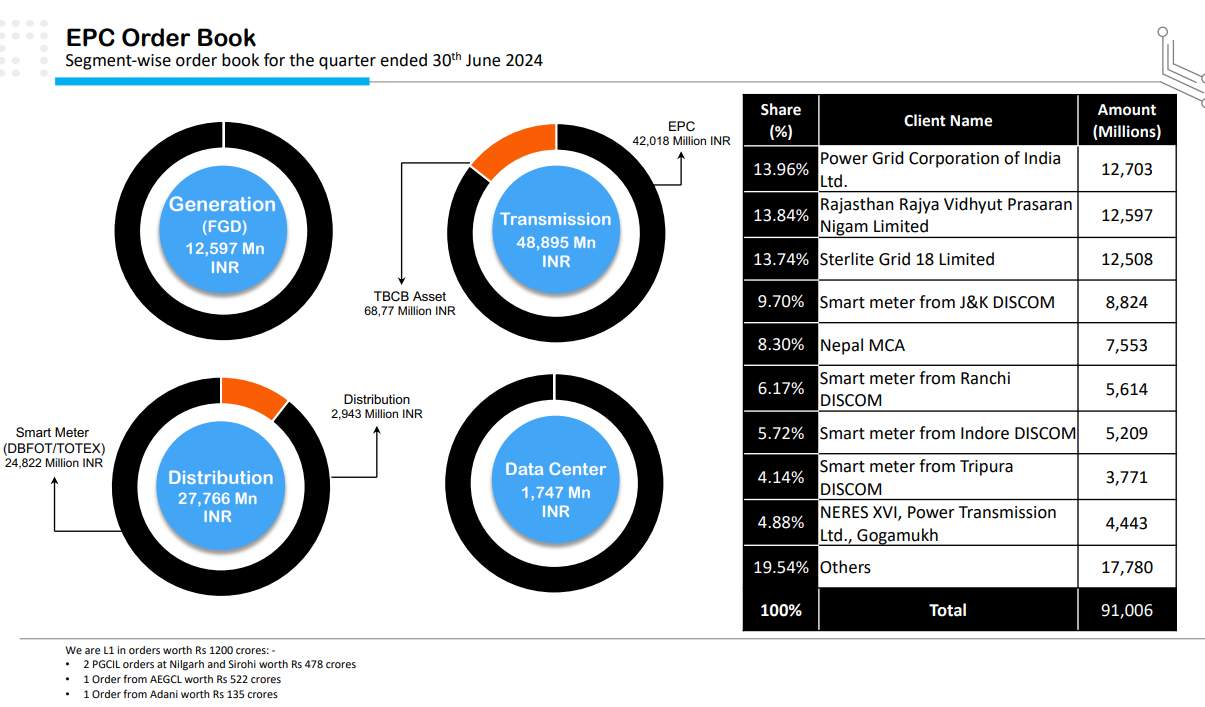

(2) EPC

Bidding for TBCB projects where Sub station/ Line content is 75/25%

L1 in 1200 Cr

Bids in the pipeline of 5000 Cr and expect to get 3000 Cr from that as well

- Technoe is now bidding for concessions in TBCB i.e. they are not just an EPC player anymore but a developer/operator as well. The expected ROEs in these projects are in the 14% range.

We want to be in a capex range of INR500 crores to INR700 crores. The total concession period revenues, INR2,800 crores, and there relates to Gogamukh and Bokajan at the moment. And the total capex involved in these two concessions put together is about 750. We touch on the – with so much of opportunity of the high end capex. The major players are quite busy now and their hands are full. But on the lower capex solutions, the competition is relatively low, and we are able to find better rewards relatively. So we thought to capitalize build on this opportunity, where station contact is about 70%, 75% and line is no more than 20%, 35%.

Smart Meters

Techno has always been conservative in this space, we are – we are the smallest of the deployers where our aim is not to do more than 5%. I will again repeat, over the next seven years my share of total meter deployment will be less than 10 million. So because we have deployed static meter as BPL, APL category over the last 10 years, so we know that we have the gangs, we know the art of deploying the meters, we understand the concession, we understand the challenges of counterparty risk under the Electricity Act. So all the knowledge put together, we did not want it to be out of the space. But we are also not trying to be the largest or the best like we may like to be in transmission or in ISTS space. So that we are conservative, we have contained risk and impact is not – which cannot be absorbed by the company.

FDG

The FGD segment is seeming to come back to momentum. We have got orders worth INR1,450 crores for FGD and that is progressing as expected. This level of business will continue for the next five to seven years, as 100 gigawatt is yet to be ordered out by CPSUs, SEBs and private cycling to a scope of INR1 lakh crores.

BESS

There was a mention of foraying in BESS space as well. This shows the hunger of the management. However, nothing is finalized yet so let’s wait for updates.

(3) Data Center

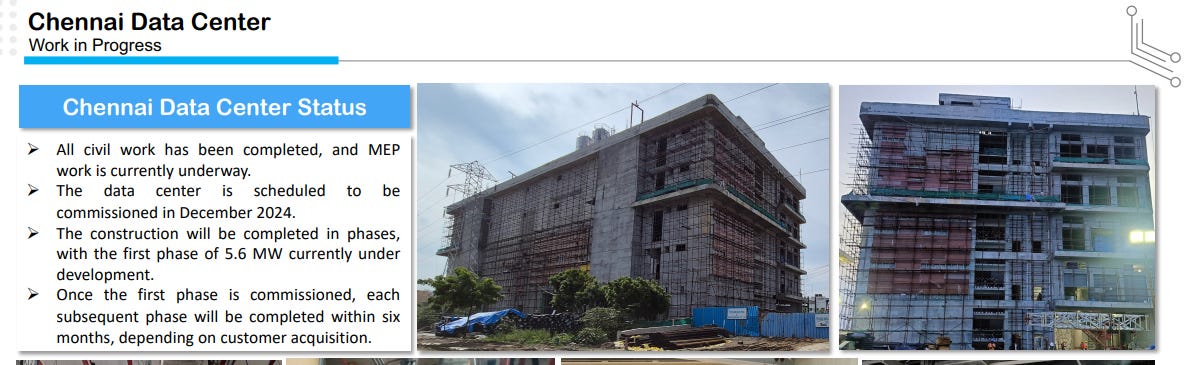

- The company presentation featured details of the Chennai Data Center which is expected to commission in Dec 2024. (This will be a key monitorable). The data center is being completed in 4 phases with the first phase of 5.6MW.

- They have already spent 300 cr on the business

- Apart from this asset, a data center is planned in Kolkata for which they have acquired land.

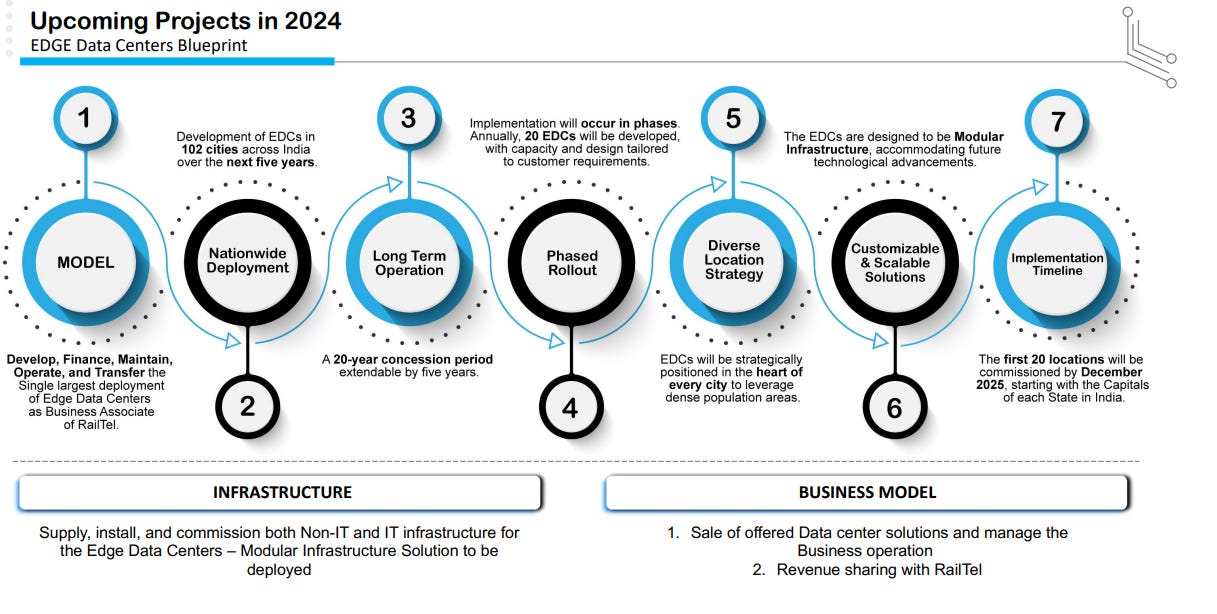

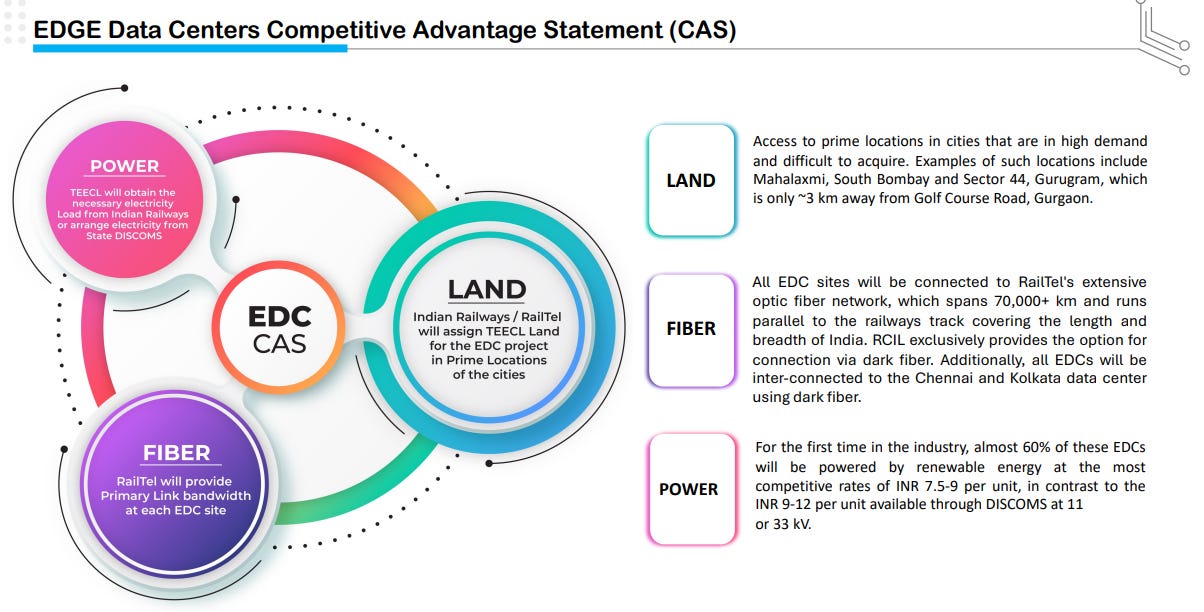

- Edge data centers – Technoe has won the concession for 100+ EDGE data centers from Railtel

Hence they are expecting to leverage the Hybrid Infrastructure:

The data center is not contributing anything on the topline now. This business is in investment mode.

I think of this as an event especially the commissioning of first phase of Chennai Data center and the first set of EDGE data centers.

If they are able to execute - which I hope they do - it can act as a catalyst. Markets value certainity and hence this is a huge catalyst. Further the capex is front loaded.

The management expects to generate an EPS of 25-30 from Data Center SPV 2-3 years down the line and given that this is a growth industry can reward investors

Update on the Monitorables

- Equity Dilution from QIP – Looking to raise around 1250 crore i.e. 9-10% of market cap today. Have raised 1250 crore

- Order wins in Transmission, Distribution (smart meters) and FGD9100 crore order book

- Progress on Chennai Data CenterIn progress – Expected to commission phase I in Dec 2024

- Progress on RailTel Edge Data Centers concessionIn progress – Expected to commission 20 EDGE data centers by Dec 2024

This was first posted on (Result Updates: Techno Electric Ltd. Q1 FY2025)

Regards

Pankaj

(pankajg.substack.com)

| Subscribe To Our Free Newsletter |