Arvind Fashion Ltd.

High D/E >1

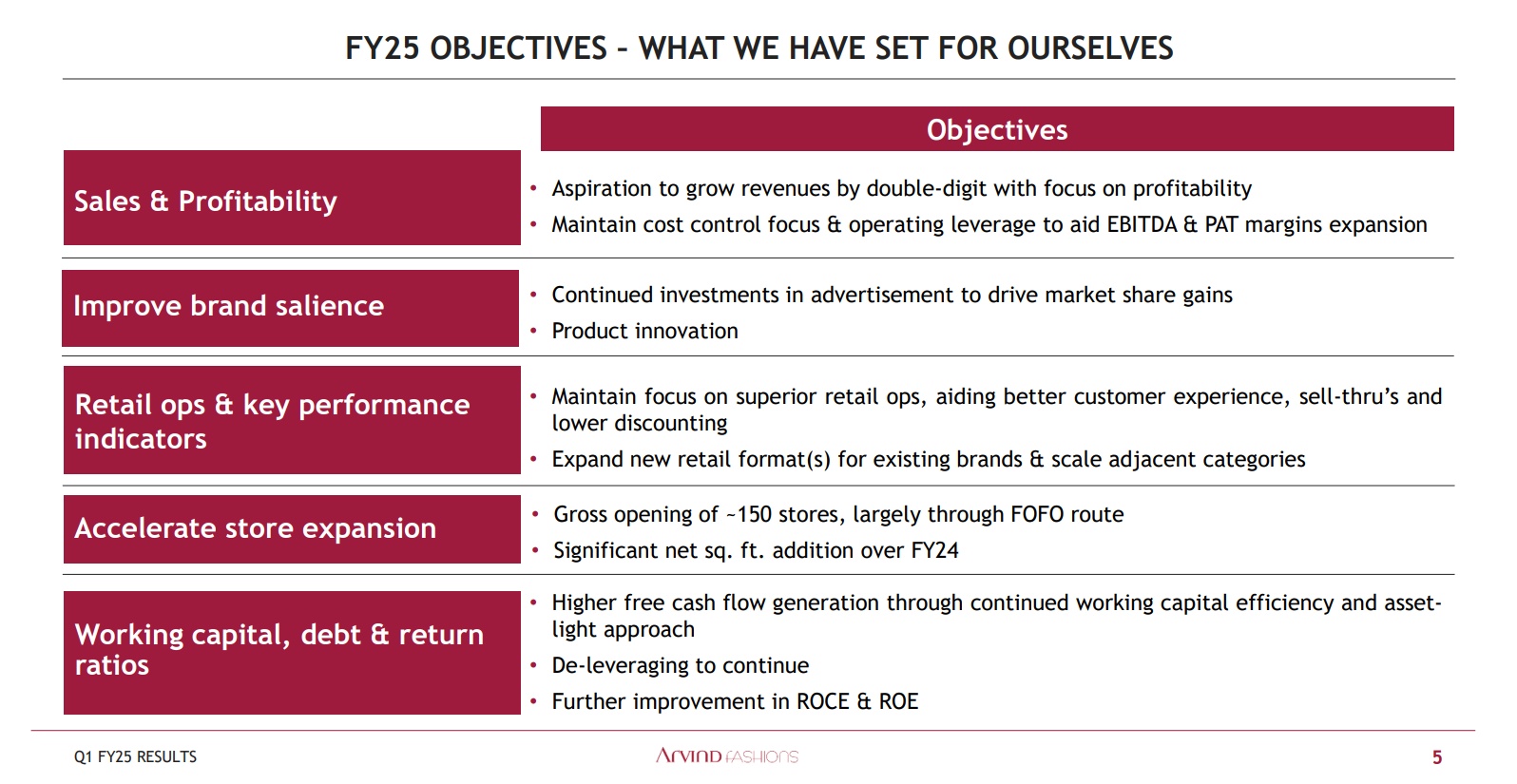

Revenue will grow- 10-12% in near term, supported by strong market position of its apparel brands, increase in sales from adjacent categories, addition of new stores, improvement in performance of ‘Arrow’ and ‘Flying Machine’ brands, and increase in store efficiency.

AFL has planned capex of ₹100-120 crore per annum in FY25-FY26, which is expected to be funded through internal accruals.

Discontinuation of loss-making ‘Sephora’ business.

The company completed closure of most of its loss incurring brands and decided to focus on its five key brands (Tommy Hilfiger, U.S. Polo, Arrow, Flying Machine and Calvin Klein) with an aim to improve its profitability. Licenses of these existing international apparel brands are long term/perpetual.

ROCE will increase to 20%

It also encompasses various segments like men’s wear, women’s wear, kids wear, inner wear, footwear and accessories; albeit skewed towards men’s wear.

The company has a dedicated team for its adjacent categories (footwear, inner wear, kids wear, women wear and accessories), which has supported revenue of around ₹600 crore from adjacent categories in FY24. Adjacent categories account for over 15% of the revenue for some brands**. Going forward, the management plans to increase its sales in adjacent categories within its existing brands to improve demographic presence.**

In Q2FY24, AFL launched women wear line under U.S. Polo through online channels.

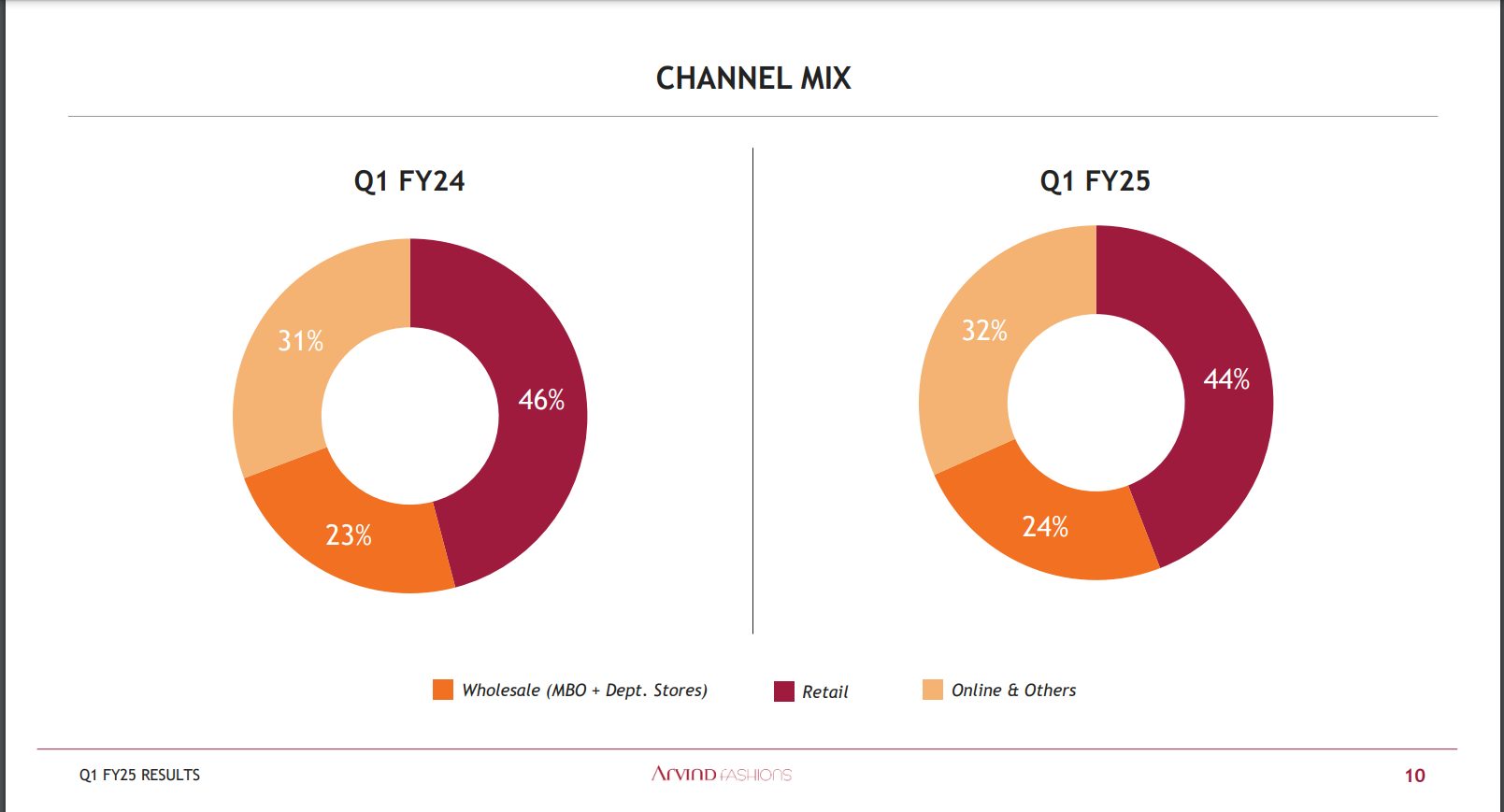

Wide distribution network with presence across multiple sales channels

Profitable track record of two years with expectation of further improvement in profitability

AFL witnessed gradual increase in share of full price sales across brands and lower discounting, improvement in performance of ‘Arrow’ brand,Flying Machine and closer of loss-making brands and benefits of operating leverage aided improvement in profitability in recent past.

However, AFL has taken steps to improve inventory turnover and collection period. The company’s gross operating cycle which elongated to nearly 400 days in FY21 mainly due to COVID-19 pandemic, improved to 197 days in FY24 (FY23: 174 days) supported by steps taken by the management to improve collection period, inventory turnover and store efficiency

Key weaknesses-

Operating performance exposed to economic down-cycles -Retail clothing and apparel industry has heavy dependence on the disposable income of its customer segment and is susceptible to economic cycles because of discretionary purchases. Retail clothing and apparel industry is facing subdued demand for value segment and online channel, which had an impact on its overall performance.

Highly competitive branded apparel retail industry- which exerts pressure on profitability margins The apparel retail sector in India is highly competitive with presence of many domestic and international brands and foray of large corporates like TATA group, Reliance group and Aditya Birla group.

Q1 FY25- Key highlights

Screenshot 2024-08-25 153121.png 67.5 KB

Screenshot 2024-08-25 153021.png 219.05 KB

Screenshot 2024-08-25 153004.png 78.11 KB

Stock inventory for coming seasion ie Q2 and Q3 will be good

The management is committed to increasing revenue growth and growing EBITDA by 100 basis points, with a medium-term goal of achieving 12-15% growth.

OPM increasing bcz of operating leverage, low discount giving,cost efficiency in sourcing,premiumization etc.

In terms of capex, the company plans to spend around 100 crores in FY’25, with investments in COCO stores, IT capex, and store renovations. The capex is expected to be funded internally, with strong cash flows from the Tommy brand. The company is cautious about inventory buildup and aims to bill closer to the season to ensure good sell-through rates.

Our net debt was around 225 crores. There is a seasonality, next quarter it could go up by 50-odd crores here because we have to build the inventory for the season and a bigger scale. But I think we will remain at this level and any free cash flow that we generate, we will try to pare down the debt level from that. So, I think we have been reducing our debt levels and that effort will continue.

Key Financial Metrics:

– Revenue growth of 10% compared to 5% in the previous quarter

- Gross margin increased by 80 basis points despite similar retail channel growth

- EBITDA margin at 13%, showing a 100 basis points improvement

Management Commentary Highlights:

- Focus on profitable growth, not just growth for the sake of growth

- Strong performance in online channel with B2C growing over 60%

– Aggressive expansion in MBO and department store channels

– U.S. Polo brand performing well with double-digit growth in sales and EBITDA

– Efforts to revamp Arrow and Flying Machine brands for higher growth

Insights into Business Verticals:

- Wholesale and retail channels both saw growth in revenue and channel profitability

- MBO channel grew handsomely due to distribution expansion and brand strength

- Department store channel saw good growth with healthy margin profile

- Online B2C business pivoting from wholesale towards B2C for healthy growth

Forward Guidance & Outlook:

-

Commitment to 15% net square foot addition in retail expansion

-

Expectation of higher revenue growth compared to previous quarters

-

Focus on increasing EBITDA margin by at least 100 basis points

-

Strategy to revamp Arrow and Flying Machine brands for higher growth and profitability

-

U.S. Polo brand expected to deliver similar profitability as Tommy and CK brands in the medium term

Continued efforts to improve stock turn and liquidate inventory for better margins and cash realization

Overall, the company is focused on profitable growth, with a strong performance in online and retail channels, aggressive expansion in MBO and department store channels, and efforts to revamp underperforming brands for higher growth and profitability. The management is optimistic about future growth prospects and committed to improving financial metrics, despite challenging market conditions.

| Subscribe To Our Free Newsletter |