Positioned for Exponential Growth in a Booming CNC market

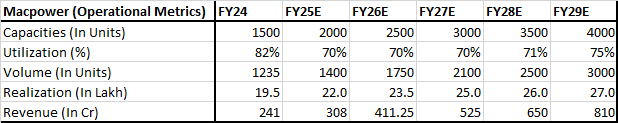

The company will add 500 machines by the end of FY25, bringing the total to 2,500 machines. Company has done a CAPEX of 9 crore in FY24 and expects the capex to be in the range of 15-20 crore in FY25E. We estimate an additional 500 machines will be added each year, reaching 3,500 machines by FY29. However, once the new facility becomes operational, capacity could quickly double, and realizations may increase beyond our current estimates. We are taking a conservative approach in our estimates.

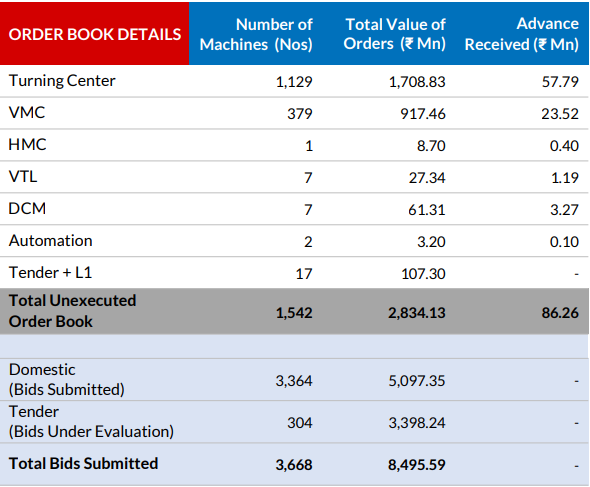

As of June 2024 company has an order book of 283 crore, 1.2 times of FY24 revenue. From 1,235 machines sold in FY24, we estimate the company to sell 1,750 machines by FY26 with an average realization of ₹23.5 lakh per machine, slightly below the management’s guidance of ₹24-25 lakh per machine. It’s important to note that the company only started manufacturing double column machines in 2019. Along with double column machines, VMC and HMC machines are high-value products (called Nexa group), with an average realization of ₹60-80 lakh per machine (below order book breakup). The revenue mix from these high-value machines is increasing rapidly.

Breakup of Q1FY25 Orderbook

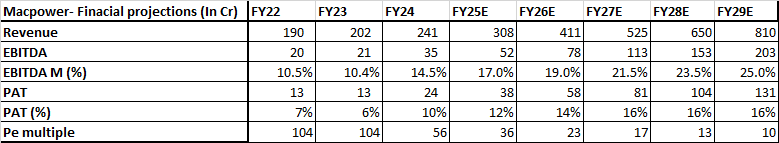

Based on these trends, we estimate the company’s revenue to reach ₹411 crore by FY26. With similar growth, we expect revenue to double over the next three years, reaching ₹800+ crore by FY29.

So far as margins are concerned, Management has indicated that 25% operating margins could be achievable in next couple of years on the back of rising share of high value machines, backward integration (manufacture 60-70% components in-house) and operating leverage. We estimate that the company will reach 19% operating margins by FY26, gradually increasing to 25% by FY29. With this, we project the company to generate a PAT of ₹58 crore in FY26 and ₹131 crore by FY29.

In terms of valuation , a company with strong industry tailwinds, growing at 35-40% CAGR, should command at least a 40-45x price-to-earnings multiple. The multiples could be even higher if order inflow from the defense sector and government initiatives supporting the manufacturing sector continue. At a 45x price-to-earnings multiple, the company’s market cap could reach approximately ₹2,600 crore on FY26 earnings, nearly double the current market cap (₹ 1,353 crore)

Competitive Landscape

While Jyoti CNC is also well-positioned for growth, however, its current high valuation (123x price-to-earnings TTM) makes it less attractive for investment at this stage. Additionally, with Jyoti already achieving operating margins around 25%, there is limited room for further margin expansion, though it could potentially reach 30%+. In contrast, Macpower has greater potential for margin expansion. Although Jyoti may see higher realizations due to its focus on EMS and defense orders, Macpower’s more favorable valuations and lower base effect suggest it could deliver better returns in the long term.

Disclosure : Please note that I hold this stock in my personal portfolio, and my views may be biased. This is not an investment recommendation, but simply my perspective. I encourage you to think independently and make your own informed decisions before making any investment.

Check the complete note: Macpower CNC: Multifold profit growth for this company

| Subscribe To Our Free Newsletter |