Compiled a short note, Enjoy,

Navigating Global Trade, Unlocking Infinite Possibilities.

01/10/2024

Listed on NSE Emerge, Lot Size 500, will change to 250 on 1st November

COMPANY OVERVIEW:

• 2 decade old Company providing Logistics and Supply Chain solutions across South America, Europe, Gulf & South East Asia. It has two wholly-owned subsidiaries i.e. SJA Logisol India Private Limited and S.J.L. Group Singapore Pte Ltd.

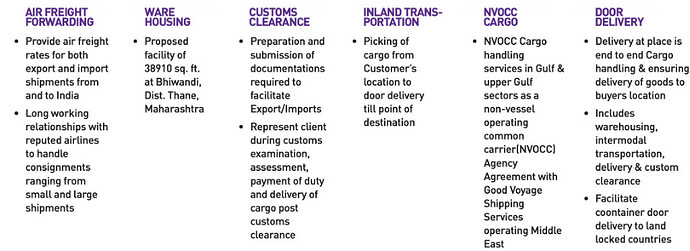

• Key services include:

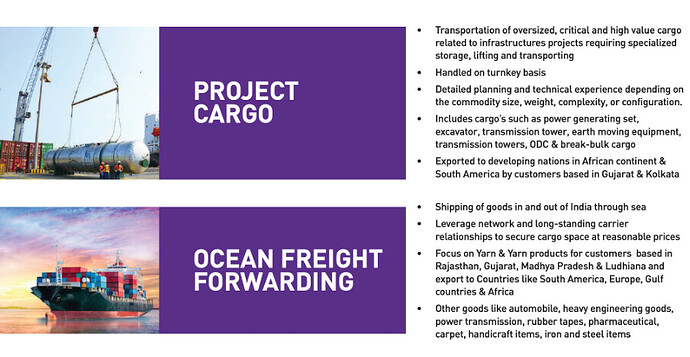

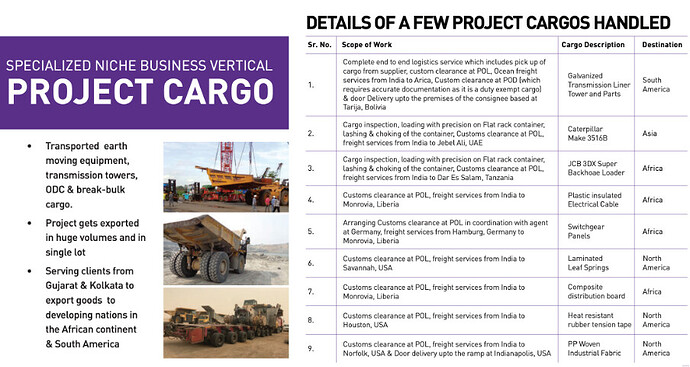

Project Cargo,

Ocean & Air Freight Forwarding,

Customs Clearance,

Inland transportation Warehousing,

Door Delivery &

NVOCC (Non-Vessel Operating Common Carrier)

• Member of agency networks like ALN Network, America Alliance & PPL

Starting the Warehousing Operations by entering into an agreement for renting warehouse space located at Bhiwandi

S J Logistics has entrenched itself nationally, accumulating extensive industry expertise. Its proficiency extends across various sectors, including but not limited to yarns, textiles, transmission towers, tyres, polyfilms, chemicals, agro commodities, and Fast-Moving Consumer Goods (FMCG).

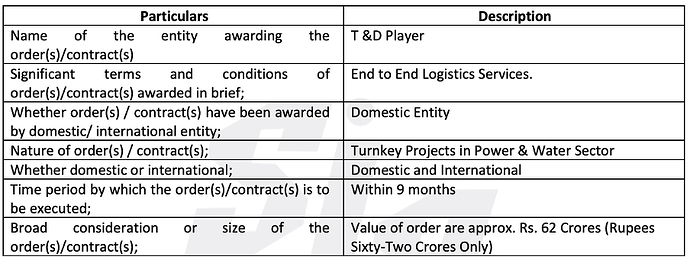

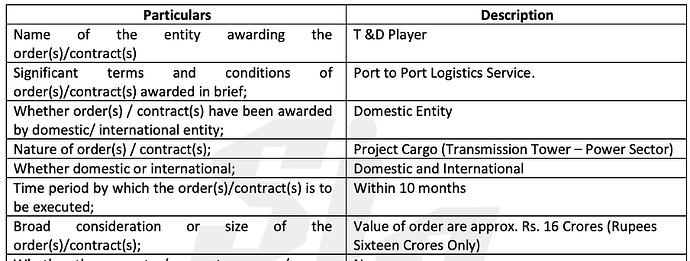

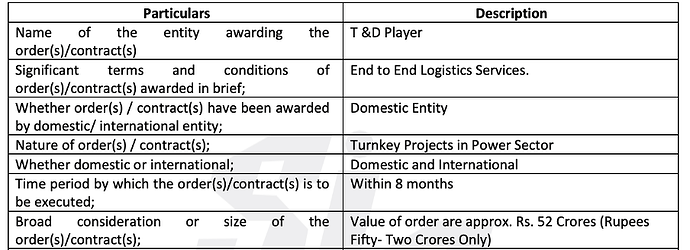

Orders Received:

May 09, 2024

July 16, 2024

22nd July 2024

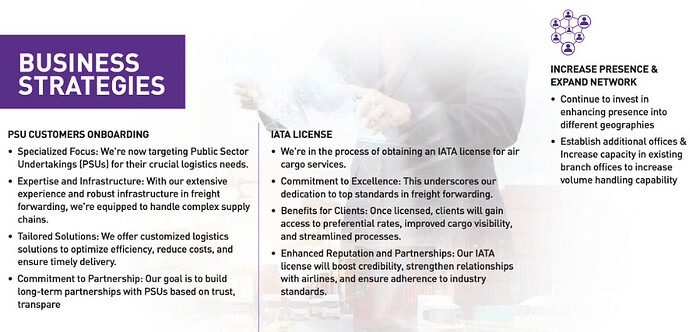

Announcement for approval of Air Cargo license issued by International Air Transport Association (“IATA”)

The International Air Transport Association (“IATA”) has issued the License to S J Logistics (India) Limited to promote, sell and handle International Air Cargo transportation vide IATA

Code: 14027270003.

Q1 Management Commentary:

Rajen Hasmukhlal Shah, Chairman & Managing Director of S J Logistics (India) Limited,

commented on the company’s financial performance for the Q-1 of fiscal year 2025:

“We are delighted to report a robust financial performance for Q1 FY25, highlighting our

resilience and strategic foresight in a rapidly evolving logistics landscape. The exponential

increase in consolidated revenue and growth in net profit are testaments to our team’s

dedication and our strategic initiatives aimed at driving sustainable growth.

This quarter, we have seen significant improvements across our key performance metrics.

Our company has achieved consolidated revenue of Rs.100.71 Crores in Q-1 FY25 which

was Rs.270.86 Crores in full FY24, this growth reflects not only the expansion of our service

offerings but also our focus on operational efficiency and market penetration. Further, the

rise in consolidated net profit demonstrates our effective cost management and operational

discipline, enabling us to enhance shareholder value while investing in our future.

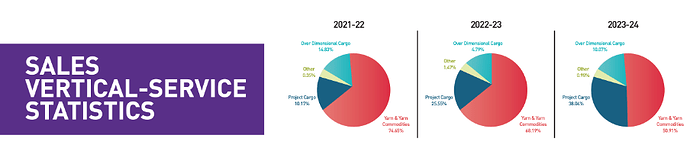

Increase in our EBITDA margin which is 14.03% in Q1 FY25, as compared to 10.87% in

FY23-24 underscore the success of our ongoing initiatives to optimize our logistics

processes and control costs. This has been possible with the increased contribution of

Project Cargo Shipments which carry higher EBITDA margins. These improvements are

crucial as we continue to navigate a complex market environment.

The increase in cargo volume and the improvement in delivery timelines are particularly

noteworthy. They are indicative of our commitment to operational excellence and our ability

to meet the evolving needs of our customers with greater efficiency and reliability.

Future Outlook:

Looking ahead, our company is optimistic about the growth opportunities in the logistics

sector. The company plans to further expand its operations and enhance its service

capabilities to meet the evolving needs of its customers and also on-boarding of new

customers. With a strong focus on sustainability and digital transformation, S J Logistics

(India) Limited aims to lead the industry in providing innovative and efficient logistics

solutions. The company is also exploring strategic partnerships and acquisitions to

strengthen its market position and drive long-term value creation. Our focus will remain on

leveraging emerging opportunities and driving innovation to deliver superior value to our

clients and stakeholders

Our team’s relentless pursuit of excellence, coupled with our strategic investments, positions

us well to capitalize on the growing demand for logistics services. We are optimistic about

the future and are committed to maintaining our momentum as we advance into the second

Quarter of the fiscal year.”

12th September 2024

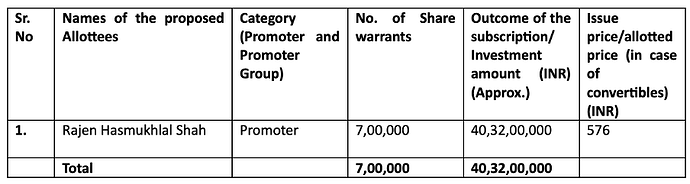

1. ISSUE OF 7,00,000 SHARE WARRANTS, CONVERTIBLE INTO EQUITY SHARES ON PREFERENTIAL BASIS TO THE PERSON BELONGING TO PROMOTER AND PROMOTER GROUP CATEGORY:

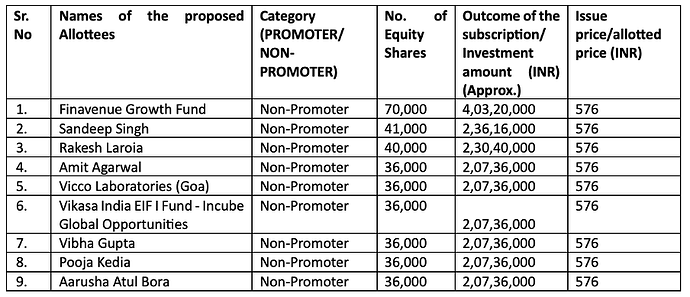

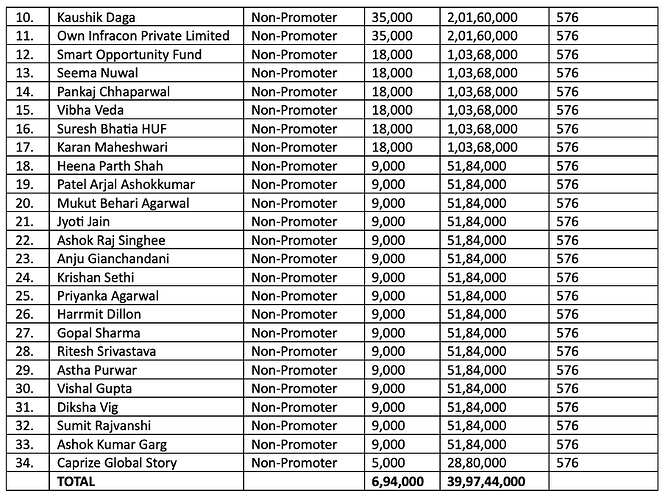

2. ISSUANCE OF 6,94,000 EQUITY SHARES ON PREFERENTIAL BASIS TO THE PERSONS BELONGING TO NON-PROMOTER CATEGORY:

Some Blog Posts to know more about the Company:

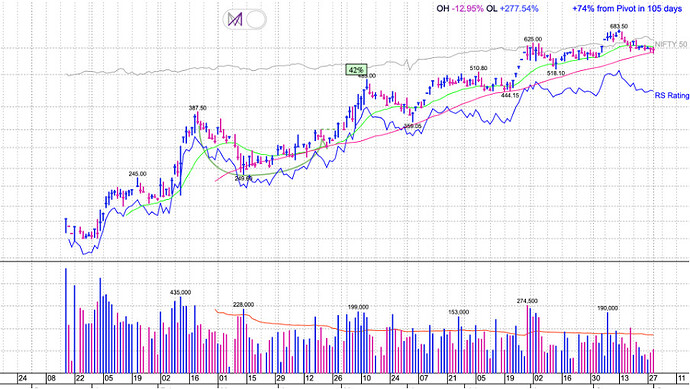

Daily:

Taking support @ 50DMA, Holding firm in this SME Meltdown

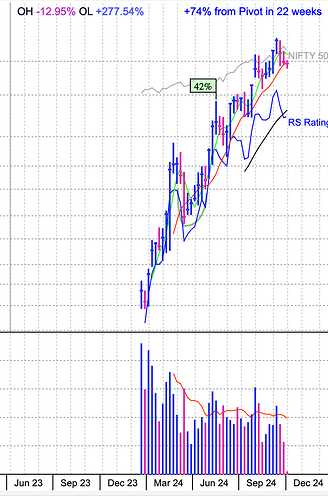

Weekly:

Taking support @ 10 WMA

Compiled Notes from here & there, No Buy or Sell Recommendation. Do your Own Diligence.

| Subscribe To Our Free Newsletter |