Investors all do fundamental analysis and buy equities. This is the beginning of the journey. Just holding stocks with best fundamentals does not guarantee you good returns. One should be aware of returns, volatility (risk) and momentum.

One should look at how the market is currently moving, it is highly volatile and can correct or steeply fall, correct? This is the time to take shelter under low volatility.

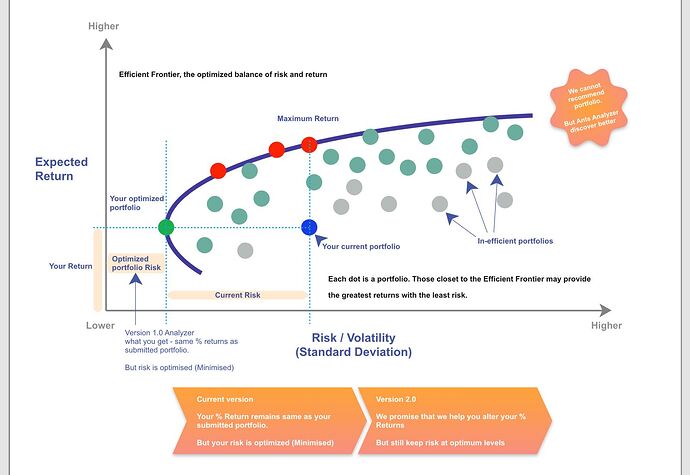

It means we should steer our portfolio by adjusting weights to take shelter under low volatility. Low volatility means lower downward risk. Portfolio can be optimized, hence when market fall happens for the selected scrips your combined portfolio will have least fall! Any other weights will have more fall! This is not theory! It works when market falls! Hence rather than panic stricken selling investors can stay invested and take shelter under low volatility. When market starts recovering, Investors can rebalance portfolio for higher expected returns but still portfolio running on optimized performance curve. No excuses for not having portfolio on Optimum performance curve.

Optimum curve is named after Markowitz who got Nobel for this discovery. Later on, many improvements were made on this model about how to make your portfolio run optimally. But never optimum curve was abandoned. This is still the same for performance. All global fund managers still manage their portfolio on this optimum curve only. Any other portfolios are inefficient!

Let us not get into theory- All MBA Fin in institutions like IIM still learn Markowitz as part of curriculum. But how to use it under different circumstances is what Global fund Managers Use-Let us get into that –

- There are no second words or thoughts, for a set of given scrips, portfolio of least volatility (combined standard deviation is minimum) is the portfolio that falls least when market correction happens. Hence if you foresee high volatile market and systemic risk, take shelter here.

- When market upward momentum is there, you can still keep your portfolio on Markowitz curve, but not on least volatility, but on higher returns. Higher the return higher the risk.

- When market is flat, you can steer your portfolio to point close to highest return on Markowitz curve, hence your portfolio still gives good return when market is flat (note this is flat after correction, not before fall). With the caveat, highest return portfolio will have highest fall if market falls!

- How to identify these points – Geopolitical uncertainty like now or your selected scrips say 3 out of 5 showing downward momentum, both MACD is down below all the 3 averages and 3 out of 5 scrips in portfolio on rsi showing oversold, this is time to take shelter.

- When 3 out of 5 are showing upward momentum, you can keep your portfolio return between least value and maximum value. But still weights should be optimized and portfolio on Markowitz optimum line. You can leverage the upward momentum.

- For those of you who don’t know Markowitz curve-see the image below.

How to adjust portfolio value to run on optimum curve and to adjust ROI on where we want-I will discuss it day after tomorrow. - Do you have a portfolio, are you an investor- Do you use Markowitz to balance your portfolio? If not, how do you decide how much % of investment should go to each scrip? Do Share in your reply!

| Subscribe To Our Free Newsletter |