Here’s a basic information set about P. N. Gadgil Jewellers (PNG Jewellers):

Company Overview

P. N. Gadgil Jewellers Limited, also known as Purshottam Narayan Gadgil Jewellers, founded in 1832, is one of India’s oldest and most recognised jewelry brands. The company specialises in a variety of gold, silver, platinum, and diamond jewelry. Its reputation for quality and tradition has helped it establish a loyal customer base

Company provides new jewellery trends in Maharashtra and have introduced Temple Motifs, Contemporary Jewellery designs, Light Weight, Daily Wear and Designer Collections, etc.

Product Categories:

a) Collections:

Azva, Color Mangalsutra, Delicate Designs, Divine Collections, Diwali Festive Collection, etc.

b) Diamonds:

Festival Diamond, First Love First Diamond, Love Again and Again, Rose Gold Collection, Ruby Gold, etc.

c) Gold:

Zaroka Jewellery Collection, Accessories, Bracelet – Gents, Bracelet – Ladies, Chain For Ladies

d) Silver:

Corporate Gift Items, Kids, Pooja Sahitya, Silver Jewellery

e) Women’s Jewellery:

Mangalsutra, Bangles, Necklace, Pendant, Tops, Finger Rings, Chains

f) Men’s Jewellery:

Chain, Chain Pendant, Ring, Bracelet

30% of the sales is made to order, 2-10 days for made to order

current stud ratio>10%.

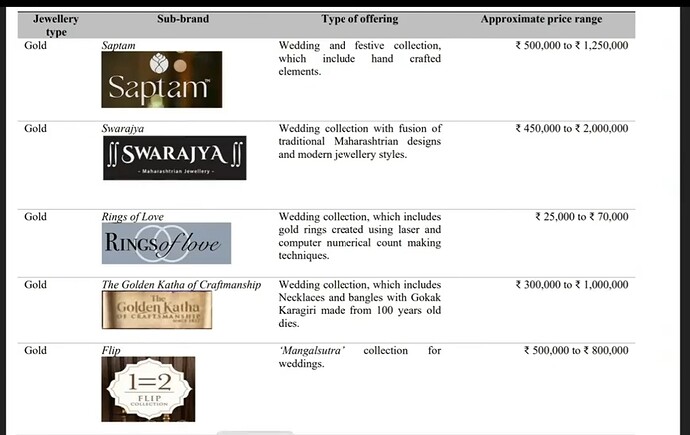

Some of their sub-brands

Closure of Overseas Subsidiaries:

In FY22, company did wrote-off Rs 52 crore following closure of loss-making subsidiaries in Dubai (PN Gadgil Jewellers DMCC and PNG Jewellers LLC). Prior to that, the group has sold off or discontinued operations in loss-making entities. Company sold Style Quotient Jewellery Pvt Ltd in FY18 and its joint venture, Anant Mauli Jewellers, in FY19. It also discontinued operations of GDPL in FY18. In FY23, it discontinued its operations in the Middle East. The US subsidiary is profitable.

•Operating margin declined to 2.8% in fiscal 2023 from 4.4% in fiscal 2022, on account of one-time write-off of Rs 52 crore following closure of loss-making subsidiaries in Dubai (PN Gadgil Jewellers DMCC and PNG Jewellers LLC).

Store count

•Pre IPO Co has 39 stores ,which includes 38 stores across 21 cities in Maharashtra and Goa and one store in the U.S. with an aggregate retail area of approximately 108,282 sqft.

•FOCO model -28 own, 11 franchise.

•large formet store :- 22 :- 2500 sqft.

•Medium format store:- 13 :- 1000 -2500 sqf

• Small format store :- 4 :- < 1000 sqft

Pune accounts for 60% of sales.

Recent Developments

• IPO: Launched in September 2024, raising ₹1,100 crore for expansion and debt repayment.

• Expansion Plans: Opening 12 new stores across Maharashtra to strengthen market presence.

Guidance

• sales to be 10,000 cr in 2 years . CAGR of 20 %

• total 57 stores in 2 years

• 2 years stores opening will be in Maharashtra

• Going forward it will be in MP,UP, Bihar , Jharkhand

• > 15 studded PF

Peers

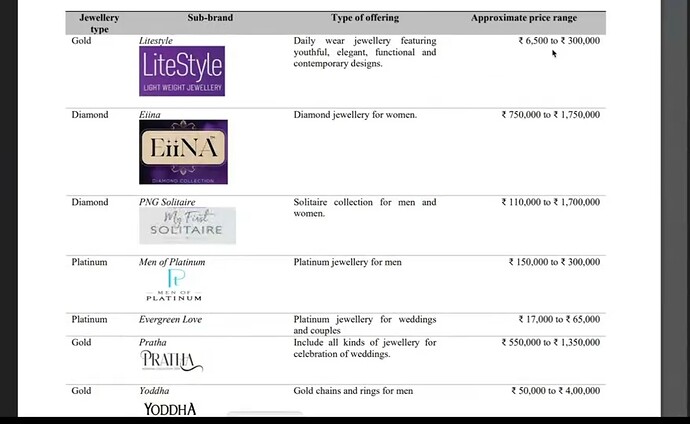

• Competitors: Kalyan Jewellers, Senco Gold, Thangamayil Jewellery

• Strengths: Established brand heritage, strong customer loyalty, effective marketing strategies.

Key Ratios: PNG’s Return on Net Worth (RoNW) is at 25.09%, outperforming several competitors, which indicates effective utilization of equity capital.

Expansion plan of organise jewellers

Some key ratios vs peers (source x.com)

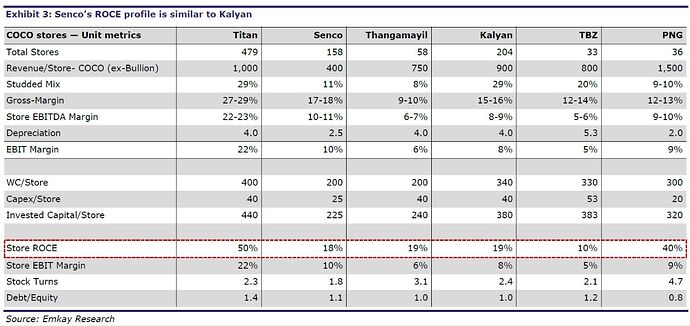

Geographic Focus

• Primary Market: Concentrated in Maharashtra, with plans for gradual expansion into other regions.

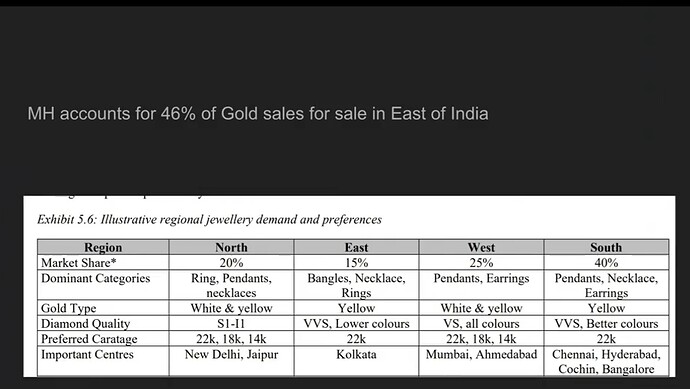

Sales breakup of whole gold market of india

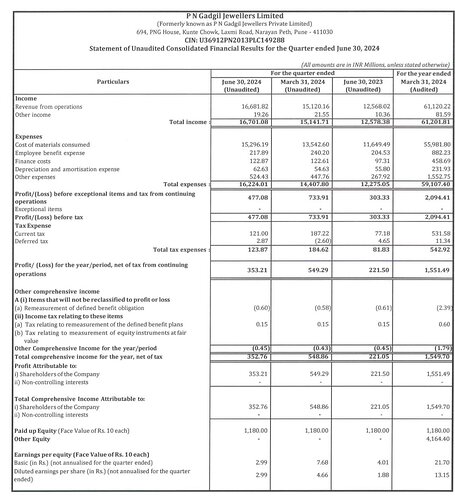

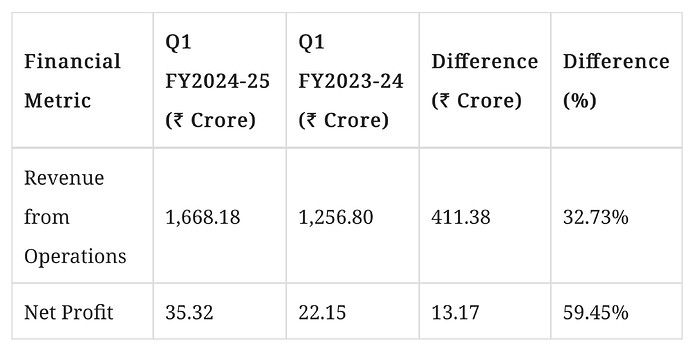

Financial Performance

• Revenue Growth:

In Q1 FY2024-25, PNG reported revenues of ₹1,668 crore, reflecting a 32.7% increase year-on-year .This growth is indicative of strong demand for its products and effective marketing strategies.

• Profitability:

The company achieved a net profit of ₹35.32 crore, up 59.45% from the previous year, highlighting improved operational efficiency and cost management .

Past 5 year’s data

The growth drivers for P. N. Gadgil Jewellers (PNG Jewellers) can be categorized into several key areas:

- Strong Brand Heritage: With over 190 years of experience, PNG Jewellers has built a reputable brand known for quality and tradition. This long-standing presence helps attract customers who value craftsmanship and trust in established brands.

- Expansion Plans: The recent IPO raised ₹1,100 crore, which is earmarked for opening 12 new stores in Maharashtra and repaying certain debts. This strategic expansion is expected to increase market penetration and drive sales growth.

- Market Demand: There is a growing demand for gold and diamond jewelry in India, driven by rising disposable incomes, changing consumer preferences, and cultural factors that favor gold as an investment. PNG’s product offerings cater to this demand.

- Diversification of Product Range: PNG Jewellers is likely to diversify its product offerings beyond traditional jewelry to include modern designs and customized pieces, attracting a wider customer base, including younger consumers.

- E-commerce Growth: The increasing penetration of e-commerce in India provides an additional channel for sales. PNG Jewellers can leverage online platforms to reach customers outside of their traditional geographic areas.

- Operational Efficiency: PNG’s focus on cost management and operational efficiency helps improve margins and profitability. This includes optimizing supply chain management and enhancing customer service.

- Shift from unorganised to organised jewellers because of BIS Hallmark , Standardized Pricing, Itemized Billing ,

(Organized retailers provide detailed itemized bills, which outline the costs associated with the purchase, including the price of raw materials, making charges, and any additional taxes) Digital Payment Solutions, Compliance with Tax Regulations, Loyalty Programs and Discounts .

Overall, PNG Jewellers combination of strong brand equity, strategic expansion, and adaptability to market trends positions it well for continued growth in the competitive jewelry market.

Geographic Concentration

The company primarily operates in Maharashtra, which accounts for a significant portion of its revenue. While this concentration allows PNG to leverage local market dynamics effectively, it also poses risks associated with regional economic fluctuations. Diversifying into other states could mitigate this risk.

Thesis

P. N. Gadgil Jewellers (PNG Jewellers) is positioned for robust growth and sustainability in the competitive Indian jewelry market.

•The company has shown impressive financial performance, with a 32.7% increase in revenue and a 59.45% rise in net profit in Q1 FY2024-25

•Its successful IPO, which raised ₹1,100 crore, demonstrates strong investor confidence and provides capital for expansion .

•PNG’s focus on enhancing customer experience through improved billing structures, compliance with regulations, and the introduction of loyalty programs helps build trust and customer loyalty .

•The company’s strong brand heritage and commitment to quality further strengthen its competitive position against unorganized players in the market.

•Reduction in import duty of gold from 15% to 6%.

•Monthly investment plans has been introduced by most of organised players one can customise monthly instalments.

•One of the best Debt/Eq ratio among the listed peers.

•PNG has Lowest inventory of 63 days.

Challenges

•PNG’s reliance on a single region, primarily Maharashtra, exposes it to economic fluctuations specific to that area, potentially limiting its growth.

• fluctuations in gold prices and changing consumer preferences can impact margins and demand, adding to the uncertainty in the jewelry sector .

•Market Competition: PNG faces challenges from well-established competitors, which necessitates continuous innovation and marketing efforts to maintain market share.

•Seasonality

•As of July 2024, of its 39 stores, PNG has 36 stores in Maharashtra, which contributed to over 95% of its revenue in fiscal 2024. Moreover, five stores contributed to ~35% of revenue in fiscal 2024

Regulatory and Economic Factors

The jewellery industry is susceptible to changes in gold prices and regulatory policies, which could impact margins and consumer demand .

In summary, PNG Jewellers displays strong financial performance and strategic growth plans, particularly in Maharashtra, while facing the inherent challenges of a competitive market and geographic concentration.

Looking forward to comments/inputs from the fellow valuepickrs.

Disc- holding from ipo allotment not buy/sell recommendation

| Subscribe To Our Free Newsletter |