Hello Friends,

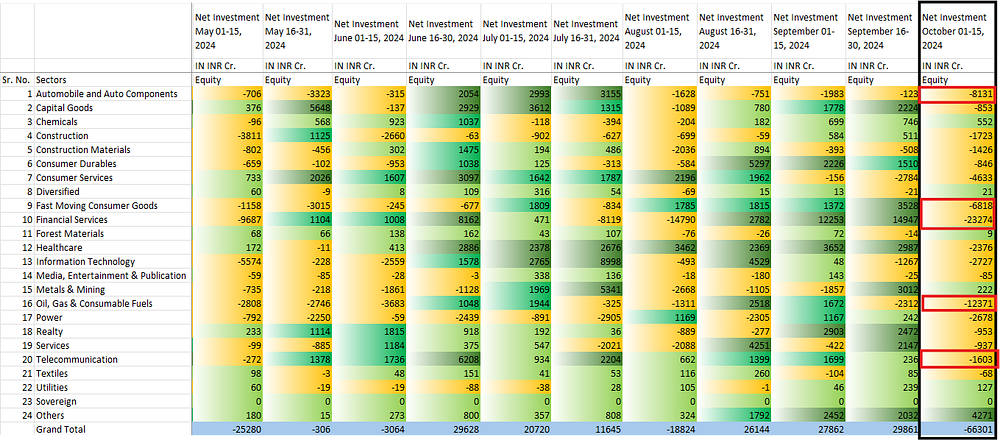

The data of net investments by FII’s are out from 1st October to 15 October.

This fortnight was one of the darkest fortnight for the Indian equities market. Due to Geopolitical tension around the globe between Israel-Iran and the China stimulus, we have experienced a huge chunk of net outflows from major 17 sectors out of 24 sectors.

The data provided in the image is for 11 fortnights starting 1st May to 15th October. In the 11 fortnights we have acquired a net inflow of 32,085 crores. However in the same duration, excluding the lates fortnight we had clinched net inflow of 98,386 crores. In just 15 days we almost lost 66,306 crores of Investments.

The most affected sectors for this fortnight are

- Financial Services: – 23,274 crores

- Oil Gas and Consumable fuels: -12,371 crores

- Automobile and Auto components: -8,131 crores

Collaboratively these three sectors have contributed to 66% of net outflows for this fortnight.

Chemical sector sees promising investments as this sector has been securing net inflows for the past 4 fortnights continuously. This shows a positive sign in the chemical sector.

| Subscribe To Our Free Newsletter |