I agree historically this hasn’t happened and probably won’t this time too but history doesn’t repeat but rhymes as they say. Pre 2008, capital goods, infra, manufacturing did quite well but post 2009, companies like page industries did very well and so on. When we look at different slices of history, smallcaps from different sectors have become midcaps/largecaps. There is a tendency for certain sectors to outperform others and this has more to do with what’s happening outside those companies as well though we tend to give them and their management all the credit.

Historically we havent had GDP growth without credit growth either – but now we are seeing govt. led capex even as private is sitting on lean balance sheets with cash – so there’s no credit growth though there’s GDP growth which is also confusing people.

So depending on how far back in history you go, you can always find some similarities to what’s happening currently. We have been a services and consumption driven economy in the recent 10-15 years which is why our Nifty today looks like this – heavy on financial services, fmcg, IT, Auto etc.

Our govt. has taken a bold step to tax heavily both direct and indirect and invest heavily in capex. This govt. driven capex is what is driving earnings in small/microcaps (To some extent midcaps too) but not in largecaps because these became large in the consumption driven economy in the first place (except a few like L&T, Cummins, Siemens, ABB etc). This has a precedent in a country like South Korea. I feel this is a fundamental shift in approach from the govt. and as long as this policy stance is in place, I will stand by what I said.

Why do I think this policy stance can continue? See the fiscal deficit print from today

Collections are higher, expense flat, capex is down (due to elections CoC, will pickup big time in H2 as we are seeing in tendering activity), < 30% of target for year means it will remain in control for full year. Our earlier concerns with this approach has been fiscal deficit and foreign capital fleeing and currency weakening and so on – now we have strong reserves, strong domestic flows if FIIs flee and deficits are well under control.

As long as there aren’t elections to win and votebase to appease, this might be the stance. What was nice was the govt. didn’t let up the stance even in election year which is telling us something. But this cannot come at the expense of consumption, so I would think a rate cut should come sooner or later which will ease consumption concerns (auto inventory, fmcg issues) but the govt. capex should resume full swing in H2.

So when people say correction is coming in smallcaps, the perception is that its completely driven by irrational flows. There’s always more to it when such simplified answers are provided. I think its a combination of govt. policy favoring these companies which were beaten down, the earnings driven performance bringing in more capital and of course the eventual fomo driven expensive valuations in some pockets – but as long as the policy stance remains intact there will be adequate spaces to fish in for a bottoms-up investor imo. As long as Nifty composition remains as it is, it may never reflect the actual economy which is a bit more accurately reflected in the smallcaps (re-rating is penciling in future growth as well, assuming policy stance continues, so of course it has overshot).

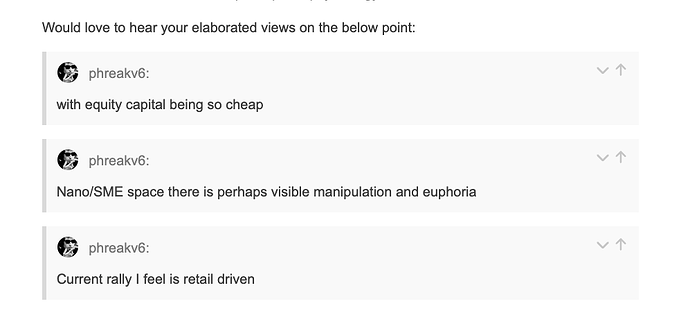

Equity capital is cheap as is evident from the number of QIPs and general market levels. Generally equity capital is more expensive than debt capital but the flood of equity capital has lowered perceived risk in equity causing this behavior. Nano/SME space – please read the dispatches some of these companies trading at 100x+ P/E or are loss-making are sending and check the noise on twitter or the buy calls on sms/telegram etc. Current rally being retail driven – I think you can see lot of supporting evidence on cnbc where they cover who sold/bought and how much retail is buying etc.

I think that’s enough with the macro gyan which is more likely to be wrong depending on how far from the future you look back at.

As for where I have put my money in, so far 3 results are out and all are stellar –

I have done some research on ceinsys and have added those inputs in the geospatial thread and the ceinsys thread. This one seems to be getting better and better, the more we unravel. Nothing new on Wockhardt as we wait for trials to complete in the next couple of months. Hopefully results in these two also would show good trajectory.

Other than this, have taken a new bet on Holmarc – covered in the Holmarc thread. Its a purely fundamental bet but technicals also look quite strong with a year long consolidation with volatility contraction and a breakout this month.

Disc: Have positions in all names mentioned. I am not qualified to advise.

| Subscribe To Our Free Newsletter |