Hello experts,

I am new to investing and had gone through Supriya life sciences Annual report and recent quarter report. Overall opportunity looks good to me also, I remember the Q1 con call they answered that OPM guidance for Q2 was given above 30% however, they reported Steller 39% now, they have given conservative guidance of 1000 cr revenue so, they need Sales growth 25% to achieve the top line of 1000cr revenue may be because I heard of Tailwinds in CDMO. what’s your thought on this ?

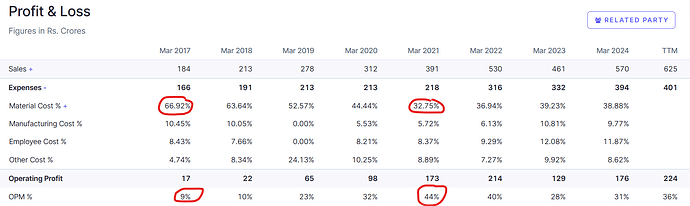

THE MOST IMP THING! I am not able to find and track that what are the raw material this company uses to manufacture all the product categories because this look like margin expansion has only been when material cost was extremely low. I just fear that this should not turn out to be a value trap when material cost inflates and margin collapse and then PE would look expensive

Need your opinion here

Status – Invested

| Subscribe To Our Free Newsletter |