Ashok Leyland (AL) is one of the largest players in the commercial vehicles space. Think of buses. Big trucks. Tractor trailers. Pickup trucks (LCVs). And recently AL has taken exposure to electric buses + e-LCVs through it’s subsidiary — Switch Mobility.

You can the full article here

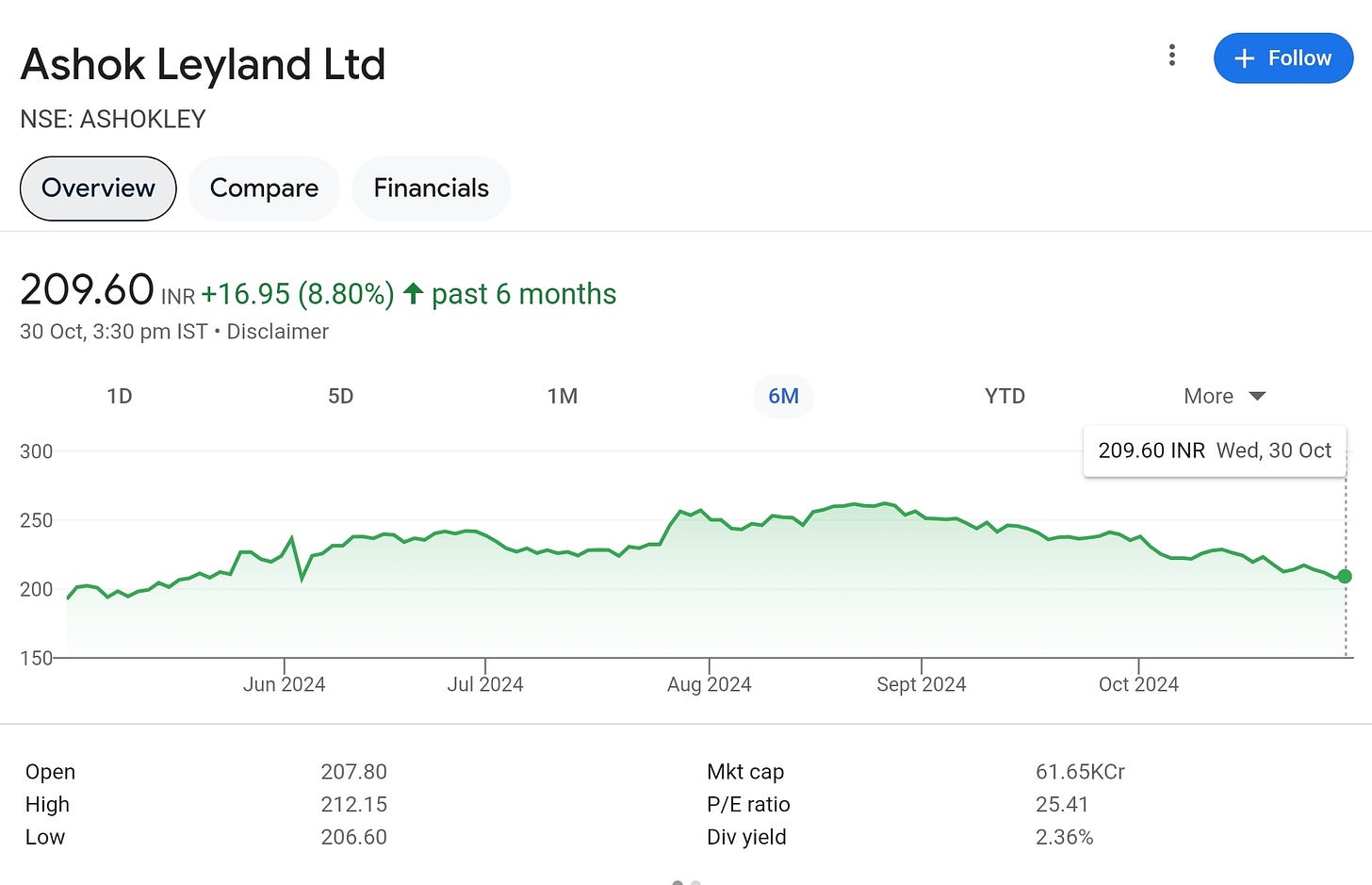

6 month price movement of Ashok Leyland

The stock has remained range bound, however the low PE ratio compared to peers indicates that investors are valuing AL as a traditional CV player — leaving some room for growth.

Q1 business update:

- Core business — MHCV [Medium & Heavy Commercial Vehicles] industry volumes grew by 10% in Q1FY25. AL’s MHCV volumes grew in line with the market, resulting in retention of market share of 31%.

- AL is confident of increasing market share in trucks + buses. Host of new product launches are lined up in FY25, which will beef up market share & price position.

- LCV volumes [domestic] increased by 4% in Q1 to 15,345 units. LCV variants cover only 50% of the market at this point — intention is to launch new products to increase coverage to 80% of the market. 6 new LCV launches are lined up in FY25, out of which 2 new LCV variants have been launched in Q1.

Note: this is not AL’s market share in the LCV segment. 80% refers to the ‘addressable market’.

- In the ICV segment — new launches are expected in the school bus + staff bus segment. Market coverage is <20% at the moment and AL wants to expand this.

- CV export volumes grew by 5% in Q1. Middle east continues to see strong demand. AL is getting strong traction in Africa. The company is looking at new markets to expand.

- Tractor trailer penetration in India is <20% whereas globally it is close to 60-70%. AL is expecting good growth in this segment.

- There is huge replacement demand building up in the MHCV segment due to an aging fleet. >37L commercial vehicles are there on Indian roads out of which only 27% are BS VI complaint. Sooner or later, the aging fleet has to be replaced which should lead to a bump in sales for AL.

- Electric portfolio — AL sells e-buses and e-LCVs through it’s subsidiary Switch Mobility. Electric trucks are sold directly by Ashok Leyland.

- Slow transition to eLCVs is underway. Switch started delivering it’s first eLCV [called IeV 4] in the market which received a good response. A few days back, another variant ‘IeV 3’ was also launched.

- The # of e-buses delivered were not mentioned in the earnings call, but Switch has an order book of 1,300 e-buses. If you’re in Mumbai, you can regularly see their double decker e-bus.

- Capex of INR 500 – INR 700 expected in Switch Mobility + to build EV capabilities / setting up centre of excellence in software, electric drive unit (EDU) and battery packs.

- Other biz segments — pertains to defence, spare parts & other business segments.

- Sales of defence vehicles have crossed >1,000 vehicles in Q1. Revenue has increased by 3X compared to the previous FY. Intention is to further double the defence business in the next 2-2.5 years.

The management did not give a concrete sales # for the defence business though.

- In the spare parts business, revenue increased by 10% overall YoY.

- Power solutions volumes were lower than last year by around 20% owing to a very high base in Q1 of last year due to emission change announcements.

- Financial performance — Q1 performance was decent. Revenue was up 5% YoY. EBITDA up 11%. PBT was up 13%. EBITDA margins were stable at 10.6%.

- Other expenses shot up due to one time expenses incurred towards development of Centre of Excellence for battery packs, electric drive units and EV related software.

- Material costs were at 72.2% of topline, lower by 1.5% compared to Q1 of last year. Steel prices remained soft, and cost saving efforts helped AL reduce material costs.

| Subscribe To Our Free Newsletter |