Summary of Q2 FY 25 call:

Defence:

- Key highlight of Q2 results was that the company came with a very bullish undertone on its defence segment. They guided for defence revenue to reach around 60% of the overall company’s revenue in next 12-18 months (from c.30% currently).

- Scale up is likely from Tejas, Su-upgrade and few other programs like Ashwini etc… Supply of sub-systems comes almost 1 year before production of LCA happens and we are unlikely to get impacted by GE engine delay.

- Production order- engineering efforts have already been expensed and there is exclusivity w.r.t. specific parts / sub-systems – this should result in good margins.

- Prototype revenues are fixed around c. Rs 100 crs; Incremental defence revenues to come from production orders at higher margins (Production orders were – FY 23 – 39 crs, FY 24 – 112 crs, H1 FY 25 – 79 crs, FY 25 full year expected Rs 170crs). As weightage of production orders increase, overall margin should increase.

- Overall,

- Q2 performance impacted by downturn in automotive (contributed c. Rs 6 crs loss in H1). Despite that, strong sequential growth in EBITDA from 19 crs in q1 (excluding ESOP writeback) to 33 crs in Q2.

- Defence + aerospace + energy c. 65% of revenue. Strong Medium-term potential in all 3 segments. H2 will be better than H1 driven by aerospace and defence. Production revenues to be scaled up in H2 (full year c. Rs 170crs, H1 Rs 79 crs) and will reflect better EBITDA.

- Lower interest costs in H1 FY 25. Aim to be zero net debt company in 2-3 quarters.

- Segment wise outlook

- Aerospace – Robust growth over medium term, won work package in aero structures c. $15m. Q2 was impacted by OEM’s plant shutdown, and overall slowdown in aerospace due to supply chain and engine issues impacting them.

- Mistral –

- EBITDA – Production orders 24%, Semi-conductor 25%, Development orders c. negative 12%

- Executable order book Rs 377 crs, Q2 order intake 121 crs. Production defence revenues (maturing defence pipeline) and semi-conductor to ramp up – higher EBITDA.

- Semi-conductor H1 Sales 55 crs EBITDA 22% c. 11.8 crs, FY 25 aim 125 crs topline

- Heavy engineering – Conclusion of US elections, infra spend to pick pace – can benefit this segment, optimizing operations to improve margins. Contributed c. 15-20% topline but EBITDA margins were marginally negative in FY 24. Working to make it positive margin by end of the year (aim eventually lower double digit).

- Automotive – Headwinds – slowdown in European OEMs, continue to be affected next two quarters. EBITDA loss of Rs 6 crs in H1.

- Energy – Expanding presence in India and Middle East, growth to continue

Snippets of calls other players in the industry

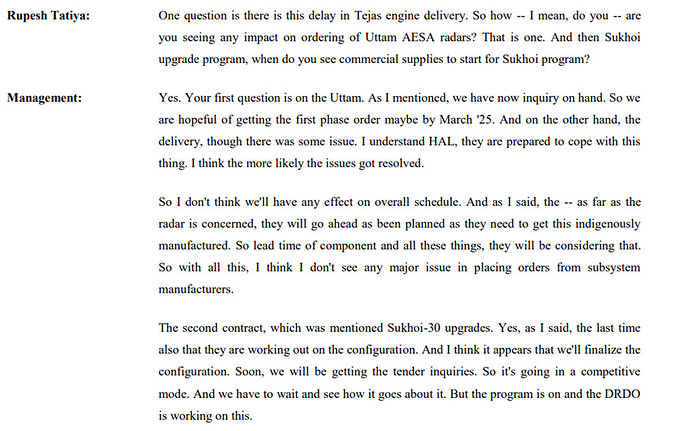

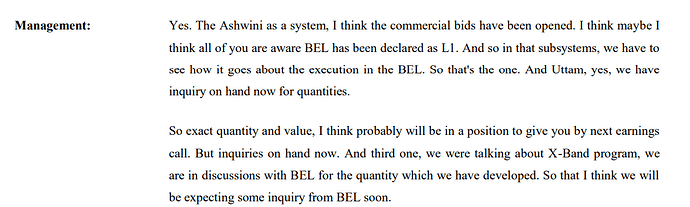

Similar guidance has been given by few other players – on expected orders pick up in next 6-12 months. Axiscades’s programs where orders are expected in H2 are: Uttam radar, Sukhoi upgrade, Ashwini radar, Atulya, X-band multifunction radar etc.

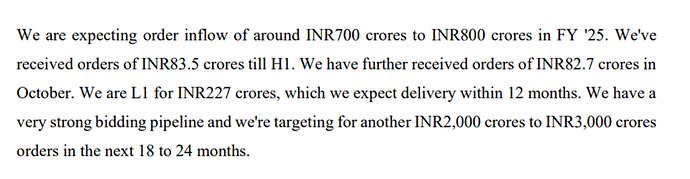

Snapshot from Data Patterns call:

Astra microwave call

BEL Call

| Subscribe To Our Free Newsletter |