A couple of reports/information sources:

Notes from Nomura report:

-

India’s power transmission sector is poised for significant growth, driven by surging electricity demand and ambitious renewable energy capacity addition targets. CEA expects USD110bn in investments over FY22-32E.

-

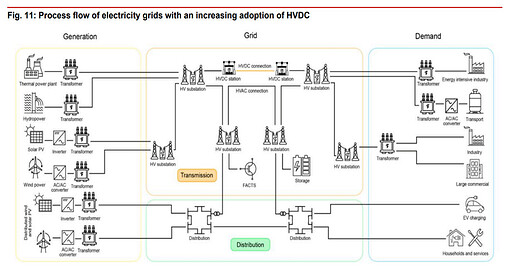

In a scenario where countries meet their energy and climate targets, wind and solar power will account for a substantial portion of the increase in global power capacity. Modern, digital grids are crucial for ensuring electricity security throughout this transition. As variable renewables like solar and wind become more prevalent, power systems must be more flexible to accommodate fluctuations in output.

-

Modern and digital grids are crucial for ensuring reliable electricity supply during the transition to clean energy. As the prevalence of variable renewables like solar and wind increases, power systems must become more adaptable to handle fluctuations in output. We think demand for system flexibility is likely to double between 2022 and 2030F, necessitating innovative operational strategies and integration of distributed resources, such as rooftop solar and diverse flexibility options. Achieving this flexibility requires the implementation of grid-enhancing technologies and the optimization of demand response and energy storage through digitalization. These measures are essential for maintaining electricity security and supporting a successful transition to a cleaner energy future, in our view.

-

A significant challenge in the transition to net-zero emissions is the grid infrastructure. While investment in renewable energy has grown substantially, investment in grid infrastructure has remained relatively stagnant, in our view. Our analysis reveals that slower grid development could lead to reduced renewable energy adoption and increased reliance on fossil fuels. Additionally, inadequate grid development increases the risk of costly power outages and heightens reliance on gas and coal imports.

-

We estimate India’s power demand will record a healthy CAGR of more than 7% over FY24- 27F driven by growing economic activity.

-

Renewables continue to scale up strongly as the share of renewables in India’s energy mix continues to grow, with solar and wind power meeting ~75% of the incremental demand by FY25F, as per our estimates. Renewable energy (RE) accounted for 33.5% of India’s electricity supply in FY24 (as per CEA), which we estimate will rise to 35% in FY25F, driven by a 23% y-y increase in solar power

-

According to the Ministry of Power’s estimates, on the capacity side, India’s installed power capacity is expected to rise at a 10% CAGR over FY24-FY30E to 777.1GW from 450.8GW currently

-

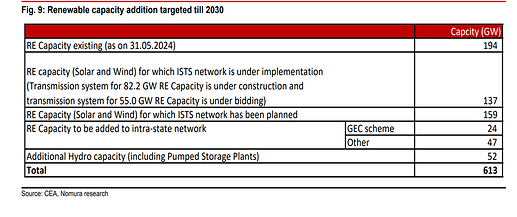

Renewables (ex-hydro) will account 55% of the total capacity and hydro will account for ~7%. Solar capacity is anticipated to record a 22% CAGR to 293GW in FY30E from 89GW at end-FY24 and wind is anticipated to increase at a 13% CAGR to 100GW in FY30E from 47GW currently. The government has set an ambitious target of 500GW of RE capacity by 2030, including 300GW from solar, as part of its commitment to achieving net-zero emissions by 2070. Currently, India’s installed power capacity is 448GW and we expect it to grow to 777GW by FY30F, with 279GW coming from renewables. The country is the third-largest power producer globally, and aims to meet 50% of its electricity needs from renewables by 2030, supported by policies such as the PM Surya Ghar for residential rooftop solar installations, PLI for PV module manufacturing and PM-KUSUM program for solar pumps among others. By 2040F, we believe RE will generate 49% of India’s electricity, driven by advancements in battery efficiency and cost reductions in solar energy. In FY24, India consumed 1,543TWh of electricity, with peak demand hitting a record 243GW, driven by industrial growth and extreme heat waves (as per CEA).

-

India’s data center industry is experiencing unprecedented growth, driven by rapid digitalization, the rise of AI, IoT, and a growing internet user base — currently at 946mn. With a current installed capacity of 960MW, we expect data center capacity to reach 7.5GW in our base case and 9GW in our bull case by FY30F, fueled by the adoption of 5G, AI, and IoT. The surge in digital activities like e-commerce, online education, OTTs generate significant data, requiring robust infrastructure for storage and processing, while AI growth will further drive robust power generation. Government initiatives, such as Digital India, further support data center expansion. Currently, data centers consume 8.4TWh of electricity, representing 0.5% of India’s total power consumption, but we estimate this will rise to 66TWh, accounting for 3% of India’s total electricity demand by FY30F in our base case and 80TWh in our bull case.

-

Increased government focus on transmission: The government’s emphasis on improving transmission infrastructure has intensified, driven by the need for adequate generation capacity and the resolution of fuel supply challenges. Currently, India’s transformation capacity (220kV and above) is at 2.83MVA/MW, compared to the optimal requirement of approximately 7MVA/MW for seamless power evacuation. This underscores the necessity for greater investments in the transmission sector.

-

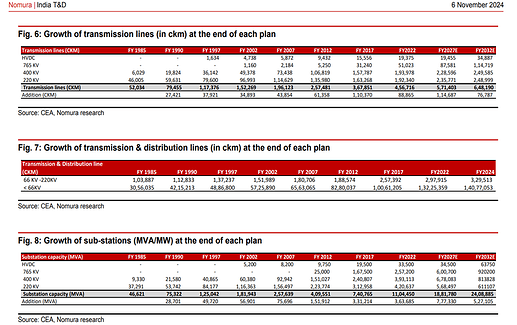

India’s power grid offers multi-year growth opportunities: The National Electricity Plan 2023-32 for Central and State Transmission Systems has been finalised with an investment outlay of INR9.15tn. Under the previous plan of 2017-22, about 17,700ckm (circuit kilometers) of lines and 73GVA of transformation capacity were added annually; 88,865ckm of transmission lines and 349,685MVA of transformation capacity have been added. Under the new plan, transmission network in the country will be expanded from 485,544ckm in 2024 to 648,190ckm in 2032. During the same period, the transformation capacity will increase from 1,251GVA to 2,345GVA. Nine High Voltage Direct Current (HVDC) lines of 33.25GW capacity will be added in addition to 33.5GW presently operating. The interregional transfer capacity will increase from 119GW to 168GW. This plan covers the network of 220kV and above. The estimated costs of the Inter State Transmission System (ISTS) and the intra-state transmission system are INR6.61tn and INR2.55tn respectively (as per CEA).

-

The Minister of Power recently unveiled the National Electricity Plan (NEP) 2023-32, a comprehensive blueprint for the expansion and strengthening of the central and state transmission systems. The NEP allocates a substantial investment of USD110bn (INR9.15tn) to address the escalating demand for electricity, driven by factors such as the rapid integration of RE sources, the development of green hydrogen and pumped storage projects, and the rising peak demand.

-

We expect the NEP to stimulate a significant increase in transmission capex, bolstering the grid’s capacity to accommodate the growing demand for electricity. However, challenges in grid connectivity for new renewable projects in certain regions have been observed, potentially impacting the overall project timeline

-

Between FY24 and FY32, the system-wide transformation capacity should expand by a substantial 1,158GW (an 8.53% compound annual growth rate), and the transmission network will grow by approximately 3.7% (from 485,544ckm to 648,190ckm).

-

As per CEA, an estimated expenditure of INR9.15tn would be required for implementation of additional transmission system of 220kV and above voltage level in the country (transmission lines, substations, and reactive compensation, etc.) during 2022-32.

-

The implementation timeline for these projects is contingent upon the development of associated generation projects. While a 5–8-year timeframe is anticipated, it is subject to adjustments based on evolving energy sector dynamics. Transmission plans will be regularly reviewed and refined to align with the specific schedules of generation projects.

-

Reduced competitive intensity following domestic manufacturing clause implementation: To support the government’s ‘Make in India’ initiative, PGCIL has implemented strict regulations requiring equipment suppliers to establish manufacturing facilities in India. Even prior to this current push, PGCIL had introduced a domestic manufacturing clause for its 765kV transformers, prompting companies such as TBEA Shenyang to set up factories in Baroda. PGCIL has expanded the domestic manufacturing requirement across various equipment types, which may encourage more Chinese and Korean companies to establish operations in India.

-

Benefits of the ‘Make in India’ clause for local players: The ‘Make in India’ clause provides two key advantages for local manufacturers: Elimination of non-serious competitors: It effectively removes non-serious players who were previously importing and dumping equipment from their overseas factories. This change increases market opportunities for established local players, as seen in the 765kV transformer market, where Korean companies have exited after PGCIL enforced the domestic manufacturing requirement. Enhanced pricing for local equipment: By creating a more level playing field against foreign competition (particularly from Chinese and Korean firms), the clause helps improve pricing for domestically produced equipment, benefiting local manufacturers.

-

765kV transformers: Reduced competition due to domestic manufacturing clause: To encourage domestic production of 765kV transformers, PGCIL implemented a requirement that vendors supply transformers from their Indian manufacturing facilities. This move was necessary because transformers have a lifespan of 30-35 years, and there had been a significant increase in imports from Korea and China. According to our analysis based on data from PGCIL, Korean manufacturers held a 22% market share in 765kV transformers, while Chinese firms commanded 44% in FY10. By FY12, the market share of Korean manufacturers plummeted to 2%, leading to their complete exit, as they were unwilling to establish a transformer plant in India. Similarly, Chinese manufacturers Baoding and Xian have also left the market due to their inability to meet qualification standards. As a result, only 4-5 companies are now competing in PGCIL’s 765kV transformer bids: GE T&D, TBEA Shenyang, Hitachi Energy India, Siemens India, and CG Power. With no new entrants expected to set up factories in India, competition will likely remain limited to these established players.

-

Importance of power transformers: Power transformers are essential for the effective functioning of power systems. Approximately half of the weight of a transformer consists of steel, with over 60% being cold rolled grain-oriented electrical steel (CRGO), known for its unique magnetic properties and high permeability. The remaining portion is construction steel. CRGO is crucial not only for transformers but also for power generators and electric vehicle (EV) charging stations. The transformer sector currently represents the largest share of demand for CRGO. Different quality levels of CRGO are available, with higher permeability varieties allowing for smaller transformer designs, reduced insulation oil requirements, and lower electrical losses. Regulatory measures, such as the Energy Efficiency Program in the US and the Ecodesign Directive in the EU, are driving the adoption of higher-quality CRGO. However, European manufacturers have recently raised concerns about potential shortages of this critical material.

-

A significant risk is the potential delay in power transmission and distribution (T&D) spending or prolonged decision-making processes by key government, which can directly impact project inflows and revenue stability. As T&D projects are capital intensive and often depend on government and utility investment cycles, any slowdown or deferment in spending could lead to a backlog of unexecuted orders, straining operational resources and delaying revenue realization.

| Subscribe To Our Free Newsletter |