Shares of Adani Enterprises were down 3% to Rs 2,837.70 in Tuesday’s intra-day trade, falling below its QIP issue price of Rs 2,962 per share

PNB shares drop 5.76% as Sensex falls (22-10-2024)

A total of 1,701,456 shares changed hands on the counter till 01:07PM (IST)

Amit Shah turn 60 today: How Chanakya of Indian politics used maths to create brand Modi (22-10-2024)

Amit Shah, India’s Union minister, has played a crucial role in revitalizing the BJP in Uttar Pradesh and crafting Narendra Modi’s political image. By strategically dividing the state, mobilizing volunteers, and organizing effective rallies, Shah’s efforts led to an impressive victory in the 2014 elections, establishing Modi as a prominent political figure.

Varun Beverages share price gains post Q3 results; profit jumps 22% (22-10-2024)

Shares of Varun Beverages gained 2.74 per cent at Rs 594.05 a piece on the BSE in Monday’s intraday trade

Raymond – The Complete Man (22-10-2024)

This took a while but played out. Did you hold all the way?

BEL shares down 2.64% as Nifty drops (22-10-2024)

A total of 627,165 shares changed hands on the counter till 01:03PM (IST).

Paytm shifts lending strategy, enters into first FLDG agreement to boost merchant loans (22-10-2024)

We already have an existing thread on Paytm. Just a heads-up, this new thread might get closed to keep everything organized. It’s better to add your thoughts there

cc @manish962

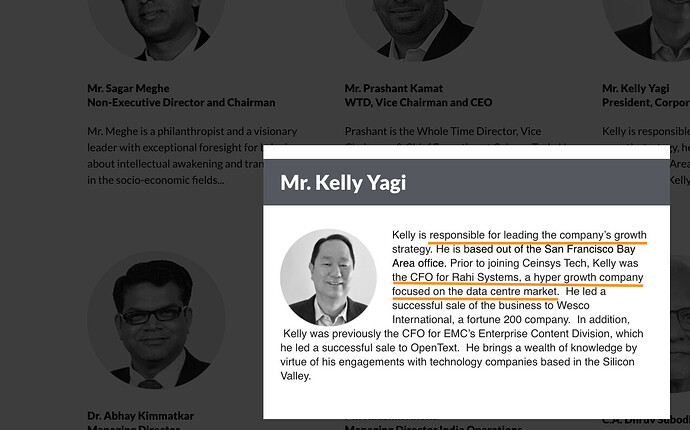

Ceinsys Tech-Engineering, Geospatial & IT solutions Company (22-10-2024)

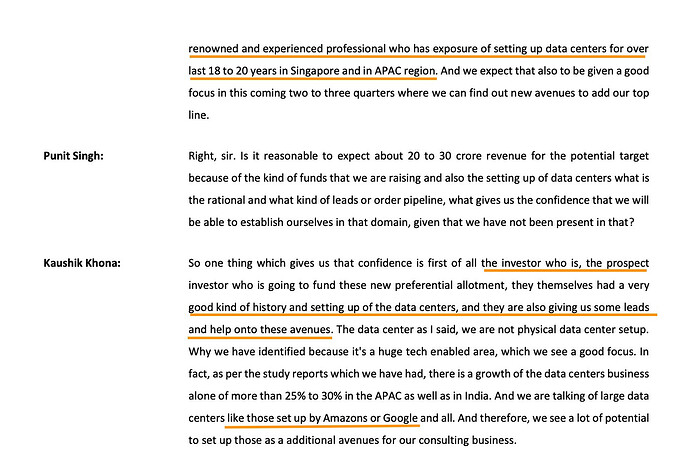

I think this has been the general assumption made on this vertical so far based on what I have seen in the AGM and concall transcripts. I think its fair considering the absolute lack of expertise in this vertical.

What we however should keep in mind is that bulk of the capital for this is from a US venture fund $15m (125 Cr) and another $13m (100 Cr) from promoters.

Nobody puts in this kind of money without clarity. The diworsification we are worrying about isn’t coming from internal accruals but from external capital and that’s a pretty big difference.

With that assumption I dug in a big deeper and here are the findings.

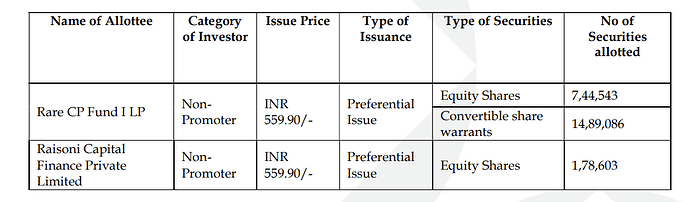

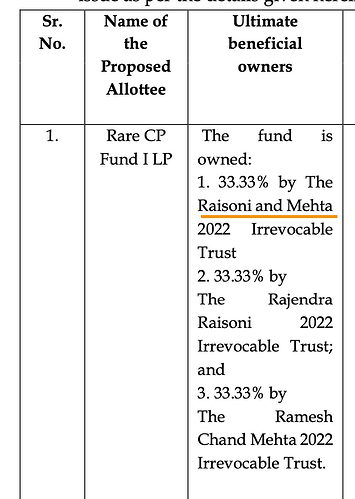

Key leads comes from the SAST disclosure

and the fund raise doc

Its clear from one of the earlier disclosures that Rare CP is also same ultimate beneficiaries Raisoni and Mehta

The people who are investing are Tarun Raisoni and his wife Rashi Mehta. What are their credentials? They co-founded Rahi and built it to a $400m revenue business (3200 Cr) in 10 years between 2012-2022.

The company was then sold to Wesco for $217m and Rahi became Wesco data center solutions.

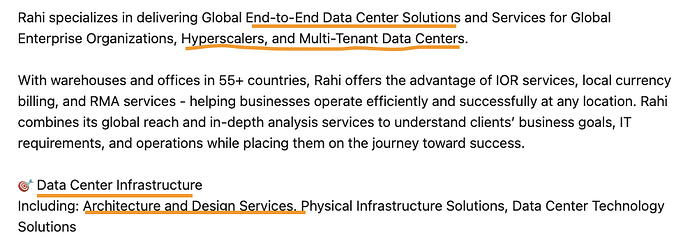

Rahi’s capabilities?

So this is where Ceinsys’ data center capabilities are going to come from. From an investor who has built a 3200 Cr revenue company in 10 years and sold it for $217m and has then gone on to found Gruve in Feb of this year (Around the same time Ceinsys announced pref allotment). Gruve has since then done two acquisitions in SecurView and Netserv (both Pune based companies with around 100 Cr revenues).

Ceinsys has also hired the ex-CFO of Rahi who was instrumental is building Rahi alongside in the APAC market

So I think we can lay all apprehensions of lack of expertise in data center business to rest. Now the team is coming in with capital and expertise and we can only hope they repeat what they did at Rahi with Ceinsys. What would be even more amazing is if Ceinsys is involved in some way with Gruve which has people with serious skillsets – from the two guys that built Rahi along with Tarun Raisoni, the guys that built SecurView and Netserv and also a person who built a successful networking and virtualisation startup and sold to Google Cloud. I would be surprised if that happens but at the very least we should have a strong data center vertical in the next couple of years.

This too should now add up. I don’t think management’s guidance that pvt. sector revenues should be 50% in the next 2-3 years is completely baseless. Let’s see how it plays out

Disc: Invested since Oct ’23 and no recent transactions

Raymond – The Complete Man (22-10-2024)

This is a great article on Raymond Lifestyle. Just released today Is ‘Raymond Lifestyle’ the Next Big Value Bet?

Liked the balanced approach taken with the analysis. Looked at the company from various valuation angles etc