After a torrent of criticism, TMZ removed the image of a body without explanation.

Dollar hovers near 11-week high, eyes on China property briefing (17-10-2024)

The dollar remained near an 11-week high due to U.S. election uncertainty and a resilient economy. Meanwhile, China’s press conference on its property sector is awaited. The Australian dollar fell to a one-month low. The euro and sterling were also weak as markets eye decisions from major central banks.

Companies with 20%+ growth guidance for next few years (17-10-2024)

I am sharing this blog below. I hope you find it useful.

dr.vikas

Hyundai Motor India Limited – HMIL (17-10-2024)

Good to debate before we invest our hard earned money in an IPO like Hyundai. Some of us in favour of investing in this IPO, some would like to invest on listing and on decline and some of us would never like to invest at all. Only Time and market could teach us a lesson …no one else…when I lose money , it is a lesson for me …when I gain , it is also a lesson for me.![]()

To me , the red flags are clear.

(1) Hyundai motors parent company Hyundai Global has a P/E of just less than 5 which owns and earns money from 5 independent entities / Brands namely Kia Corporation, Genesis- Luxury cars & Ioniq – EV. and Hyundai India and Kia india operations.

But the parent company expects Indian investors to pay a 25 P/ E from India for its lone entity Hyundai motors India .

(2) In india itself – there is a conflicts of interest in its business strategy with two parallel set ups – Kia & Hyundai – they are going to list Hyundai motors and kia would remain as its unlisted entity so that the intention to divert its high margin products through Kia india so that they don’t have to share profit with Indian investors.

(3) The parent company when they found it difficult to increase market share (infact their market share is coming down in recent days) , they have planned to take some profits out of their investment in India. They will be getting a return of 20X with its current IPO divestment plan in India which they would have never got from Korean investors.

(4) Just before IPO, they have increased loyalty from 3.5 % to 5% and repatriated cash balance of Rs10000 crores to their motherland in form of Dividend before the IPO with a clear intention of not sharing the cash with Indian investors

(5) In spite of all above concerns , Indian investors are crazy to pay for this IPO which Hyundai wants to take advantage of.

Anyway as of end of day Two , 42% already subscribed Let us see if it gets subscribed 100% – i would not wonder if it does as I say we as Indians (that includes me too ![]() ) tend to make A quick buck on listing gains. But there are equal chances of not making any money or even losing money on listing. I wish people make money and don’t lose money at any cost -make a safe exit before they make a loss- All the best

) tend to make A quick buck on listing gains. But there are equal chances of not making any money or even losing money on listing. I wish people make money and don’t lose money at any cost -make a safe exit before they make a loss- All the best ![]()

![]()

in a lighter note, When Short term gain tax was increased from 15 to 20% everyone made hue and cry, but for LTCG went up from 10 to 12.5 % , very few reacted

Gold holds below record high ahead of US data (17-10-2024)

Gold prices remain steady below record highs as investors anticipate key U.S. economic data for insights on Federal Reserve’s rate cuts. Spot gold stood at $2,674.96 per ounce. U.S. retail sales, industrial production, and jobless claims data are awaited. Lower interest rates and geopolitical tensions typically enhance bullion’s attractiveness.

BJP had looted Jharkhand for 20 years: CM Hemant Soren (17-10-2024)

Jharkhand Chief Minister Hemant Soren launched a scathing attack on the Bharatiya Janata Party (BJP), claiming that the party had tried to “loot” the state for over 20 years.

Stocks To Watch: Bajaj Auto, LTTS, CRISIL, Bikaji Foods, PFC (17-10-2024)

Stock Market Today: Bikaji Foods has announced a strategic investment of Rs 131.01 crore for a 53.02 per cent stake in Hazelnut Factory Food Products

Jagsonpal Pharmaceuticals – What is driving the price? (17-10-2024)

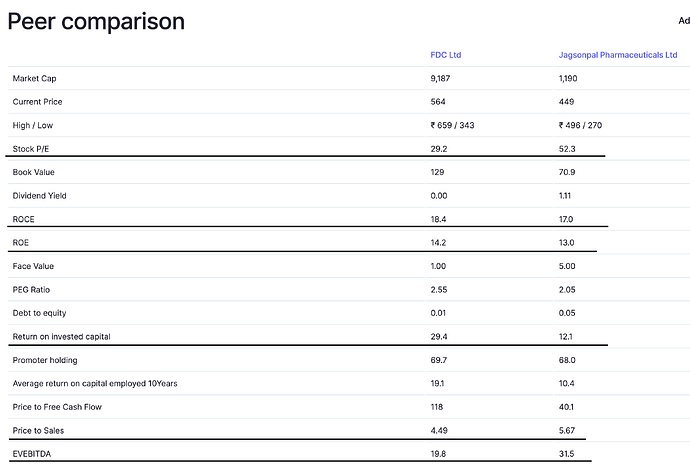

Hi, I have been following this company for the last few months. Yes, it’s a small cap with good growth prospects. But I don’t understand its hefty valuations.

Check its peer-to-peer comparison with FDC, which already has vast brands like Electral.

Can one explain the reason for such a higher valuation?

dr.vikas

Oil inches up after surprise drop in US crude stockpiles (17-10-2024)

Oil prices rose in early Asian trade after an unexpected drop in U.S. crude stockpiles. Brent and U.S. West Texas Intermediate crude futures climbed, reversing prior losses. Factors such as OPEC’s demand forecast cuts, easing Middle East conflict fears, and awaited fiscal stimulus from China influenced the market.