Sir can you please share your latest portfolio… Its always interesting to read about your stocks…

Posts tagged Value Pickr

Aarti Industries – Integrated Diversified Player on Benzene Derivatives (08-11-2024)

Aarti Industries Q2

Revenue/EBITDA: ₹197 crores, down from ₹233 crores YoY (~15.47% decline YoY).

Profit: 52Cr, down 42%

EBITDA Margin: 12.10%, down from 16.02% YoY.

I have lowered holding, will average up when the cycle turns.

Astec Lifesciences (08-11-2024)

Q2 -2025(oct 2024) concall

1…PERFORMANCE

Astec LifeSciences continued to experience pricing pressures in the enterprise products business

and lower-than-expected volumes in the CDMO category due to a cautious approach adopted by

our CDMO customers. This adversely affected both revenue and margins

2…CDMO

=Overall, the earlier guidance remains the same, we’ll see a 50% growth over last year.

=Cdmo rev

2024@270 cr

This yr target@400cr

3…Enterprise segment

=In terms of enterprise business, the demand is slowly picking up, but the prices are much lower because of the Chinese pressure

=There have been two approaches to this solution. One, yes, some of the capacities already.

= If you see some of the capacities we are using for new products, the new product launch, which has happened in these two quarters, is using the existing capacity.

=Secondly, yes, some of the

life cycle we are trying to manage in terms of we will be reducing some of the capacities and

using it for some other products. But it will take some time to materialize, because that will be

the question of registration, buyer’s agreement. So, this takes time. But on both the fronts, we are working.

=Finally, Q3 should be the last quarter for high-cost inventories. However, overcapacity by other players is still there

4…Herbicide 2 plant

=It has been commissioned on time and that will play big role in terms of achieving this target.

=herbicide plant, definitely, the assumptions for that plant capacity

utilization are definitely pushed by a year or two. And I feel that probably it will be only in FY26

that we will see upwards of 60%-70% utilization of this plan

=Normally, it takes around three years to have a full capacity.

=This year, we’ll be using around

30% of the capacity.

5…Rnd

=Total this year we have introduced one new molecule and total molecules will be nine. Eight

was for the past and one new molecule,

=And that is one more

addition which we are doing. We are now also working in the development phase. Since we are

working with innovators during the development phase, the scale of optimization, everything

we are doing. These are major shifts from our previous R&D

=However, even the innovators are having some tough time

worldwide. So, whatever used to take two years, two years may take three, four years now. So

that I think is the story as of now.

There are inquiries, there are collaborative efforts, but they’re

a little sluggish. Some of the very big innovators have banned international travel. So just

because they’re under tremendous stress. So, I think all this will take a couple of quarters to

clear.

Disc …invested

Time technoplast (08-11-2024)

—-

the Board of Directors of NED Energy Limited (“NED”) (“the Transferor Company” — Holding Company of PBBPL) and Power Build Batteries Private Limited (“PBBPL”) (“the Transferee Company” —the Wholly Owned Subsidiary of NED Energy Limited) at their meeting held on November 08, 2024, have considered and approved the Scheme of Amalgamation under the provisions of Sections 230 to 232 and other applicable provisions of the Companies Act, 2013 (“Act”) and the rules made thereunder.

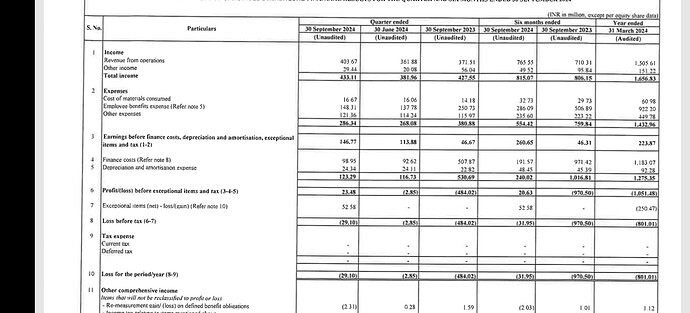

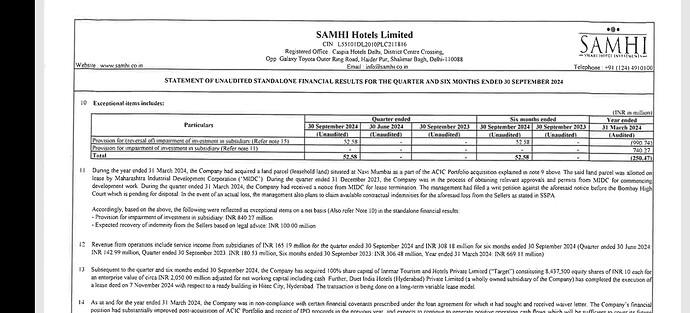

Samhi Hotels – Turnaround with Tailwinds (08-11-2024)

They took more provisions for impairment at the end of FY’24, out of which this amount got reversed.

Samhi Hotels – Turnaround with Tailwinds (08-11-2024)

(post deleted by author)

Great articles to read on the web (08-11-2024)

Thanks for the write up.I think the real ground down opinions like this really add value to this forum eventhough its macro . It shows we need to be objective and ignore the nationalistic (often jingoist) noise which politicians make.

Ranvir’s Portfolio (08-11-2024)

Thankfully, my last 10 yrs XIRR is > 24 pc ( I started investing in 2014 )

Last 2 yrs have been exceptionally kind ( XIRR > 30 pc )

Most of the portfolio gains pre – COVID were led by Bajaj Finance ( I bought at split adjusted price of 300 and exited at 2700 before the COVID fall ), Zydus Wellness ( made a 5 X on it ) + Steady compounding in Dabur, Marico, GCPL, HDFC twins, Nestle ( from 2014 -20 ). In those days, I used to own 15-16 stocks at a time ( because I used to feel far more comfortable with FMCG stocks )

Post covid gains have been led by Piramal Pharma ( up 3X ), Laurus Labs ( up 4X ), Neuland Labs ( up 8X ), Wockhardt ltd ( up 3X ), RPG Life ( up 4X ), Ami Organics ( up 2X ), Royal Orchid Hotels ( up 2X ), Garware Hi Tech ( up 2X ), Glenmark Pharma ( up 2X ), KVB ( up 2X ), Aditya Vision ( up 2X ), Narayen Hrudalaya ( up 2X ), KIMS ( up 2X ) and some more ( that I don’t remember off hand ![]()

![]() )

)

Basically – it has been a very rewarding journey