good growth

Posts tagged Value Pickr

Praj Industries (05-11-2024)

Praj Industries- changing orbits

Turnover ~$400M

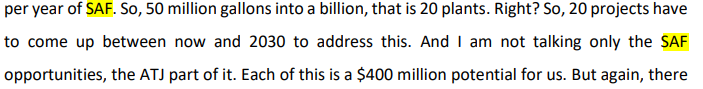

Each SAF plant is a $400M opportunity for Praj

20 SAF plants needed just in US alone in 5yr, Praj is a top contender.

From concall ![]()

Add to that,

- SAF opportunity in India, EU & RoW

- 1G E25, Biodiesel, 2G, CBG

- ZLD, PHS biz

- futuristic Bioploymer biz

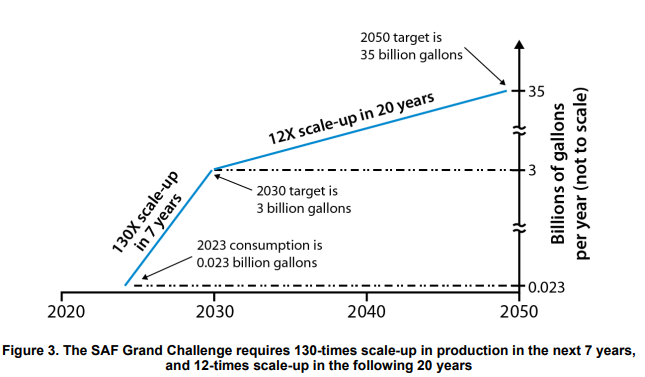

SAF will a huge biz opportunity for Praj till at least 2050. Check the image below. 20 SAF plants over next 5yr (each ~$400M opportunity for Praj) and then 20 SAF plants every year from 2030-2050 in US alone !!!

Interesting read on SAF in US:

The Challenge Ahead: A Critical Perspective on Meeting U.S. Growth Targets for Sustainable Aviation Fuel

Crude from ground is converted in oil refineries to fuel (Petrol, Diesel, Jet Fuel, etc) & Naptha.

Naptha is hydrocracked to produce polymers which are building blocks for man-made materials such as plastic, textiles, etc

After conquering fuels, Praj has now entered materials side of crude-oil applications

Biomaterials will replace many/most crude oil derived materials over next 30yr. This is again trillions of dollars opportunity

Plus,

Natural growth in fuel demand + service biz (O&M +performance enhancer materials) for new plants give Praj a multi-decade runway for very high growth.

L&T – Bluechip, Value play, Digital giant in making (05-11-2024)

For a 5T economy target, the amount of infra work needed is still underdone, LT is not even sweating completion and targets. Still more dams, refineries, power plants and nuke stations are needed, 2X the current need. Price may not appreciate but it’s got legs for at least 5 years IMO

Hindustan Zinc – Galvanize Capital of Investors? (05-11-2024)

Finally GoI begins disinvestment – It to sell 2.5% of its stake in HZL through Offer for Sale at a Floor price of Rs 505

Retail Investor can bid for shares amounting to Rs 2 Lakhs each which translates into a bid of roughly 400 shares per retail Investor

Wealth First Portfolio Managers Ltd (05-11-2024)

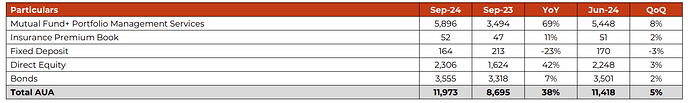

Incorporated in 2002, Wealth First Portfolio Managers Ltd is in the business of wealth management

Services Offered

a) Investment Strategising Asset Research

b) Trade-Execution-Broking

c) Portfolio Review and Accounting

d) Retirement Planning

e) Treasury Management

f) Asset Allocation

g) Tax Planning

h) Inheritance Planning

Business is very similar to Motilal Oswal or IIFL securities or Nuvama.

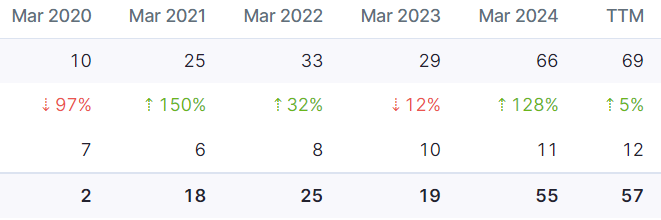

- ROCE 56.8 %

- ROE 43.8 %

- Market Cap to Sales 24.0

- Price to book value 11.6

- Debt ₹ 5.90 Cr

Disc: No holdings, in radar because of the sales growth

Summit securities holding company of RPG group at discounted among holding companies (05-11-2024)

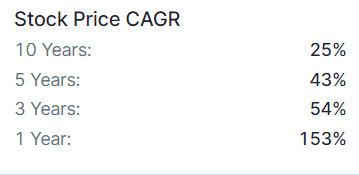

how is this CAGR considered bad?

Manappuram Finance (05-11-2024)

Summary of earnings call for Manupuram Finance for Q2 FY25. Note that this is AI-generated summary of the actual recording.

- Manupuram Finance reported strong consolidated AUM growth of 17.4% YoY and 1.7% QoQ. Consolidated profit after tax was 572.1 crores, up 2.8% QoQ and 2% YoY.

- The gold loan business saw a growth of 3% QoQ and 17.1% YoY, making up 53% of the total AUM. The company added over 4 lakh new customers during the quarter, and online gold loans accounted for 74% of the total gold loan book [2].

- The microfinance subsidiary, Asirvad Microfinance (Asirvad), faced regulatory action from the Reserve Bank of India (RBI).

- Asirvad was ordered to stop disbursing new loans from October 22nd, 2024, due to concerns about pricing policy, income assessment of borrowers, and gold purity discrepancies [1, 3].

- Manupuram has taken steps to address the RBI’s concerns at Asirvad, including reducing interest rates and improving income assessment processes. The company submitted a compliance plan to the RBI and expects the lending ban to be lifted in 3-4 months [1, 3-5].

- Asirvad’s AUM declined by 1.3% QoQ but grew 11% YoY, impacted by the lending ban. The company is focusing on collections and expects to maintain a healthy collection efficiency [2, 6].

- The RBI issued a circular on September 30th, 2024, aiming to standardize gold loan practices across lenders. The circular addresses concerns regarding loan-to-value (LTV) monitoring, loan renewals, and the use of gold loans. Manupuram is working to comply with the new guidelines by the December deadline [1, 7].

- The management expects the gold loan business to grow by 10-15% annually despite the new regulations. They believe the regulations will create a level playing field, benefiting organized players like Manupuram [8, 9].

- The vehicle finance business recorded strong growth, with an AUM increase of 6.8% QoQ and 54% YoY. The home loan business also grew, with an AUM increase of 6.6% QoQ and 29.6% YoY [2].

- The company maintained a strong capital position, with a CRAR of 29.22%. It declared an interim dividend of 1 rupee per share for the quarter [2].

The regulatory actions on its microfinance subsidiary will likely impact growth in the near term, but the company seems to have taken proactive measures to address the issues and management expects a recovery in the medium to long term.

Kirloskar Electric – A Turnaround Bet? (05-11-2024)

About 80k CR of thermal power projects sanctioned this evening by NTPC.

KECL worked with NTPC several times in the past on thermal projects. Walchandnagar too.

I am hopeful this will be positive for KECL.

Shriram AMC – Waking up after a hibernation. Mcap 300cr (05-11-2024)

Hi. All your arguments are justified. Have addressed all these issues in my previous comments on 8th April and shared my view on why 500crs for a AMC + PMS biz is very cheap. Pls go through the comments once.

Start-up was in the sense that it just had 8 employees since 1990’s and now from last year have start recruiting. From 8 employees in Sep 2022 to 70 employees in Sep 2024. Most of these employees would be recruited for back-end/ systems. Its at initial phase of scale up and will take time. It has no innovative product yet…

Shriram brand is obviously not associated in the MF industry. Thats where the optionality lies and hence it just trades at 500crs valuation ![]()

Shaily Engineering Plastic (05-11-2024)

To be frank, I was unable to find the same. I asked a few analysts ( over Wassup ) who were present on the company’s concall. They gave me this figure of Rs 200 / pen