Any one tracking this stock, Financials look good and with the latest drop stock price is an opportunity to enter?

Posts tagged Value Pickr

Addictive Learning Technology limited (LAWSIKHO) (13-05-2024)

I think you got this wrong. Market Size is very large for them as they are going into other fields apart from Law.

In this interaction on YouTube (timestamp: 25:10), Ramanuj Mukherjee said that the Market Size is $7 billion and there are very few players in the market.

I know that’s a very big number and should be taken will a pinch of salt.

But if things go right, there is a big opportunity.

Addictive Learning Technology: Connecting Indian Talent With Global Remote Economy

Also, they are growing in the US market also.

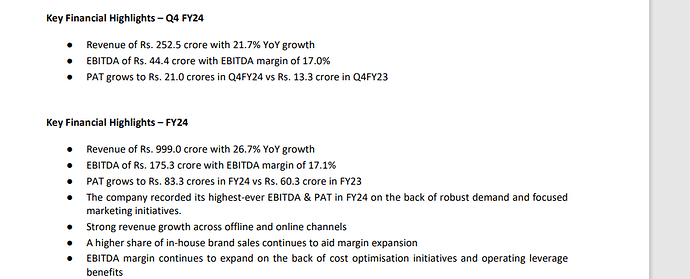

KDDL (Ethos Watches) – Scalable business model at an inflection point? (13-05-2024)

Walking the Talk in terms of results. Good Margin expansion. Keeps on adding brands to the retail mix.

The secondhand market should be the kicker if they get it right. But its a tough business to get into in terms of sourcing and authenticity.

Only worry is why did transfer Silver city stake for such a low amount.

Disc: Have been invested in this before. Rebought around 2350 couple of months back in family accounts. More of a short-term play since they sold silver city.

Tembo Global – Infrastructure play? (13-05-2024)

I have this company in my portfolio which makes fittings and fasteners for pipes, solar modules and have recently announced order win larger than their market cap. (though in past they almost had orders from Kalpataru Projects that got sort of cancelled)

From screener:

TGIL is a manufacturer and fabricator of metal products used in Pipe Support Systems, Fasteners, Anchors, HVAC,

Anti-Vibration Systems and Equipment for industrial, commercial, utility and OEM installations. Company is a fabrication and installation specialist in ductile pipes, HDB pipes and fittings, and MS plate. Its products are certified and approved by Underwriter’s Laboratory Inc. (USA) and FM Approval (USA) for Fire Sprinkler System Installations.

Could it be a infrastructure proxy? How to analyze this company to improve conviction on either side?

Piccadily Agro Industries Ltd (13-05-2024)

Sir, please clarify why did Mr Batra says single malt takes 6-7 years to be made while you are mentioning there is no aging required for single malt ,which Indri is making.

Bcos all these capacity expansion will kickin post 6-7 years or immediately? Pretty confusing but key statements.

Focus Lighting & Fixtures Limited (SME) (13-05-2024)

This is my first post , I was going through the posts and thought of sharing my thoughts , and if there are any mistakes in my views please accept my apologies.

@ranvir -Schweitzer – I couldn’t find an Italian company like this – Can you post the link if available?

Outdoor lighting – Their product range is very limited as per their website (Plus Light Tech), in this segment their main competition will be with Lighting Technologies ( Subsidiary of Russian Company), Signify , Panasonic,( Roads, Ports, Stadiums etc)

K-Lite – Outdoor lighting portfolio is much bigger than Focus lighting in the outdoor decorative space. K-Lite might be importing housing from china and assembling it in Chennai , this could be to make it more competitive and transfer most of the fixed cost of production to 3rd Party.

@johnsgeorge.cet : Your enquiry about Focus Lighting to IHG , their Client tele is different and probably that could be the reason the sales person of IHG couldn’t know about it. Focus has an office in Ajman freezone and targets major retailers for their showroom lighting, the business is headed by an Indian, who was working priorly with a major German Lighting Manufacturer in UAE.

Focus – Opening an experience center in Saudi Arabia is an interesting move, because of the project volume in all provinces of Saudi Arabia.

Focus is a Manufacturer predominantly focusing on projects, and the order bank will not be regular and there will be payment issues for sure.

Usually companies tries to strike deal with European or American Manufacturers to become there OEM partner for products, by this they can expect sustainable revenue. and i could see only schweitzer in this direction (website not found for schweitzer)

Electrosteel Casting – Ductile Pipe King (13-05-2024)

Update on track for capex of 8.95 Lac Tonne.

FY 7580 Cr Ebita 1281 Cr PAT 740 Cr (9.8% Margin). FCF at 935 Cr

ROCE/ ROE 19 /19.3 with 10 months order on hand.

33 % reduction in finance costs.

Wont be suprised it exceeds the quidance.

Lt foods (daawat) (13-05-2024)

LTFoods:

As per my understanding:

- Since their 80% of revenues are coming from exporting (US & Europe) premium brands of aging basmati rice business, which is cash cow.

- They have organic & convenience segment – till now they are not contributing much.

- How they are ensuring consistent margins? They are absorbing short term(1-2 Quarter) pricing shocks & also passing the costs to customers if they are long term pains.

- LTfoods is addressing the cyclicality – by establishing brands basmati business(cash cow) exporting to western countries. They are testing themselves in investing different high margin segments like snacks, organic, convenience, soyameal – if they are successful in anyone of the investments then re-rating will start (consistent earnings with high margins). Now all the big boys(MF, FII) are watching ltfoods from past 1 year, if they have consistent earnings for the next few quarters you can see huge rerating.

Zomato – Should you order? (13-05-2024)

(post deleted by author)