seems company has no strategy… expansion without sales. margins coming down… then why increase capacity?? It is anyway a very fragmented market with many small players and low margins…

only 2 years of COVID sales and profits were high – maybe due to supply crunch from other countries…

should go back to pre-COVID prices.

Posts tagged Value Pickr

Premco Global — Narrow Fabric (A critical component for inner wear) (06-05-2024)

PayTM (One 97 Communications Ltd) (06-05-2024)

“A company cannot go bankrupt with negligible debt” is apply to old time manufacturing company. It is not applied to technology company. Company can not servive without proper business model.

For paytm case, Market just lost faith on paytm Management. Company have some good product but doesn’t have any moat and lot’s of problem with regulator. And market still give 25000cr marketcap(its huge for many companies). For current situation,I think its fair.

Ranvir’s Portfolio (06-05-2024)

Bajaj Auto –

Q4 and FY 24 results and concall highlights –

Q4 outcomes –

Revenues – 11555 vs 8929 cr

EBITDA – 2284 vs 1657 cr ( margins @ 20 vs 19 pc )

Other income – 444 vs 595 cr

PAT – 2011 vs 1705 cr

FY 24 outcomes –

Revenues – 44870 vs 36455 cr

EBITDA – 8762 vs 6465 cr ( margins @ 20 vs 18 pc )

Other income – 1704 vs 1703 cr

PAT – 7708 vs 6060 cr

Highest reported highest ever Pulsar, Three wheeler and KTM volumes in India in FY 24

In Q4, volume growth was 24 pc ( despite continued sluggishness in the export markets )

Export markets like Kenya, Bangladesh, Nigeria, Argentina, Egypt – continue to be under pressure due steep inflation and current devaluations

Other LATAM countries, ASEAN mkts continue to do well

To commence exports of Quadricycle – Qute to Egypt in Q1 FY 25 ( 3-wheelers were banned in Egypt – LY. Qute can capture a large Mkt in Egypt )

The manufacturing plant in Brazil to go online in Jun 25- should be able to address the pent up demand in Brazil

Company’s mkt share has improved by 800 bps ( 8 pc ) in the 125-200 cc category of bikes. Company is now no-2 in this category

Launched Pulsar -400 in first week of May 24. Company has 4 popular models in above 300 cc category ie – Pulsar 400, Dominar, KTM 390 and Triumph 400. This makes Bajaj Auto – the second largest player in this segment behind RE

Company’s 3 wheeler EVs are now avlb in 60 cities. Will double the no of cities covered by opening 90 new stores in Q1 FY 25 !!!

Chetak is now ranked no 3 in the EV scooters mkt. It started FY 24 at 6th rank and gained 3rd ranks within FY 24 ( mkt share up to 13 pc vs 5 pc YoY ). Chetak’s monthly sales have risen from 3k units / month to 12k units / month inside 1 yr

Bajaj Chetak is being sold through 200 showrooms across India. Company to ramp this up to 600 stores in Q1 FY 25. Will also launch another model of Chetak in Q1 FY 25

To scale up the Triumph business in H1 FY 25 by taking the total Triumph – stores count to 150 in India. Made in India Triumph’s exports are holding up well. Company exported 19k units of Triumph bikes from India in FY 24

Cash on books is around 16000 cr

To launch a CNG motorcycle in June 25

With PLI benefits, the electric three wheelers business is as profitable as ICE three wheeler business. However, electric two wheelers are yet to break even, despite PLI incentives. Company has undertaken a lot of cost reduction initiatives in this space. Additionally, the EV costs are structurally slated to come down. Assuming a stable selling price iro Electric Chetaks, unit economics should improve with every passing Qtr

Seeing good response for Triumph – 400 (both models) in domestic mkt

Company has set up a subsidiary – Bajaj Auto Credit Ltd ( an NBFC ) to finance 2 – wheeler sales. Aim to cover 100 pc of Bajaj outlets by end of FY 25. Have pumped in 2250 cr into the subsidiary

Disc: hold a small tracking position, biased, not SEBI registered

HDFC Bank- we understand your world (06-05-2024)

such high valuation and no growth… liquidity and capital constraints… HDFC Bank is not going to be flat… but will go down…

Ugro Capital – Opportunity To Invest in a Fintech-like Company Below Book Value (06-05-2024)

I would say the book value of all the NBFC is quite accurate at screener, wrt. Ugro capital, it maybe some on off error by the screener.

Ugro Capital – Opportunity To Invest in a Fintech-like Company Below Book Value (06-05-2024)

I was struggling to calculate the CAR (capital adequacy ration) of Ugro capital. Could someone please help me calculate this?

Due to their on and off-balance sheet lending model, i do not know how to find the risk weightage asset. Thanks!

INOX Wind (06-05-2024)

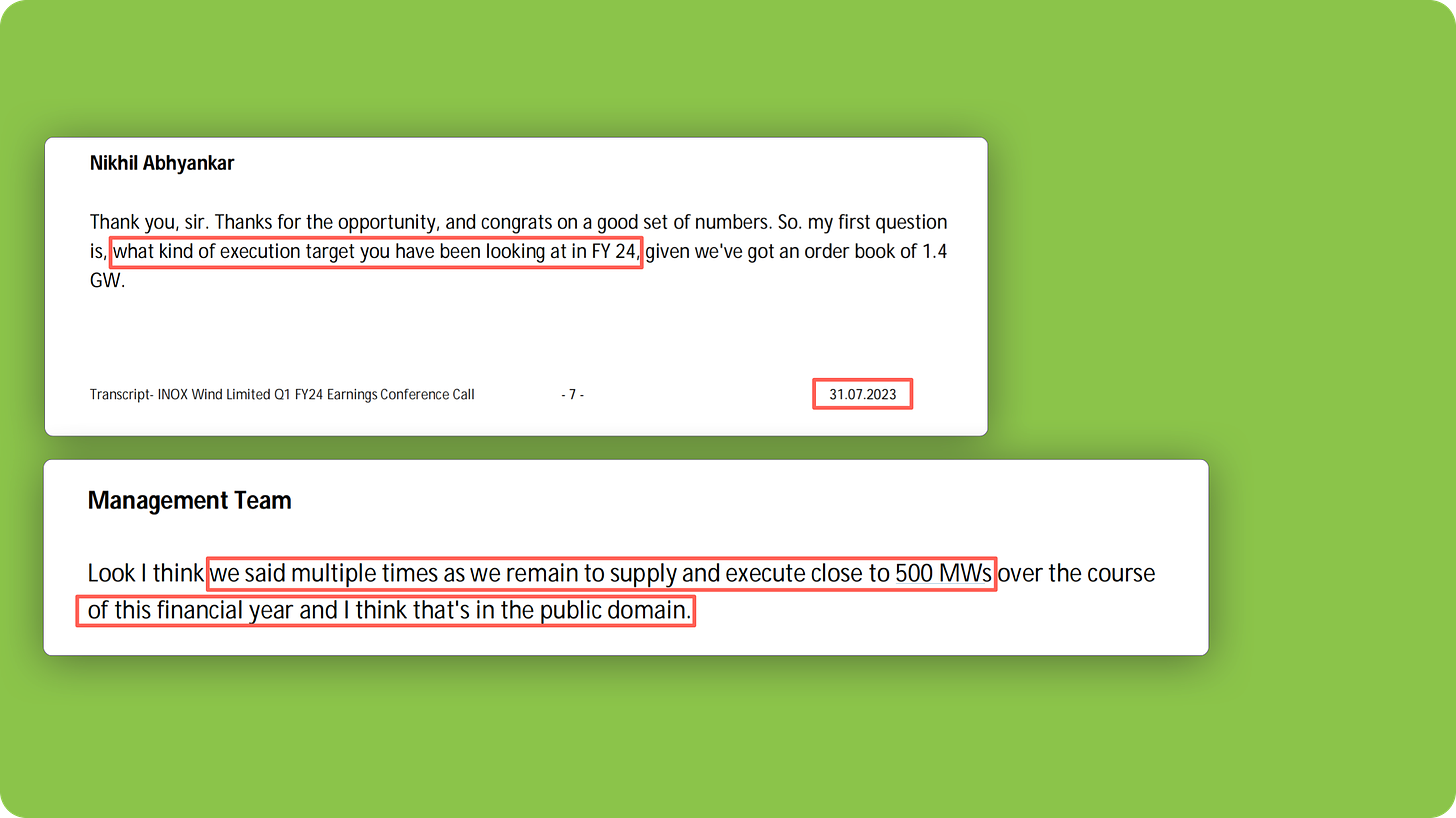

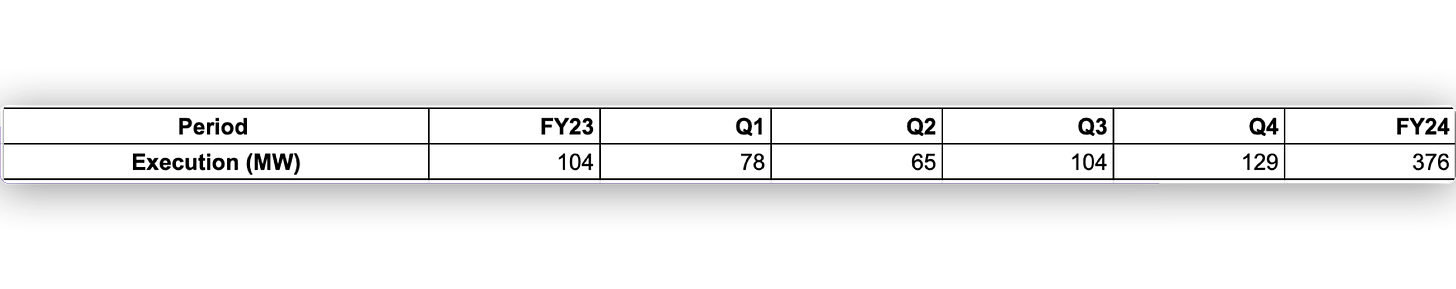

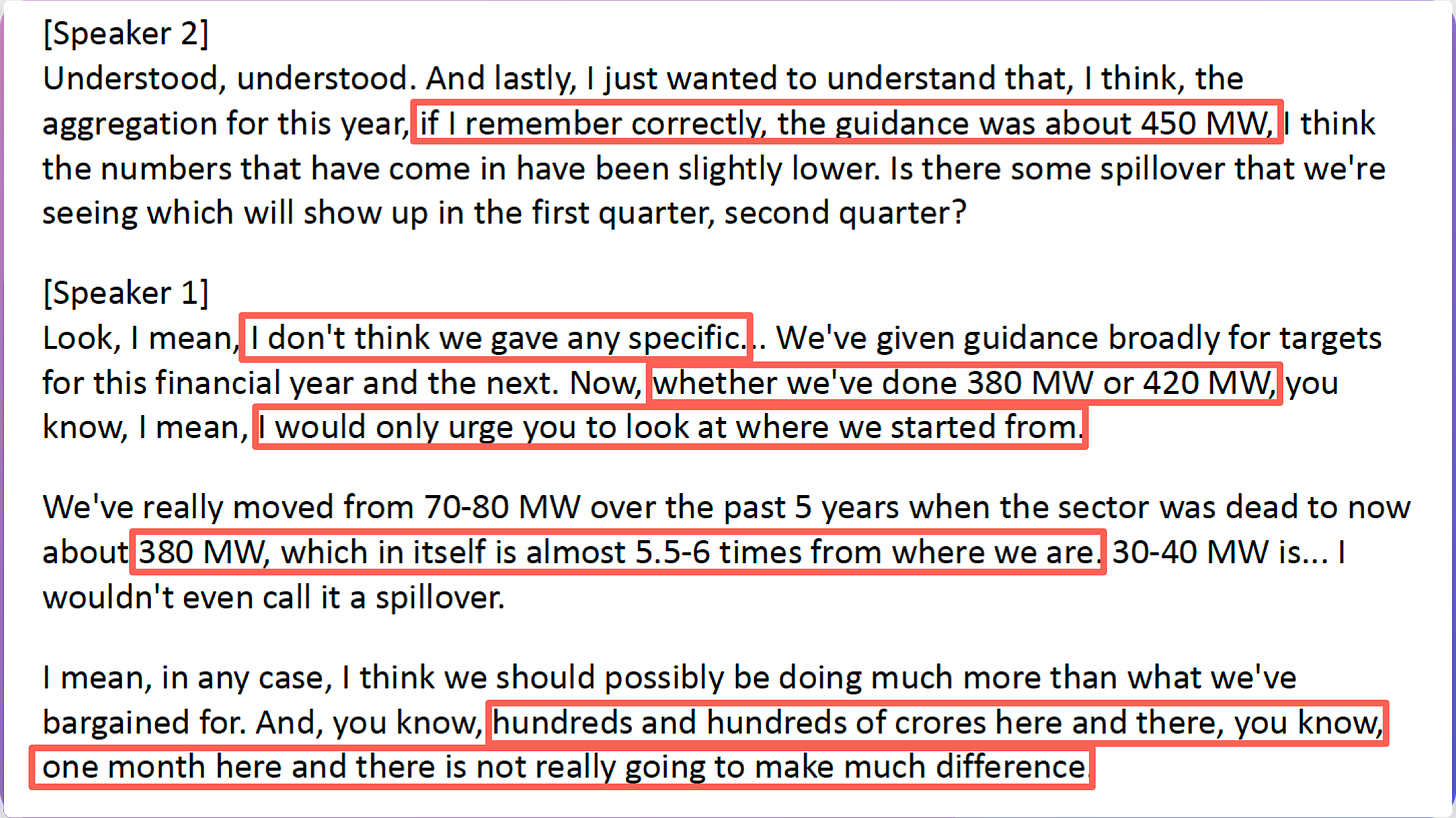

Inox Wind Ltd was expected to deliver (or Execute) ~500 MW of Wind Energy Equipment in FY24.

Although on a yearly basis, the execution was ~3.5X compared to last year, Markets are forward-looking and Expectations of 500 MW had been ‘priced in’. The Actual execution was close to ~25% lower than ‘Expectations’.

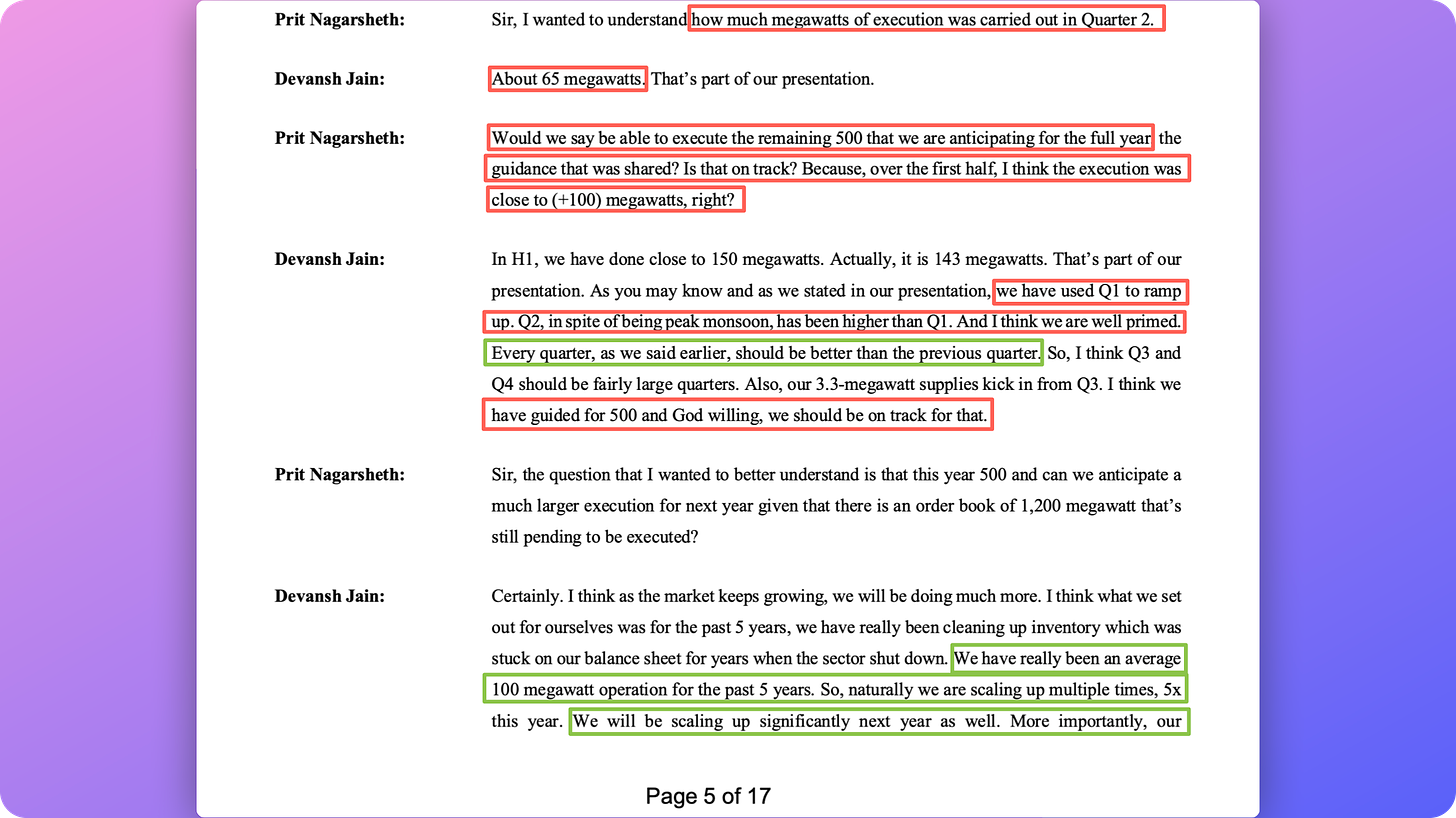

At the end of Q2FY24, when asked whether 500 MW would be on track, Management said we’re ramping up and rightly so, every Quarter has been better than the last.

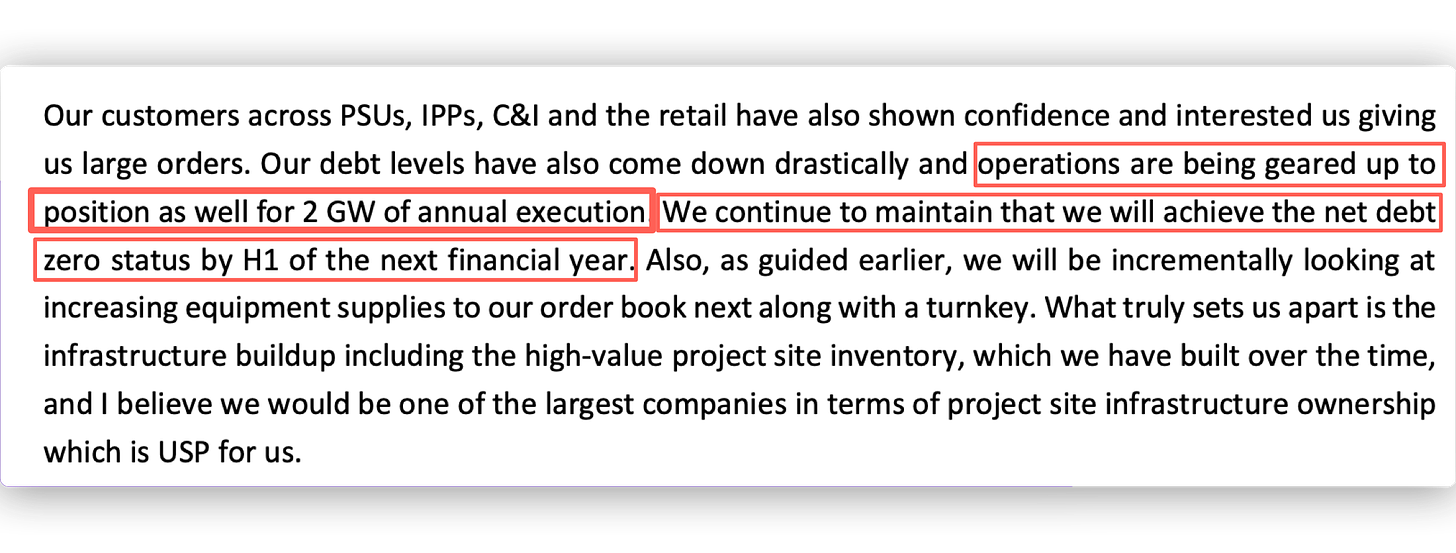

By the end of the December 2023 Quarter, Managements outlook and commentary was still bullish (104 MW Execution in Q3) and references were made to ‘2W Annual execution’

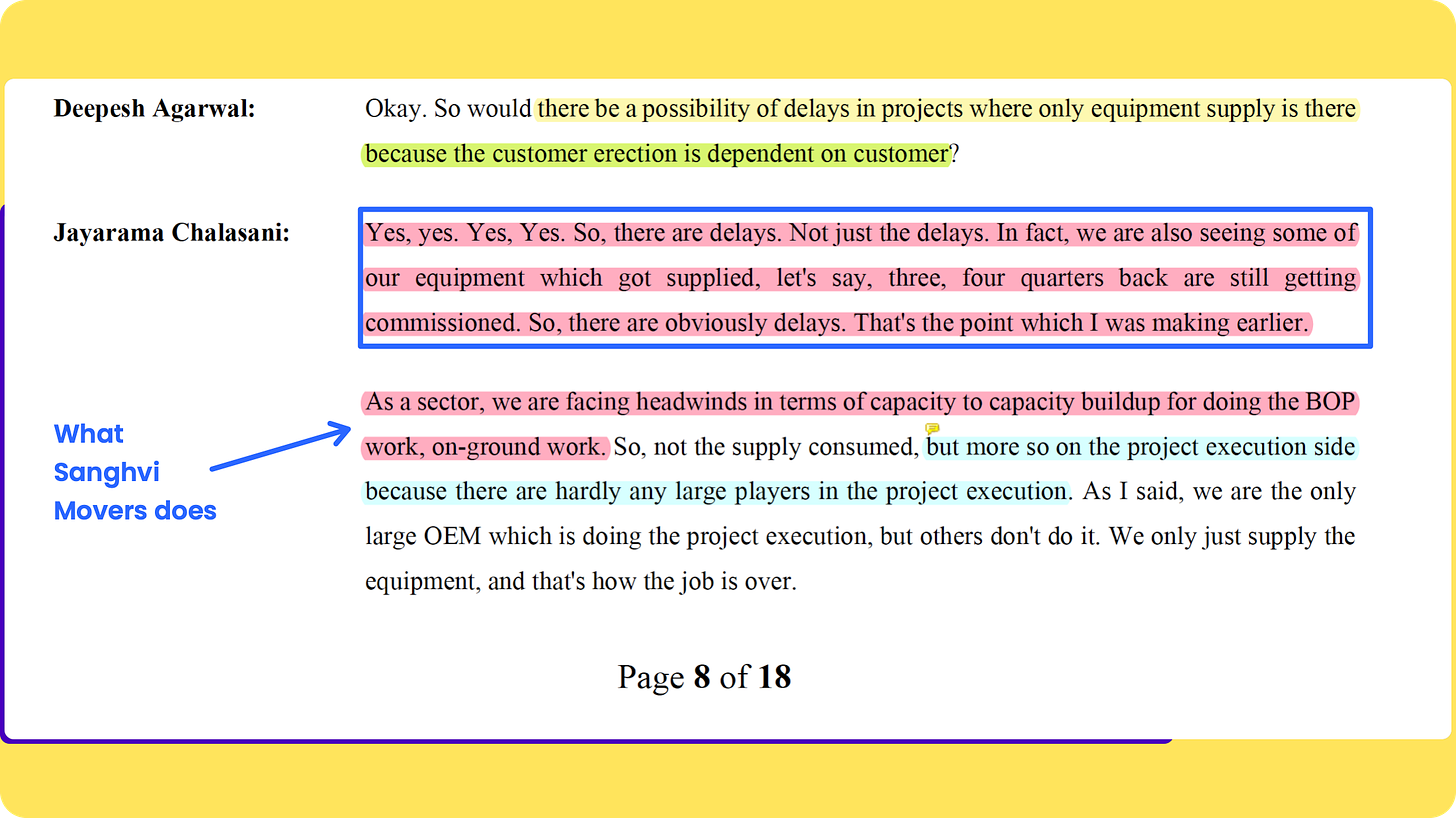

Meanwhile, Suzlon was reporting scarcity of EPC guys (think : Sanghvi Cranes) and slow execution on account of the Evacuation Grid not being ready.

“It appears that its Customers (IPP – Independent Power Producers) are running into execution problems – Land Acquisitions, Grid Connectivity, and a shortage of EPC guys (such as Sanghvi Movers) – Suzlon Valuation Note

Inox Wind Management used this opportunity to sh*t on Suzlon while at the same time highlighting the merits of their Order book i.e – EPC + Equipment Delivery, alluding to the fact that while Suzlon may have EPC issues they do NOT because of their ‘plug & play’ Infrastructure and ‘EPC capabilities’

Finally, It turned out that by the end of Q4, Inox Wind has fallen short of their 500 MW target/expectation by a significant margin.

Bottomline is :

-

Q4 Results were NOT ‘as per expectations of 500 MW execution’ ! However, from the vantage point of FY23 executions, 3.5X in FY24 is obviously spectacular but all that is already ‘priced in’

-

IWL Management has NOW upped the FY25 Execution to 800 MW !! I remain skeptical until proven otherwise [Watch Q by Q developments closely & Track Suzlon & Sanghvi as well]

-

The Biggest Trigger for boosting Earnings is the hoped for reduction in Interest Cost. Every Single Cr saved goes straight to the bottom line ! The co’ is expected to be ‘Net Debt Free’ which means Debt – Cash = 0.

Gulshan Polyols(GPL) – Business by FMCG and Valuation by Commodity (06-05-2024)

Assam facility consent to operate

Buy Unlisted Shares (06-05-2024)

For every 1 NSE share held, you will get 4 bonus shares.

Smallcap momentum portfolio (06-05-2024)

Order is also same as yours.