Any view on Q4FY24 results?

Posts tagged Value Pickr

Security and Intelligence Services (India) Limited (03-05-2024)

Does anyone know why management wants to use leverage the balance sheet even when there’s Capex as such involved?

Its hurting the bottom-line.

Simple Investing (03-05-2024)

Last few months have been watching significant up moves in Power, energy, engineering, infra, defence etc. when I held nothing of these sectors. It was a bit easier because I had done my portfolio creation exercise couple years back and junk removal an year back or so. I was not in lookout of buy & neither exit so just held back and watched.

Got a taste of how wild things happen with stocks. First taste was in Tata Elxsi couple years back when IT was the word…got a quick 10X and after that stock has done nothing last 2 years or so…I never bought it for a quick 10x or whatever so it just sits there.

Second taste came with Hitachi Energy, which I had bought for technology & not infra/power as these companies are rich in technology. With power the word now, got a 10x here as well in couple years or so.

While the taste was good, it did not satiate the appetite, because initial investment was meagre and now they form maybe 2-3% of portfolio even after 10x.

However, with a little better portion of Trent to begin with, a quick 5x did seem to impact a course a day meal.

There have been likes of HDFC Life and good old Dabur, where initial investment was worth a full meal but it still remains a meal. With so much time lost, the meal maybe even stale now.

Portfolio looks like below. 90% can be considered core now after junk removal exercise done an year back or so. Remaining 10% non-core, looking to build some positions there with couple of them. The “Weak” conviction ones are something to be trimmed when opportunity is right. Either the conviction needs an upgrade or the portfolio when it comes to them.

Edit: I admire the big change @Mudit.Kushalvardhan has brought in his investing strategy. From a pure fundamental to a momentum/stage/techno-funda approach. Admire the zeal to learn & change themselves. Lower than expected/peer/certain index returns may have been initial driving force. I have faced similar situation last year or so but haven’t got the energy, zeal and aptitude to learn the technical aspects and change my style. I believe its one of most difficult task in investing – To change one’s style which one has stuck since long. So Kudos to @Mudit.Kushalvardhan. CAGR would follow the person who puts in the extra effort and is also gifted with the aptitude!

I will have to settle with lower numbers considering my style, aptitude & zeal.

CORE Portfolio

| Company | Percentage | Holding Period | Conviction |

|---|---|---|---|

| Tata Consumer | 15.5 | Long | Strong |

| Trent | 13 | Medium | Strong |

| ITC | 9.5 | Medium | Strong |

| Pidilite | 8 | Long | Strong |

| IT basket | 6.5 | Medium | Strong |

| Godrej Consumer | 6.5 | Long | Strong |

| Marico | 6 | Long | Strong |

| HDFC Life | 4.5 | Long | Medium |

| United Spirits | 4 | Medium | Strong |

| HDFC AMC | 2.5 | Medium | Strong |

| Avenue Supermarts | 2.5 | Medium | Strong |

| Nestle | 2.5 | Medium | Strong |

| Dabur | 2 | Long | Medium |

| Asian Paint | 2 | Medium | Strong |

| Hitachi Energy | 2 | Medium | Strong |

| Britannia | 2 | Long | Strong |

| United Breweries | 2 | Medium | Strong |

NON-CORE Portfolio

| Company | Percentage | Holding Period | Conviction |

|---|---|---|---|

| SBI Life | 1.5 | Long | Medium |

| Johnson Controls Hitachi | 1.5 | Medium | Weak |

| Spencer retail | 1.5 | Medium | Medium |

| Agro tech Foods | 1 | Long | Weak |

| Nelco | 0.5 | Short | Strong |

| Restaurant Brand | 0.5 | Medium | Weak |

| Max India | 0.5 | Short | Strong |

Disc. Invested & highly biased. Not eligible for any advice or recommendations. Post is only for learning purpose. I can be wrong in all my assessments.

Skipper Ltd., (Power and Water) a moat in making? (03-05-2024)

I am still waiting for the concall transcript but i am not inclined to take any action as of now (2% of portfolio invested). I would definitely want to understand the reason for such high tax and what tax rate shall we expect moving forward. What i did like is that company still generated good Operating cash flow of about 199 crores. This makes the company valued at 20 times operating cash flow. I felt the revenue growth and cash flow figures are decent, rest let’s see once we have the concall transcript.

Sona Comstar BLW – Direct EV Play (03-05-2024)

Playing with numbers to judge valuation.

Sona B last 3 years doubled revenue and 2.4 x increase in PAT.

Order book in healthy, TAM is big and good management – can expect 2x revenue and 2.25x EPS growth.

CFO in recent CNBC inverview indicated that they can able to grow revenue by 25% cagr (2x in 3 yrs).

Current PE is 69 and EPS is 8.82

If we consider EPS to grow 125% in 3 years than EPS will be 20.

If we consider stock price to grow 15% CAGR than, it will be 937 at end of 3 years. With 20 EPS and 937 price the PE will be 47.

That as per me fairly to highly valued for 20% CAGR company (Considering growth will slow down after 3 years).

My status is hold. Views will change to negative if growth will slow, positive for good acquisition.

Disc: Invested in past with average price at 498.

Meghmani Finechem – Underrated multibagger? (03-05-2024)

although im not have any insight about ECH , if any one have kindly share

Meghmani Finechem – Underrated multibagger? (03-05-2024)

I have Conversation with one of the Dealer of Company ,

I ask about company ,i Specially ask about CPVC.

When i ask about CPVC Quality how is quality of company CPVC ?

reply : there is standard Product with no quality issue with company and DCW and 3-4 player is manufacturing this Product ,

how was the Market of CPVC ?

It is difficult to produce CPVC , company mostly do utilize chlorine and produce CPVC , mostly company in chloro-alike industry face difficulty with there chlorine disposal Problem , in over the world chlorine is main product and Caustic is by Product-USED in PVC manufacturing , and here in India CAUSTIC SODA is main product and Chlorine is By product with limited consumption of Chlorine ,compancy like GACL had JV with NALCO and face Problem of Disposal of chlorine and face Problem and shut plant also .

How is Demand of CPVC ?

With limited Producer 3-4 , and Big plant of Lubrizol is comming in 1-2 year , what ever Produce is sold , and DIfficult to produce with entry barrier .

you sold company CPVC any quality issue or sales Return or quality rejection ?

NO , Quality is standard , almost all manufacturer is standard quality parameter .

what about payment term ?

well, im dealer i purchase from distributor , and company is mostly sells in cash only .

what will be margine ,is company friendly or delar friendly ?

company decided all aspect of business and margine of delar .

thats from my side ,

i would love to disscuss with fellow investor and also want to build heart to heart connection with fellow investor in personal level because in my town i have no friends with same interest ,

any suggesition here i put my email id ![]() Parthsarsavadiya@gmail.com

Parthsarsavadiya@gmail.com

Shakti Pumps – solar shakti (power)! (03-05-2024)

Nuvama’s Management meet note

shakti-pumps-india–management-meet-note .pdf (1.1 MB)

Projections by Nuvama

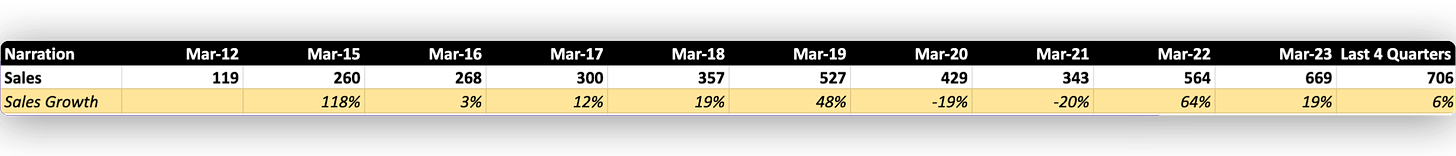

Dynamic Cables – Much more dynamic in 2022? (03-05-2024)

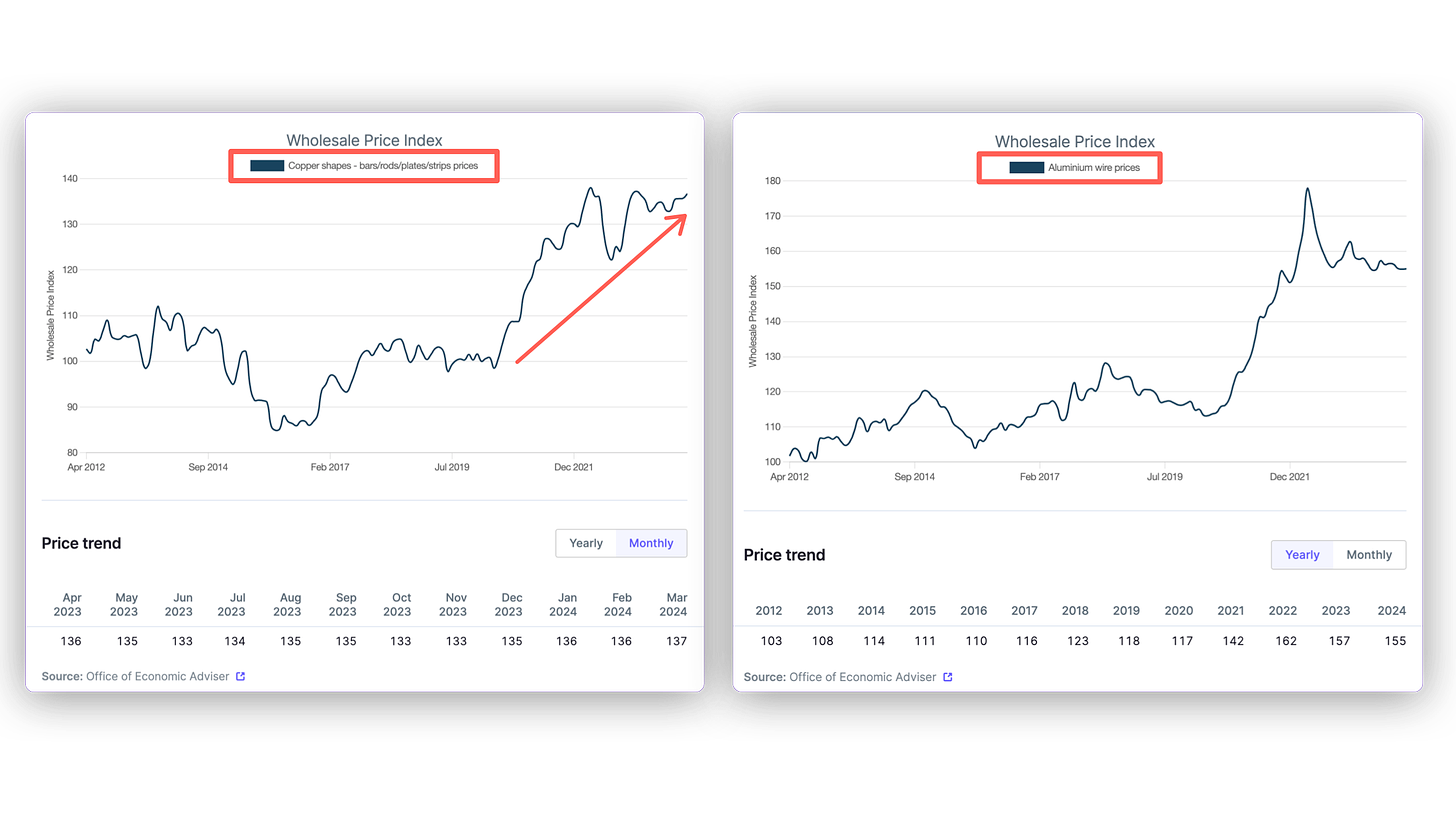

Dynamic Cables (DCL) business model is highly dependent on Raw Materials such as – Aluminium, copper & Rubber.

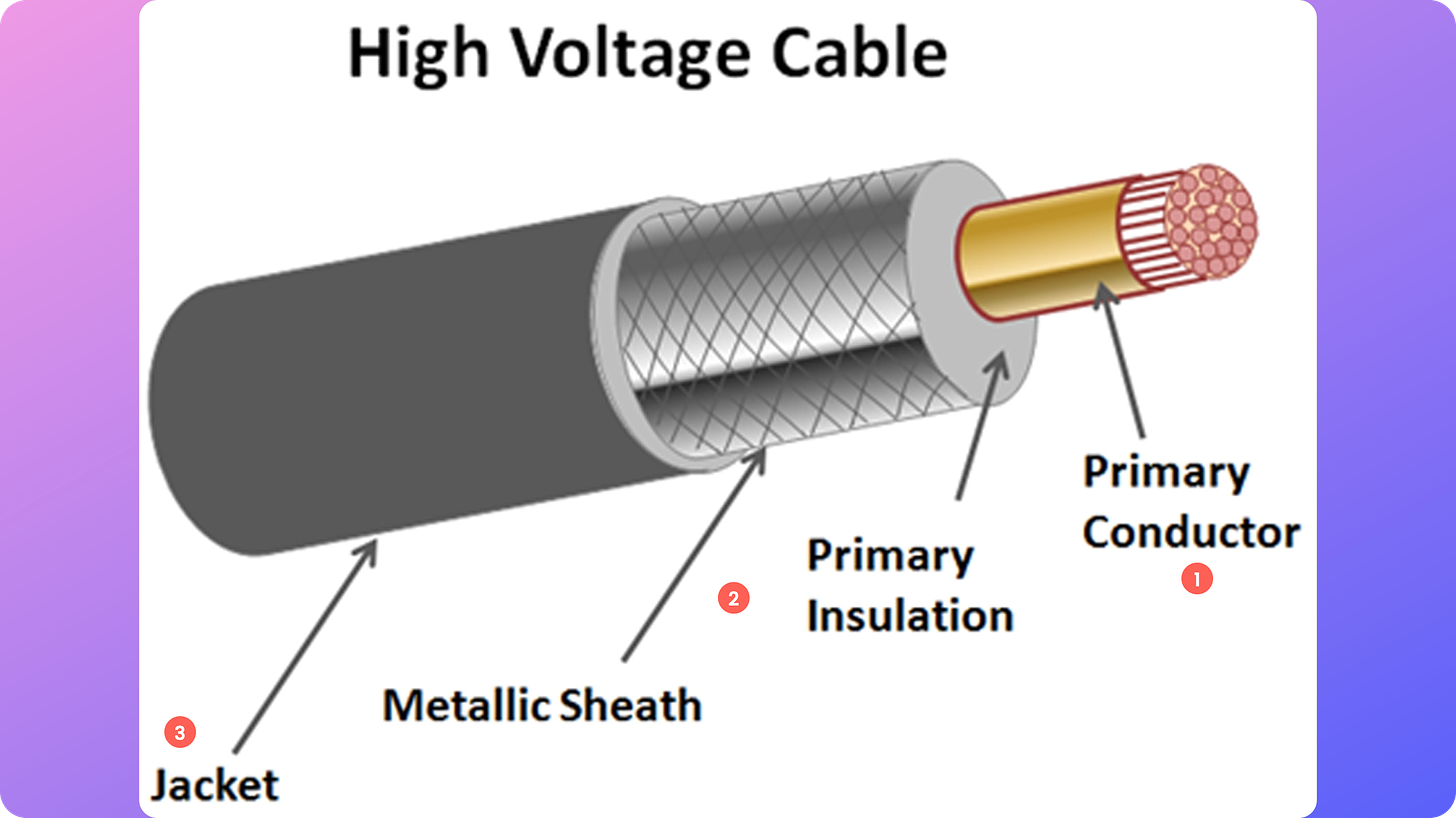

After all a cable is simply made of 3 parts: conductor (Copper/Aluminium), insulation (metal/rubber) and the Jacket (Rubber)

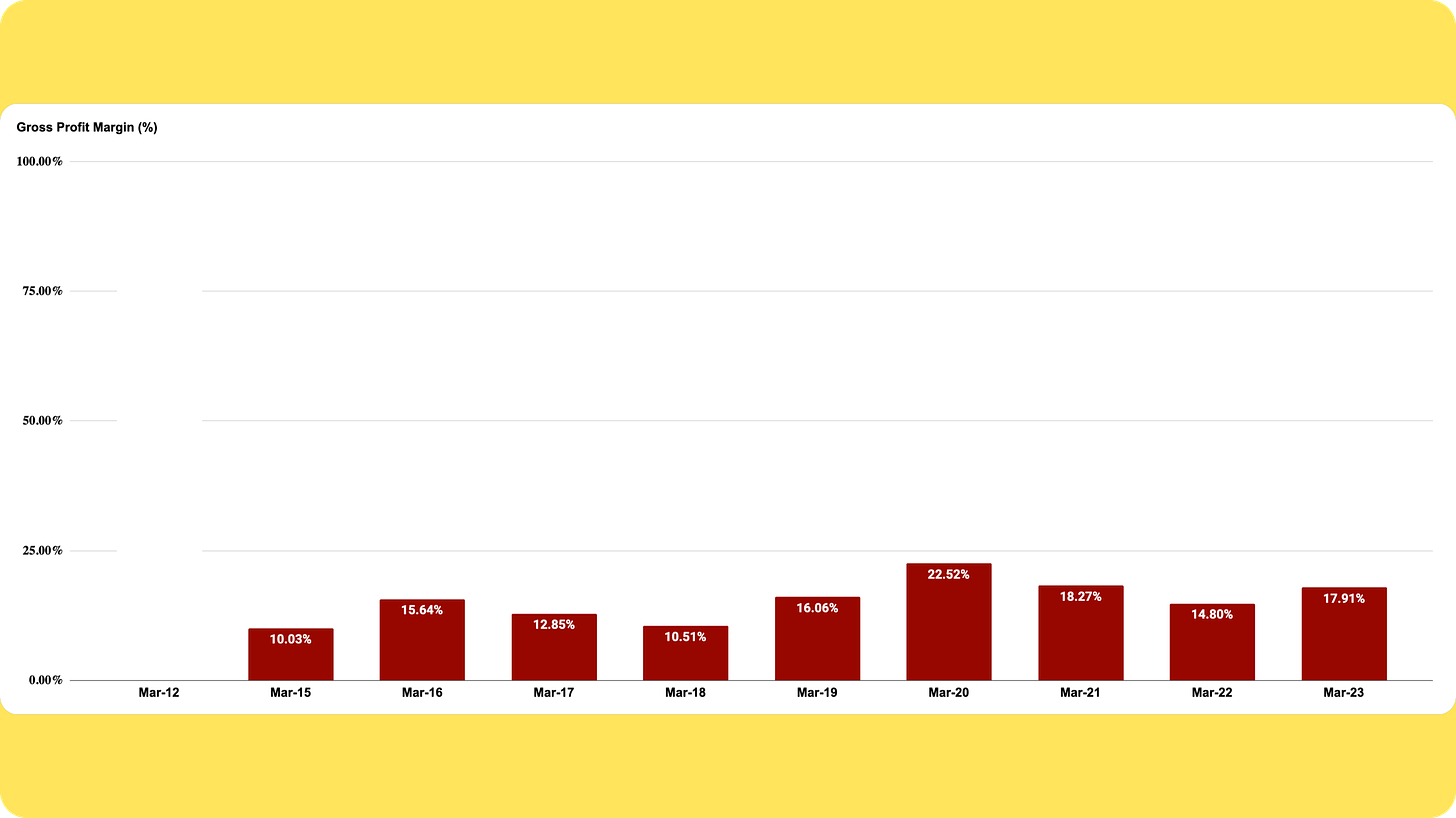

(#1) Gross Profit margins reflect DCL’s ‘high-dependency’ on RM prices, which are at all-time highs anyway. You can read this article I wrote on Copper (later ![]()

Challenges in the Copper Value Chain

Put another way, with a measly 15-20% GPM, the co’ can barely charge above the cost of the Raw Material. On top of that, any sharp fluctuations can impact margins.

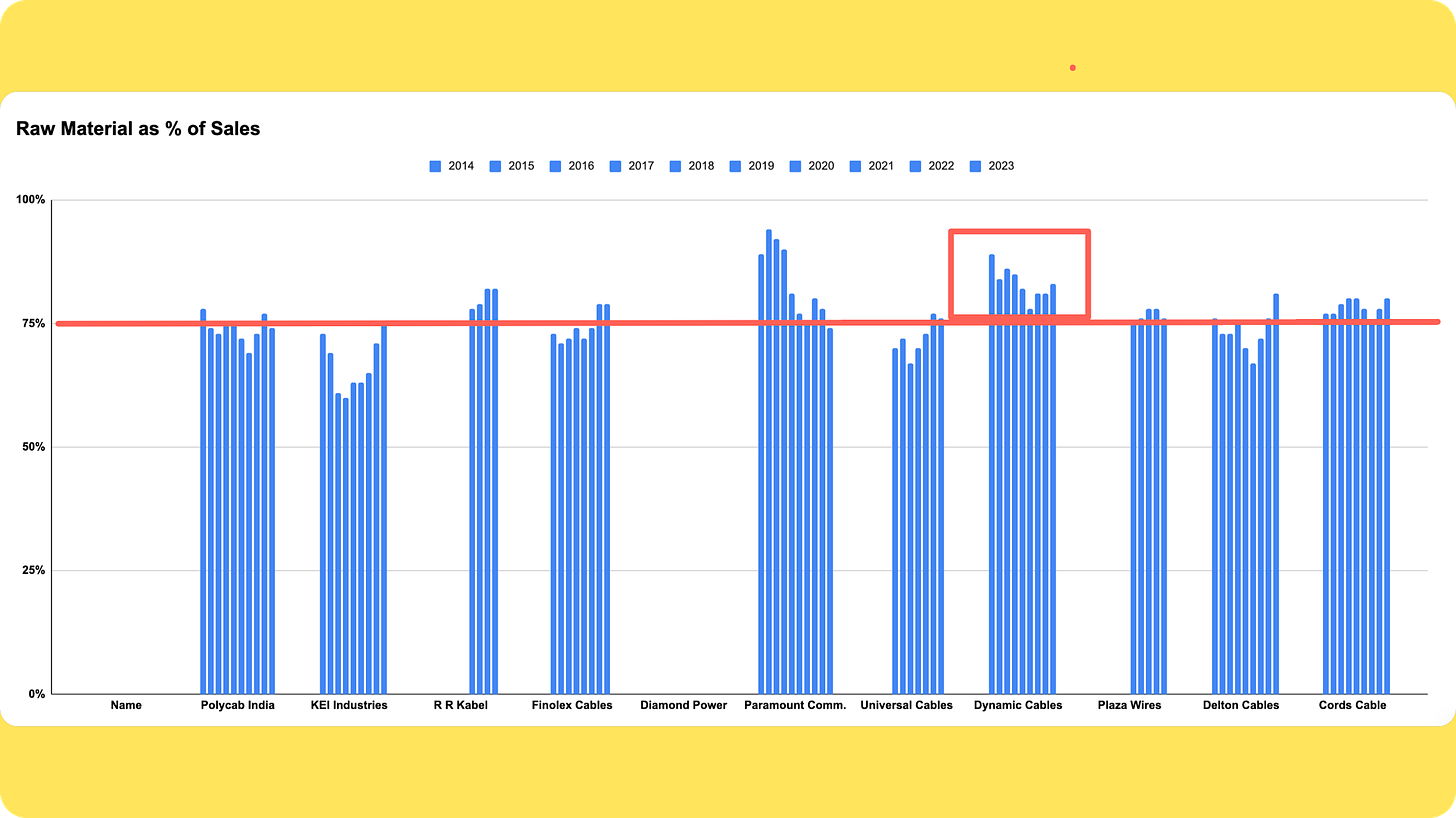

Even in comparison to other players, some bigger, some smaller than DCL, RM as % of Sales seems on the higher side consistently. However, the reason for the same is yet to be determined

Given low GPM and fluctuating RM Prices, ‘pricing power’ seems to be a distant dream for the co’.

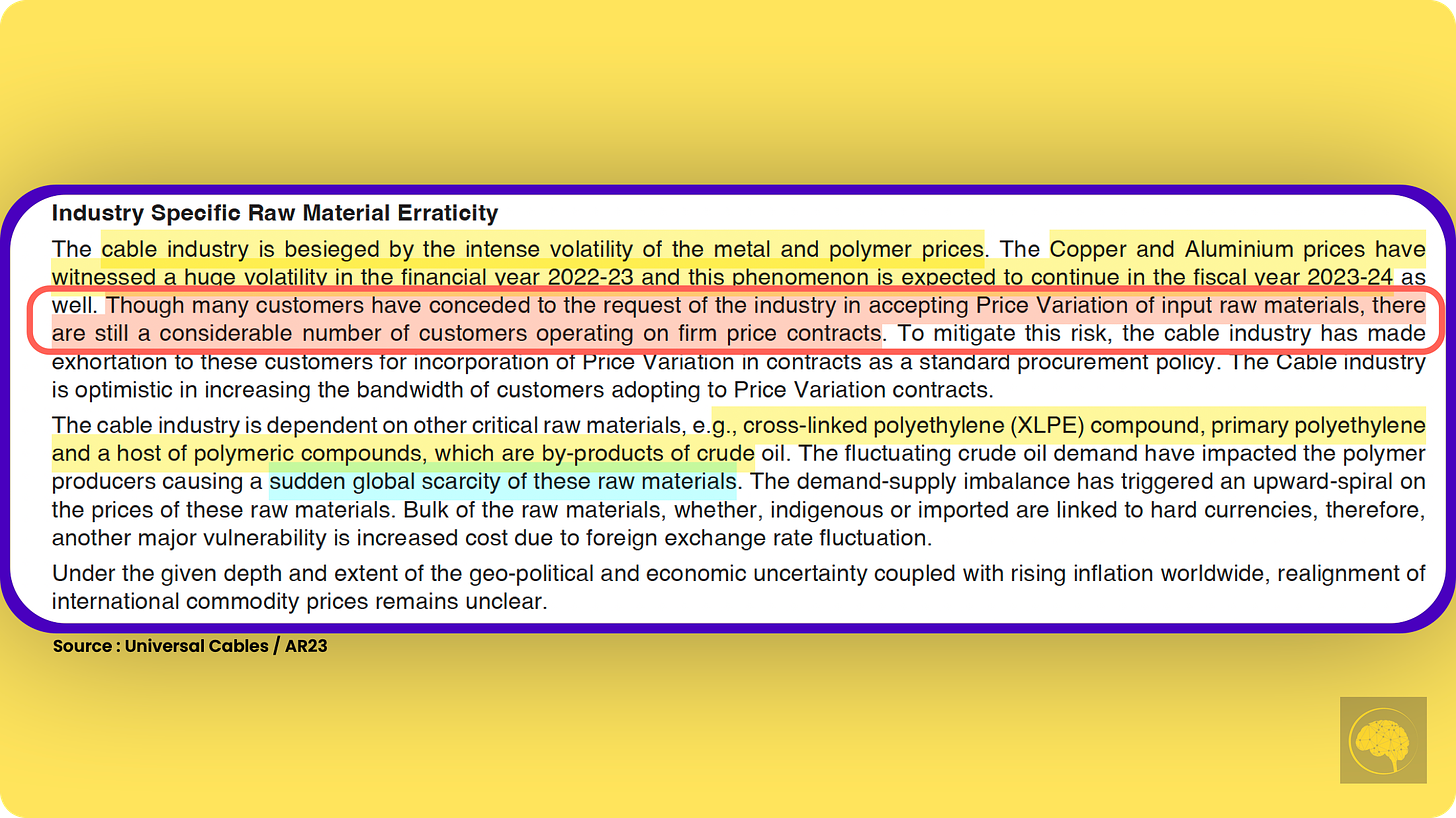

Although, that is an industry norm, not a predicament faced only by DCL.

Except maybe some of the larger players, which have better (not exceptional) ability to pass on RM prices given their higher retail (B2C) focus & higher bargaining power (size matters), most players in the Industry supply on a ‘Firm Prices contract’ i.e – Between the time you get an order and you supply it, if RM prices move, it’s your problemo!

There are 2 ways in which DCL tries to protect itself from adverse RM movements :

- Hedging RM Prices

- Places RM orders only post receiving Order from Clients

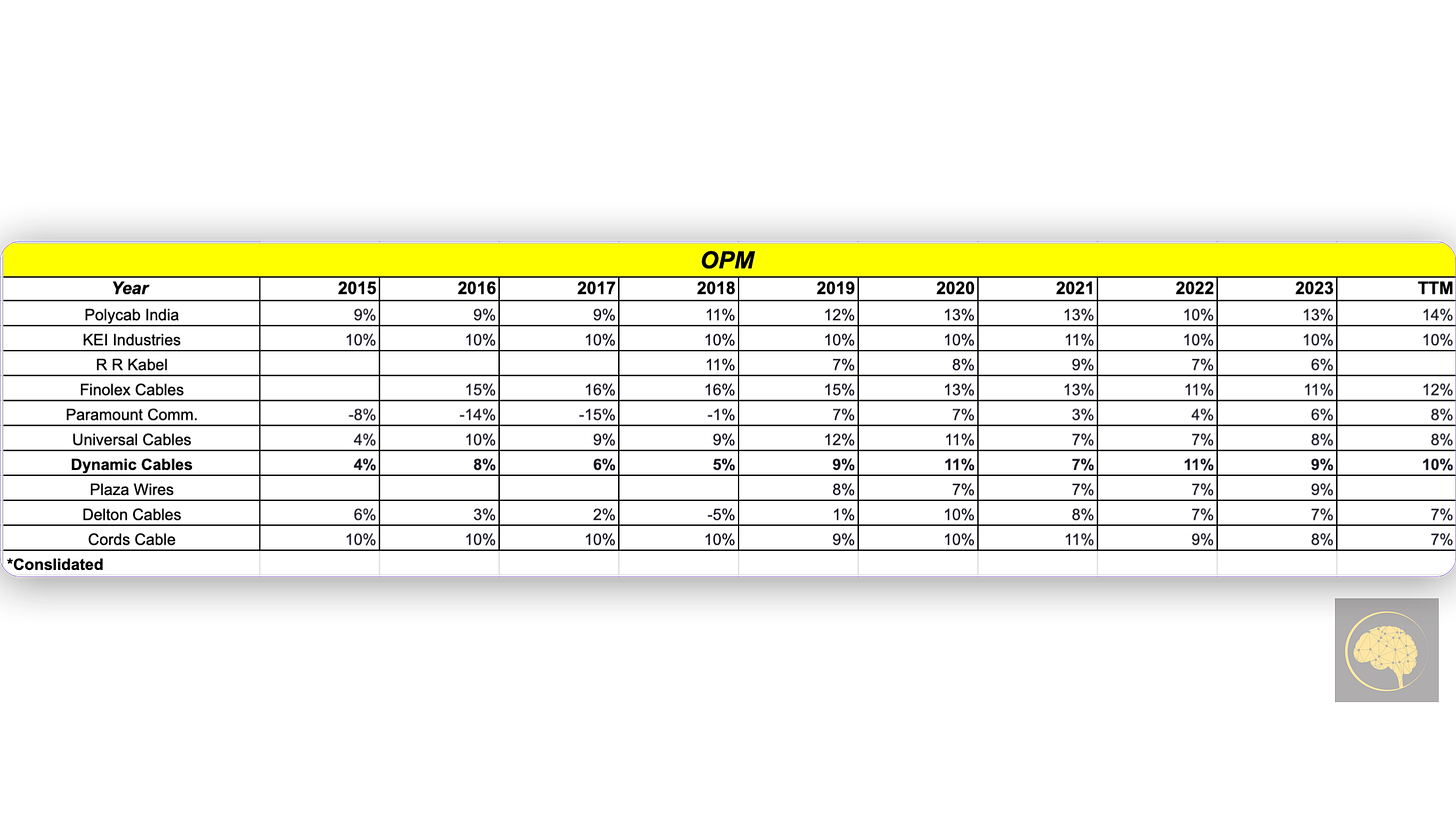

Despite higher than normal GPM, DCL’s (#2) Operating Profit Margins (EBITDA %) seem to be in line with expectations: Lower than the larger peers but higher than the smaller peers.

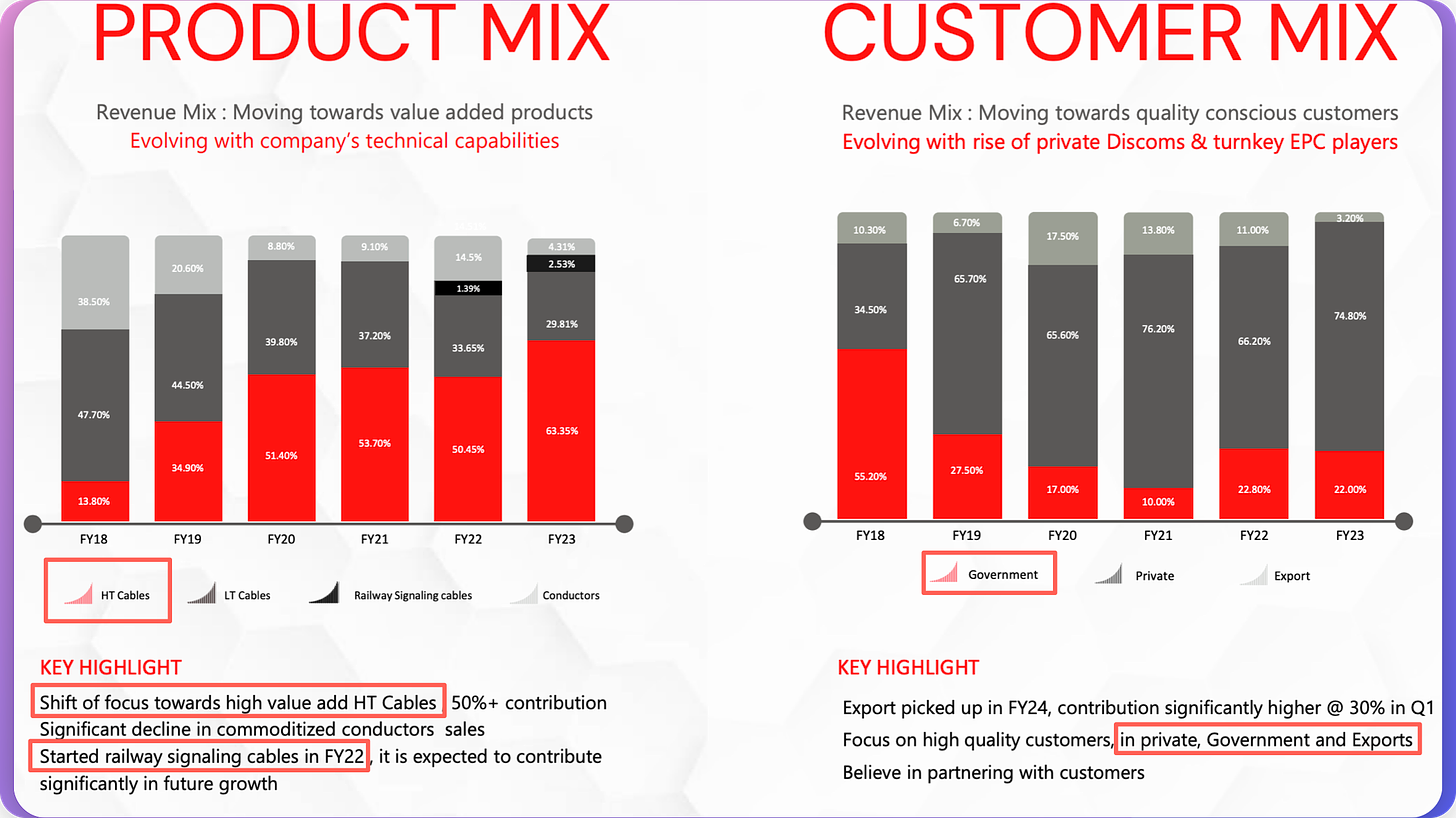

#3 – Product Mix

~ 63% of the Sales (FY23) came from HV Cables (Higher margin) and the remaining ~27% from LV Cables.

DCL has increasingly shifted towards higher margin HV cables over the last 5 years. It has also reduced reliance on Government business.

A likely outcome of the above 2 strategic shifts is that :

- EBITDA Margins have improved from ~5% to ~9-10%

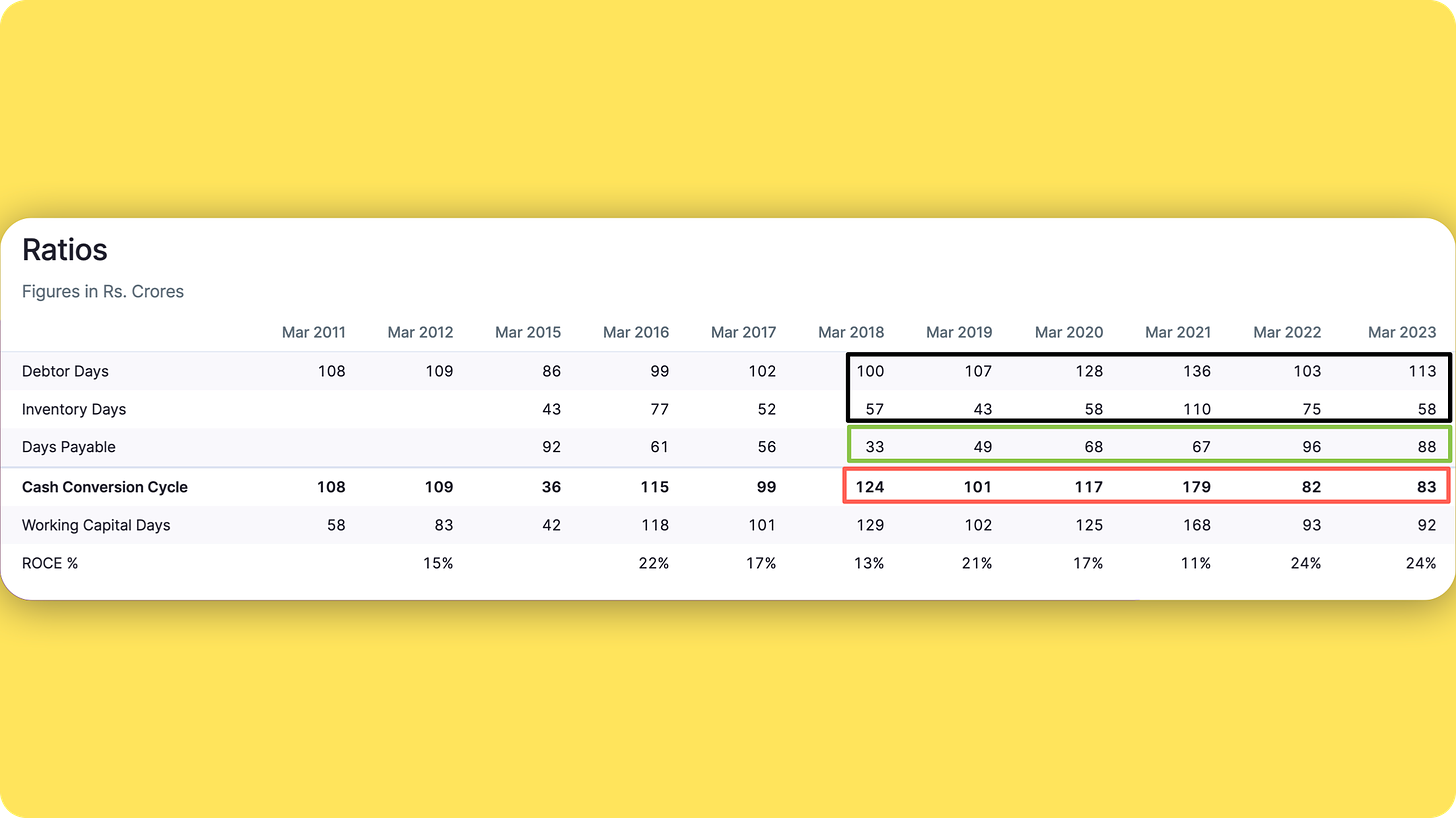

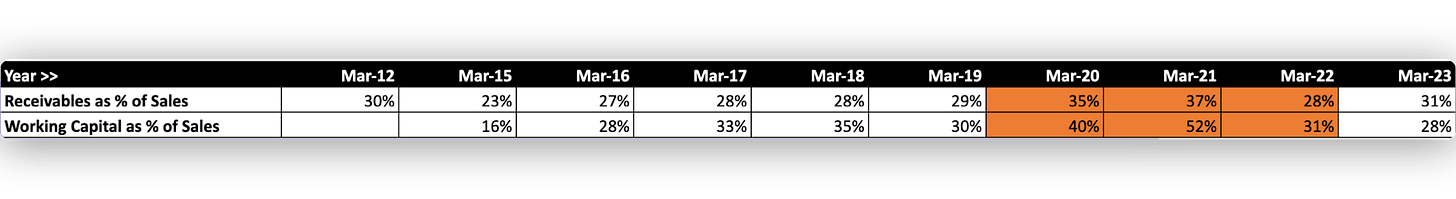

- Cash Conversion cycle has improved from 124 Days in 2018 to 83 days in 2023. But this is a result of increasing payables (taking longer to pay suppliers), not of decling receivables days.

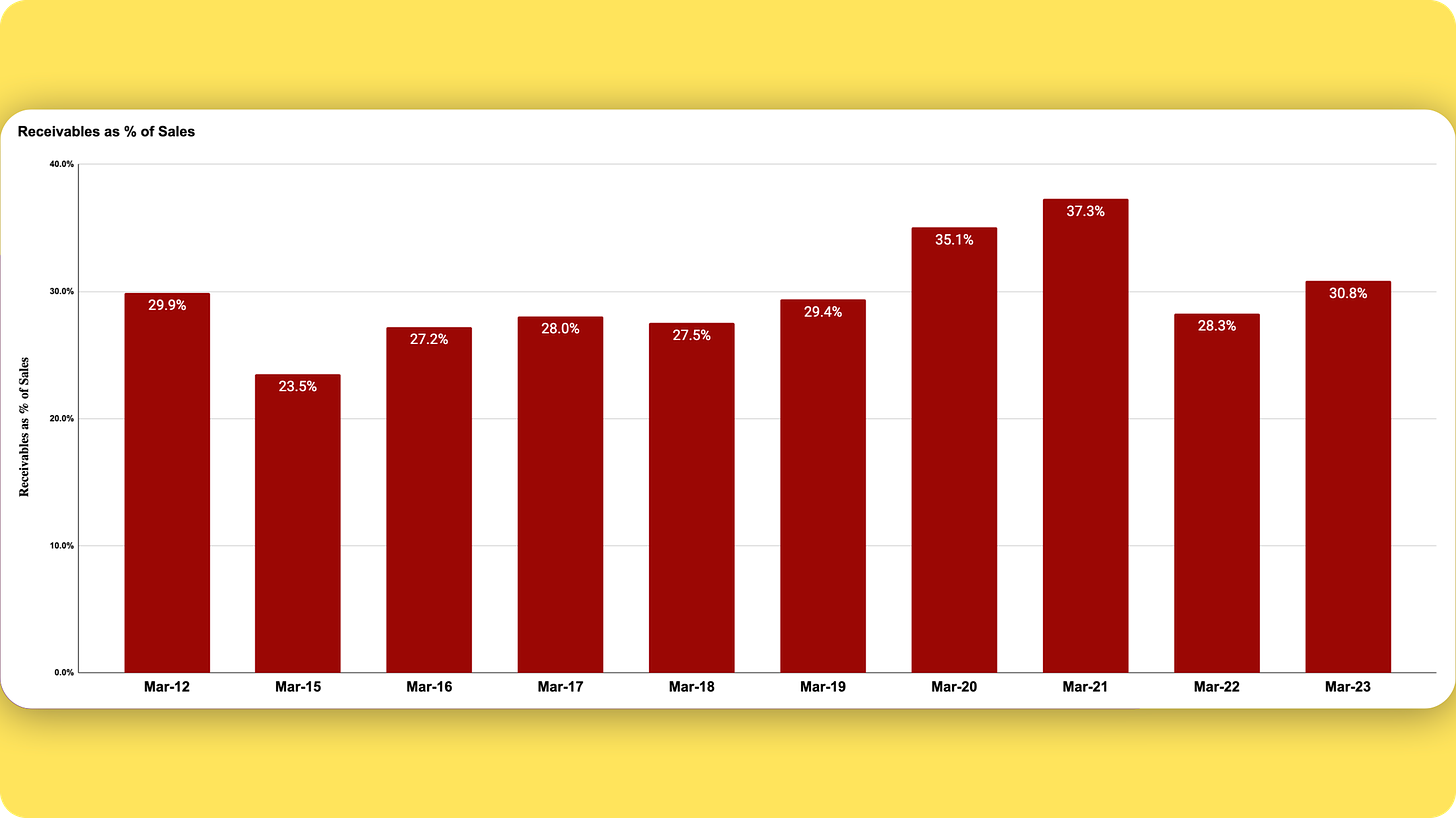

In fact, Receivables as a % Sales have increased over this period.

Therefore, shifting away from Government orders may have other benefits but shortening receivables cycles is not one of them.

Going forward co’ is betting on HV cables & Railway Signalling Cables to contribute to growth.

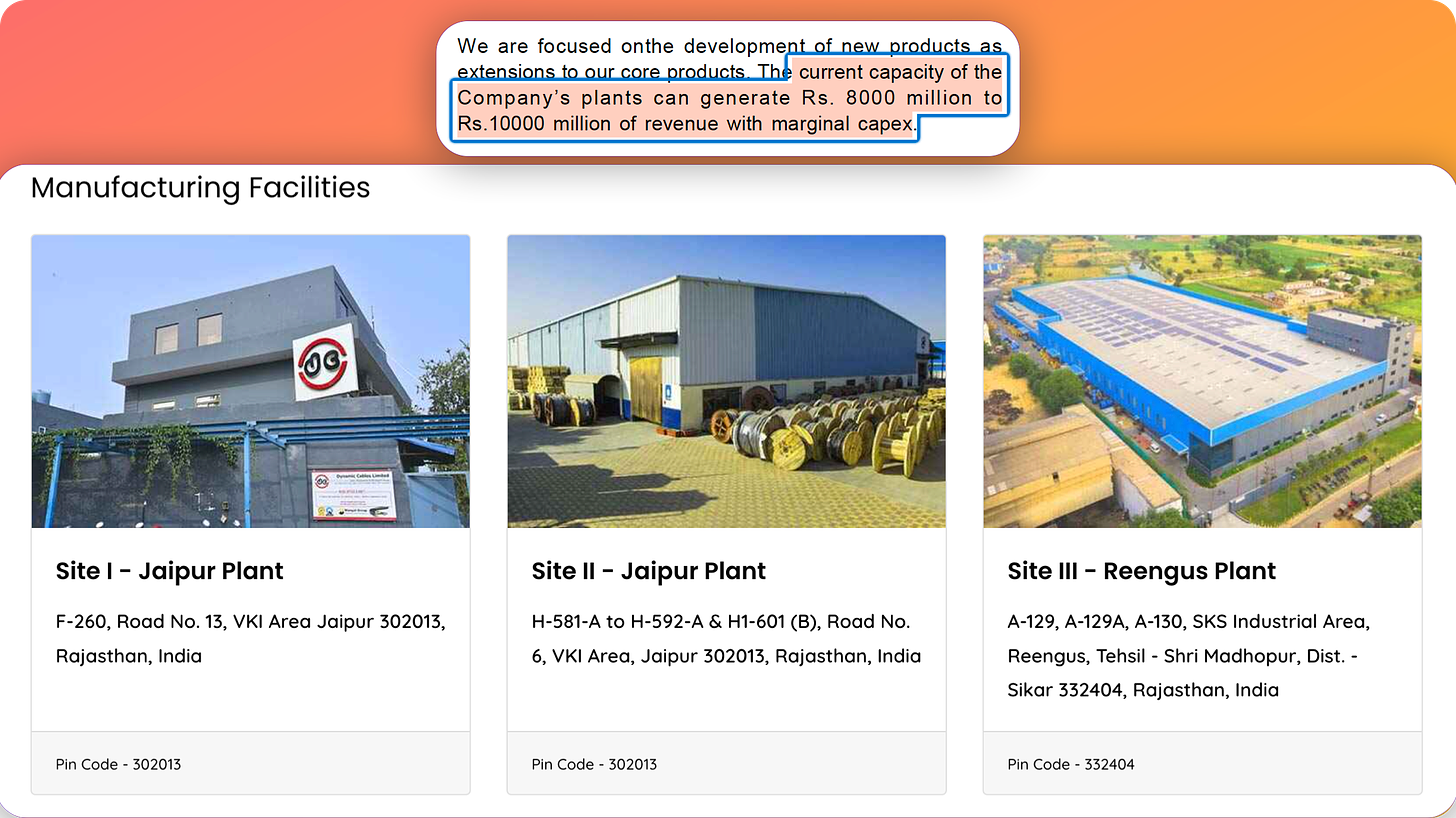

#4 – Capacity

Current Capacity can generate sales of 800-1000 cr (AR – 2023) with marginal capex.

SOURCE : AR 23 & COMPANY WEBSITE

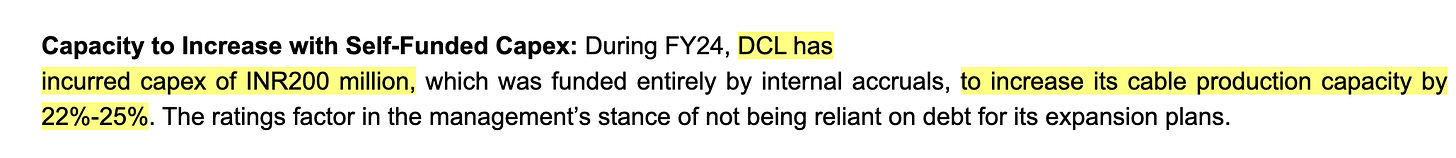

Additionally, Co’ has invested 20 Cr in FY24 to increase capacity by 22-25%

Source : Credit Rating Report – January 19th 2024

This brings Revenue potential to ~ 1000 – 1200 Cr ( Expected FY24 @ 780 Cr)

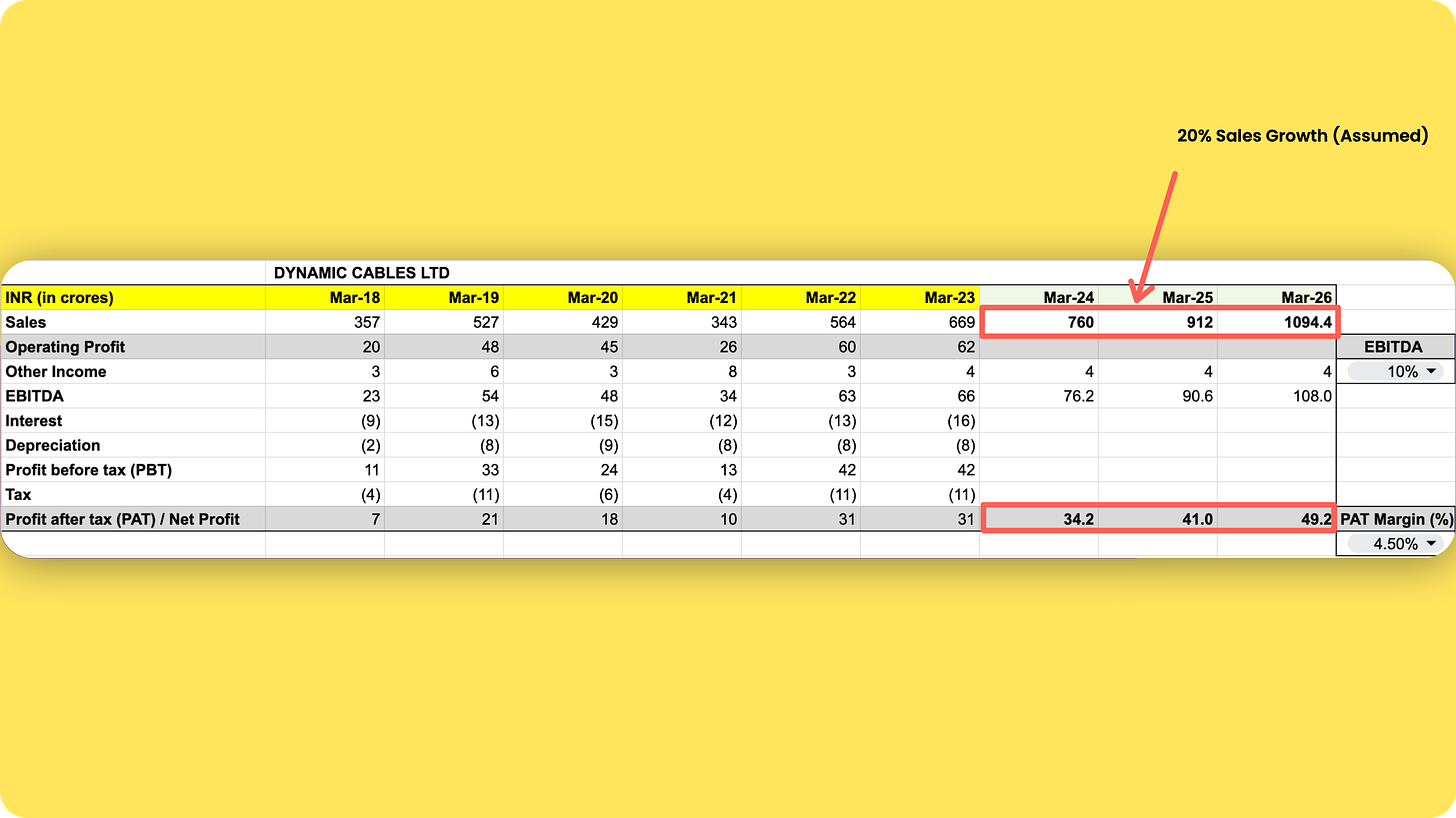

A simple model with some basic estimates suggests over the next 3 years if Sales grow by 20% YoY, we’re looking at a PAT of 45-50 Cr.

If multiple remains the same, the co’ might become a ~1500 Cr Company (currently 1000 Cr). This is hardly enticing but I’d say this is the base case.

The question is: can the co’ grow at 20%+?

Even if Sales Growth is lower than 20%, there 2 possible levers that can lead to a 20-25% PAT Growth :

- EBITDA Expansion – Unlikely (unless co’ decides to focus on retail in which case it is going to require upfront investments in brand building)

- Improving Working Capital – Unlikely (If Interest cost reduces as a % of Sales, it could boost PAT, however, most of the interest cost is derived from Working capital Loans and WC/Sales has been fairly consistent at around ~30% with no imminent reason for improvement at this point)

Click to View Enlarged image

Ignoring the Covid-inflicted period, there seems to be a downward trend in Working Capital / Sales (%) which means lesser WC Debt and lower Interest cost and higher PAT. Can it go lower, remains to be seen.

The most reliable growth trigger is ![]() capacity Expansion. Let’s see how this plays out. This is NOT a Recommendation/Advice, please read the Disclaimer.

capacity Expansion. Let’s see how this plays out. This is NOT a Recommendation/Advice, please read the Disclaimer.

In Conclusion, there seem to be limited triggers (Currently) for Dynamic Cables that can help the co’ achieve a 20-25% PAT Growth.

Would like to hear your thoughts in the comments.

Thank you

Rahul

DISCLAIMER :

I am NOT a SEBI – REGISTERED Investment Advisor | Nothing you read here should be construed as investment advice. I do not know your circumstance so please treat the above as nothing more than my personal opinion, which is subject to change without prior notice to you. Please do your work and consult your financial advisor. I may own positions in all stocks, sectors and indices discussed and can exit them without notice

Gurugram Valuepickr (03-05-2024)

Next upcoming Meetup is on 12th May 2024 Sunday. Timing And Venue to be decided soon.