@visuarchie @R_Sawkar.

This indeed is a nice initiative…if its a free account zoom call…i think the time will be limited to 40-45 minutes…u’ll have to complete within that time frame just in case.

The recording of the webinar and sharing its link… is Another very good and very convenient idea…That way anyone can repeat…someone like me can keep repeating.![]()

Posts tagged Value Pickr

Microcap momentum portfolio (19-04-2024)

Hitesh portfolio (19-04-2024)

You are right every tom dick and hary is into RE while unit rates have crashed and in many cases projects wouldnt be viable .

Dynamatic Technologies – Can it be Dynamite (19-04-2024)

HDFC reduced stake from 7.5% to 5.49%.

Inox India, a story worth looking? (19-04-2024)

I’ve recently published a post on Inox India on substack (https://pankajg.substack.com). Posting the excerpts here to further the discussion on the stock:

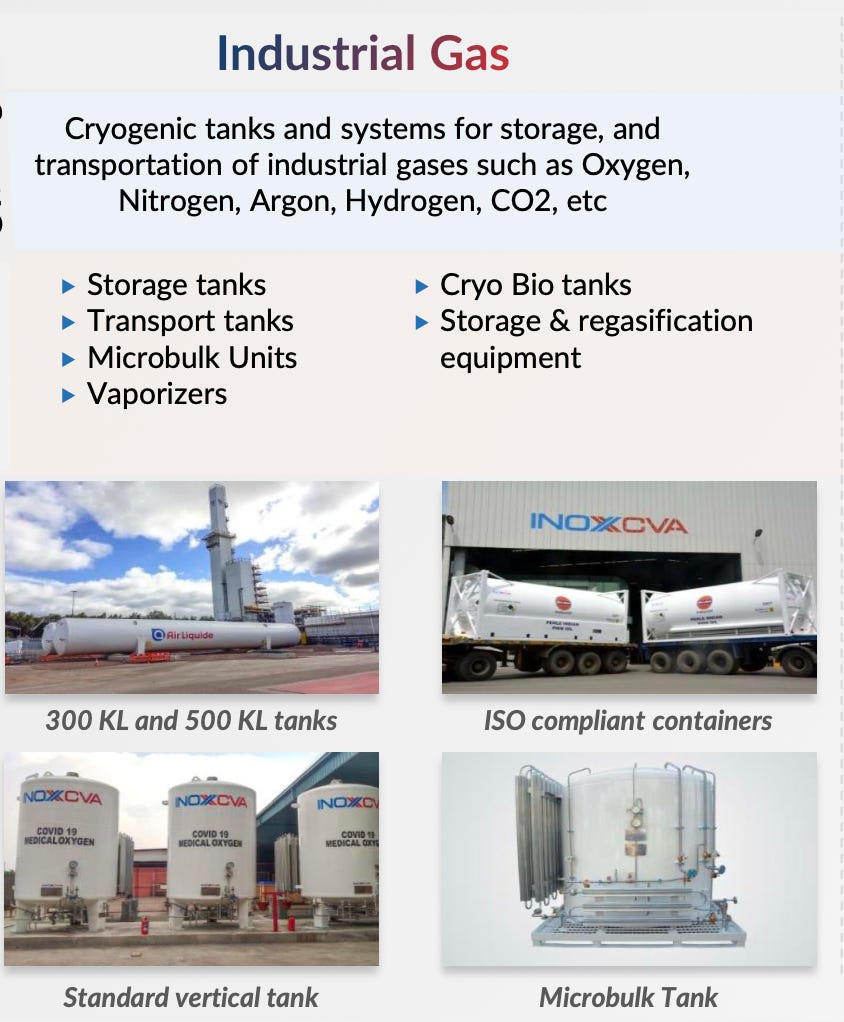

Cryogenics: Cryogenics is the scientific study of materials and their behavior at extremely low temperatures typically below -150°C (123 K). Cryogenic gases have a very low density at room temperature; thus, require a high-pressure vessel to store gasses in large quantities.

In India, there are three players which deal in cryogenic tanks i.e. Inox India, VRV Color, and Cryolor. Inox is the market leader in the segment with over 4x revenue as its nearest competitor VRV Color.

Three Business Segments: * i.e. Industrial Gases, LNG, and Cryo Scientific

MoU with Adani Total Gas

- “preferred partner” status for the delivery of LNG and LCNG equipment and services with Adani Total Gas. A long-term contract where Inox and Adani intend to collaborate on engineering, design, and planning.

- Adani Total Gas is building out this LNG infrastructure, Inox to facilitate fast-track setting up of LNG stations across the country

- In the coming two to three years, they will be expanding heavily, especially in the fueling station, LCNG station, satellite station, and maybe the convergence of their mining and cement trucks to LNG as a fuel.

- Though the numbers are not clear but could become a substantial driver of LNG business. Order booking has already started. Worked with them earlier on three stations, they were having, (helped them in starting those stations because they were having some issues with the station which was delivered by some other companies) and recently received five fueling stations from them (con call Q3FY2024)

Green Hydrogen Optionality

Inox is currently focusing on solutions for hydrogen fueling infrastructure, storage, distribution, etc. As per the company update, they have already:

- Manufactured trailer mounted Hydrogen transport tank, designed jointly with ISRO

- Produced & supplied liquid Hydrogen tank to 2 customers in South Korea

Looking good on chart as well:

Srivari Spices and Foods Limited (19-04-2024)

How exchange/regulators allowed these companies to do right issues since these are traded in lots.

All shares of retailers will be in different multiple and then no body will be able to sell his right share untill company goes to main board

Hence please avoid applying rights

Microcap momentum portfolio (19-04-2024)

Thank you. That’s great. If the organiser and you are fine, record it. The timing do not duit me, but like to watch it if possible later.

Green Hydrogen as a Fuel – Indian Companies leading the Green Revolution (19-04-2024)

So ultimately its still chump change at 4.3*1000 * 300 *365 = 500 Crores per year. Gail has annual revenues of 1.3 Lk Crores.

They Need minimum 430 MT per day to make the business relevant in terms of revenue. Even then it will be just 20% of revenue and profits after lets say 10 years.

Green Hydrogen for now will not make any difference in moving these companies. Its more a long term play.

Need to reconsider the euphoria perhaps.

Ujjivan Financial – Small Finance Bank (19-04-2024)

It went up 5 per cent today, the gap is closing down.

Lazycap’s Portfolio – Feedback (19-04-2024)

Update

I have added very small position to Bandhan Bank today around 172, its like 0.6-0.7% position size of folio on cost basis. Could scale up basis development going forward, but will not do so if there are better relative options with high risk reward asymmetry

Rational for addition:

It has pristine history (at least till now), NCGTC audit seemed like a big overhang to me. If proven then, have no idea of repercussions on Bandhan’s business but stock might nose dive and if bank comes out clean from audit then I think that’ s a positive (When is audit result due – God knows). If proven otherwise this could be next Yes bank (but I think highly unlikely given Founders pedigree and recent banking license with so many uncontrollable events in their concentrated region of WB, Assam)

Growth is there as MFI in itself is growing, my concern is their Corporate Book (did not dig deeper on CB)

Valuation wise seemed reasonable, not undervalued but lets say fairly valued given the historical and peer’s, but banking is a big blackhole so this could turn out to be 0 or 1 bet

And exit of Mr. Ghost could just be the short term hiccup as we are talking about an institution which will go on no matter what (Key man risk has already played out)

Reason for buy: Bottom fishing in current market with least efforts and of course anchoring bias, rationalizing away my bet with above points while reality seems different. If conviction builds up might switch Heranba position to Bandhan completely

Ujjivan Financial – Small Finance Bank (19-04-2024)

In terms of USFB price, the price of UFS is equivalent to 615 today. While actual price is @ 550.