Why is the promoter holding so low at 19%?

Please can someone shed some light on this.

Also, what is the market share between Wagah & EMS would anyone know?

Thank you

Why is the promoter holding so low at 19%?

Please can someone shed some light on this.

Also, what is the market share between Wagah & EMS would anyone know?

Thank you

CAMS gets RBI approval to operate as an online payment aggregator.

Portfolio Update and Allocation

Exits: Sold Dycons Systems after quick 28% Profit

Nice analysis regarding the involvement of Indian companies. Towards construction involved in various activities, ACE, Hercules Hoist and Escort Kubota etc may be considered. Tiger logistics is the preferred logistic company for co- coordinating passage through sea, especially Defense load as seen in the recent past. The owner hails from Defense background and has availed the connections for access into the market. Armenia as of now is relying on Indian defence systems and in the future Greece

Hello, would you be able to update portfolio allocation in each of these stocks?

Hi, I came across the company recently, went through the concalls/PPTs and below are my observations.

The super high valuations of the company at the time of the IPO has not held up, and the current price has gone below IPO price and profits have increased, thus making the company relatively cheaper, hence attracted my interest.

The co. is growing ahead of the industry, margins have improved and now there is little headroom for margins to improve from here, based on A&P spends. If they continue to grow ahead of the industry, and A&P spends grow at lesser rate, then some benefits will show up in the EBIDTA, and the co. expects that it could reach 20% EBITDA margins next year. Currently their margins are second best, slightly behind Asian Paints.

The company has finished the TN capex and initiated the Jodhpur capex. Their strategy of focusing on 750 cities has resulted in growth. The mgmt is expecting to finish the year (FY24) around 1350 Cr, this is 25% growth over last year. And next year they are targeting to grow beyond 25% (their target is to grow between 30-40%), provided industry grows to its pre-pandemic levels of around 8-10%. The co. is expecting Apple Chemie also to grow to 55-60Cr, and very bullish on the subsidiary outperforming going forward.

The mgmt has, multiple times, alluded to reaching closer to #2 and #3, and if from Fy24, they grow 5x they would still not be #3 by 2029, they will be less than 7000Cr topline. Assuming they maintain their margins (10% NPM), and assuming PE multiple of 40, the mcap could reach 28,000Cr, that would be over 4x from current levels in 5 years (32% CAGR).

The triggers are:

A big question is, will the company be able to grow as per its own expectations.

Another big risk to this thesis, and connected to the above risk will be, how Grasim executes its plan. There are fears that Grasim will alter the industry structure significantly and historical profits/returns earned by the incumbents will reduce. If that plays out, then all the parameters like growth, margins, multiples will reduce for the current players and above thesis will fail.

Disc: not invested, but interested

(Ref:chittorgarh.com)

Incorporated in 1997, Chatha Foods Limited (CFL) is a frozen food processor. The company offers frozen food products to top QSRs (Quick Serving Restaurants), CDRs (Casual Dining Restaurants), and other players in the HoReCa (Hotel-Restaurant-Catering) segment. Chatha Foods’ product portfolio includes Chicken Appetizers, Meat Patties, Chicken Sausages, Sliced Meat, Toppings & Fillers and more. The company produces more than 70 meat products.

The company sells products under the brand Chatha Foods and distributes through the network of 29 distributors covering 32 cities across India and catering to the needs of 126 mid-segment & standalone small QSR brands.

Chatha Foods Limited has a Manufacturing Facility, located in District Mohali, with a production capacity of approximately 7,839 MT for all the frozen food products.

The company is serving top QSRs, CDRs and other players in the Hotel-Restaurant-Catering segment like Domino’s & Subway’s India franchise, Café Coffee Day, Wok Express, etc.

The company does not have any subsidiaries or any Group Companies.

Figures in Rs. Crores

| Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | |

|---|---|---|---|---|---|

| Sales + | 91 | 85 | 61 | 87 | 117 |

| Expenses + | 81 | 80 | 63 | 83 | 110 |

| Operating Profit | 10 | 5 | -2 | 5 | 7 |

| OPM % | 11% | 6% | -3% | 5% | 6% |

| Other Income + | -0 | -0 | 0 | -0 | -0 |

| Interest | 2 | 2 | 1 | 1 | 1 |

| Depreciation | 2 | 2 | 3 | 3 | 3 |

| Profit before tax | 6 | 1 | -6 | 1 | 3 |

| Tax % | 29% | 27% | 27% | 36% | 27% |

| Net Profit + | 4 | 1 | -4 | 1 | 2 |

| EPS in Rs | 3.50 | 0.83 | -3.23 | 0.54 | 1.98 |

| Dividend Payout % | 0% | 0% | 0% | 0% | 0% |

Market overview

The global QSR market was valued at INR 25.05 Trn in FY 2022. It is expected to reach INR 54.53 Trn by FY 2027, expanding at a CAGR of ~17.41% during the FY 2023 ─ FY 2027 forecast period. The requirement for a wide variety of fast-food items and the growth of the market both contribute to the quick-service restaurants market’s expansion globally. The QSR market in India was valued at INR 171.90 Bn in FY 2022. It is expected to reach INR 431.27 Bn in FY 2027, expanding at a CAGR of ~20.47% during the FY 2022 ─ FY 2027 forecast period. The current decade is overseeing a shift to a larger organized sector. Customer retention and a higher range and depth of offerings are new goals among the organized market players of QSR.

QSR Market in India

• The QSR market in India was valued at INR 171.90 Bn in FY 2022. It is expected to reach INR 431.27 Bn in FY 2027, expanding at a CAGR of ~20.47% during the FY 2022 ─ FY 2027 forecast period.

Major quick food-service chains, such as McDonald’s, Burger King, and Domino’s, among others, are

deepening their reach in India’s smaller cities and benefiting from a younger demography, thereby further aiding the growth of the market.

• The QSR segment will see its next big growth come from consumers in tier II and tier III cities. Annual spends on eating out at QSR chains in non-metros are expected to surge 150% to INR 3,750/- per household over the next three years.

Competition

Our industry comprises of both organized and unorganized players, therefore we face competition from both small players who belongs to unorganized sector and big players who have better resources availability.

Promoters are Paramjit Singh Chatha, Gurcharan Singh Gosal, Gurpreet Chatha and Anmoldeep Singh.

Paramjit Singh Chatha aged 55 years, the Chairman and Managing Director of the Company and a member of the Promoter Category, has founded the Company. He was appointed the Managing Director of our Company, w.e.f. April 01, 1998. He has been actively involved in business planning, strategy development and expansion activities since the inception of our Company. He has an experience of 25 years and has been instrumental in expanding the operations of our Company. His leadership has contributed to the growth of our business and the establishment of long term relationships with our customers. As the Managing Director, Paramjit Singh Chatha is responsible for

developing and maintaining the company’s vision, mission statement, and strategic plan. He reviews financial statements and other reports to evaluate the Company’s performance. Furthermore, he identifies new opportunities for revenue growth, such as the introduction of new products, new customers and new businesses. He effectively communicates with employees to ensure they understand the Company’s goals, objectives, and policies.

Additionally, he evaluates new technologies and business practices to assess their potential impact on the Company’s operations and effective marketing strategy to promote the products offered by the Company.

(a) Non-Vegetarian: We manufacture and sell non-vegetarian products such as pizza toppings, sandwich fillings, burger patties, snacks and more to leading QSR’s, CDR’s and other HoReCa segment players.

(b) Vegetarian: We manufacture and sell vegetarian products such as pizza toppings, sandwich fillings, burger patties, taco fillings to leading QSR’s, CDR’s and other HoReCa segment players. We ventured into vegetarian products in the year 2022.

(c) Plant-Based: We manufacture and sell plant-based products such as plant-based sausages, salami, pepperoni; Indian snacks like kebabs, tikkas & samosas; plant-based nuggets & burger patties, grilled burger patties to certain QSRs, CDRs and other HoReCa segment players. Additionally, we supply our products to larger conglomerates and other companies under their own brand names, including Bluetribe (Alkem Group), Shaka Harry (Liberate Foods), Green Bird (Continental Coffee), Plantaway (Graviss Group), and many others. We ventured into plant-based mock meat products in the year 2021.

Figures in Rs. Crores

| Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | |

|---|---|---|---|---|---|

| Debtor Days | 37 | 26 | 39 | 32 | 30 |

| Inventory Days | 27 | 34 | 33 | 38 | 39 |

| Days Payable | 55 | 59 | 64 | 59 | 48 |

| Cash Conversion Cycle | 9 | 1 | 7 | 11 | 21 |

| Working Capital Days | 3 | -5 | 4 | -1 | 15 |

| ROCE % | 10% | -16% | 7% | 15% |

Disclosure: Have taken a small tracking position in last 10 days.

Thanks,

Dhaval Patel (SMEmitra)

How does it compare to Welspun? The company is expecting to achive topline of Rs 15000 crore by 2026.Currently it is at 9300 -9400 cr. Below is from Concall transcript

Dipali Goenka: So we are looking at a commitment to be towards the INR15,000 crores in 2026, we maintain that number and we will continue to look at maintaining our commitments that we have given

to the market.

This NOTE does NOT delve into Polycab specifically but provides an Insightful Sectoral overview ALL the 20 listed Power Cable companies in India.

![]()

Power Cables are to Electricity, what Roads are to Automobiles.

If we’re going to hit the 5$ Trillion GDP mark, we’re going to need a hell lot more Energy/power/electricity!

Wires & cables being the carriers of Electricity, are fundamental to our growth goals as a nation ![]() So, In this note, we’ll conduct a mostly Quantitative Analysis of 20 Listed Power Cable companies in India.

So, In this note, we’ll conduct a mostly Quantitative Analysis of 20 Listed Power Cable companies in India.

Some (not all) of the Ratios we will be using are :

Also, just some ultra-basics: Power cables are usually categorised according to the voltage of the current they can carry.

They are categorised into Low voltage (< 1000 Volts), Medium ( 1 – 36 KV) & High Voltage (36KV+).

Their respective use across the Power Value Chain are illustrated below

With that basic background, Let’s Go! ![]()

Log scale (Data as of 5th April 2024)

Source: screener.in data | Left to right: Highest Market Cap to lowest.

‘Size Matters’! This is evident from the chart below which shows Polycab & KEI seem to have consistently high ROCE, most likely because of their larger size (NOTE: Size should ideally be measured in Gross block terms no M.cap)

Dynamic Cables is an anomaly in that it has consistently (last 5 years ROCE) maintained high ROCE vs 18 other peers.

The sector is experiencing is positive uptrend (Improving ROCE). Not surprising given the increased spending on the Power/Real Estate/Infra Sectors.

Some of the differences in ROCE amongst players may be explained by the Business Models i.e. their B2B vs B2C mix, their product mix etc. That analysis would be a logical next step i.e Performing Deep dive into specific companies

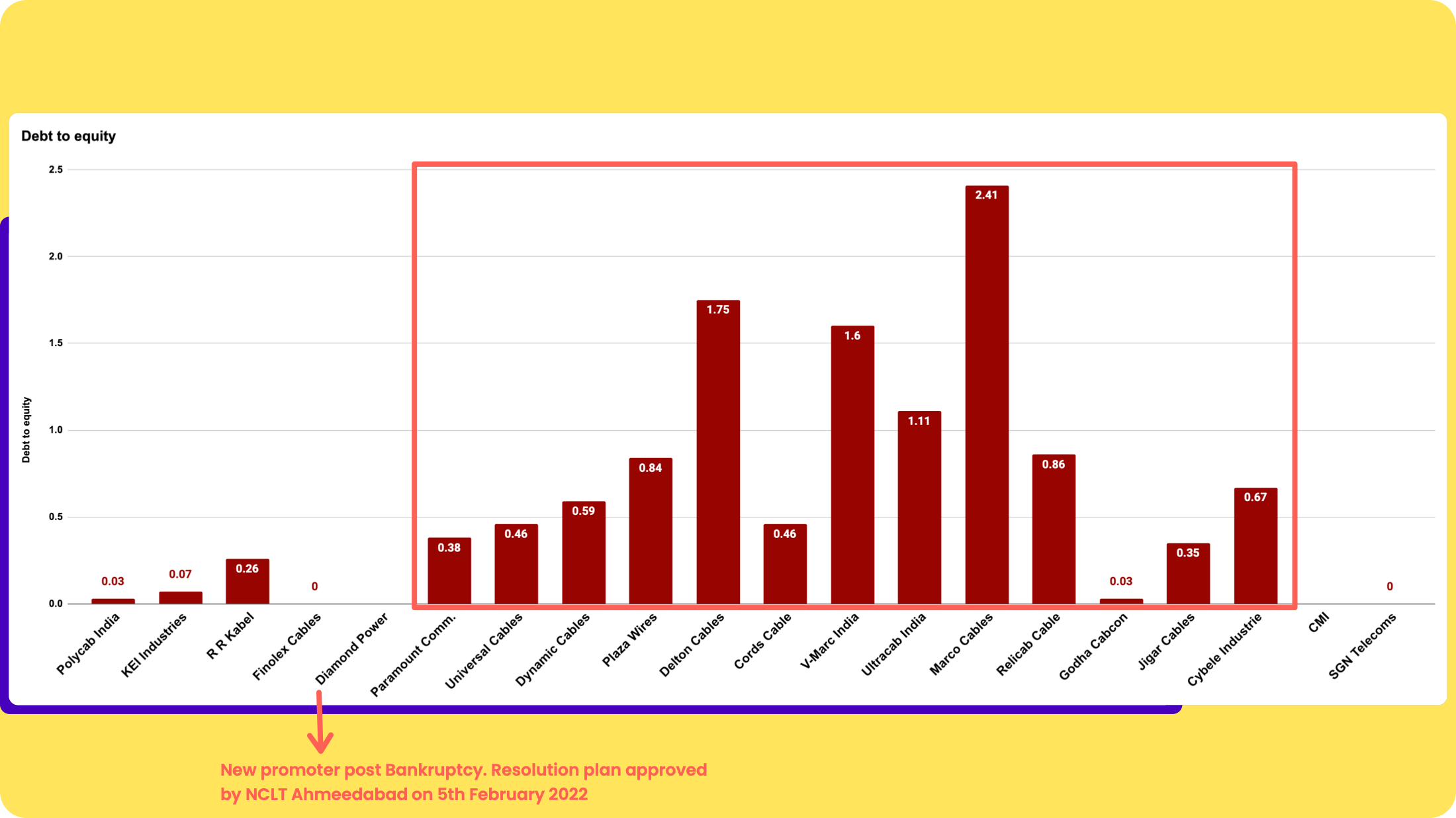

3. Smaller companies have higher Debt & lower Interest Coverage

Left to Right: Highest Market Cap to Lowest Market Cap companies in the sector.

![]() The higher debt for smaller companies is mostly working capital Debt.

The higher debt for smaller companies is mostly working capital Debt.

Working capital days (No. of days to convert working capital to sales) for smaller companies tend to be higher (unsurprisingly). Higher WC days would lead to higher Working capital debt (measured as % of WC to Sales)

Larger players tend to have higher Asset Turnover (Sales / Assets) which means they’re able to squeeze out more rupees in sales from every rupee of assets held.

There are also positive and negative anomalies amongst the pack, as shown below.

source: Screener.in Data |

RR Kable and Dynamic Cables are examples of positive anomalies.

Finolex and Universal cables are examples of negative anomalies.

At least amongst the top 4 players, FMEG could be the reason why RR Kabel has a notably higher Asset Turnover.

RR Kabel derives 11% of its Revenues from the FMEG Segment – Fans, lights, switches etc whereas Polycab derives ~8% of its Revenue (9MFY24) from FMEG, Finolex (< 5% Revenue from FMEG) whereas KEI is NOT present in FMEG at all.

Operating profit Margin (%)

Dynamic cables and KEI Industries have the most consistent margins across timeframes and Ultracab & Relicab (< 200 Cr M.Cap) have shown the sharpest improvements in OPM (%).

Finolex’s shrinking margins could be a sign of shrinking pricing power (assuming it has some, to begin with) or poor operating expenses management etc.

Whatever the root cause, shrinking margins make markets unhappy. This may be one (of the many) reasons why Finolex trades at a significantly lower PEx (< 26X) vs peers.

The above chart also displays one of the hallmarks of Wealth creation in the stock markets: P/E Re-rating. And when it rains, it pours!

Every single (almost) co’ in the sector has undergone significant re-rating (Exceptions: V-Marc & Ultracab) and judging by the the multiples, it’s unlikely there is room for further expansion, at least for most companies in our cohort.

As for Why V-Marc India trades at such a low valuation? It’s just Fraud baby! ![]()

Finally, the growth metrics. Firstly, the last 3 years Avg growth may not be the best metric for visualising/judging the recent change in Sales/EPS, however, using the data below there are 2 key observations we would like to comment on.

![]() RR Kabel and Finolex have not been able to grow EPS as fast as Sales (why? Worth exploring in the next step: co’ wise research)

RR Kabel and Finolex have not been able to grow EPS as fast as Sales (why? Worth exploring in the next step: co’ wise research)

![]() Ultracab has shown EPS growth much significantly higher than Sales (including Jigar cables & Cybele Industries)

Ultracab has shown EPS growth much significantly higher than Sales (including Jigar cables & Cybele Industries)

Want to guess which stocks gave the highest returns in the last 1 year? (Not that it has any predictive value). Here’s the jaw-dropping data :

![]() 7 / 20 Stocks gave a 100% + Return

7 / 20 Stocks gave a 100% + Return

![]() 9/20 Stocks gave an 80%+ Return

9/20 Stocks gave an 80%+ Return

This reminds of some Key lessons we can learn/re-learn from the stock price behaviour of stocks/sectors :

![]() If you get the sector right, the probability of making satisfactory returns goes up!

If you get the sector right, the probability of making satisfactory returns goes up!

![]() When a Sector Turns, the best stocks in the sector rise at first and as the cycle continues, the relatively worse (sometimes smaller) players tend to do better than even the best companies (returns wise) because of the delta-from Shit to hit!

When a Sector Turns, the best stocks in the sector rise at first and as the cycle continues, the relatively worse (sometimes smaller) players tend to do better than even the best companies (returns wise) because of the delta-from Shit to hit!

Delton Cable surely has my attention and curiosity. The question is: Is it another pump or Dump or is it a special business? Should we find out more?

Tell me in the poll below because a logical next step in my opinion (you can share yours in the comments) is doing a deep dive on any 3, under 2000 Cr Market Cap companies and I need your help to decide ![]() which ones.

which ones.

Just name your Top pick ![]() Go !!

Go !!

Hope this was insightful, would love to hear your thoughts

Rahul

![]()

P.S – The Orginal article is written on my substack – First Principles Investing. Since including a link to a personal blog is considered blasphemy on the forum, I would urge your to visit and checkout my other work. It takes tremendous hardwork to get this stuff going and I have no moral reservations in asking for your support.

@Arjun_Pillai thanks! ![]()

I have targets, which depend upon developing situations also, so like a moving target. When prices approach this target, and margin becomes less, I start booking, in stages. Sometimes momentum carries it over the target while I keep booking.

Mostly I have 100-150% kind of targets over 1.5 to 2 year time period.

It’s a very slow withdrawal rate, on a monthly scale, I just book a bit randomly. For bigger withdrawal, indeed it is sometimes simpler to just take out equally from most constituents of folio.

EvoLve theme by Theme4Press • Powered by WordPress & Rakesh Jhunjhunwala Latest Stock Market News

The Most Valuable Commodity Is Information!