What is the peak revenue they said ? where can i find the recording?

Posts tagged Value Pickr

PVR Ltd.- Play on increasing disposable income (10-03-2024)

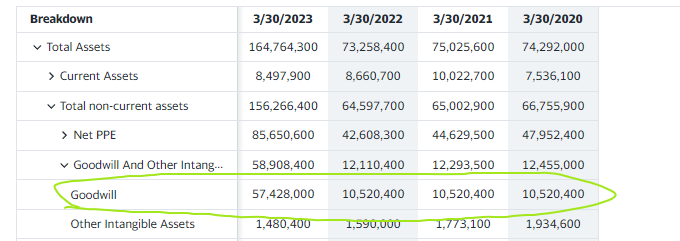

Company Goodwill is increasing to the point it is 1/3 of Total assets. Couldnt find management reasoning on this in the transcripts of last 3 calls either. If someone has any explanation on this. It will be greatly appreciated.

Microcap momentum portfolio (10-03-2024)

There have been several messages asking me to explain the procedure in greater clarity. I am putting together some points below for everyone’s benefit. I will also explain some steps that could be a starting point.

- I use two look back periods of 1 year and 6 months.

- Let us take for example, AARTIPHARM, one of the stocks in the Nifty Microcap 250 index that is used for our purposes.

- Price change over 1 year is 455.9 / 303 = 1.504 and over 6 months it is 455.9 / 450.2 = 1.012

- Do the same for all stocks in the index.

4a. You could rank the stocks based on 1 year or 6 months and invest in the top 20 or 25 stocks.

4b. You could add the ranks based on 1 year and 6 months price change and then add the ranks. Do the ranking based on the sum obtained. Then invest in the top 20 or 25. This will give a balance between 6m and 1y performance.

4c. This could be a quick way of starting a momentum pf. - Check the daily change in stock prices, ie stock referred above was 455.9 on 29-Feb and 456 the previous day. Determine log(456/455.9). Calculate daily returns over previous 6 months and 1 year period.

- Calculate standard deviation of the returns of these two periods. This will help to understand volatility.

- Divide the 1 year return with 1 year standard deviation. This will give the momentum ratio.

- Divide the 6 months return with 6 months standard deviation. This will give the momentum ratio.

8a. You can rank based on momentum ratio for 1 year or 6 months and invest. In our case, AARTIPHARM gave a rank of 149 for 1 year and 153 for 6 months.

8b. You can add the rank over 1 year and 6 months momentum ratio. Rank again based on the total obtained. Total rank for AARTIPHARM will be 302. The total rank for the best of best can be 2 (1st rank in both time periods) and the worst of worst 500 (250th rank in both time periods).

8c. You can invest based on the total rank in the top 20 or 25 stocks. - I then calculate the mean and standard deviation of the population. Then work on ranking.

People can stop at Step 8 itself and obtain necessary performance.

Investing Basics – Feel free to ask the most basic questions (10-03-2024)

If a company shows a big no as depriciation eventually leading to low or negative PAT, what should we derive from such a company while reading financials. Will it add only to free cash flow or there is any other benefit too?

Company in focus – TVS Supply Chain

Evaluating financials (10-03-2024)

If this is just 1 question, you can post it here.

Evaluating financials (10-03-2024)

If a company shows a big no as depriciation eventually leading to low or negative PAT, what should we derive from such a company while reading financials. Will it add only to free cash flow or there is any other benefit too?

Company in focus – TVS Supply Chain

Gensol Engineering – A play on Energy Transition (Solar Energy & EV) (10-03-2024)

People are investing bcos promoter is liking and replying to comments on twitter… this gonna end badly

Hitesh portfolio (10-03-2024)

I think this is the one.

Webinar – Building the Multibagger Mindset

But anyway, this is a GREAT video.

ENJOY.

Nesco (10-03-2024)

I think ideally the way forward should be to use the catering business experience to foray into QSR space , create your brand restaurant , no lease costs invloved for those restaurants . Once they have been able to establish the brand , expand with few outlets elsewhere also and than demerge Nesco foods so that gets PE valuation of a QSR

Omkar’s Portfolio Analysis and Discussion (10-03-2024)

Thanks for articulating your thought process.

I agree with you at a certain level.

But where I would differ at a top-level thinking is Franchise Value in an Auto Tier 1 supplier. No doubt you can have consistent compounders here but its far more unlikely for various reasons which you no doubt are aware of.

ROCE / ROE and OPM will always be constrained as pricing benefits always have to be passed on.

Only way you have value add is if you are a consistent next generation tech provider like a Bosch or a Continental or even a Sona BLW now who innovates at the frontline and hence owns the IP stack. Even they struggle when winter sets in. No Tier 1 supplier in India owns tech first IP and are rather fast followers.

Again, this is not on Suprajit but overall Indian tier-1 story. Nothing wrong with owning it and making returns but none of them provide enduring consistent returns above ROCE on a CAGR basis.