In case you’re wondering why Sanghvi took a beating today ~8-9%

There is an article in the Hindu Businessline which mentioned the potential reinstatement of the Reverse bidding mechanism for Large projects (600MW+) since a lot of auctions were not being awarded because of increasing cost/KWHr for Wind Energy.

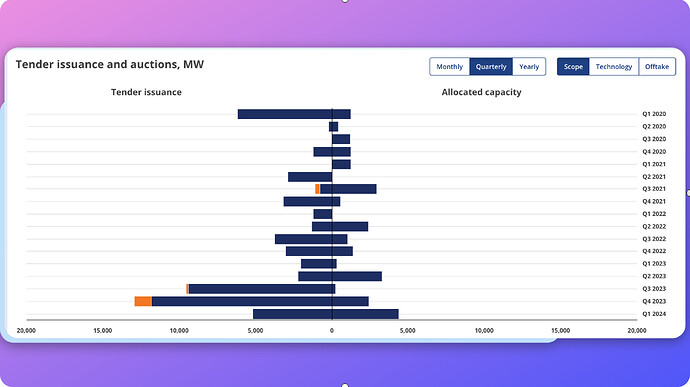

This is evident from the bars on the left being much higher than on the right. Allocated capacity is much lower than the Tenders issued.

So even though Auctioning and ‘awarded capacity’ has increased (look at the order books of Suzlon, Inox) but according to the Government it is NOT enough.

According to the article, a “Letter” sent by the Government to SECI, NHPC, SJVN etc to implement Reverse bidding for larger projects (600MW+).

However, I have neither found the letter nor found any other evidence that verifies the contents of the Article. I even wrote to the writer of the article to get more details and I’m awaiting his reply. Will update here when/if I do.

To give you a backdrop, the reason why many Investors are Shitting bricks right now (unless you’re blissfully unaware) on the back of this news is that Reverse Bidding was actually abolished in just January 2023 and was one of the most important requests of Wind Energy players. Too much competition during bids was killing the Industry.

That’s why there’s wisdom in being extra cautious while Investing wherever the Government exerts significant influence on the fortunes of the Industry. Flip Flop is a norm, not an exception. There is a reason why some of the best Investment Managers avoid overly regulated Industries but we’re beyond that point so ![]()

Reinstatement of Reverse bidding means that Auction Bidders – Energy Generation companies (NOT Suzlon, Inox and Sanghvi) would end up competing for tenders, which is likely to push the per KWH cost lower and likely their IRR.

Too low and Generation companies wouldn’t be motivated to execute the project, too high and the Government and eventually (You & I) the consumer would become unhappy.

In that sense, If the “letter” is what the article says…is an attempt to find a balance between the motivations of various stakeholders.

And that’s why In my view (and I could be completely wrong), the letter, is actually a positive signal instead of a negative one because an optimum pricing would actually ensure higher Awarded capacity, higher order books and likely higher execution and higher profitability in the long run.

If anyone has more details on the “letter” please share here. Anyone working in the Wind Energy Industry, kindly DM me ![]()