Gulshan poly and bcl ind

Posts tagged Value Pickr

Investment in Japanese Market (26-02-2024)

You may also enter through Nippon India Japan equity fund.

Wockhardt – A story with twist and turn (26-02-2024)

Discussed it here in brief.

Today’s presentation has some very useful information

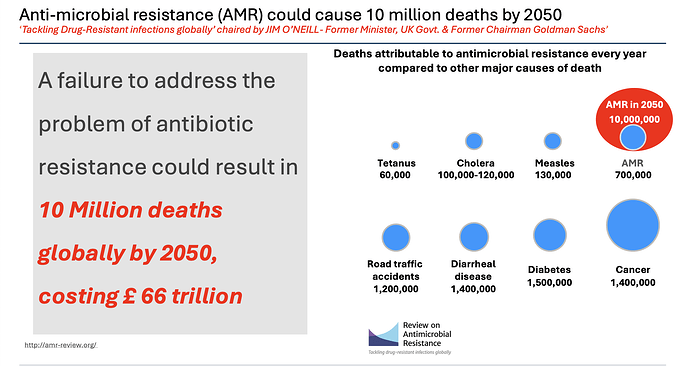

AMR deaths at 700k worldwide and could be 10 million by 2050.

I found the same information from multiple sources

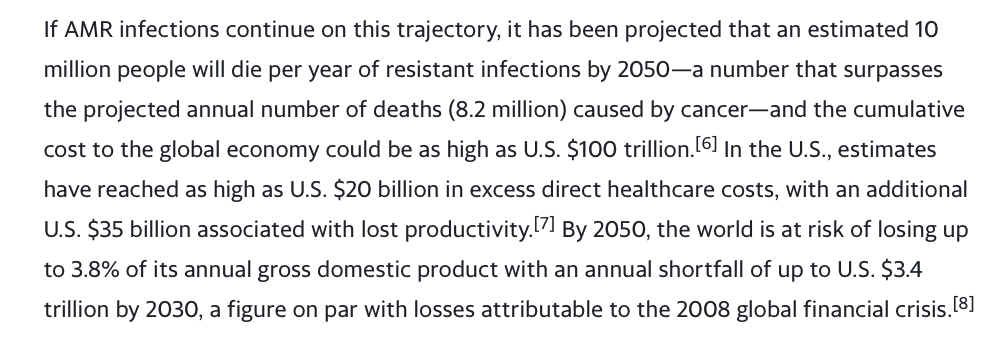

This bit is from Venatorx failing to get FEP-TAN approval this month (more on this later) which again speaks of a similar 10 million number by 2050.

Antibiotic pipeline is more or less dry so a company like Wockhardt which has kept its R&D going becomes all the more valuable, over and above the value of the 6 NCEs it has developed. (Consider gestation in decades and experienced talent with 315 scientists and 55 PhDs)

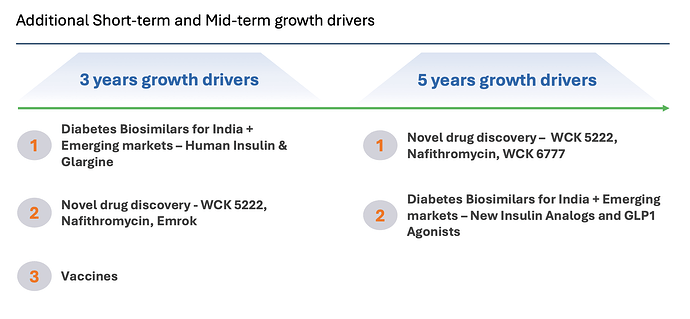

It looks like growth will come from insulin glargine launches in emerging markets and also from vaccines business (need more clarity here though on what these 150 million doses are for and what Wockhardt can expect to make from it – the longevity and profit-sharing is enticing but hard to figure out what it will generate) and from US business restructuring, alongside growth in Emrok/Emrok-O and Nafithromycin launches in India and other Emerging markets in the next 3 years – outside of WCK 5222.

Also good to see long-term vision in GLP-1 analogs – but this could be a rather crowded space by the time semaglutide goes off-patent.

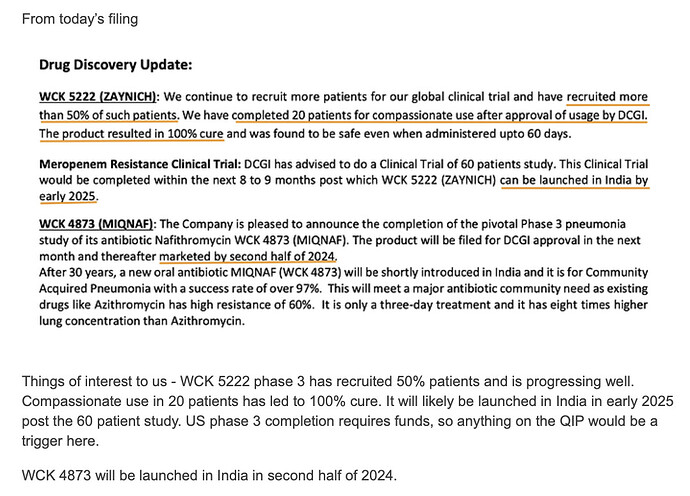

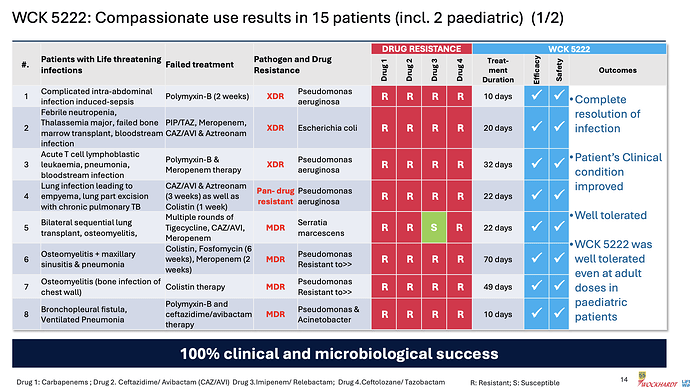

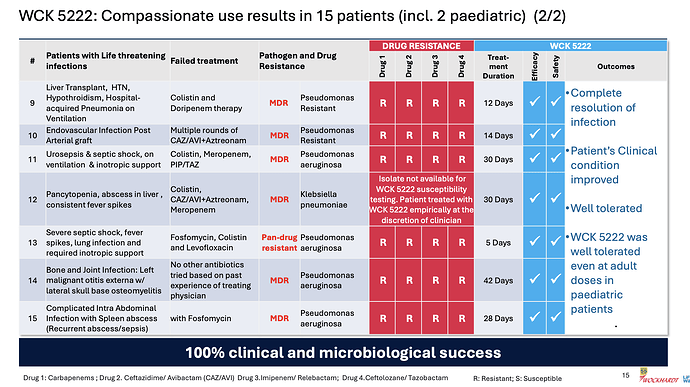

Coming back to WCK 5222, the company has disclosed the compassionate use results in great detail

Few things of note

- Pediatric use was well tolerated even at adult doses – so safety of the drug is becoming better established

- 100% clinical and microbiological success confirming efficacy

- CRPA is where WCK 5222 seems to shine (11/15 cases)

- Avg. use of drug could be around 4 weeks (though sample size is small, it appears varied so could be a general indicator)

- Colistin and Polymyxin are present in most ineffective treatment – wondering if these could be replaced with WCK 5222 right off the bat. While Meropenem is expected to fail in these, it is also good to see CAZ/AVI or CAZ/AVI + AZT resistant strains being susceptible to WCK 5222

(Please take above interpretations with pinch of salt – I am going by my half-baked knowledge)

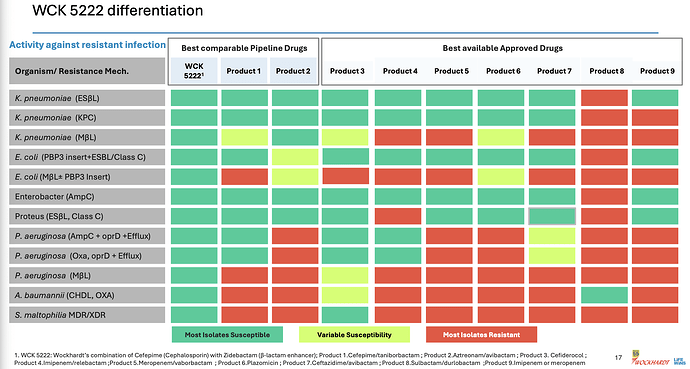

This is the clincher for me

This was the point of our post based on our research from various papers. Here it is laid out clear for even a layman to understand.

The actual products are mentioned in fine-print at the bottom of the slide. I see WCK 5222 being better than CAZ-AVI, FEP-TAN, CFD, AZT+AVI which are the main comparable treatment against lot of the resistant strains – especially the MBL-producing PA and E. coli. With FEP-TAN too falling out (probably due to Treatment Emergent Adverse Effects being higher than Meropenem), value of WCK 5222 once approved should be substantial.

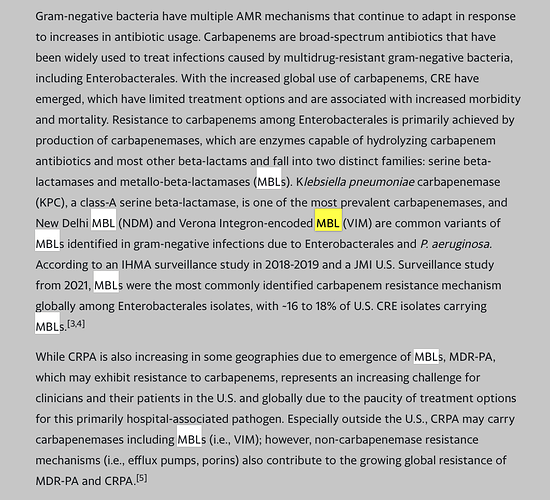

Before I close, the same yahoo finance piece mentioned MBL prevalence increasing the US

MBL-producing pseudomonas is where WCK 5222 has very good edge over the others. This increase in prevalence in the west again increase market value of WCK 5222 once approved

Overall things seem to be going in the right direction. Hope the company can raise the funds required to take the phase-3 to completion and not botch it up somewhere

Disc: Invested

Centrum Capital (26-02-2024)

I was just checking their banking app Unity SFB on Play Store. It has only two star rating and very bad reviews by the users. Being completely digital bank they should have a very good app. Any user experience here in this forum?

Sugar Cycles: 7-8 years of losses followed by 2-3 years of super gains! (26-02-2024)

Which companies produce maize based ethanol today?

Why would the sugar production remain low for next crushing season or do you mean to say the current crushing season ( and hence some quarters of next year)?

Sky Gold ltd. – Will it reach the sky? (26-02-2024)

This is the old one or a completely new one?

Vaidya Sane Ayurved Laboratories Ltd (Madhav baug) (26-02-2024)

Thank you @mantis1 for such an amazing write up about the company. It saved me time in making my own notes about it. To add to your write up, I have done my own analysis about the company as I’ve recently taken an exposure in it. The below highlights my rationale behind investing in the company,

Growth:

-

Company owned clinics are going to expand from ~400 in FY24 to ~1000 in the next 3-5 years.

-

Current hospitals in Khopoli and Nagpur are going to see their beds double in the next 12 months. Eventually, 8 more hospitals/health resorts are going to be launched in the next 3-5 years.

-

A lot of the infrastructure, personnel and marketing costs are being incurred upfront. As sales kick in and these margins stabilize and become efficient over time, the business will see a good margin kicker coming in. Furthermore, the company’s plan on backward integration for its food kits will improve the margins further. All of this will flow to the bottom line. Thus, there is a nice operating leverage play waiting to happen here.

-

Growth in the patients visiting these clinics and hospitals as the brand and the treatment it offers becomes more visible. This will happen through word of mouth (more patients = more gospel being spread), marketing spends, tailwinds in the sector with the government pushing ayurveda through the ministry of Ayush (just like it pushed Yoga).

-

Launch of its B2C products in offline stores and setting up offline distribution for the same.

Company/industry potential:

-

Unorganised to organised theme at play here for ayurveda treatment.

-

The company is adding value by offering a chance for disease reversal using ayurveda viz a viz allopathy and doing so at a lower costs. This is the value migration at play here.

Risks:

-

EXECUTION. The single BIGGEST risk. The company and its promoter have set really high goals for themselves. They may not be able to achieve this in the timeframe they’ve set or the quality of services and products may suffer as they scale. They may not be able to scale margins beyond excel projections. People may remain skeptical of ayurveda and the patients will not increase as projected.

-

Key man risk. Second BIGGEST risk. Everything rests on Dr. Rohit Sane and his vision and dream. The company over time will need to add more professionals to the business. Though, they do have some professionals like the CEO, CFO, Marketing head etc. in place.

-

The failure to building Madhavbaug as a brand.

-

Its B2C product venture fails to have the desired impact. Worse still it takes away time and limited company resources from its main mission of building more clinics and hospitals. It has happened in H1 FY24 where the management was busy in marketing its Madhvprash product and this impacted the sales, margins and profits.

-

General management missteps and highly ambitious goals that fail to materialize beyond presentations and excel sheets.

In summary,

| Parameter | Rationale/Thoughts |

|---|---|

| Sales growth starting FY25 | Sales are expected to grow ~20-25% for 3-5 years |

| Margin expansion | EBITDA margins are expected to increased from ~9% EBITDA (in FY23) to ~15-20% EBITDA over the next 3-5 years |

| Profit growth | Profits should grow at ~20-25% over 3-5 years with steady state margins. But the fun part is, the margins are going to expand, hence the profits will grow at a faster rate than the expected sales growth |

| Valuations | Here is how I’m looking at it, |

- PE ratio: 70 at CMP of 215. With ~20% growth on the exit EPS of FY23 (4.59) works out to an EPS of 5.50, thus resulting in a PE of 39 for FY24. One-year forward EPS of 6.6, results in a PE of 32.57. Is this cheap? Well not really, but for a company poised to grow for a decent period of 3-5 years with an expected expansion in margins, it is not overly expensive either. I think it is fairly valued

- PEG ratio: At a PE of 39 (FY24) and PE of 32.57 (FY25), there is a chance that the company will grow its profits at these speeds or higher over the next 3-5 years. Thus, it should have a PEG of 1 or under, again making me believe it is fairly valued

- Price to sales ratio: The company is available at P/S ratio of ~1.87 on FY24 exit sales (Mkt cap 224 crs /120 crs revenue) and ~1.55 on FY25 exit sales (Mkt cap 224 crs / 144 cr FY25 sales). The question I ask myself, will I buy a business under 2 times sales? At this juncture, I’m getting a fast growing business with – cash on books, land and buildings, tech and systems in place to grow and scale, a somewhat proven business model, trained staff and processes and a hardworking promoter/owner. The answer is, hell yes!

- Stock is down ~42% from its 52-week high, it is already beaten down and some of the early hype about the business seems to have faded away. Can it fall further? Sure, in case of market corrections and poor results, it may go down further, but to me the downside from here looks limited. For e.g. if it goes down another ~30% (under normal market conditions), I would suspect there is something wrong with the business/promoter. A company with a clean balance sheet like this shouldn’t get hammered further (at least in my experience).

- In the last fund raise in July 2023, a set of marquee investors were issued warrants at 261, currently it is trading below that. I ask myself, if they saw value at 261, why can’t I at this stage?

Thus, my general consensus is that the stock seems fairly valued at this juncture and should do well with as the business grows and scales

| Parameters | Rationale |

|---|---|

| Promoter Holding | Dr. Rohit Sane, the founder of the business has a lot more skin in the game than I do, he holds 66.29% of the company. He has more to lose than I do. He also comes across as a very passionate promoter. Very driven to solve the problem of diseases by going to the root of it and reversing them. I want to back a promoter like this. |

| Dividends | Short history to ascertain the same. Though the company did give one in FY23 |

| Balance Sheet | No debt on the books and the business growth has been funded mainly from internal accruals in the past. The current fund raise will ensure the balance sheet will not get stretched going forward either. So, there is less risk of the company becoming insolvent |

| Ratios | Good cash conversion cycles, less working capital days, 20% type of ROCEs, with the business growing and getting more efficient, these should get better over time |

| Moats | 1. First company (in my knowledge) to attempt organizing the unorganized ayurveda treatment market to an organised one 2. Their food kits (including its backward integration), treatment processes, research papers, tech enabled platforms and systems, trained ayurveda doctors, well established and organised clinics and business model 3. Over time, it’ll be their brand ‘Madhvbaug’ which they are building from scratch 4. In time their scale and ambition of setting this up pan India and making it a truly national chain of clinics and hospitals |

| Triggers for stock price growth | 1. Expected growth in number of clinics and hospitals 2. Expected sales growth 3. Expected margin expansion 4. Expected profit growth 5. Foray in B2C products and setting up of physical distribution for the same 6. Better discovery of the company and its business model in the markets |

| Odds in my favour? | Yes, I think investing in this company at this juncture renders the odds in my favour |

Sources:

- All projections and details are based off numbers shared by management in their publicly available concall and interview

- Numbers have been taken from Screener

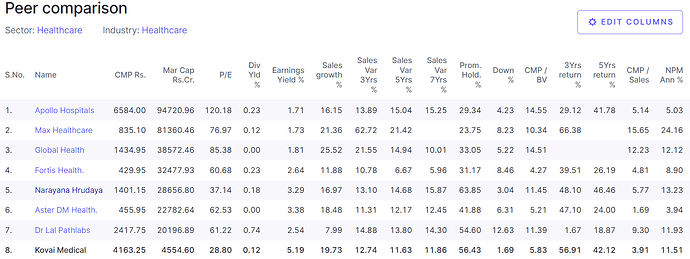

- Comparative PE ratios of companies in the similar business of hospitals, clinics and diagnostics

Disc: Invested as a tactical 2-4 year bet. May hold longer depending on how management executes its plans. Position size is 2.3% of my entire pf.