Yes. You can compare with the long term median PE.

Posts tagged Value Pickr

Annapurna Swadisht Ltd – A Swadisht FMCG investment? (10-02-2024)

Hi Guys,

What does it meant by this paragraph on page 11. Is it saying that volumes are low in North East Region. So profit will be low in upcoming results?

https://nsearchives.nseindia.com/corporate/ANNAPURNA_10022024123443_Intimation_SE_PB_ASL.pdf

Rategain – Fast Growing SaaS Leader (10-02-2024)

RateGain’s Bhanu Chopra: Man With Rs 127 Cr House, Rs 100 Bn Firm | Rollin’ With The Boss Ep 05

Here’s a very casual interview of Bhanu Chopra in which he reflects about his company (Rategain) and life in general. In this he aspires to make Rategain a $1B revenue generating company.

Iris Business Services – Emerging SAAS Microcap (10-02-2024)

The results are pretty good:

- Sales grew 14% QoQ and 45% YoY

- EBITDA grew 24% QoQ and 16% YoY. Reason for lower EBITDA growth is that company has recently increased its partnerships in US and LATAM as a result of which partnership fees has 2x QoQ and 6x YoY. Also, travelling costs have increased which is a good indicator for their potential SAAS product marketing in US.

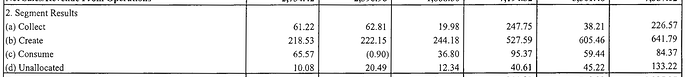

- Segment-wise revenue growth and contribution is as below

| Sales | Q3 FY24 | Contribution (%) | Q2 FY 24 | Contribution (%) | QoQ | Q3 FY 23 | Contribution (%) | YoY | |

|---|---|---|---|---|---|---|---|---|---|

| Regulators | Collect | 12.52 | 46% | 10.8 | 45% | 15.82% | 6 | 30% | 120.42% |

| Filers | Create | 13.65 | 50% | 12.3 | 52% | 10.62% | 12.28 | 65% | 11.16% |

| GST, Analytics | Consume | 1.16 | 4% | 0.8 | 3% | 45.00% | 0.91 | 5% | 27.47% |

- With regards to segment-wise revenue, Collect has been the driver which is a low growth RFP-driven segment where company already holds 10% of world’s XBRL market share.

- However, keep in mind that the major potential growth driver, which is the Create segment is based on SAAS model where billing typically happens at the end of financial year. So, the 11% YoY growth in this segment is not a good indicator

- Need to keep a close eye on Create segment growth in Q4 results to assess the full growth trajectory.

- Also, the company has shared Segment results, anyone has any idea what they are? Operating profit?

Will publish a more detailed analysis of this company that has been resting in my drive for a while and I’m too busy to publish.

Discl: Invested

Companies with 20%+ growth guidance for next few years (10-02-2024)

Capacite infra and pennar industries have mentioned in concall about growth >25% for next 3 years.

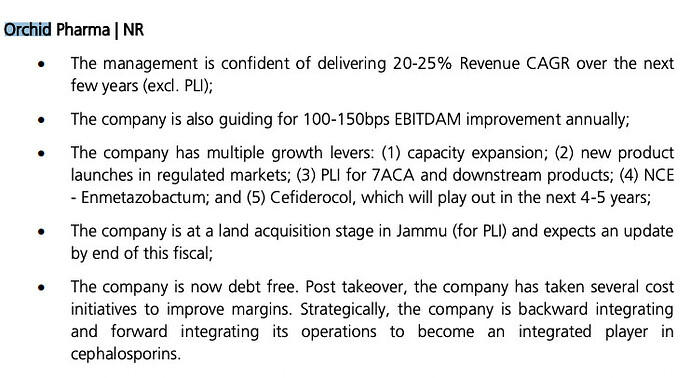

Orchid Pharma Ltd (10-02-2024)

Land acquisition in Jammu

Jammu to strengthen NPV and financial viability of the 7-ACA project

Apart from the PLI incentives available under Production Linked Incentive (PLI)

Scheme for Promotion of Domestic Manufacturing of critical Key Starting Materials

(KSMs)/ Drug Intermediates and Active Pharmaceutical Ingredients (APIs) in the

Country, the Jammu location provides additional meaningful benefits to ORCP 1)

Power is a key component of the total cost of manufacturing 7-ACA, and Jammu has

the lowest power cost in the country, 2) under the New Central Sector Scheme for

Industrial Development of Union Territory of Jammu & Kashmir, ORCHP will be

eligible for GST refund at 18% 3) Cumulative PLI incentive of Rs. 6bn

Can Someone Please Guide Newbie’s Like Me (10-02-2024)

It is basic accounting 101. It is the accounting equation.

Assets = Liabilities + Equity

HDFC Bank- we understand your world (10-02-2024)

Apple products have record sales in this quarter, and HDFC bank has issued record number of cards in the last quarter.

For Q4 2023, Apple reported USD 8.6 billion in revenue for its India business. This represents a 3% year-over-year (YoY) growthAssuming at least 50 % of Apple customers in India have bought their Apple products by HDFC card ( rest have purchased at No cost EMI from other banks or sold their silver… ) that makes for USD 4.3 Billion dollars. Also YOY its just a 3% growth, HDFC bank has a long runway with an Apple in Hand.

Disc : Invested

Can Someone Please Guide Newbie’s Like Me (10-02-2024)

Good Question, I too had same Thought

MOLD TEK PACKAGING—dividend plus growth (10-02-2024)

Hi,

Unable to read the names clearly. Can you share who are the competitors you have listed under paints and lubs?

Also any other competitors you know of for the other segments – Pharma etc?

Regards