Company website, Investor Relations section or BSE Corporate Announcements section.

Posts tagged Value Pickr

Investing Basics – Feel free to ask the most basic questions (05-01-2024)

Company website, Investor Relations section or BSE Corporate Announcements section.

Praveg Ltd: Play on Indian Tourism Industry! (05-01-2024)

What’s gotten to the stock ? It’s leaping every day. It’s kind of scary. It’s making me feel to book profits at this level. Looks like ppl pinned too many hopes on this counter.

DISC : Invested heavily at 450 Rs

Mann’s Portfolio (05-01-2024)

sorry to interrupt here, this high demand text has been pasted in each of their announcements regarding crane addition.

no one can know whether the promoters are trustworthy or not, we can just judge them on their actions and other minor points.

from what i understand, the oldies left the leadership position and the younger ones have took helm, post them joining we can see significant changes in the biz and increased aggressiveness.

we can see the margins inc qoq.

promoter gave out dividend and declined his part of the total payout.

capex done here is huge with no benefit flowing down till the latest quarter, so all of it would start paying this yr.

after my talk with several industry participants, one thing is clear that the demand is very strong, and the leader sanghvi being a sort of a monopoly seems to be arm twisting clients.

please compare the rental yield between both crown and sanghvi, you will understand what is going on.

secondly people are getting worried about this debt funded capex, but fail to see the interest costs and calculate that as a % of ltb.

i am for sure biased lol

invested from lower levels

RITES Ltd – PSU With a Difference (05-01-2024)

Prof has used 2019 analysis in his 2024 blog. I think he should have refreshed his analysis before writing the blog.

Fundamentally a lot has changed for the company since 2019- There’s margin compression as more projects are moving from nomination to competitive bidding. Revenue too is expected to be flattish for next year, management is trying its best to maintain the bottom line.

At a 1 year forward P/E. of 26, this is the highest valuation the stock has ever traded at.

Disc: Invested from lower levels

Krsnaa Diagnostics – what is the diagnosis? (05-01-2024)

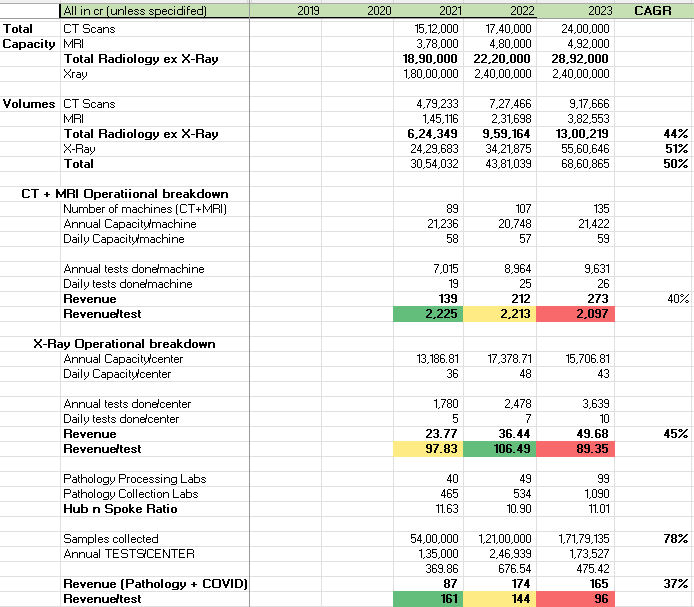

tried going into the nuts and bolts behind the machine, and here is a small snip of that. What i notice is that the realization / test, especially for Pathology (this is ex COVID), has been under some pressure – what does this point toward?

Heartning to also see radiology realizations stable as this segment is where Krsnaa differentiates itself from others

Investing Basics – Feel free to ask the most basic questions (05-01-2024)

what is source for the Concall/Investor Presentation if it not available on screener?

Please Guide

JTL Industries – Fast Grower at an inflexion point (05-01-2024)

I had few questions regarding the JTL Industries if anyone can answer them.

Q1. Company currently has a capacity of 5.86L MTPA and is planning to increase it to 10L MTPA in next 2 years. But in FY23 their sales volume was 2.5L MT which is ~50% of the current capacity.

Why company is expanding its capacity rather than first trying to achieve 100% utilisation on the current capacity?

Q2. To whom will they cater this capacity?

Q3. Promoter (Madan Mohan) brother Vijay Singla got arrested by CBI in 2013 who held a 6.71% stake in the company in June and which has been reduced as of sept to 0%. Is he completely out of the business now?

In 2020-21, the company conducted a private placement. Who are these individuals (Kusum Bansal, Shilpa Bansal, Mukesh Kumar, Mohinder Pal, Laxmi Kant, Aakarshan Tracom) and are they related to the promoters?

Are the mentioned Kusum Bansal and Shilpa Bansal related to Vijay Singla?

Q5. What are company’s future plans and roadmap to increase their utilisation with the increase in capacity?

Sunteck Realty – Quality Real Estate Company (05-01-2024)

Experts, how is Suntech’s project pipeline in MMR, is it poised to gain due to RE boom? Stock has been a laggard, fetching meagre <40% return since last 5 years while all other players have doubled or tripled since pre-Covid days. Whats holding the stock to perform in this bull market, any triggers that’s worth following on Suntech?

P.S. Didn’t know that Prestige estates has sizeable presence in Mumbai, i thought its dominant only in Bangalore.

IZMO- bet on new technologies in Auto retail & defence (05-01-2024)

The company has a high intangible asset and due to which it has low ROE. Can someone please throw some light on its asset quality vis a vis ROE.