Hi Shanid, is there any link where the latest AGM is uploaded?

Posts tagged Value Pickr

Aavas Financiers :: Banking on the unbanked (27-12-2023)

It does look like a head and shoulder pattern, but the reversal will be confirmed only when the neckline that you have pointed out is materially breached. If it does, it should make for a great buying opportunity ![]()

Disc: Invested at ~1600 levels. Looking to add more.

IDFC First Bank Limited (27-12-2023)

By the end of 2025 they will be paying most of the legacy borrowing, Credit card business was incurring losses of 75 cr per quarter in Q3FY2022 , which should turn profitable.

these two can help Bank generating ROE of 15% to 16% by end of FY2025.

Rohit’s Portfolio : Requesting Feedback (27-12-2023)

Lux will continue to have the promoter overhang – would want to shift to Dollar once the cycle turns. Globus always seems very promising and deep value, but promoter guidance and results have not aligned at all with good times always in the next quarter. Would like to cut and pyramid up in new winners – Gravita, TIPS, Aarti etc

Piccadily Agro Industries Ltd (27-12-2023)

(post deleted by author)

KPIT – CASE (connected, autonomous, shared, electric) – Focused Automotive Play (27-12-2023)

Maybe the market and most investors like me are convinced that KPIT will have 20% growth for next decade or so. I suggest trend is your friend and stay on until it bends.

Piccadily Agro Industries Ltd (27-12-2023)

That article is only mentioning sales in India .Its not necessary sale only in India …right ? Piccadily had bought one distillary in UK and already sales 30% of its total sales in 15 foreign markets as per the articles sited in this thread .

However, tripling production does not mean trippling sales …there are lots of other variables to consider .a single product will surely not beat every other single malt in everyones taste.But they do have Kamet,Camikara etc. and going by their silent but robust execution of a longterm plan for the past 10 years or so , its not too fantastic to expect them to excel in future as well .

Disc… invested from below 40 levels … 2x of invested capital taken out by selling a third of holdings.planning to kèep the rest for long term.

Glenmark Life Sciences (27-12-2023)

As per the draft open offer document, it was supposed to be open from 16th Nov to 30th Nov. Not sure if there was any change in the dates later on.

Arvind Fashion : Value Unlock or Trap (27-12-2023)

Hello everyone,

Thanks for sharing your thoughts in this thread. It helped me a lot in understanding the business.

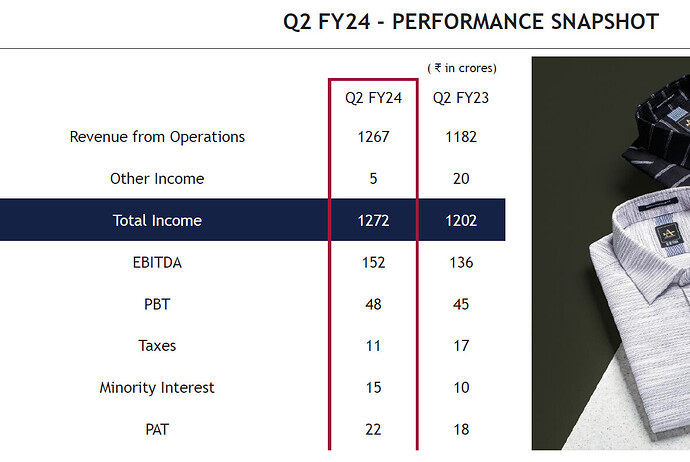

In the Q2FY24 PPT, they’ve mentioned about “minority interest” and the profit that’s transferred to them is significant amounting to almost 40%.

I understand Flipkart holds a minority share in Flying machine brand. But I’ll be damned if 40% of overall profit is transferred to them and hence I’m betting it’s not Flipkart. Who’s this minority interest?

There was a question regarding this in Q2FY24 concall and mgmt mentioned it is linked to Tommy and CK.

So,

Flying machine – Flipkart owns minority interest.

Tommy and CK – Around 40% is owned by someone else(Arrived at this number by profit sharing percentage of latest quarter)

USPA and Arrow – Appears to me that whole profit stays with the company.

This implies company may own only 4 complete brands. Even if the company grows profit in the future, won’t significant part of profit goes out of company?

Aarti Industries – Integrated Diversified Player on Benzene Derivatives (27-12-2023)

EXCLUSIVE Sources to

Bayer Group likely to have tied up with Aarti Industries Contract was cancelled earlier with another global agro-chemical player Aarti Ind : Due to confidentiality reasons, we cannot comment or share any details of the entity.