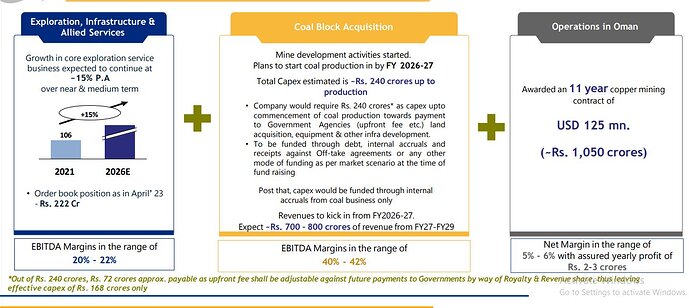

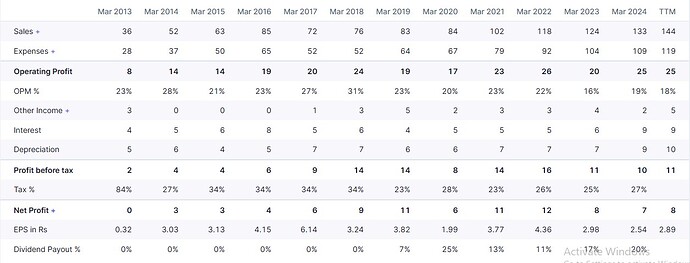

I see the PE ratio for TTM in screnner is b/w 39-40 compared to industry median of ~57(as per screener) and similar in case of EV/EBITDA .And considering the sector it is in ,compared to peers and its Mcap ,guidance the management is giving the valuations still seems to be attractive.

FY 25 – guidance 1000cr . considering similar net profit margins that were in fy24,Its profits are ~180cr.

PE ratio – cmap/net profit – 5202/180 – ~29

Disc: Invested tracking amount. Looking to enter when possible.

These are my views. Feel free to correct me