Investor presentation being made at the Jefferies 3rd India

Forum today.

Posts tagged Value Pickr

Indian Hotels–for long term portfolio stability (19-09-2024)

IIFL Finance (erstwhile IIFL Holdings) ~ Retail focused diversified NBFC (19-09-2024)

IIFL FINANCE: Company inform that the Reserve Bank of India (RBI), through its communication has lifted the restrictions imposed on the gold loan business of IIFL Finance Limited (“the Company”).

Megatherm – Mega Opportunity (19-09-2024)

My Takeaways on Furnace Industry

-

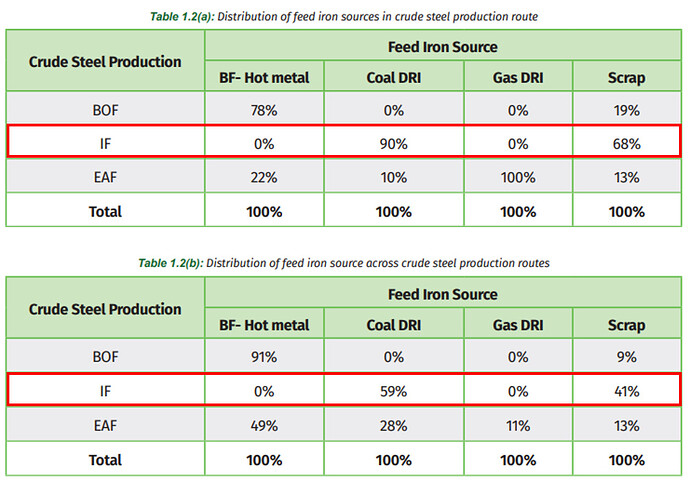

Typically, the hot metal is converted into steel through the basic oxygen furnace (BOF) route, while DRI (direct reduced iron) is converted to steel in an electric arc furnace (EAF) and an induction furnace (IF).

-

The larger integrated steel plants (ISPs) typically use the BF-BOF and DRI-EAF pathways, whereas smaller plants use the coal-based DRI-IF pathway.

-

A higher growth of 8% and 12% was observed in (Electric arc furnace) EAF and induction furnace (IF) routes of steelmaking compared to 7% for the BOF route.

-

Green hydrogen can be used in blast furnaces and gas-based shaft furnaces as a substitute for fossil fuels since it has significantly lower breakeven cost than coal & natural gas. Tata Steel has demonstrated hydrogen injection in blast furnaces while JSW is planning for hydrogen injection in shaft furnaces.

-

Despite lower breakeven cost than coal & natural gas it very unlikely to substitute due major challenges such as high capex required for modifying the furnaces, lack of a fully developed ecosystem and availability of green hydrogen.

-

There are around 1032 Electric Induction Furnace (EIF) units in India with a total installed capacity of 68.8 Mt. The production through the EIF units is 50.4 Mt registered a capacity utilisation of 73% and contributed to 35% of crude steel production in India.

- Continuous technological developments and the availability of bigger-size furnaces enabled EIFs to contribute to steelmaking in India. The furnace capacity ranges from 8 tonne to 60 tonne.

Potential Problem or this an opportunity?

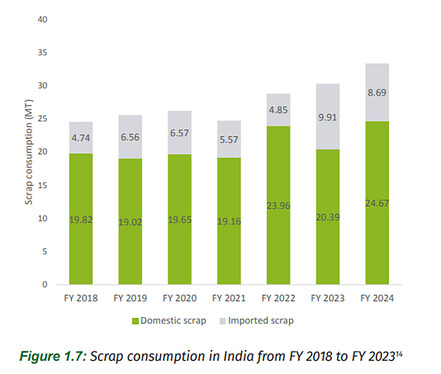

IF mainly uses scrap or a mix of scrap which consist 40-60% scrap material

Extremely low consumption of scrap totalling 33.36 Mt in FY24

All this round me back to the question, Is there really a significantly market size for Megatherm Induction Ltd? (Critics/opinions are appreciated)

Disclosure : Not invested, My understand may be about the business is very little

“Kothari Petrochemicals: From Poly to Power – Shaping Tomorrow’s Petrochemical Landscape” (19-09-2024)

Some of this is based on work of Jim Simons ( Renaissance Technologies ).

I leave up to other experienced members of this forum to try to look into this, and provide more insights. If any one know any one with expertise in this, then please tag them here.

Thanks

“Kothari Petrochemicals: From Poly to Power – Shaping Tomorrow’s Petrochemical Landscape” (19-09-2024)

Sharing a Hypothesis:

1. Lag correlation model:

A lag correlation model between Brent Crude prices and Kothari’s stock could indicate that a 5% increase in crude oil prices leads to a 2-3% decline in Kothari’s stock price after a lag of, say, 15 trading days. This would help set up hedging strategies and time entry/exit points into the stock.

2. Factor-Based Regression Analysis

Stock Return=α+β1(Brent Crude)+β2(INR/USD Exchange Rate)+β3(Global PIB Demand)+ϵ

Where:

- β1 represents the sensitivity of Kothari’s returns to oil price fluctuations.

- β2 represents the impact of currency fluctuations, specifically the Rupee/Dollar exchange rate.

- β3 measures how much Kothari’s returns correlate with the overall global PIB demand.

3. Pattern Recognition and Machine Learning

Eg. The model could detect that a combination of falling oil prices and a weaker Rupee has historically been associated with positive price movements in Kothari Petrochemicals within the following 30 days. This insight could then inform a buy recommendation when these conditions are met in real-time.

4. Risk and Volatility Analysis

Calculating historical volatility using metrics like:

- Standard deviation of price movements.

- Value-at-Risk (VaR) to estimate the potential loss on any given trading day.

- Expected shortfall to capture extreme risk events in volatile environments.

Example Calculation**: If Kothari’s historical volatility is 20%, and we estimate that a 1 standard deviation move (based on recent oil price spikes) could result in a 5% stock price drop, the model would reduce exposure in times of heightened market stress.

5. Statistical Arbitrage and Correlation Analysis

Analyze minute-by-minute price movements of Kothari relative to peers like ExxonMobil and BASF (other large PIB producers) to identify statistical arbitrage opportunities

6. Multi-Factor Regression Analysis

The dependent variable (Y) would be the stock return for Kothari Petrochemicals (percentage change in stock price), and the independent variables (X) would include:

- x1 : Brent crude oil prices (as a proxy for input cost fluctuations)

- x2 : INR/USD exchange rate (affecting export profitability)

- x3 : Global PIB demand (affecting revenue from international markets)

- x4 : Time lags (for predicting delayed reactions to economic changes)

The multi-factor regression equation would look like this:

Y= α + β1X1 + β2X2 + β3X3 + ϵ

Where:

- Y = Kothari stock return

- X1 = Brent crude price (in USD)

- X2 = INR/USD exchange rate

- X3 = Global PIB demand

- ϵ = Error term

- β1,β2,β3 = Coefficients to be estimated

Step 1: Stock Price Return Calculation

![]()

For this example, let’s assume that we have weekly price data for Kothari for June 2024, which ranges between ₹135 to ₹142 over the four weeks:

- Week 1: ₹135

- Week 2: ₹138

- Week 3: ₹140

- Week 4: ₹142

The weekly returns would be calculated as:

Week 1 to Week 2: 2.22%

Week 2 to Week 3: 1.45%

Week 3 to Week 4: 1.42%

Step 2: Factor Data

We now run the regression using the historical price data and the independent factors (Brent crude and exchange rates) to estimate the coefficients ( β1,β2,β3 )

Assume after running the regression, the results yield the following:

Y = 0.015 + 0.35X1 − 0.40X2 + 0.10X3Y

So,

- A 1% increase in Brent crude prices leads to a 0.35% increase in Kothari’s stock returns.

- A 1% strengthening of the INR (appreciation) leads to a 0.40% decrease in Kothari’s stock returns (negative impact on exports).

- Global PIB demand has a smaller impact, but a 1% rise in global demand increases Kothari’s returns by 0.10%.

Using this regression model, we can now input future estimates of Brent crude prices and INR/USD exchange rates to predict Kothari’s future returns. For instance, if Brent crude is expected to rise by 5%, and the Rupee is projected to strengthen by 2%, we predict:

We can also try

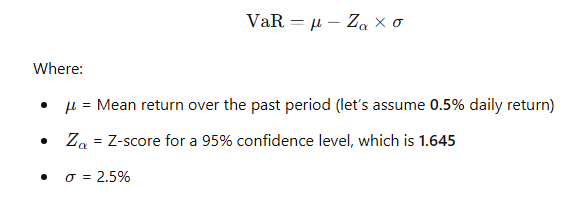

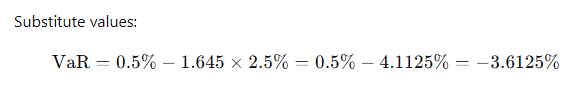

Volatility and Value-at-Risk (VaR) Calculation

Calculate VaR to understand the downside risk Kothari might face over a given period based on its historical volatility.

Assume Kothari’s stock has a standard deviation (σ) of 2.5% over the past 90 trading days (which could be calculated from daily returns).

We calculate VaR at the 95% confidence level for one day:

This means there is a 5% probability that Kothari’s stock could drop more than 3.61% in a single trading day.

If Kothari’s stock is currently trading at ₹142, a 3.61% decline would result in a potential drop of:

142 × 0.0361 = ₹5.13

Thus, Kothari’s stock could fall to ₹136.87 under this scenario.

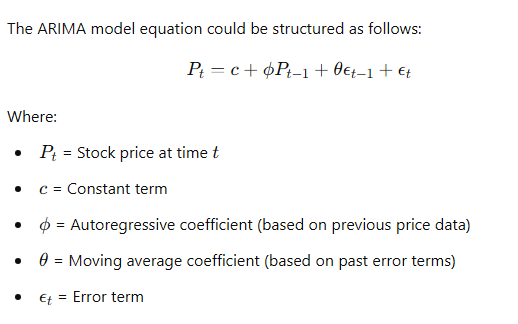

Another model we can try,

ARIMA (AutoRegressive Integrated Moving Average) model:

Another method,

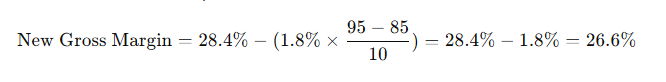

Predicting Margins Using Oil Price Sensitivity

Kothari Petrochemicals is sensitive to oil price movements due to its reliance on isobutylene, which is derived from crude oil. Let’s calculate sensitivity between oil prices and gross margins.

Assume Kothari’s gross margin is 28.4% (as per June 2024 data). If oil prices rise from $85 to $95 per barrel, we expect input costs to increase, reducing Kothari’s gross margin. By applying a cost-sensitivity ratio, we can predict the impact on margins.

- Historical Sensitivity: Let’s assume, based on historical data, that for every $10 increase in oil prices, Kothari’s gross margin decreases by 1.8%.

If Brent crude rises to $95 per barrel:

Thus, if oil prices rise to $95, Kothari’s gross margin could shrink to 26.6%. By simulating oil price changes over time using Monte Carlo simulations, we can develop probabilistic forecasts for Kothari’s margins.

Tilaknagar Industries- Potential Turnaround Candidate (19-09-2024)

Good news in recent times for Tilaknagar Industries due to future increase in FCF

-

Co. has approved an investment of Rs. 8.03 Crores in Round the Cocktails Private Limited (“Bartisans”), acquiring 36.17% of the share capital. Bartisans specializes in non-alcoholic cocktail. This company was featured on Shark Tank season-3.

-

Tilaknagar Industries has increased its stake in Spaceman Spirits Lab, producer of Samsara Gin.

-

Andhra Cabinet approves new excise policy. Company says they will have double digit volume growth on account of this policy.

Edelweiss Financial Services (19-09-2024)

Very good reports by ValueQuest on wealth management and AIF, which is relevant to Edelweiss.

Valuequest-Riding-the-Wealth-Wave.pdf (5.0 MB)

@Worldlywiseinvestors has done very good YouTube video on AIF/Wealth which covers edelweiss.

“Kothari Petrochemicals: From Poly to Power – Shaping Tomorrow’s Petrochemical Landscape” (19-09-2024)

Thanks for the info @padiyar83 , I think your reply answers point raised by @ankurgupta .

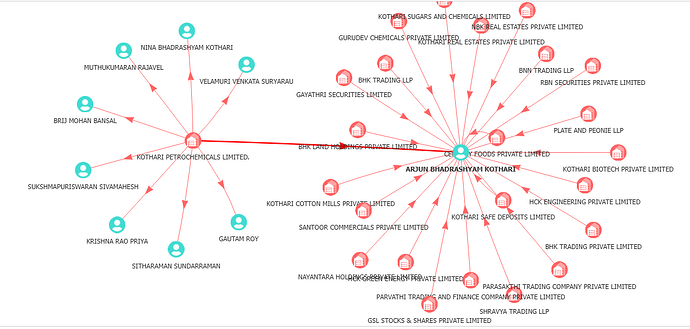

Also sharing an image above that might help to see: Arjun Kothari’s network better.

Newgen Software (19-09-2024)

Hello, fellow stock market enthusiasts and experts,

Loved the thread on Newgen Software and have been following this stock for a long time now.

Just adding my article on Newgen’s analysis and valuation which I have made after referring to its annual report, con calls, presentations and of course with the help with Screener and TradingView.

Attaching the link here for easy access: https://www.linkedin.com/pulse/ep-1-new-generation-newgen-software-rohit-chowdhury-de9yc/?trackingId=9%2FXoRA21RWeaCfGnndiVrA%3D%3D

This is my first contribution to ValuePickr and I hope you will like it

Also, just to continue with the above discussion, I feel this is just the start for Newgen. US market opening up after yesterday’s rate cut will surely bring in more business plus it is just a midcap stock with exposure to AI and other fast-growing tech solutions. Much better bet for growth investors than Infy/Tcs!

Newgen Software (19-09-2024)

Hello, fellow stock market enthusiasts and experts,

Loved the thread on Newgen Software and have been following this stock for a long time now.

Just adding my article on Newgen’s analysis and valuation which I have made after referring to its annual report, con calls, presentations and of course with the help with Screener and TradingView.

Attaching the link here for easy access: https://www.linkedin.com/pulse/ep-1-new-generation-newgen-software-rohit-chowdhury-de9yc/?trackingId=9%2FXoRA21RWeaCfGnndiVrA%3D%3D

This is my first contribution to ValuePickr and I hope you will like it

Also, just to continue with the above discussion, I feel this is just the start for Newgen. US market opening up after yesterday’s rate cut will surely bring in more business plus it is just a midcap stock with exposure to AI and other fast-growing tech solutions. Much better bet for growth investors than Infy/Tcs!