Malabar has invested in SBFC. Also Amansa. This is a segment where I trust the judgement of such big names. Suggest you to hear what Mr Nagar from Malabar has to say about SBFC. Also the jockey (Aseem Dhru) comes across as someone who will create shareholder value. The stock has given 0 returns since listing but sales and profit growth is upwards of 30%

Posts tagged Value Pickr

Rossell India Ltd (12-09-2024)

Hello Malhar,

Thanks for sharing. Could you also explain the data shared and the sources? Thanks in advance

Disc. Invested

MTAR Technologies – A wager on innovation meeting economies of scale (12-09-2024)

They’re scientists not MBA guys. Takes time to change

Amara Raja Energy & Mobility Limited: Powering Ahead (12-09-2024)

Amara Raja’s Strategic Partnerships in EV Battery Technology with Gotion-Inobat (GIB) and Beyond

Tembo Global – Infrastructure proxy? (12-09-2024)

(post deleted by author)

Ranvir’s Portfolio (12-09-2024)

RACL Geartech –

Q1 FY 25 concall and results highlights –

Company’s product profile includes transmission gears and shafts, sub assemblies, precision machined parts, chassis parts and Industrial gears

Company has 02 manufacturing facilities in India (Gajraula and Noida) and 03 warehouses in Europe

Company has 22 active customers for its products ( globally )

Company has been awarded Tier – 1 supplier status by a premium German car manufacturer for manufacture and supply of parking lock mechanisms. Mass production for this is expected to start in Feb 26

Company has strong relationship with ZF group. In coming years, revenues from supplies to ZF group should contribute Double digit revenues for the company

Q1 Financial outcomes –

Revenues – 109 vs 88 cr

EBITDA – 20 vs 22 cr ( margins @ 18 vs 25 pc )

PAT – 4 vs 9 cr ( due higher depreciation and interest outgo )

Exports:Domestic sales @ 68:32

Company had budgeted for a Q1 sales of aprox 125 cr. Could not achieve the same due to last minute inventory rationalisation by some clients in Europe resulting in order cancellations. Company had produced the finished products but did not ship them. Hence the tooling costs, costs related to Third party vendors are all booked in Q1 but the sales are not booked. Hence the operating deleverage and resultant compression in margins

Also, the growth in India business in Q1 was strong. India business has lower margins. All this has contributed to EBITDA margin compression

Their customers in Europe ( catering to EV space ) are facing a demand slowdown and hence their projections / demand forecasts are going haywire. This is resulting in order cancellations for RACL from their EV focussed customers

Customers in Europe that were focussing heavily on EV, have again started working on ICE and Hybrids. Overall – the auto industry in Europe is in a state of flux

Company is hopeful of a demand revival in H2 ( more so in the domestic mkt, where the demand is as such holding up ). Their earlier guidance of 550 cr of sales in FY 25 is not going to materialise – because of the disruptions mentioned above

Company has tightened its belt ( earlier they were quite liberal as the company was growing rapidly ) wrt various operational costs to tide over this demand uncertainty

Have operationalised 4MW (off-site) + 1.3 MW (on-site) of solar power plants – should result in energy cost savings

NEW BUSINESS PROSPECTS –

(a) Company is in advanced discussions with a European PV maker for new business related to their new EV/Hybrid/ICE platform – likely to be a big ticket order ( incase the company gets it )

(b) In advanced discussions with a Tier 1 European customer for Pedal – Assist – E Cargo vehicle ( discussion in final stages )

(c) Have received new business from a German customer for additional parts for their E-Bikes ( will be made at Noida plant )

(d) In advanced talks with 2 Indian OEMs for their Sub 400 cc motorcycle gearbox – again, likely to be a fairly large order

(e) Have received orders from Tier-1 clutch suppliers namely – FCC India, Alder Italy for supplies to US/Italian 2W OEMs

(f) In final stage negotiations with on of the domestic OEM for award of substantial business. The business is for a component which is identical / very similar to the component they were supplying to a European customer. The result of negotiation / final ward of business should happen by end of Q3

Company has again started to focus on the agri-segment ( due to the disruptions mentioned above in the export – PV segment )

Company continues to be upbeat on the China + 1 story. The Europeans are increasingly being more stringent wrt imports from China and are increasingly imposing higher import duties. This augurs well for Indian manufacturers

Escorts – Kubota is a big domestic customer for the company. As Escorts – Kubota becomes more aggressive wrt their India business ( which they are becoming ), this again is a good news for RACL

Disc: hold a small position, will add more only if I see a business recovery, not SEBI registered, not a buy/sell recommendation

Advanced Enzyme Technologies Ltd – The Enzyme company (12-09-2024)

@vikasbargale Sir

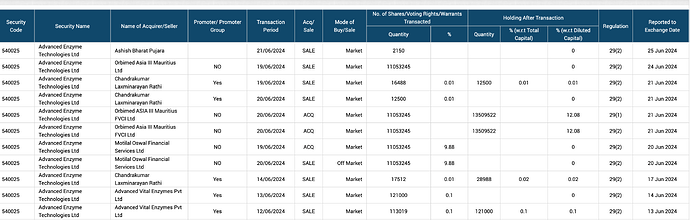

The information published on Screener doesn’t seem to be accurate. From what I could gather from BSE filings, Orbimed exited from one fund and took entry into a different fund (while increasing their stake from 9.8% to 12.08%). Motilal Oswal most likely brokered this transaction. Source: Bulk/block deals data from BSE.

Disclaimer: Invested, biased

Commodity and Cyclical Plays (12-09-2024)

Was checking the prices from 2021. I do not see much correlation of stock price w.r.t tea price. similar prices are seen in 2021 and 2022. I am yet to download and chart. But only eyeballing the data.

Kitex Garments Limited (12-09-2024)

Yes. Raymond has already given good returns