Erection and commissioning= EPC. Unless we hear that Suzlon has purchased 10s of cranes for captive use, this doesn’t mean that they won’t rent cranes from the likes of Sanghvi.

Posts tagged Value Pickr

Greenpanel Industries Ltd. (Demerged Entity of Greenply) (09-09-2024)

My veiw

- MDF prices have bottomed out.

They have been saying this in every quarter. - Unorganised players in trouble and do not have pricing power anymore due to rising timber prices.

- BIS norms for MDF to be implemented in Feb 2025 will further weed out unorganised players

Getting BIS license is not a rocket science that only Green panel can get it and other players can’t get it…its very easy task but take 4-5 months time. - Imports are gradually reducing.

Management has no control over imports at all

Indian terrain—play on consumption (09-09-2024)

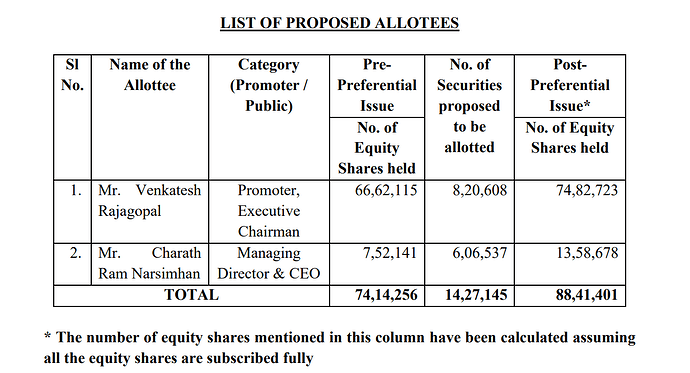

Promoter Venkatesh Rajagopal and MD Charath Ram inducing 10Cr to the company via preferential allotment.

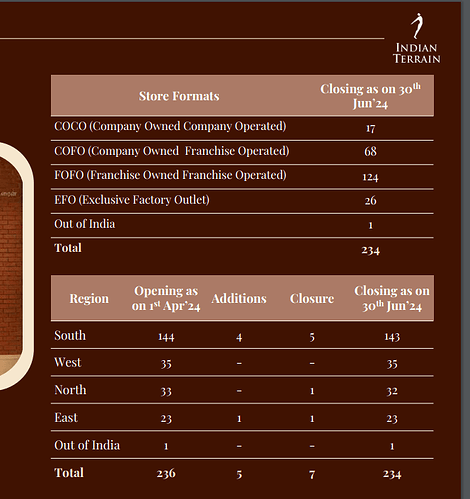

The closure of kids segment has significantly impacted the topline and bottom line. Indian Terrain is a 20 year old brand present across 230+ EBO and 800+ MBO and is available at 260-270 Cr Mcap. Promoters do have 30+ years experience in garments.

Latest Inv presentation: https://www.bseindia.com/xml-data/corpfiling/AttachHis/e372ed28-1087-4728-8e10-5517277c3119.pdf

Disc: Invested. No transactions from last 6 months.

cc: @Sridharj

Antony Waste – Long Term (09-09-2024)

I understand the concerns of the people in the forum- I share many of them.

But here’s what I think:

-

Competition like Urban Enviro seem good. But AWHCL is many times bigger, and has major Metros for it’s business.

-

Waste management seems linear- more fixed assets, more revenue. This alongside fairly stable but mildly volatile margins makes it seem like a bad business. But the scope for revenue growth is tremendous. Goverment risk is always there in India so I don’t agree with the regulatory risk that people are excessively worried about. It is a service business, with better margins than retail stores and restaurants.

-

Does seem to be undergoing small capex- always a good sign.

-

I don’t think WM business is a commodity. There is no raw material or fluctuations in revenue. Fixed costs are there, yes but that makes it more like a safe utility . The actual payment form governments might take time to arrive, but with such monopolies at hand, AWHCL should be considered very safe.

-

There is some decent scope for scale economies. And as they manage more waste, their operations will become streamlined, more so than other upstarts.

-

And the main thing is that professional waste management is such a new but essential service in India. It will grow by a lot this coming decade— to not have it grow means the death of all major metros.

Have you seen our streets, the dusty roads, the garbage dumps be it in Bangalore or the gigantic Delhi Garbage mountain?

Camlin Fine Science Limited — Looks interesting but some way to go (09-09-2024)

Board meeting on 10th September to consider rights issue. Given the negative sentiment, possible to get more than entitlement as the sentiment is negative in chemical sector.

cc: @Sridharj

Dream FIRE Portfolio (09-09-2024)

Good question, let me explain my thought process.

First of all, I am not on Twitter for this very reason. Both India and the US market throw curveballs every now and then. I won’t remain sane if I have to take more from Twitter everyday:)

Also I don’t know how to value a disruptive company like Nvidia whose TAM increases continuously. More data center means more server means more GPUs and then more business for Nvidia.

I have found the best way to minimize entry error w.r.t valuation is to buy stocks when there is a bloodbath in market/individual stock. Then by definition all these stocks will be available in throw away prices potential to its future value. And there is huge chance that investment may come out as grand slam dunk. This is easier said than done. It took quiet a bit of time for me to wire this behavior in my head:)

If the entry is secured with downside protection then we need to wait patiently for the desired events to unfold. Once events occur as expected then we need to figure out how long music is going to continue.

In US market tech stocks are valued based on quarterly numbers and very next quarter guidance. That’s it. I don’t think any one has a crystal ball on how a dynamic company like Nvidia is going to perform in next two quarters let alone for next 4-5 years. Unlike software companies, Nvidia provides guidance only for next quarter not even for full fiscal year.

Given this information, growth hungry US investors start rewarding companies those show acceleration in YoY revenue growth with improved gross margin. If company keeps on beating market expectation (revenue growth) with improved/flat gross margin then at some point momentum investors/algo traders arrive with full force and take the stock valuation to the moon:. Then at some point of time earnings won’t even matter because everyone will get convinced about power of AI. That time stock will command 3/4 digits PE and P/S may be over 50, And then eventually stock collapses as it tries to fly too close to the sun:)

Now one has to look at the Nvidia’s YoY revenue growth and quarterly gross margin data for last couple of years.

If an investor enters the stock during Q3-2023 or earlier then she is able to capture YoY revenue acceleration with improved gross margin till Q2-2025 (this is called S curve) by simply getting reassured with next quarter guidance. If same investor is aware about how growth hungry US investors reward such companies then she can peacefully sit tight during entire period irrespective of market/valuation/price fluctuation (Huge AI capex budget reported by large customers add more confidence). These data will also make it clear why stock is getting sold out after recent quarterly result. Just compare growth in YoY revenue guidance (huge growth deceleration) and slight gross margin deceleration. This is pivotal moment w.r.t stock price action. First momentum investors will take full exit. Fundamental investors who are sitting on huge gain may start lightening the position a bit. Though true Nvidia and AI believer will remain invested steadfastly. This is exactly what is happening now.

Now the question is how one might know/sense that Q3-2023 was the best time to enter the stock in hindsight. That time valuation was cheap due to sharp revenue deceleration. But that’s not enough to generate conviction to buy this stock going against market wisdom. For me it was my AI side hustle led me to this investment. Actually these tables are generated by GEN AI model which is able to read unstructured 8-K SEC filing as is and show data io a format that I want it to see. Previously I was able to automate mere 50% flows with the existing AI libraries/models. But that time I was able to automate almost 95% flows training my own GEN AI model. This hands-on experience with AI helped me to increase my conviction on AI’s future capability and led me to invest in AI monopoly stock Nvidia at cheap valuation. Next I became pure lucky as Nvidia entered into its S curve after chatGPT’s success within an year.

Now the question is what should new/existing investors do given the data known to everyone

As explained above, this backdrop is complete no-go for momentum investors.

Traders will enter and exit at appropriate level if stocks remain rangebound

Long term value investors will think that being just a hardware company Nvidia can’t scale/accelerate its GPU product sell forever as there is a limit to expand Data Center globally. Not only that other competitors will come and eat Nvidia’s lunch in not so distant future. Also Nvidia does not have experience in selling software to cover up hardware revenue shortfall. At some point in future, revenue will show massive de-growth, With 1-2 years forward discounting logic, price is too high to pay for now. So it’s either a sell or complete avoid.

Long term AI software enthusiast/practitioner/fundamental investors/analyst will think that Nvidia does not just sell GPU hardware , it also provides software and networking to program/deploy its GPU. It actually controls 70-80% of AI ecosystems as of now. If AI cycle continues for next several years then even if it’s unable to sell enough GPUs, it may cover up the shortfall with selling more software services (as Apple does it with services) and/or with new improved hardware (e.g. Blackwell). For such investors it’s just a start for Nvidia, for new investors it’s a resounding buy and for existing investors it’s a buy on dip.

ASIC/Hardware/Electrical professionals will first try to join Nvidia to earn RSUs for free:) Individual investors may think that as compute power requirement keep on increasing exponentially so Nvidia should be able to create another massive market (similar to Data Center) from scratch (e.g. robotaxi/automotive segment) sometime in future. For them also it’s also a hold or better buy on dip.

Big investors (including hedge fund/institutional investors) who are sitting on cash have crystal ball till next quarter. They have started discounting stocks based on that information only. In my opinion stocks may remain rangebound for some time. Market will decide on next action after being reassured with capex budget reported by hyperscalar in next quarterly earning report.

As most of these assumptions are still up in the air so the conviction with understanding technology/continuous learning/insight plays a huge role behind investment in such companies. At this valuation major accident may happen if these assumptions don’t get materialized in future. But it was always true throughout the existence of Nvidia as public company.

For this very reason, value investors who follow the principal “a bird in hand is worth two in the bush” will stay away from most part of the stock’s public existence and rightly so. But at the same time it’s a dream stock to hold forever for investors who bet on massive growth, innovations and visionary winning CEO (e.g. In my opinion very few companies like Nvidia, Tesla, Amazon, Palantir belongs to such category).

Long story short, investors have to decide on which camp they are in to make life changing wealth holding these kind of stocks for long term irrespective of market/price volatility. That’s why It’s rightly said that investment is simple but not easy:)

Top level Management (09-09-2024)

1.One can also go through the conference call recording uploaded on exchange /company website , check how candid are they in answering questions regarding distress or challenges faced by them. if they are trying to wash it down u need to be on alert.

2. Check the organization of the board or diff committee’s of the company if it has high quality independent directors whose reputation can be impacted if company does anything hunky dory, then its a good structure. if board /committee’s are made full of uncle ,aunty ,cousin,sister,wife then these companies need deeper analysis before investing.

3. Frequent CFO/Auditor changes , then these companies need deeper analysis before investing.

Top level Management (09-09-2024)

Read about them, read their interviews, watch their interviews, draw inferences from the words, phrases they use, their thought processes, their beliefs, their philosophies, their outlook etc. All of this does not necessarily reflect in the business always, but it will give some idea about the people who run the business. Qualitative, so subjective.

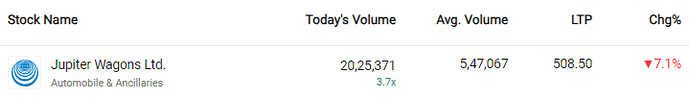

Jupiter Wagons Ltd (previously CEBBCO) (09-09-2024)

Why the selling pressure ? Is it purely QIP related?