Let’s brainstorm as I have built something on the similar lines.

Posts tagged Value Pickr

Antony Waste – Long Term (12-11-2024)

Hi All,

I hold Antony Waste & I got a question after listening to the last concall. The current ROCE is 14% & the management says it’s not going to increase due to the capital intensity of the business. ROE is around 16% & the management stated that it will come down to 9% levels. Management is guiding for ~25% growth in the topline & said that the OPM will stay around 23% over the next 3-4 years. Debt levels as per my understanding of the past & their future guidance, management is consecutive & thus, debt should remain low to nill. In that case, can we model it like below over the next 2 years? Due to the return ratios either staying stable or coming down & the very high dependence on the small governments, the business may not be able to command higher valuations unless the revenue mix tilts more towards higher margin projects (waste processing, vehicle scrapping, waste to energy, etc).

Revenue after 2 years at 25% cagr comes to ~1450 Cr.

EBITDA at 23% margin, comes to ~330 Cr.

Interest + Dep ~110 Cr.

PBT ~220

PAT ~154

EPS (provided same share count) ~54

PE remaining between 15-25:

15 PE: ~770

20 PE: ~1080

25 PE: ~1350

So questions :

- Does it make sense to have such businesses where the probability of better profitability, return ratios over 5 years is low, in our core portfolio?

- CnT business seems a commodity & can face steep competition even from small regional players then does the management have the capability to venture into the new value added areas?

- It seems that even valuation of sub 20 levels is not cheao for these businesses, what should be a good margin of safety?

Please reply as much as you all can to enlighten all of us. ![]()

Ugro Capital – Opportunity To Invest in a Fintech-like Company Below Book Value (12-11-2024)

YTM is a complicated calculation and fluctuate overtime. It’s calculated after discounting the future coupon payment. Kinda DCF method.

I would just focus on annual coupon rate. Post rating upgrade, it’s evident that their incremental CoB has been reduced. Since, only new funds are being borrowed at the lower rate and the older borrowing was at higher rate, it will still take some to see the material change on the aggregate CoB.

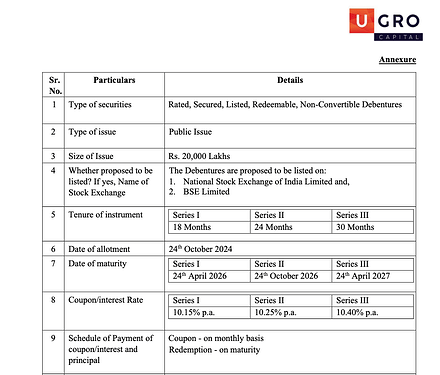

Attaching screenshot of the recent fund raised via allocating 200cr worth of NCDs in October 2024. Check for yourself the Coupon rate, which is materially lower than the aggregate CoB.

Ugro Capital – Opportunity To Invest in a Fintech-like Company Below Book Value (12-11-2024)

Thank you for clarifying the distinction between Yield to Maturity (YTM) and the annual coupon rate. You may be right regarding the current coupon rate being below the aggregate cost of borrowing at 10.7%.

However, I noticed that previous bonds were trading at less than 11% YTM, whereas these new bonds are now offering an 11.5% YTM. Doesn’t this indicate an increase in the cost of borrowing compared to past issuances? This higher YTM could reflect a shift in market conditions or perhaps a change in U Gro’s funding strategy.

Ugro Capital – Opportunity To Invest in a Fintech-like Company Below Book Value (12-11-2024)

@Akash_Padhiyar I think you miss-understood the concept of yield to maturity. It is not same as Annual Coupon Rate or annual yield.

The annual coupon rate here is approx. 10.5%. On the contrary, the cost of borrowing here is lower than their current aggregate CoB which is 10.7% (as per Q2 earnings).

Community please feel free to correct me, if you disagree!

Srivari Spices and Foods Limited (12-11-2024)

Share has not increase even after stellar performance. Something is cooking up here.

KPI Green- Turning Sunshine Into Cashflows (12-11-2024)

Rather IPP is much better where you will get annuity. The payback period is 7-8 years and then total 25 years it will be there. They are doing CPP also but that will not be story of long term but IPP will give revenue in long term as well and that is the best part in Kpi

Aaron Industries Ltd- The Elevator Play (12-11-2024)

Latest Update on Capex:

AIL has clarified that the ongoing capital expenditure (Capex) project is still under development, and the recently shared PPT contained a typographical oversight.

The target capacities for this CAPEX, which is expected to be operational by December 24, are as follows:

The elevator division :

| Product | Existing Capacity (Per Month) | Targeted Capacity (Per Month) |

|---|---|---|

| Elevator Cabins | 150+ | 300+ |

| Automatic Doors | 2000+ | 5000+ |

| Safety Frames | 50+ | 100+ |

Other Components: Supporting parts and accessories for cabins, doors, and frames, which form an essential part of their product line, cannot be measured in specific unit terms.

In Stainless Steel division :

| Product Name | Existing Capacity (Per Month) | Targeted Capacity (Per Month) |

|---|---|---|

| Matt Polishing | 50+ Tons | 150+ Tons |

| Mirror Polishing | 50+ Tons | 100+ Tons |

| PVD Coating | 700+ Sheets | 2000 Sheets |

| Decorative SS Sheets | 500+ Sheets | 1500+ Sheets |

| Embossing | – | 100 Tons |

| Press Plates | 100 Plates | 100 Plates |

Note on Capacity Utilization:

All are interconnected in production process. For example, sheets may pass through multiple steps—such as embossing, matt or mirror polishing, and then decorative SS finishing—before reaching the final product stage. Thus, each process step contributes to a cumulative production journey for a single end product, and as such, the capacity utilized in each stage cannot be simply summed up as an overall utilization figure.

The primary focus area of the company is matt polishing, mirror polishing, PVD coating, and decorative SS sheets due to increased demand and customer interest especially post installation of embossing machine (put to use in Feb ’24 update); which is now commercially operational. Company has delivered trail batches to key clients and once they confirmed their complete satisfaction with the product quality, production will start in full swing.

Way forward:

AIL is expecting at least an additional topline of Rs 150cr on conservative basis post commercialization of CAPEX and successful installation of Salvagnini machine. The company is expecting to maintain EBITDA margins at 20% plus. At present, company do not foresee the need for further long term debt.

SG Mart- Can it successfully create a marketplace? (12-11-2024)

The 2nd question and answer you’ve mentioned – one from Ms Alisha – is from the previous concall. But the answer management has given is extremely relevant in this quarters results. The entire pretext of preserving the thin margin under all situations has been shaken. They said inventory days is 8, even if two price revisions happen each month – roughly 15 days each – how does this affect margins so severely is hard to understand.

One minor point was that during stressed periods they have to offer more discounts to their customers, which had lead to fall in margins. But this again points to weak pricing power. Overall disappointed with commentary

Cigniti – Special situation in cheapest IT stock with top notch management (12-11-2024)

There’s already a thread for cigniti please continue discussing there!!