May be you have visited a store and collected some data. The only way it could be right is they should be selling more of the other products than footwear. Is that what your learning from visiting the stores is?

Posts tagged Value Pickr

The Anti-Portfolio (24-08-2024)

Hello Vikas. Do you see any fundamental change/ trigger in Sanghvi Movers?

Aditya Birla Fashion and Retail Ltd (24-08-2024)

This is largest holding in my portfolio as of now, Ashish Dixit is a real disappointment here, just playing on demerger to see what value market will give to demerged entities. 9000 cr topline and 19% margin gives EBIDTA of 1700 cr for ABLBL, with conservative EV/EBIDTA of 20-25, it many list between 340- 400, ABFRL don’t know what price market will give with pathetic balance sheet, still hoping combined valuation of 500 before of after merger by Jan 25.

Deepak Fertilizers and Petrochemicals (24-08-2024)

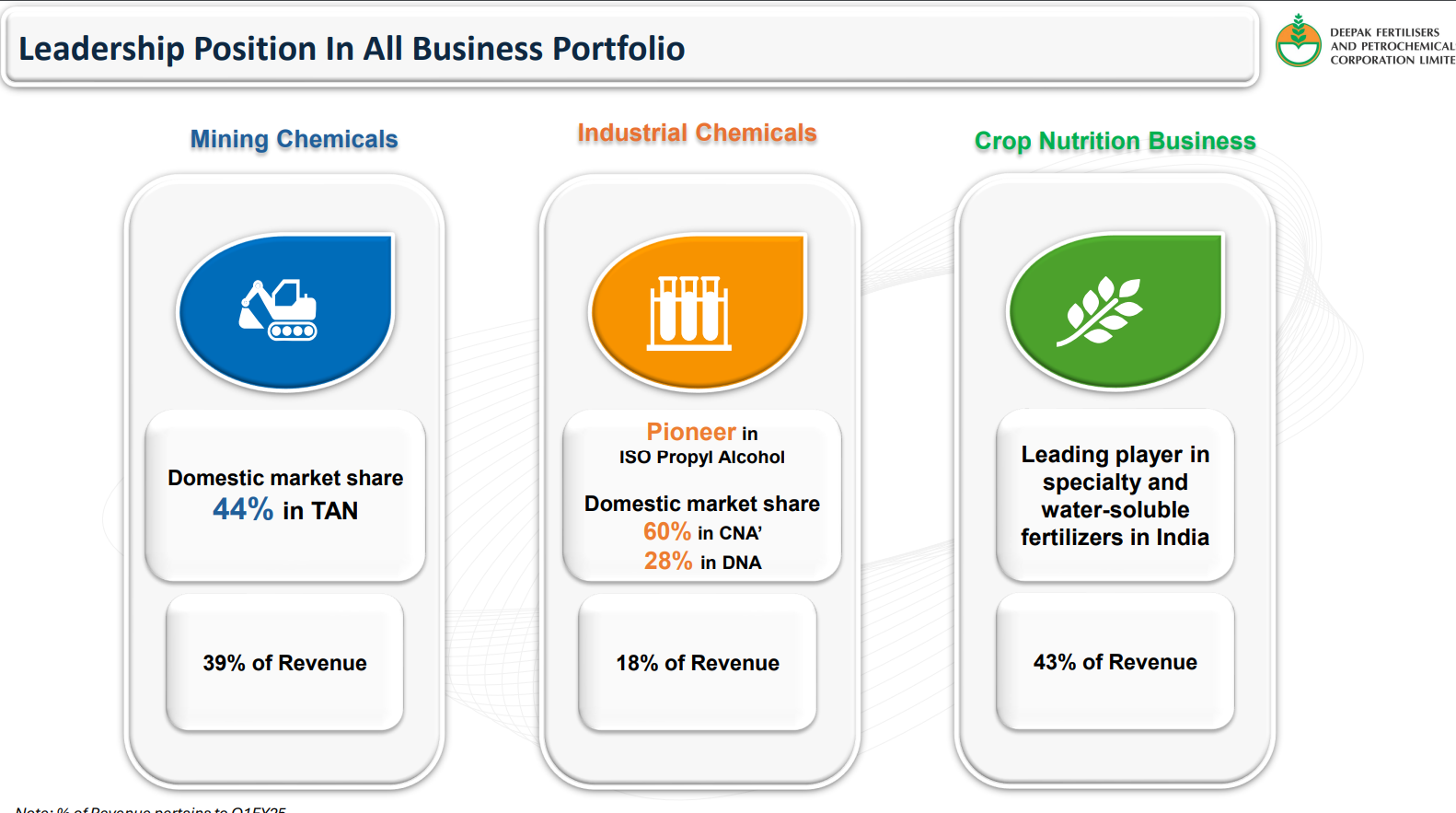

Q1 FY 25-

Trigger-

TAN and other capex,

Focus to increase TAN export,

4000-5000cr capex in FY25 and FY26

Capex go live in H2 FY26.

50-55% revenue comes from TAN business.

Risk- Over- capacity of ammonium nitrate bcz Coal and BHEL have signed a JV for setting up 2,000 ton per day ammonia nitrate plant,but capex is not started yet, also Chambal is actually coming up with some kind of new capacity. As I have been telling that they have actually announced that it is an ammonium nitrate capacity which they’re bringing in. But they are also manufacturing fertilizers. So we’ll have to really see where their facilities will get utilized. .( This will mitigate by almost 25% to 30% of the demand actually is fulfilled by imports today)

We are not expecting on long-term basis any capacities which are basically going to be idle, but there could be a few quarters when the business is not doing well maybe there could be some surplus capacity.

- Debt can go upto 5500cr ie D/E almost 1

Screenshot 2024-08-24 230409.png 408.78 KB

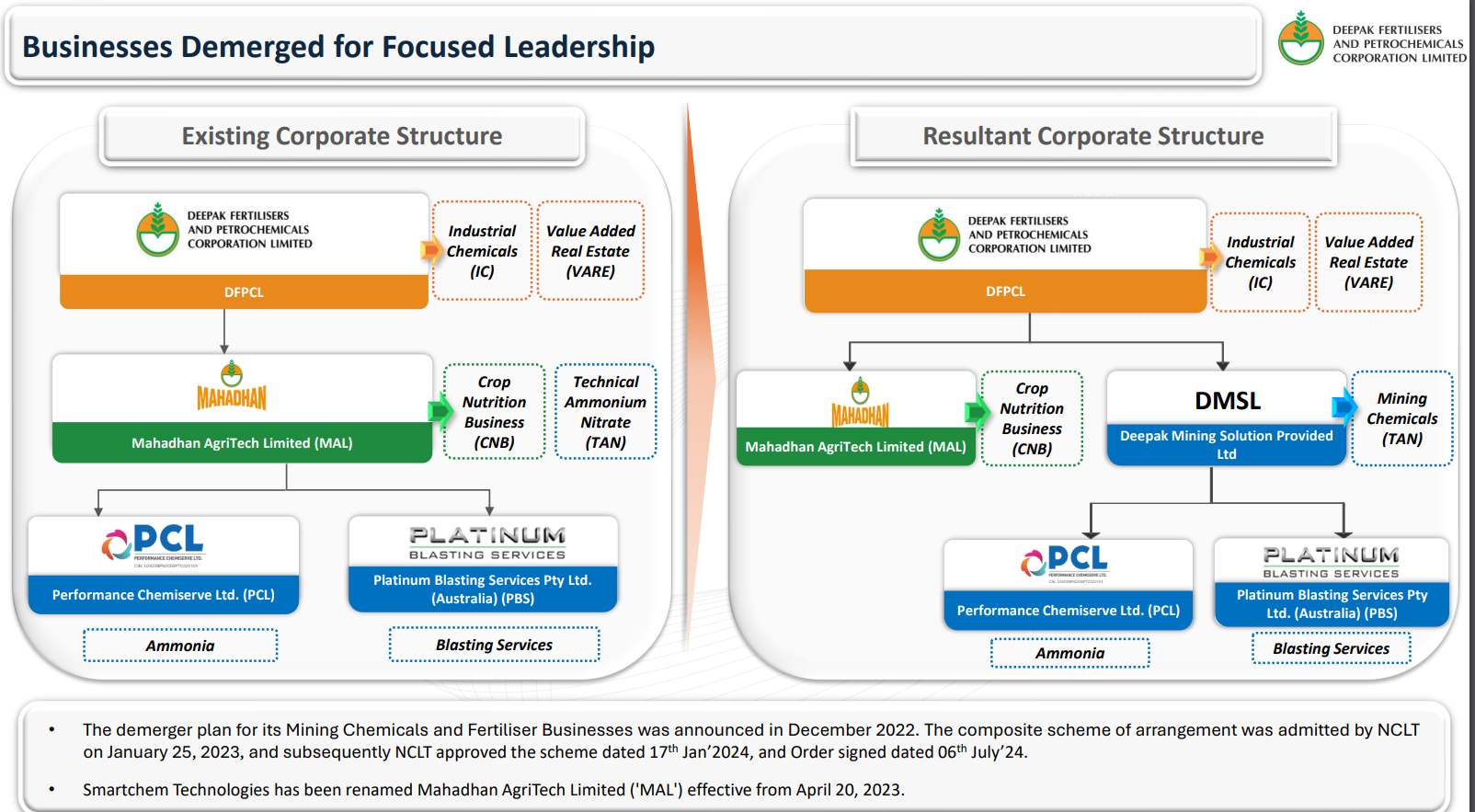

So the demerger happened, which is the subsidiary of Deepak fertilisers, and it is called Mahadhan Agritech Limited, which is an unlisted company. It used to house the CNB business, which is our fertilizer business and also the technical ammonium, which is the Mining Chemicals for us business. Now the Mining Chemicals business is getting carved out into a new legal entity and its name is Deepak Mining Solutions Limited. So that is the impact. And hence, there is no impact on the existing shareholders of Deepak Fertilisers.

we have 2 unlisted entities, which is one is for Mahadhan Agritech, which is an unlisted entity. The other is Deepak Mining Solutions Limited, that is other unlisted entity.

Currently both the unlisted entities are wholly owned subsidiaries of deepak fertilser and petro ltd.

So the answer is, yes, because we would continue to look for technology partners as well as strategic investors to grow those businesses. Whether it is the fertilizer business or whether it is the Technical Ammonium Nitrate business. So whatever growth which we see automatically it will show up in the holding company. So that is how it will benefit all the shareholders indirectly, but not the way that any shares would get allocated to them.

-Three division- Explosive(TAN), Industrial chemicals, Fertiliser

- Mining(Coal, steel) increase will help first segment, Good monsoon,govt policy and tailwing in agro sector help third segment

So, in a nutshell, 3 things. Beautifully aligned India growth story; number two, solid value chain; and number three, move from commodity to holistic solution. All the 3 promises to change the very face of Deepak Fertilisers in the years to come.

The capacity utilization of our nitric acid plant was closer to 90% for the quarter. And for the IPA plant, it was closer to almost 78%.Bulk fertilizer manufacturing capacity utilization was closer to 67% during the quarter

Performance Chemicals Limited, which houses our ammonia plant. Ammonia plant as you know that we basically started this plant last year in Q2. The capacity utilization in Q1 at around 98%.

As we have been telling all our investor communities that the backward integration is helping us and will help us to reduce volatility to enable us to retain the margins within the group.

The ongoing expansion at Gopalpur for TAN and Dahej for nitric acid starts in H2 FY26.Initially with70-80% capacity then go to 90-100% capacity as we did with ammonia capex(now at 98% capacity utilisation).

So we have said that the Gopalpur project, we are going to incur close to INR2,200 crores. As far as Dahej is concerned, we have said we will do around INR2,000 crores.

INR1,500 crores capex will be equally divided between Gopalpur and the Dahej in FY25 and around same capex for bot in FY26

TAN business- We currently have a capacity of around 540,000 tons right now, we are actually expanding additionally 50,000 tons, which will come upstream by the end of September. So obviously, the capacity would go up. We are looking for getting our new plant ready in Gopalpur with a capacity close to 376,000 tons. You can say around 400,000 tons, which would come upstream sometimes to next year.

50-55% revenue comes from TAN business.

So actual exports started only last quarter for TAN , which is the last quarter of the last financial year, which is ’23-2024. Now from this quarter the business will start looking at aggressively all the exports to be done.(TAN Business)

Demand is expected to remain strong in TAN over the next couple of quarters driven by growth in coal mining, power, and infrastructure sectors.

Post commissioning of this plant, we will become 3rd largest pure play TAN producer in the world.

The project is strategically located close to major mining hubs to be able to cater to their demand, while its proximity to Gopalpur port provides favourable export opportunities

IPA segment- On a long-term basis or rather short to midterm basis, this trend will continue. So, we are expecting that demand would continue for the next at least a couple of quarters or maybe a couple of years as well.

Leveraging 40 years of credible experience in Nitric Acid, DFPCL will become ‘Asia’s Largest Manufacturer’ of Nitric Acid post expansion

I’m also happy to share the positive impacts emerging from the recently announced Union budget. From a larger perspective, the Finance Ministry’s continued strong support on the fertilizer subsidies, the growing outlay for the agriculture sector, and the strong support to infrastructure. All of them will go to provide a strong and positive tailwind to all our business segments. Additionally, our recent partnership with Israel-based Haifa Group will help to promote high-performance specialty fertilisers.

NCLT Mumbai has now formally approved the demerger plans, now paving the way of unwinding each business into a separate corporate entity. So the Chemical business will be housed in 1 entity, the Crop Nutrition Fertilizer business in another one and the Technical Ammonium Nitrate Mining Chemicals in the third.

The restructuring will also open doors for strategic global investors focus on specific businesses to join us and besides that, it will also further improve the specific business visibility for the investors in general.

Now with this strategic restructuring, this aligns very well with our vision of evolving from a commodity player to one that provides specialized holistic solutions.

Now turning to our business performance. In case of Mining Chemicals, Technical Ammonium Nitrate(TAN businesss), showed a robust growth, resulting in a 23% increase in the technical ammonium nitrate sales volume year-on-year. This growth is supported by improved prices and increased demand in key end sectors such as coal mining, steel production and both showed around 11% growth.

As far as the industrial chemicals goes, the business delivered lower volumes in nitric acid due to an extended repair job at our Taloja Nitric Acid plant and partly due to reduced demand from the downstream industry following a temporary shutdown of the GNFC TDI plant, leading to an oversupply of their asset in the market.

IPA volumes were a little lower due to a plant shutdown. So that was as per plants. Having said that, our specialty products in the Chemical segment – Industrial Chemicals segment, including the pharma grade IPA and the stainless-steel grade nitric acid continued to grow based on the positive customer feedback as regards their value propositions

When it comes to the Crop Nutrition Fertilizer business, the business delivered 11% year-on year increase in sales of manufactured bulk fertilizers, whereas sales of specialty products like Bensulf have surged by 51% over last year. During the quarter, the business launched Croptek grade for soybean and Smartek grade for paddy and pulses, taking us forward in our cropspecific nutrient journey.

From an outlook perspective, as Mr. Mehta said, post demerger and the TAN business would get into a separate legal entity now. And it will establish itself as a fully integrated technology solution provider for all our customers. As you are aware that the export ban was lifted last financial year. We have already started exports from March ’24 onwards,

So we basically feel that we have a very strong case and whatever demands which the commissioner of income tax has actually saying, we continue to obviously fight that at various levels. And we will go to the highest level because we think we have a very strong case to defend us.

We are actually creating the market for it. So we’ve been telling our investors is that we will be definitely, we are very aggressive in expanding it, but it will take some time before we get there. And this will become a material till the time it becomes a material part of the business. So we are still a few quarters or a few years away from where we should be right now.

TAN business- But so far, there are no antidumping duties. But in the new budget, as you would have read is that the duty has actually been increased for importing ammonium nitrate. So 2.5% of the duty has gone up, part of it would create some kind of a deterrent for the importer, but we’ll have to see. I’m sure that the government is taking more steps to be able to at least give some competitive advantage to the domestic manufacturers as well.

State-GST benefit – Incentives for the ammonia plant. So last year, as you know, that we have actually got in Q4 around INR89 crores. For this quarter, we have done closer to almost INR35 crores. We have booked it which is prorated for the year. We expect similar if the volume obviously, if the prices goes up, it may be even higher in the future quarters.

So, we always continue to reduce debt. But there are ongoing projects, which would require new debt for funding those projects. So whether it is Gopalpur or whether it is Dahej. So overall even though we may be repaying the existing debt, but overall, the debt portion may go up because the new debts are coming in for the new projects. And it should peak out sometime next year… And hence, we would start seeing some reductions there on.

So it depends how we see it. But more or less, it should be between INR5,000 – INR5,500 crores to INR6,000 crores is what we think right now, but it can be lower than that as well.

Aptus Value Housing : Is valuation justified or just another HFC? (24-08-2024)

I understand that dividends are a key metric for the company’s authenticity. However, that is not in question here given the past track record of sizeable PE investment.

Clearly, they have more capital than they need. This is why, the RoE is not justifying such a good RoA. One should also understand that giving out dividends will lower book value while improving RoE. Price to book multiple will also become more expensive.

However, the recent mild correction in stock price is due to Westbridge reducing their stake and general negative sentiments for NBFC. I feel that this stock will only perform after the complete PE exit. And for that to happen, valuations must be right for other large institutions to get into.

Otherwise, the company is demonstrating predictable AUM growth with an above-average RoA. This is just a case of a Quality business at an unfavorable price. I personally see limited downside by price, but potential downside with time.

Ador Welding Ltd (24-08-2024)

Does anyone know what is happening to ador and its valuation.

Is it because q4 was better.

Ador Welding Ltd (24-08-2024)

(post deleted by author)

Newgen Software (24-08-2024)

Interesting. $500M equals around INR 4000 Cr. With guidance of 23-24% EBITDA and 20% PAT (Q1FY25), PAT could be around 800 Cr. If PE normalizes to 30-35x (for a very fast growing asset light company), valuation could possibly be around 24000-28000 Cr in FY27. And if (less likely) current valuations hold, this be 48000 Cr!! Still ~2-3x from current levels!

Invested from 200 levels. Biased.

Manaksia Coated Metals & Industries Ltd – manufacturing and exporting high-quality coated metal products (24-08-2024)

This company looks interesting for the current situation and economical conditions of India. I started looking into this company, the following is summery:

Manaksia Coated Metals & Industries Ltd. operates on a diversified business model that focuses on manufacturing high-quality coated metal products and expanding its production capacities through technological advancements. The company targets both domestic and international markets, leveraging its strong brand presence and adherence to stringent quality standards to maintain its competitive edge. Additionally, it diversifies its portfolio by producing other industrial products like Ultramarine Blue Powder and mosquito repellent coils, which further strengthens its business model.

1. Core Business Activities

- Manufacturing and Exporting Coated Metal Products: Manaksia Coated Metals & Industries Ltd. (MCMIL) specializes in manufacturing and exporting various coated metal products, primarily focusing on Colour Coated Galvanized Steel and Plain Galvanized Steel, available in both coil and sheet forms. These products are crucial for industries such as construction, automotive, appliances, and general engineering.

2. Production Facilities

- Location: The company’s manufacturing operations are based in Kutch, Gujarat, where it has been operational since 2006.

- Capacity: Initially, the plant had a production capacity of 108,000 TPA (Tons Per Annum). However, with ongoing expansions, including the addition of new Cold Rolling Complexes and a second appliance-grade Colour Coating Line, the capacity is expected to increase to 180,000 TPA.

3. Technological Advancements and Expansions

- Color Coating Line Upgrade: In April 2022, the company completed a project to enhance the production capacity of its Color Coating Line from 39,000 MTPA to 60,000 MTPA. This upgrade included an overhaul of the electrical automation system and the installation of a new thermal incinerator for better fuel efficiency.

- Alu-Zinc Coating: The company is converting its existing galvanizing line from pure zinc coating to Alu-Zinc coating, a superior product that lasts longer and commands a premium in the market. This upgrade will increase production capacity by 33% to 144,000 MT/year and is expected to be completed and commissioned in FY24.

4. Product Offerings

- Colour Coated Metal Sheets & Coils: These products involve coating substrate metals like galvanized steel, Alu-Zinc coated steel, and aluminum with a protective paint layer. The advanced processing ensures the coating adheres firmly, enhancing the product’s strength, aesthetic appeal, and corrosion resistance.

- Galvanized Steel Sheets & Coils: Galvanized steel is coated with zinc, providing a barrier and sacrificial protection against corrosion. The company’s state-of-the-art galvanizing line ensures high-quality output for various applications.

5. Diverse Applications

- The products are used across multiple sectors, including:

- Construction: Steel framing, false ceilings, ducting, etc.

- White Goods: Refrigerators, washing machines, etc.

- Automotive: Auto internal components, bus bodies, etc.

- Furniture: Office equipment, partitions, etc.

- Others: Roofing, solar panels, elevators, etc.

6. Other Business Ventures

- Ultramarine Blue Powder: MCMIL also produces Ultramarine Blue Powder, a fabric whitener, under contract for Reckitt Benckiser India, with a highly automated facility in Bhopal, Madhya Pradesh.

- Mosquito Repellent Coils: The company also produces mosquito repellent coils in Guwahati.

7. Market Presence and Strategy

- Global Presence: MCMIL exports its products to various regions, including Europe, Russia, Africa, and the Middle East, establishing itself as a key player in the international market.

- Brand Development: The company has developed strong brands like “ColourStrong,” “Zingalvo,” and “Singham,” which cater to different market segments and emphasize product quality and durability.

8. Certifications and Quality Assurance

- The company is accredited with ISO 9001:2015, ISO 14001:2015, and OHSAS 18001:2007 certifications, underscoring its commitment to producing high-quality products.

How it’s different from other companies in the similar space:

1. Strong Product Portfolio and Brand Equity

- Diverse Product Offerings: MCMIL’s wide range of products, including Colour Coated Galvanized Steel, Plain Galvanized Steel, and Alu-Zinc coated steel, caters to various industries such as construction, automotive, and white goods. The diversity in its product range allows it to serve multiple market segments, reducing dependency on any single sector.

- Brand Strength: MCMIL has developed strong brands such as “ColourStrong,” “Zingalvo,” and “Singham,” which are recognized for quality and durability. This brand recognition provides a significant advantage in markets where brand loyalty and perceived quality are important.

2. Technological Advancements and Capacity Expansion

- State-of-the-Art Manufacturing: The company’s continuous investment in upgrading its manufacturing facilities, such as the Color Coating Line and Galvanizing Line, allows it to produce high-quality products efficiently. The technological edge in its production processes ensures that it remains competitive in terms of both cost and quality.

- Capacity Expansion: The ongoing expansion projects, such as the Cold Rolling Complex and the conversion to Alu-Zinc coating, will significantly increase the company’s production capacity. This not only helps in meeting growing demand but also allows for economies of scale, reducing the per-unit cost of production.

3. Global Market Presence

- Export Capabilities: As a Three Star Export House, MCMIL has a strong presence in international markets, including Europe, Russia, Africa, and the Middle East. This global reach diversifies its revenue base and reduces the risk associated with reliance on any single market.

- Quality Certifications: The company’s adherence to global quality standards, as evidenced by its ISO certifications, enhances its credibility in international markets, allowing it to command a premium price for its products.

4. Relationships with Key Suppliers

- Strategic Partnerships: MCMIL sources critical raw materials from leading global suppliers like Nippon Paints, Kansai Nerolac, HENKEL, and BASF. These partnerships ensure access to high-quality inputs, which is crucial for maintaining the quality of the finished products. Such relationships can be difficult for new entrants to replicate, providing MCMIL with a supply chain advantage.

5. Entry Barriers in the Industry

- Capital-Intensive Operations: The steel and coatings industry requires significant capital investment in machinery, technology, and infrastructure. MCMIL’s established manufacturing facilities and ongoing investments in capacity expansion create a high barrier to entry for potential competitors.

- Technological Complexity: The production of high-quality coated metals involves complex processes that require specialized knowledge and technology. MCMIL’s experience and expertise in these areas provide a competitive edge that new entrants would find challenging to match.

6. Customer Relationships and Customization

- Tailor-Made Solutions: The company’s ability to offer customized solutions to meet specific customer requirements enhances customer loyalty and creates a competitive barrier. Customers are likely to stick with a supplier that can meet their exact needs consistently.

What are the Risks and Threats for the company:

1. Technological Disruption

- Emerging Technologies: Rapid advancements in materials science or manufacturing technologies could lead to the development of new, superior materials or more efficient production processes. If competitors adopt these technologies faster than MCMIL, they could gain a competitive edge, reducing MCMIL’s technological advantage.

- Digitalization and Automation: As industries increasingly adopt digital and automated solutions, MCMIL must continuously invest in these areas to avoid falling behind. Failure to keep up with the latest advancements in automation and digital integration could lead to inefficiencies and loss of competitiveness.

2. Intensified Competition

- Entry of Global Players: The global steel and coatings industry is highly competitive, with large multinational corporations that have significant resources and advanced technologies. If these global players increase their focus on MCMIL’s core markets, they could exert pressure on pricing and market share.

- Local Competitors: In regions where MCMIL operates, particularly in emerging markets, local competitors might leverage their understanding of the market and lower operating costs to challenge MCMIL’s position.

3. Raw Material Price Volatility

- Dependence on Key Suppliers: MCMIL relies on strategic partnerships with suppliers like Nippon Paints, Kansai Nerolac, and BASF for high-quality raw materials. Any disruption in these supply chains, whether due to geopolitical tensions, price hikes, or supply shortages, could increase costs or affect product quality.

- Commodity Price Fluctuations: The prices of raw materials, particularly steel and zinc, can be highly volatile. Significant increases in these prices without a corresponding ability to pass costs onto customers could compress margins.

4. Regulatory and Environmental Challenges

- Environmental Regulations: The steel and coatings industries are subject to strict environmental regulations, which are becoming increasingly stringent. Compliance with these regulations can increase operational costs. Additionally, any non-compliance could result in fines, sanctions, or damage to the company’s reputation.

- Trade Policies: Changes in trade policies, such as tariffs, import restrictions, or anti-dumping duties, could impact MCMIL’s ability to compete in international markets. Such changes could also disrupt supply chains or increase costs for imported raw materials.

5. Economic Downturns

- Cyclical Nature of the Industry: The steel industry is highly cyclical, with demand closely tied to economic conditions. An economic downturn could lead to reduced demand for steel products, affecting MCMIL’s sales and profitability. The construction and automotive sectors, in particular, are sensitive to economic fluctuations.

- Global Market Uncertainty: MCMIL’s reliance on exports exposes it to global market risks, including economic slowdowns in key regions, currency fluctuations, and geopolitical instability, all of which could negatively impact revenue.

6. Customer Concentration Risk

- Dependence on Key Customers: If a significant portion of MCMIL’s revenue comes from a few large customers, the company is at risk if any of these customers reduce their orders, switch to competitors, or negotiate more favorable terms. Diversifying the customer base is crucial to mitigating this risk.

7. Supply Chain Disruptions

- Global Supply Chain Dependencies: MCMIL’s operations rely on a global supply chain for critical raw materials and components. Disruptions due to natural disasters, pandemics, or geopolitical conflicts could lead to delays or increased costs, impacting production and profitability.

- Logistics and Transportation Issues: Delays or increases in transportation costs, particularly for exports, could affect delivery schedules and erode margins, especially in competitive international markets.

8. Brand and Reputation Risks

- Product Quality Issues: Any lapses in quality control or product recalls could damage MCMIL’s brand reputation, particularly in international markets where brand loyalty is harder to build. Maintaining high standards is critical to protecting the brand.

- Negative Publicity: Environmental issues, labor disputes, or negative publicity related to corporate governance or ethical practices could harm the company’s reputation, leading to a loss of customer trust and potentially impacting sales.

Financial Summery:

Balancesheet:

Key Growth Drivers:

The key growth drivers for Manaksia Coated Metals & Industries Ltd. include its strategic capacity expansions, diversified product portfolio, technological advancements, strong global market presence, and efficient supply chain management. These factors, combined with its focus on cost management, geographic expansion, and strong brand equity, position the company for continued growth in both domestic and international markets.

Long term Strategy of the company:

As per the Q1FY25 concall, ths Manaksia Coated Metals & Industries Ltd.’s long-term strategy revolves around capacity expansion, product diversification, technological upgradation, global market expansion, and operational efficiency. The company aims to strengthen its competitive position by focusing on high-value markets, maintaining financial discipline, and adopting sustainable practices. By leveraging innovation, strategic partnerships, and a customer-centric approach, MCMIL seeks to achieve sustainable growth and build a resilient business model for the future.

Summary of Recent Financial Trends:

- Revenue Growth: MCMIL has been experiencing steady revenue growth, driven by increased demand and expanded production capacity.

- Rising Costs: Operating expenses have been increasing, which has put some pressure on profit margins, particularly in FY 2023.

- Stable Operating Profit: Despite cost pressures, the company has managed to maintain operating profitability, with a significant increase projected for FY 2024.

- Debt Management: The company has been using debt to finance its expansions, which needs to be managed carefully to avoid over-leverage.

- Increasing Reserves: The steady growth in reserves indicates a healthy accumulation of retained earnings, contributing to the company’s financial stability.

These trends suggest that MCMIL is on a growth trajectory but faces challenges related to cost management and debt, which it must address to sustain profitability and financial health in the long term