HDFC Mutual Fund has launched the HDFC Nifty India Digital Index Fund, an open-ended scheme tracking the Nifty India Digital Index

Posts tagged All News

Supreme Industries (25-11-2024)

DI pipes will eventually be replaced by OPVC pipes. This was explicitly mentioned by Astral management in one of the concall Q&A. There’s no immediate threat though but it’s a very mid to long term story

Paramount Dye Tec: A Yarn of Growth, Risks, and Strategic Expansion (25-11-2024)

Business Model

Paramount Dye Tec Limited operates through two primary activities: manufacturing and trading, focusing on synthetic fibers and yarns. Here’s an overview:

- Manufacturing Operations

- Produces synthetic fibers, particularly recycled acrylic yarns used in sweaters, mufflers, caps, and socks.

- Yarns are made by processing waste from virgin synthetic fiber manufacturers.

- Contributes 65% of FY24 sales with a 22% EBITDA margin.

- Since they use recycled fibres, their raw material procurement costs are significantly lower than virgin fibre yarn manufacturers and thus their EBITDA margins are higher.

- Trading Operations

- Trades in various yarn types, such as acrylic cloth, blended yarn, nylon, and polyester yarns.

- Includes domestic sales and surplus raw materials from manufacturing.

- Contributes 35% of FY24 sales with a 5% EBITDA margin.

Note: While the primary focus is expanding the manufacturing unit, trading continues to maintain customer relationships and handle bulk orders.

Capacity and Utilization

- Fiber Capacity:

- 3600 MT annually (12 MT/day x 300 days on a 12-hour shift).

- Capacity doubled from FY22 to FY23, with EBITDA increasing 4x.

- Current utilization: 95%.

- Company is producing excess recycled fibres as their yarn capacity is fully utilized so they have to sell the excess stock or store it as inventory

- Yarn Capacity:

- Current: 1440 MT (4.8 MT/day x 300 days) with 97% utilization.

- Planned by FY25-end: 3540 MT (7 MT/day + 4.8 MT/day) using funds received from IPO in Oct-24, a 2.5x increase.

- Company had already given orders for the new machines as per the RHP

- The company has started laying the wires and transformers in mid-Nov with machines expected by end of Nov. Production to start in Q1FY25.

Key Financial Highlights

-

Cash Flow:

- CFO/EBITDA ratio: 11%, with positive operating cash flow.

- Trade Receivables: ₹6.05 Cr (mostly <6 months old) and largely secured.

- Inventory Levels: ₹17.5 Cr, including ₹7.7 Cr in raw materials and ₹4.2 Cr in unsold finished goods due to excess fibre being produced.

-

Peer Comparison:

| S No | Company Name | MCap | Land | PAT | PE | Gross Margin | MCap (Adj. for Land) | PE (Adj.) |

|---|---|---|---|---|---|---|---|---|

| 1 | Paramount | ₹67.7 Cr | ₹13 Cr | ₹6.3 Cr | 10.7 | 50% | ₹54.7 Cr | 8.7 |

| 2 | Indian Acrylic | ₹170 Cr | ₹3 Cr | -₹53 Cr | -3.2 | 30% | ₹167 Cr | -3.2 |

| 3 | Nitin Spinners | ₹2195 Cr | ₹16 Cr | ₹132 Cr | 16.6 | 34% | ₹2179 Cr | 16.5 |

| 4 | GHCL Textiles | ₹910 Cr | ₹211 Cr | ₹25 Cr | 36.4 | 31% | ₹699 Cr | 28.0 |

| 5 | Sportking | ₹1503 Cr | ₹24 Cr | ₹70 Cr | 21.5 | 24% | ₹1479 Cr | 21.1 |

Additional Observations

- There seems to be a discrepancy in the land value reported in RHP (₹12.8 Cr) vs. screener data.

- Increasing demand for acrylic yarn positions Paramount well, but margins and multiples compared to peers need closer monitoring.

Promoter

- He comes across really well in his interviews, showcasing a clarity of thought. Has ambitions to increase production to 100 MT per day eventually

- A really good YouTube video with his interview: https://www.youtube.com/watch?v=ITgfJNFHZJg

- Personally, whenever, I have reached out regarding some questions, he has been really forthcoming and prompt even on late Sundays.

- The remuneration seems fair

Risks and Concerns

- Concentration Risk: Although, this is because the company is really small and doesn’t need to diversify yet.

- Top 10 suppliers account for 100% of purchases.

- Top 10 customers contribute 78.18% of revenue.

- Promoter-Related Risks

- Promoter company is engaged in a similar line of business of cotton yarn recycling and manufacturing. Future plans, including potential acquisitions, remain unclear.

- Raw Material Volatility

- Prices of key inputs like acrylonitrile fluctuate, impacting pricing and margins. Competitors with better production efficiency or superior quality may erode market share.

- Seasonality in Demand

- Seasonal dependence exists, but capex from IPO proceeds targets expanding into the summer wear market.

- Planned portfolio includes blends of acrylic-cotton, cotton-polyester, and other materials for t-shirts, shorts, and polos, mitigating seasonality risks.

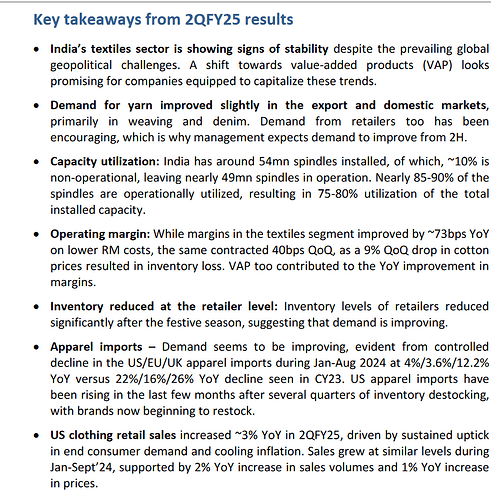

Industry Outlook: Textile industry going through major tailwinds.

Source: Systematix Institutional Equities

Areas to Monitor

- Raw material price fluctuations.

- Execution of capex plans and their impact on mitigating seasonality risks.

- Competitive landscape, especially regarding peer gross margins and efficiency.

Disclosure: I am invested in this stock. Please do your own due diligence before investing

Foreign investors turn net buyers of Indian stocks after record selling run (25-11-2024)

The benchmarks rallied on Monday, after the ruling Bharatiya Janata Party (BJP) secured a decisive victory in the elections of the country’s richest state, Maharashtra

HUL to demerge ice cream business (25-11-2024)

FMCG major Hindustan Unilever Ltd (HUL) on Monday said its board has approved the demerger of the ice cream business, which owns brands such as Kwality Wall’s, Cornetto and Magnum, into an independent listed entity.

Property Share files offer document for Rs 353 crore IPO of its SM Reit (25-11-2024)

Property Share Investment Trust (PSIT) is India’s first registered small and medium real estate investment trust (SM Reit)

Infollion Research Services Ltd – Moated Microcap with Differentiated business? (25-11-2024)

Nomura too has a meeting set up with the Infollion’s management, this week.

Supreme Industries (25-11-2024)

thanks basu sir for reply that means sir there is no way to replace the ductile pipe by cpcv pipes in coming time.

TMC MP suggests Mamata Banerjee as INDIA bloc leader (25-11-2024)

After a high-level National Working Committee (NWC) Meeting of Trinamool Congress convened by Mamata Banerjee on Monday at her residence in Kalighat, Trinamool Congress leadership has decided to raise the Manipur issue in Parliament, along with price rise, unemployment, stoppage of MGNREGA and PM Awas Yojana funds among others.