Scaling a Manufacturing Business to IPO in 8 Years | Make in India | Sukrit Bharati | Ep #168

Posts in category Value Pickr

Hariom Pipes Ltd: A Capex Play! (10-11-2024)

So what I think is & tried to researcher deeper & found out:

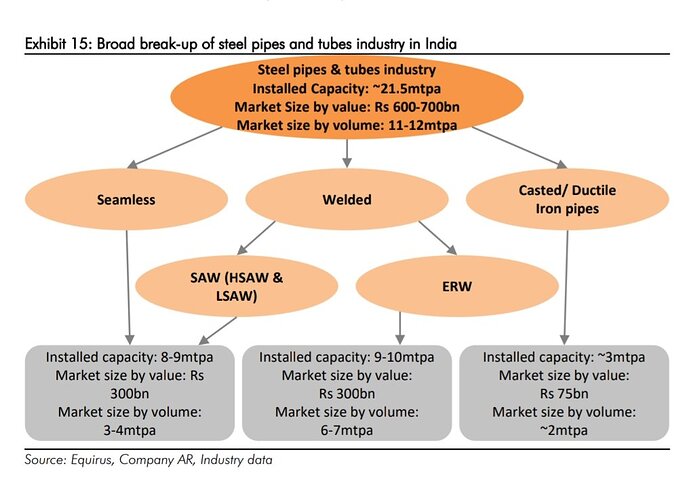

- The report from where I took data is of Equirus initiative coverage report on APL Apollo tubes… I tried to go to many companies related to steel tubes company PPT & initiative coverage, but can’t able to verify the data about installed capacity higher than market size (might be it was just estimates & reality would be different as all companies have different estimates)

But I can verify data about ERW Pipes segment (where hariom has main focus)

So, this was the original image… ERW Pipes has 9-10 mtpa installed capacity & 6-7 mtpa size… so this is somehow correct

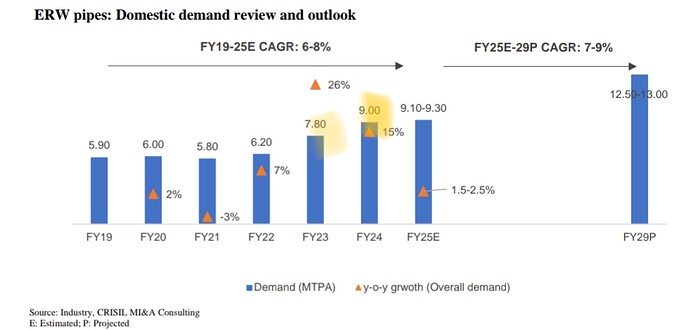

This is from DRHP of Vibhor steel tubes… here it stated as demand for ERW Pipes as of FY25 is 9 mtpa + their would be export market as well, so demand is almost maching installed capacity if Equirus is correct + industry is expected to grow at 7-9% CAGR for next few years (so feel not much over capacity issues in this segment)

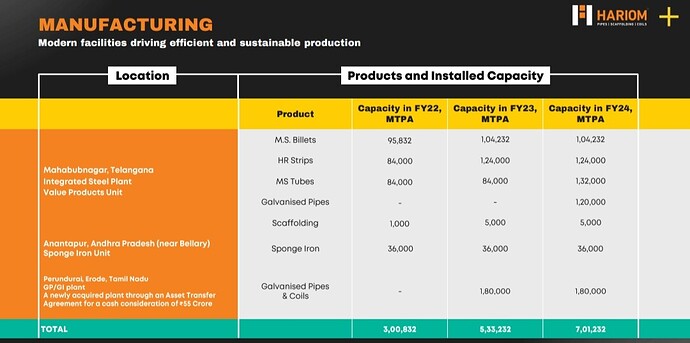

- So for asset turnover… their asset turnover is lower because they are running at just 35-40% capacity utilisation… from last 3-4 years they are doing Capex & increasing capacity at full pace thatwhy their Asset turnover are lower + their WC cycle was worsen cause of such huge capex

They can match asset turnover of peers once their capacity utilisation reaches above 60%; also they are now Focusing on normalising WC cycle this can lower total assets (lowering inventory & Receivables + paying debt from that) and Asset turnover can increase drastically due to this + Deleveraging can lead to ROE & ROCE inching upward (above 20% can easily possible if management walk the talk)

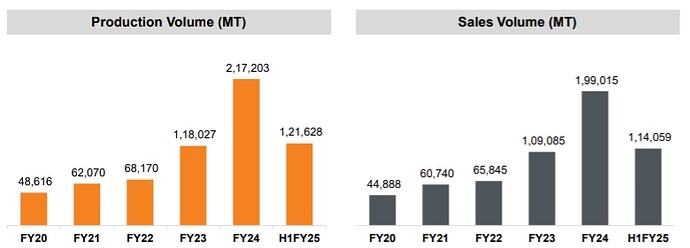

Last 3 yr capacity:Last 3 year volume:

Hope I can answer ur query… open for future discussion

Disc: Invested & Biased

Manappuram Finance (10-11-2024)

in the gold loan, microfinance area, the possibility of collusion to defraud is very high. There were even murders of the collection agent by a group of women where they borrowed and instead of paying back to the agent every week, they colluded and murdered her. Here in the gold loan business, substitution, theft, robbery at every transit stage now mirrors early ATM thefts(insider jobs) when ATMs were being pushed.

As it is, the RBI has warned on the lending practice in this area. I personally feel, this is a high risk investment area purely from a finance POV; high interest rates, higher NPAs. Also culturally, if someone is desperate to pledge their gold, they’re most likely over their head in other loans or issues somewhere else.

JB CHEMICALS — value buy (10-11-2024)

JB Chemicals –

Q2 FY25 results and concall highlights –

Revenues – 1001 vs 882 cr, up 13 pc

Gross margins @ 66.2 pc – flat YoY

EBITDA – 285 vs 251 cr, up 13 pc ( margins flat yoy @ 28.5 pc )

PAT – 175 vs 151 cr, up 16 pc ( due reduction in finance costs from 10 cr to 2cr due sharp reduction in gross debt )

Gross Debt @ 82 cr vs 357 cr on 31 Mar

Cash on Books @ 421 cr

Capex spends for H1 FY 25 @ 49 cr

Breakdown of Q2 revenues –

Domestic formulations – 588 cr, up 22 pc ( excluding the Opthal portfolio acquired in Jan 25, YoY growth was at 12 pc vs IPM growth of 7 pc ). Domestic business now constitutes 59 pc of revenues vs 55 pc at the end of Sep 24. Cilacar, Cilacar-T, Metrogyl, Sporolac, Nicardia, Rantac, Razel – company’s leading brands continue to do well. The acquired Othalmology portfolio ( from Novartis ) grew by 19 pc – @ 57 vs 48 cr YoY. Company has a dedicated field force of 100 + MRs for this division

International formulations – 300 cr, up 14 pc. South Africa and US business registered double digit growths. Russian business grew in high single digits

CMO – 94 cr, down 19 pc – due deferment of orders from Q2 to Q3. Expect to see strong Q3 and Q4 for the CMO division

APIs – 19 cr, down 20 pc

Company’s mix of Chronic : Acute sales in domestic mkt at 48:52 vs 37:63 in Mar 19. Chronic share has been inching up year after year

Company’s 5 brands ( Cilacar, Rantac, Metrogyl, Cilacar-T, Nicardia ) feature in top 150 brands in India. Their brand wise annual sales are as follows –

Cilacar ( Anti – Hypertensive ) – 431 cr

Rantac ( Antacid ) – 359 cr

Metrogyl ( Anti-Bacterial ) – 218 cr

Cilacar -T ( Anti – Hypertensive ) – 199 cr

Nicardia ( Anti – Hypertensive ) – 189 cr

Their fast growing emerging brands include – Sporolac ( probiotic ), Azmarda ( used to treat chronic heart failure ), Razel ( used for management of dislipidemia ) and the portfolio of Ophthalmology brands acquired from Novartis ( currently generating an annual sales run rate > 200 cr ). Razel and Sporolac brands have started clocking annual sales of 90 cr and 135 cr respectively

Current MR strength @ 2300+. MR productivity @ Rs 7 lakh + per month

Company is among the top 5 Contract manufacturer of Lozenges in the world. Annual CMO sales are > 430 cr. Expected to be a high growth area

Company’s manufacturing facilities are located @ Panoli ( Gujarat ) – 03 facilities, Ankleshwar ( Gujarat ) – 01 facility and Daman – 01 facility

Excluding the Ophthalmology portfolio, Gross margins improved by 100 bps ( 1 pc ) in Q2 vs Q2 LY ( as the Opthal portfolio has structurally lower margins )

Guiding for full year EBITDA margin band of 26-28 pc for FY 25 ( FY 24 margins were at 26 pc )

Expect the CMO business to reach $ 100 million ( from $ 50 million currently ) annual run rate in 3-5 yrs timeframe. Seeing good business momentum in this segment

Azmarda continues to grow strongly. Should be able to grow this brand @ mid teen rate in the foreseeable future. Razel brand is growing at even higher rates

India business’s volume growth in Q2 was 5 pc vs flattish volume growth for IPM

Capex spends lined up for H2 @ 50-55 cr

When the company acquired Othal – branded portfolio of Novartis India, they were covering aprox 6k ophthalmologists. Company has expanded that coverage to 13k+ ophthalmologists and plan to take it to 16k+ by next FY – this is again a high growth portfolio for the company

Metrogyl franchise ( ie Metrogyl + brand extensions ) is growing in high single digits. Rantac franchise is growing in low single digits

Despite being big brands, Cilacar + Cilacar T continue to grow volumes @ 12-14 pc for last 3-4 yrs

Company has lined up a lot of new product launches ( aprox 20 products ) in the branded generics space for SA + Russia mkts – beginning Q3 next FY. This should accelerate the growth in these geographies in FY 26, 27

Continue to participate in the 2000 cr probiotics mkt with their brand – Sporolac. This is a high growth area. Expecting Sporolac franchise ( ie Sporolac + brand extensions ) to keep growing in healthy double digits

Company has lined up a couple of Injectable products and a throat spray product to be launched under their CMO division

Disc: holding, biased, not SEBI registered, not a buy/sell recommendation

Ranvir’s Portfolio (10-11-2024)

JB Chemicals –

Q2 FY25 results and concall highlights –

Revenues – 1001 vs 882 cr, up 13 pc

Gross margins @ 66.2 pc – flat YoY

EBITDA – 285 vs 251 cr, up 13 pc ( margins flat yoy @ 28.5 pc )

PAT – 175 vs 151 cr, up 16 pc ( due reduction in finance costs from 10 cr to 2cr due sharp reduction in gross debt )

Gross Debt @ 82 cr vs 357 cr on 31 Mar

Cash on Books @ 421 cr

Capex spends for H1 FY 25 @ 49 cr

Breakdown of Q2 revenues –

Domestic formulations – 588 cr, up 22 pc ( excluding the Opthal portfolio acquired in Jan 25, YoY growth was at 12 pc vs IPM growth of 7 pc ). Domestic business now constitutes 59 pc of revenues vs 55 pc at the end of Sep 24. Cilacar, Cilacar-T, Metrogyl, Sporolac, Nicardia, Rantac, Razel – company’s leading brands continue to do well. The acquired Othalmology portfolio ( from Novartis ) grew by 19 pc – @ 57 vs 48 cr YoY. Company has a dedicated field force of 100 + MRs for this division

International formulations – 300 cr, up 14 pc. South Africa and US business registered double digit growths. Russian business grew in high single digits

CMO – 94 cr, down 19 pc – due deferment of orders from Q2 to Q3. Expect to see strong Q3 and Q4 for the CMO division

APIs – 19 cr, down 20 pc

Company’s mix of Chronic : Acute sales in domestic mkt at 48:52 vs 37:63 in Mar 19. Chronic share has been inching up year after year

Company’s 5 brands ( Cilacar, Rantac, Metrogyl, Cilacar-T, Nicardia ) feature in top 150 brands in India. Their brand wise annual sales are as follows –

Cilacar ( Anti – Hypertensive ) – 431 cr

Rantac ( Antacid ) – 359 cr

Metrogyl ( Anti-Bacterial ) – 218 cr

Cilacar -T ( Anti – Hypertensive ) – 199 cr

Nicardia ( Anti – Hypertensive ) – 189 cr

Their fast growing emerging brands include – Sporolac ( probiotic ), Azmarda ( used to treat chronic heart failure ), Razel ( used for management of dislipidemia ) and the portfolio of Ophthalmology brands acquired from Novartis ( currently generating an annual sales run rate > 200 cr ). Razel and Sporolac brands have started clocking annual sales of 90 cr and 135 cr respectively

Current MR strength @ 2300+. MR productivity @ Rs 7 lakh + per month

Company is among the top 5 Contract manufacturer of Lozenges in the world. Annual CMO sales are > 430 cr. Expected to be a high growth area

Company’s manufacturing facilities are located @ Panoli ( Gujarat ) – 03 facilities, Ankleshwar ( Gujarat ) – 01 facility and Daman – 01 facility

Excluding the Ophthalmology portfolio, Gross margins improved by 100 bps ( 1 pc ) in Q2 vs Q2 LY ( as the Opthal portfolio has structurally lower margins )

Guiding for full year EBITDA margin band of 26-28 pc for FY 25 ( FY 24 margins were at 26 pc )

Expect the CMO business to reach $ 100 million ( from $ 50 million currently ) annual run rate in 3-5 yrs timeframe. Seeing good business momentum in this segment

Azmarda continues to grow strongly. Should be able to grow this brand @ mid teen rate in the foreseeable future. Razel brand is growing at even higher rates

India business’s volume growth in Q2 was 5 pc vs flattish volume growth for IPM

Capex spends lined up for H2 @ 50-55 cr

When the company acquired Othal – branded portfolio of Novartis India, they were covering aprox 6k ophthalmologists. Company has expanded that coverage to 13k+ ophthalmologists and plan to take it to 16k+ by next FY – this is again a high growth portfolio for the company

Metrogyl franchise ( ie Metrogyl + brand extensions ) is growing in high single digits. Rantac franchise is growing in low single digits

Despite being big brands, Cilacar + Cilacar T continue to grow volumes @ 12-14 pc for last 3-4 yrs

Company has lined up a lot of new product launches ( aprox 20 products ) in the branded generics space for SA + Russia mkts – beginning Q3 next FY. This should accelerate the growth in these geographies in FY 26, 27

Continue to participate in the 2000 cr probiotics mkt with their brand – Sporolac. This is a high growth area. Expecting Sporolac franchise ( ie Sporolac + brand extensions ) to keep growing in healthy double digits

Company has lined up a couple of Injectable products and a throat spray product to be launched under their CMO division

Disc: holding, biased, not SEBI registered, not a buy/sell recommendation

Journey of Equity investing learnings , growth and scaling (10-11-2024)

I have missed a few multibaggers in journey Waaree , Zen technologies as i was too biased on my idea of valuation . I am now trying to be flexible and add position where valuation could be higher ( perceived ) PE / P/B but buisness and scalability runway is higher .

I have other few bets i have taken in the process but not writing about all of them as they are small position and some have done better and some have not .

Reason i am.writing this post is because i got a portfolio to handle pretty early on when i wasnt prepared . Learning to sell your old winners ( i have trimmed or sold lot of my old holdings inherited ) and moved to new business. This helps to grow the portfolio better if done in a wise manner and can create huge wealth.

I always try to evaluate my risk reward when i buy a buisness .

I would say whats my downside whats my upside . If upside is huge downside is limited go for big allocatio . If downside is also 40% or more add decent position and then average up.

If its too risky bet take a started position and slowly evaluate.

I am still learning and my next learning implementation would be when i will be able to load up big position on business at initial stage when price and valuation are in lot of comfort .

Cheers to learning together and growing together. Have made some greats friends mentors in the process .

Ranvir’s Portfolio (10-11-2024)

Very few people have the courage to go against the standard norm (ex- 15-20 stock PF) and to test new things.Among them, very few people have the courage to openly discuss all these things.Massive respect for you sir, i learnt alot from you.Thank you and keep educating us.

Journey of Equity investing learnings , growth and scaling (10-11-2024)

Elecon gave me the needed confidence now take some more risk as my idea was now i have some buffer i can take some risk .

2022 Gujarat fluoro and HBL were 2 ideas i loved both stories GFL aroudn 3300 & HBL around 95 .

HBL i added initial a 5% allocation and eventually scaled with improving business @ 250 & 270 . Here as well i tried to wait for numbers @130 rs when train accident happened and then HBL never stopped. I still hold my position and havent sold and this is now highest position for me in PF . GFL i sold at 10% loss which was also a 15% size .

Credits where due @basumallick @Anant . Anant detail post and his view on valuepickr had benefitted a lot . It helped to understand the business better as they didnt do any concall.

I have learned from @hitesh2710 @Anant concept of building big positions i am trying to get better as it comes with its own risk . Note – those are my learnings i have tried to pick up its my view not their thoughts which i am penning here .

Scaling a position is what i am trying to go to. Now after lot of practise i can scale upto 20% position . I generally averge up my position basis fundamental and charts . Even if i like story i will add and then wait for numbers / technical volume and price to play out to add further . I prefer cushion of my first entry to add more.

Lt foods (daawat) (10-11-2024)

LT foods management has done a tremendous job in making a brand out of the commodity, no doubt company is trading at premium from it historical multiples but I believe this is because the company successfully transformed the business from commodity to FMGC business. Current EBITDA margins of the company are in the range of 12% to 13% and there is further scope for these margins to expand due to the freight cost coming down once the tensions in middle east eases, also there is a one time gain of 300 crore to 400 crore will be coming to company which they will be receiving from their insurance provider on account of the case won in SC. I have made a detailed video on it, which is pinned to my X profile , one can watch for more details.

X – @amitsinghpal