Hi Prashant,

It will depend on, the industry PE at that time.

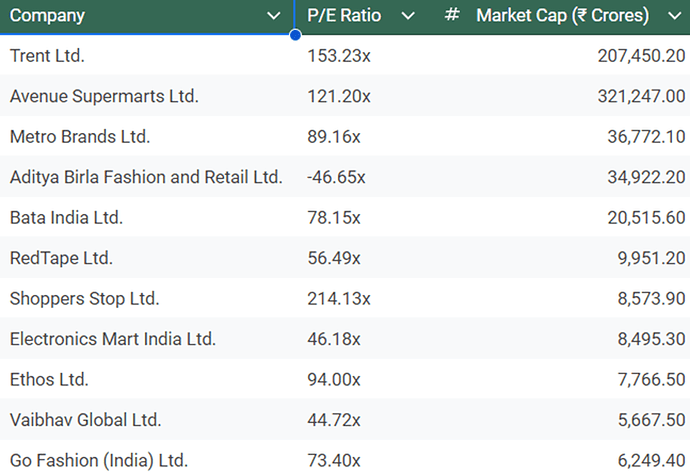

How does Trent Ltd’s forward PE compare to its industry peers currently

Here’s an analysis of Trent Ltd.’s forward P/E ratio compared to its industry peers in the retail sector:

Posts in category Value Pickr

Trent — A value unlocking story from the house of TATA (02-08-2024)

IDFC First Bank Limited (01-08-2024)

Checked with analyst and sharing what I learnt. All my info here are from public sources – concall and research reports like Jefferies, Motilal Oswal etc.

The management has not said they are making 16-18 % ROE on incremental book, instead they have said they are making 20% ROE on normalised basis “in retail assets” because the Capital First lending machine placed on Bank borrowing lines. I have checked the annual report.

So,

20% ROE on Retail Assets

14% ROE for Wholesale,

and approx. 2000 cr loss in Liab, and approx. 300 cr loss in credit cards as spoken in conference calls. To a question on how this loss is arrived, they said it is the transfer pricing to assets at approximately at G Sec rates. He specifically gave an example that if Savings account team raised SA at 6% their income would be 1% (about 7% less 6%). Similarly CA team would be compensated at 7% (about 7% GSEC rate less 0%). Plus the fees they make from branches less the cost of branches, head office allocations for technology, building products, journeys, marketing etc. is Rs. 2000 cr. He said this will continue for a while and then taper off, liabilities takes a long time to build and break even. I found the logic reasonably straightforward. Asset team carries the money from 7%, adds cost of CRR, SLR, PSL cost etc and treats as their cost of funds. (quoting from concall).

So he says if retail loan book is say 1.5 lac cr average last year and equity capital allocated is say 14%, then 21000 cr capital deployed and 20% so they should be making pat of approx say 4000-4200 cr in retail assets.

Similarly on wholesale book of say 30000 cr equity allocated is 4200 cr and 14% ROEon 4200 cr capital can be say pat of 600 -800 cr

Together they have made say 4800 cr on lending business

Less 2000 cr on liab

Less 300 cr on credit cards

They should have made pat of 4800 to 5000 cr less 2000 less 300 = 2500-2700 cr, they posted 2900 cr, so the differential could be because of some treasury gains. So ROA is about 1%. Last year average equity would have been about 29000 cr, so incremental ROE also they are making around 10% only don’t expect 15-16 etc, net of liabilities and credit card losses, on the whole they are making 10% only. Even Jefferies report talks of 9% roe for FY 25 also, so the incremental also seems in this range only.

He then computed the impact of reducing cost to income ratio from 72% to 65% over 3 years as follows:

Income 6.2% NII plus 2% fees= 8.2%. Impact of reducing C:I by 700 bps (72% less 65%) = 56 bps. Post tax increase = 56 bps multiplied by 75%= 42 bps. Currently making roa of 1% add this 40 bps looks like they will go to 1.4% ROA. In this con call someone specifically asked them (hear the end of the call) what will be the ROA he said about flat in this year FY 25, and by FY 27 around 1.4%. you multiply that by 10, for a bank you get to 14%.

Analyst research reports from Jefferies also points to this direction. Its public it says FY 25, FY26 an FY 27 at 0.9, 1.1% and 1.3%. Jefferies guesses ROE at 9, 11 and 13 with PAT at 3084 cr, 4607 cr and 6772 cr, The numbers add up to this only, say 1.3 or 1.4, and ROE at 9, 11 and 13 starting FY 25. Numbers tally, but whether they will deliver such steep increase is to be seen. If you go to page 99 of the investor presentation and page 46 of presentation, then you can see they are making loss pre merger and even on merger basically nothing. Because PPOP of 0.32 (pre merger standalone H1 of IDFC Bank, increased to 0.76 after merger because capital first increased ROA), then in 2020 for full year PPOP was 1.12%. Now if you post 1.12 % for full year after merger, and even if normalised credit cost is 1.%, you basically make nothing. (which is my basic point and grouse all along that capital first should not have merged with IDFC Bank).

From 0 they have come to about 1% will be flat at 0.9 or 1% probably for FY 25 also, they are talking to go to 1.4% in 3 years. If they do if Jefferies is right, it will be a super job, let’s take projections with a pinch of salt, you can share what you feel, whether it is achievable or not. Looks a hard climb. Other things quality of tech, management, culture etc. can be valued if these numbers are achieved, I cannot get my head around these things, this is not my core job. Have been invested from capital first times since long time and tracking them all the while and learning from this topsy turvy journey.

Sharing what I learnt, if you disagree with projections don’t bash me, bash analyst reports they are public have taken from there!

On JLG they are saying floods, heat wave, elections, general JLG market etc. in interviews so cant make out. But they said in concall 1.65% credit cost ex jlg for rest of book and add 0.2% because of jlg so total abour 1.85 including jlg. Which is not an issue, but ifbyou reversr compute, since jlg is 6.5% of book, then 0.2% multiples 13 (100/6.5) is 2.6 pc, so jlg credit cost must be 2.6 plus 1.65 say 4.5 pc or so. Normal for industry is about 2.5 to 3%.

Nirlon- Forgotten Story or A sleepy compounder? (01-08-2024)

In short this company is not good for investment unless someone wants to speculate the company will sell their property and company will get huge capital gains. This will be more of speculation than investment.

Arman Financial Services Ltd (01-08-2024)

let me give some instances where arman was kind-of ahead of the curve in some aspects.

- doing mfi and non mfi businesses under separate entities. rbi has norms regarding how much non mfi business an mfi lender can do. by having separate entities, arman doesnt face these constraints.

- they started individual unsecured lending much ahead of peers in 2017. that too as a completely separate business from mfi, with completely different set of borrowers as well and no overlap with their mfi borrowers. other mfi’s have only recently started individual lending that too to their higher cycle mfi borrowers. by setting up their msme business as a separate vertical, they established separate lending norms, collections processes, operations etc. which they have been replicating since then. only recently under pressure from their own mfi team, arman has started individual lending to their higher cycle mfi borrowers.

- they have been almost always the fastest movers in switching off business (during demon and covid), biting the bullet and taking the pain early on (no mass scale deferrals/restructurings, taking provisions quickly) and this enabled to recover faster than peers.

- piloting newer businesses such as rural 2W, gold loan (dropped; for now), micro LAP (start-stop and now started again after getting due comfort in their underwriting and other processes), exploring other businesses such as cv etc.

they were also the earliest to call out that the pre covid credit cost levels of around 1% are a thing of the past. at that time they had said they expected 2-2.5%. which did come about. and now they think it could be higher. whether it is temporary and whether it would settle back to 2-2.5% levels, only time will tell.

whether it can fall more, whether it can become cheaper? sure it can. i dont know.

how soon will dust settle down for mfi sentiments, if at all, is also tough to guess/gauge for now.

like i said it is a waiting game, and it is quite alright if anyone does not want to play it. its tough to suggest a buy in any mfi at the current juncture.

Bull therapy 101-thread for technical analysis with the fundamentals (01-08-2024)

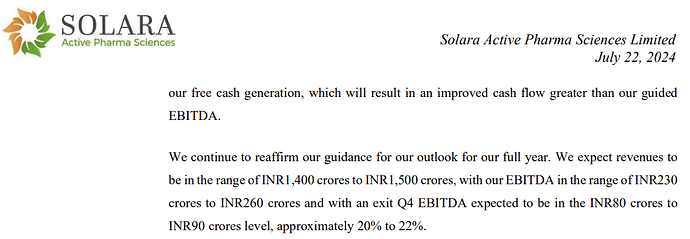

Solara Active Pharma – New 52 week high today. Technically, stock entering possibly in Phase 2 after a good Stage 1 basing period of 2.5 years.

Management has guided for 1400-1500cr topline and 230-260cr of EBITDA with Q4 EBITDA of 80-90cr. IF these numbers are delivered then current valuations are reasonable. IF their CRAMS business starts contributing – then this can become more than FY25 numbers play.

Disc: no position

SG Mart- Can it successfully create a marketplace? (01-08-2024)

This must be an older document right?

Arman Financial Services Ltd (01-08-2024)

@sammy11 – I have entered the stock probably at the wrong timing. 20% loss right now. However, I invested in this stock given its past resilience and being the fastest growing MFI. However, I see the following challenges –

-

The GNPA number is increasing from last 3 quarters → 2.5% (Q2), 2.8% (Q3), 2.9% (Q4). This is a bit concerning.

-

Management has said that the honeymoon period for MFIs has been over. So, the 40% AUM growth is at risk also.

-

The other MFIs are performing extremely poorly on valuations, with exception of Credit Access Gramin.

Fusion – 1.55 P/B (RoE – 17.9%)

Muthoot Microfin – 1.47 P/B (RoE – 20.4%)

Satin Creditcare – 1 P/B (RoE – 21%)

Credit Access Gramin – 3.21 P/B (RoE – 24.8%)

All these factors give lower the confidence. I am not sure when to average more. Arman is still at 2.3 P/B. Is this the bottom? Or are we looking for more correction?

I am awaiting results. Will invest post that I guess. Any counter opinions?

Mankind Pharma – Next Big Pharma Player? (01-08-2024)

Mankind Pharma –

Q1 concall and results highlights –

Revenues – 2893 vs 2579 cr, up 12 pc

Gross profit – 2081 vs 1759 cr, up 18 pc

Gross margins @ 72 vs 68.3 pc, up 370 Bps

EBITDA – 686 vs 655 cr, up 4 pc ( margins @ 23.5 vs 25.5 pc ). Adjusted for one time M&A related cost, EBITDA would have been 728 cr, margins would have been 25 pc

PAT – 543 vs 494 cr, up 9 pc

Cash on books @ 3750 cr

Domestic sales grew by 9 pc ( growth in domestic business impacted by delayed onset of anti – infective season )

Export sales grew by 62 pc !!!

Domestic : Export sales ratio @ 91 : 9

Chronic : Acute sales ratio @ 39 : 61

Company’s domestic Mkt share share @ 6.1 pc ( second largest after Sun Pharma )

In Q1, Company Acquired Bharat Serums and Vaccines for 13,630 cr. This translates to 22-23 times FY 25 EBITDA that BSV is expected to clock. To be funded by cash on books, debt and Equity ( if required ). Transaction expected to close in 3-4 months

Some brands where BSV enjoys 100 pc Mkt share in India are –

Rhoclone ( Injection – prevents formation of antibodies after a person with Rh-Negetive blood is given a transfusion with Rh-positive blood ) – FY 24 sales @ 180 cr

Thymogam ( immunosuppressant injection )- FY 24 sales @ 32 cr

ASVS ( anti Venom Injection ) – FY 24 sales @ 41 cr

Other dominant brands where BSV is no 1 / 2 in domestic mkt are –

Hucog ( infertility treatment – injectable )- FY 24 sales @ 63 cr

Humog ( supports ovulation – injectable ) – FY 24 sales @ 55 cr

Luprodex ( used in treatment of prostate cancer – injectable ) – FY 24 sales @ 37 cr

Foligraf ( infertility treatment – injectable ) – FY 24 sales @ 35 cr

BSV ltd reported sales of 1723 cr with 28 pc EBITDA margins for FY 24

Company in-licensed Symbicort ( inhaler – for Asthma ) from Astra Zeneca and launched in Q1. Seeing good traction

Also in-licensed Inclisiran ( lipid lowering – injectable ) from Novartis in Q1

Company’s OTC business reported flattish sales @ 206 vs 208 cr. Their popular OTC brands include – GasOFast, PregaNews, ManForce, AcneStar, Unwanted 72, HealthOK

Company’s EBITDA margins in their OTC / Consumer Healthcare business are @ 20 pc

After the acquisition of BSV ltd, company shall emerge as the No 1 player in the Gynae therapeutic segment

Capex for Q1 @ 125 cr

For FY 25, company is guiding for EBITDA margins for 25-26 pc

Company’s EBITDA margins in Q1 did not rise despite the sharp rise in gross margins as the company launched a number of new products in Q1 and there were higher marketing spends in Q1 to support them. These spends should moderate going forward

Company believes that BSV’s business is under – levered and Mankind’s distribution can help improve growth and margins of BSV’s business

The difference in gross margins of Chronic vs Acute business are > 10 pc ( similar figures were given by Alkem Labs in their Q4 or Q3 concall LY … quoting from memory )

Company’s In-Licensed brands give them a foot in door when it comes to high end Hospitals / Clinics / Doctors. These deals do enhance the company’s reputation in a big way + these In-Licensed products are limited competition products

Company believes, it can sustain 70 pc kind of gross margins in the medium term

There will be merger related costs that ll come up in Q2 as well

Company may raise around 3000 cr via equity route to fund the BSV ltd acquisition. At current valuations ( that Mankind trades, I think it makes sense to raise equity )

Confident of accelerating the BSV Ltd’s growth rates to much higher levels due to speciality + complex to make + monopoly products ( under patent ) – that BSV offers

Disc: holding, should do well over medium term ( IMHO ), biased, not SEBI registered, not a buy / sell recommendation

Arman Financial Services Ltd (01-08-2024)

hi…i have been invested in arman since 2016-17. what kept building my confidence in the company, the promoters, the management and the team was the way they handled every crisis – demon, ilfs, gst, covid and various other intermittent issues such as floods, elections etc in between.

it seemed as if everytime the company was coming out stronger and better prepared for the next eventuality.

being a high beta play in lending, mfi has always been susceptible to more swings than a normal more diversified lender. but the cross cycle performance of arman has been quite remarkable. and there are not many players who have been able to consistently do this.

it was felt that it was easy to do mfi business and hence many lenders entered the sector. banks took over nbfc-mfi’s thinking it was easy business. moreso after recent rbi relaxations. but many took many missteps and ones like arman and creditaccess who just played it the right way came out stronger, even after getting affected by the same circumstances that afflicted other players.

jlg mfi is more an operations game than a risk game. so consistency, uniformity, simplicity, etc. is the key. ofcourse, it is also important to navigate the risk scenarios, which come in spikes. but how one manages the business during “normal” times is what sets it up to weather the next crisis.

i cannot suggest or recommend, but arman probably looks like it is very near the cheapest levels it has quoted.

sentiments are poor right now given rbi glare on unsecured lending, high growth, visible stress in certain pockets. but by and large, the mfi borrowers are of the resilient nature and typically losses are because of inability and not intention.

improvement in rural economy, some self corrective steps taken by the mfi’s (in terms of moderating growth, increasing provisions etc) under guidance of the self regulatory authorities like mfin and sadhan, may give some comfort to rbi.

mfi remains critical for financial inclusion and that is recognised by finance ministry as well as regulators.

someone interested in the company and the sector will just have to wait it out i guess.

Zomato – Should you order? (01-08-2024)

Zomato has come out with good numbers in Q1FY25. Food delivery Gov grew 27% with margins of 3.4% and Blinkit GoV grew 130% at breakeven margins. Blinkit added 113 stores on base of 526 in the quarter (~20% growth)

The key points I am tracking from my earlier post here –

| KPIs | Expectation | Reality |

|---|---|---|

| Food Delivery GoV Growth | 20%+ | 27% |

| Blinkit Gov Growth | 70% | 130% |

| Adj EBITDA Food Delivery | 4-5% in 2-3 years | 3.40% |

| Ad. EBITDA Blinkit | Can reach Food delivery numbers | -0.10% |

| Store Count Blinkit | 1000 by FY25 | New target of 2000 by FY26 |

- In Q4FY24 letter, management said there will be pressure on margins in blinkit business due to rapid expansion in stores but on positive note the margins have improved QoQ despite expansion.

- Also management gave target to have 1000 Blinkit stores by FY25, now they have given 2000 as optimistic target by FY26. This is 3x growth from current number. Today average GoV per store per day is 10 Lac. This number has increased despite rapid expansion in last year. Even if this sustains at 10L and 2000 stores are online by FY26, GoV can be 60-70K Cr. At 2-3% Ad. EBITDA margin (less than management’s vision), Adj. EBITDA from Blinkit can be 1500-2000 Cr in FY26 itself. This is upward revision to my estimates earlier when I was estimating GoV to be 1000-1500 Cr from Blinkit in FY27

– Add to this 2000-2500 Cr of Adj. EBITDA from Food delivery, total Adj. EBITDA can be 3500-4500 Cr in FY26 and they might end up beating my FY27 estimates of 4000-4500 Cr Adj. EBITDA