From the above Costcard , you can find out the Ex-Distillery Price (EDT) for Indri which is Rs 21,000 for 9 litre case (12 bottles x 750ml).

Posts in category Value Pickr

Hariom Pipes Ltd: A Capex Play! (08-11-2024)

@SwapanBansal , thanks for your detailed analysis earlier. You have been quite passionate and very much consistent in providing the business level update for this scrip. Also thank everyone else for adding the details.

I have a few points that i want to mention here.

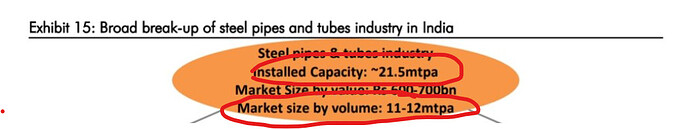

- @SwapanBansal : your analysis mention earlier as the below exhibit. Does this mean that the industry installed capacity is more than market size? I am sorry if this sound stupid question but do we have any view of estimate market size in India? ALso i see that other players are also doing capex to increase capacity what is the scenario here? I think it is important to understand this in order to be able to completely understand the 2x growth they are planning to achieve, though i do not deny their growth story.

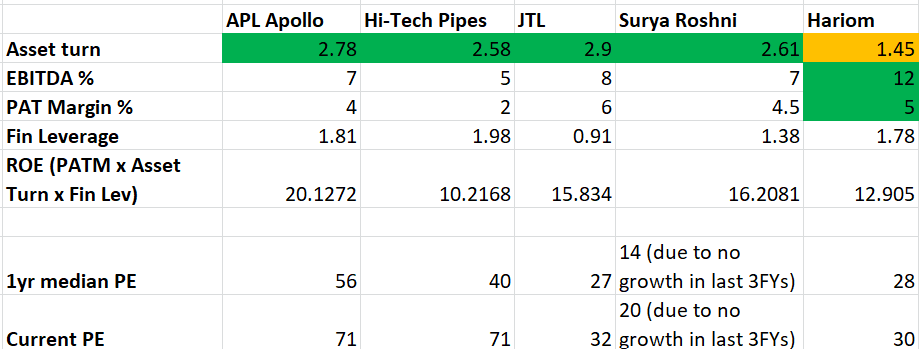

- I have observed that the ROE for Hariom is just matching the other players (if not below), and main reason i can see is the asset turns for Hariom is significantly lower. All other competitors operate at >2.5x of asset turns while Hariom is <1.5. WHat is the reason for this? I can understand that this may be partially because they produce VAP as opposed to the commodity. But this may not be the sole reason behind the significantly lower asset turn. If they can achieve the same asset turns as the peers, this can be a very big game changer given that they are already working to improve PAT margin by reduction of debt. Currently they are just able to match the ROE in fact it is lower than peers) as the peers because of a little higher PAT. This is also one reason they have lower PE than peers i believe.

Infollion Research Services Ltd – Moated Microcap with Differentiated business? (08-11-2024)

Hi,

I was looking at the PEG ratio; currently, it’s above 1. Does anyone here have a view on Infollion Research’s realistic valuation in the medium term (1 year)?

Samhi Hotels – Turnaround with Tailwinds (08-11-2024)

Only problem for low valuation now is shareholding structure, best case scenario is some big corporate house make a bid for controlling stake which is a real possibility, projected EV/EBIDTA is 10 for FY25, even takeover cant happen below 400 levels else it will be slow grind during upward journey post 230 levels. Invested for at least 3 years here, let the events unfold. STOCK WILL FIND ITS OWN RATE. One if best bet in current markets

Trent — A value unlocking story from the house of TATA (08-11-2024)

The stock reaction reminds me of the song “Ye to hona hi tha” ![]()

Sooner or later that was meant to happen because of various factors like human psychology, inertia, tendency to extrapolate etc. etc. The expectation & estimates were very high so even an excellent result resulted in drawdowns…guess most of the momentum investors quickly left the ship.

Looking little closely at the numbers, EBITA was closer to expectation but net profit was not because of reduction in other income and increase in depreciation cost. Maybe people with strong accounting background comment on depreciation costs for retail companies and see if this was expected and within healthy limits. Is this a result of too many store opening and we must expect this cost to bump up later as stores grow older? Don’t know much here…

Long story short – The exuberance has to end or consolidate at some point of time or other. Although very painful, especially for those who have large portfolio percent invested in the concerned company, but can be healthy over long term.

Personally, I trust the promoters, management, business and the new growth paths that they keep creating for themselves – I would not read too much into them like Star’s growth, Beauty, international etc. as they are very small now but intention & direction is right. I was mentally prepared for this crash and even more correction, although my largest holding & very painful, so needed a numbness pre-medication. At some point of time, I would be a repeat buyer again to add.

Disc: Largest holding so very biased. Not a buy/sell recommendation. Not eligible for any advice. Views only for learning and I can be wrong in all my assessments

KDDL (Ethos Watches) – Scalable business model at an inflection point? (08-11-2024)

Attended the call today. Few of the pointers and honestly a mixed takeaway:

Most of the questions were asked about proposed GST structure and impact on sale.

Next set of questions primarily focused on margins taking a hit and they were aptly answered that due to new store openings, forex fluctuations, they had taken a hit.

Few questions that I would’ve loved to ask but will write to them anyways –

The business growth in Metro vs non Metro and how’s it looking.

CPO business growth– there’s not a huge delta between the growth in CPO and overall growth. A lot of exuberance was there about it a year back and now in the garb of expansion, it is not getting the same importance atleast in calls.

The repeat business and rising ASPs– If it’s fair to assume that their customer segment is now stabilised and we can see stable ASP growth or will it start to plateau now. The ASPs have grown upwards of 2 lakhs now.

Confused about– The management stated that they’ll now do half yearly calls. Now Pranav Saboo has been spearheading the last few calls and it’s okay that they want to focus on long term strategy but still don’t understand why this call has been taken all of a sudden when next 2 years are all about store expansion and lot of new initiatives are being taken.

All in all, still very bullish on the theme but I invested here initially because of Yashovardhan Saboo and while the leadership transition has possibly happened but seems like his focus is more towards KDDL.Will see now how business progresses. The valuation is anyways steep.

Disclaimer- A very big holding and have added in last few weeks as well post GST news when the stock corrected.

Samhi Hotels – Turnaround with Tailwinds (08-11-2024)

Revenue grew 21% YOY, I think they felt short of expectations by some 5% to 6%.

Piccadily Agro Industries Ltd (08-11-2024)

Thanks for this insight! Do you have any idea what would be the Revenue/Cask for Indri?

Ranvir’s Portfolio (08-11-2024)

After reading few stock list I left it. But I am curious to know , with close to 80 plus companies stock. What is your XIRR or CAGR you are making? This year or last 2 years. I am keen to know if it is worth to take so much of pain.