@Investor_No_1 @Devsuman What’s your take on Trent Q2 results and recent turbulence in stock price? The company delivered strong performance with a 47% profit growth and 41% EBITDA growth on QonQ basis. Seems too much price reactions despite of good set of numbers.

Posts in category Value Pickr

Unemployed investors portfolio (08-11-2024)

Hey! May I know on what basis do you say stable growth for Contrast Media over the next 5 years? What is the trigger? Thank you!

Piccadily Agro Industries Ltd (08-11-2024)

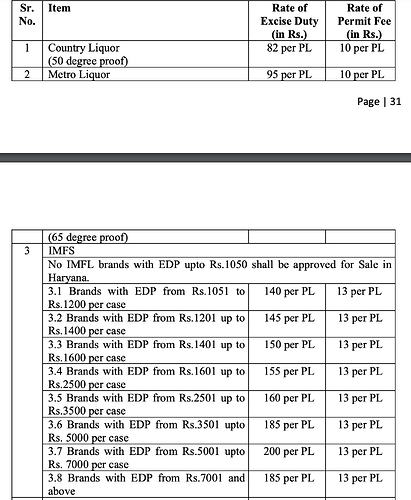

Yes, excise is a smaller portion for premium alcohol…Check out this cost card from a state government for premium vs non-premium alcohol. Compare Indri vs Piccadily’s Whistler…huge difference in % excise charged – Indri excise is ~10% whereas for cheaper whisky its a very high %.

Piccadily Agro Industries Ltd (08-11-2024)

I’m no expert, but my guess is that as the liquor gets more premium, the excise duty as a percentage of the bottle price becomes lower as per the data below (hope I’m referencing the right document/numbers).

For country liquor and cheaper priced alcohol (where most of the sales for established brands comes from), the excise duty is Rs. 82 per proof litre (where the bottles cost Rs. 180-200), while for brands like Indri it would fall in the Rs. 160 range per proof litre. Even though the proof litre as a percentage of the total quantity is slightly higher than single malt brands such as Indri, even if we assume the same percentage, they work out to 30-40% of the bottle price vs 5-6% for Indri (assuming its price is Rs. 3,100).

https://haryanatax.gov.in/HEX/DownloadPDF?formName=/ExcisePolicy2024_25/Excise_Policy_2024_25.pdf

Additionally, the CFO seems to have resigned. Any red flags here or is this just a coincidence?

Disclosure: Holding this stock, biased.

Equitas Small Finance Bank: A Profitable lender to small businesses (08-11-2024)

Some of the challenges before bank was facing are being improved here like due to higher rates interest nii was concern,now it is improiving. Likewise there is stress in microfinance sector and gold loan sector as well of which microfinance is 18 percent of whole loan book. In bad times as well bank is resilient from core remaning problems could be solved in 3-4 quarters. As per some experts in gold loan sector, the real stress would come in q3 and q4 lets see how bank would perform.

Piccadily Agro Industries Ltd (08-11-2024)

Trade receivable for 31.03.24 were 136.55 cr and now they are 135.21 means they have decreased by 1.34 crore.

But the cash flow statement mentions other receivables of 250 crores. What these other receivable could be?

Bull therapy 101-thread for technical analysis with the fundamentals (08-11-2024)

Thank you for your valuable insights. Any view on genesys promoter selling a large block (almost 4% ) last week? Kinda surprising that promoters are selling with such large growth potential ahead

Equitas Small Finance Bank: A Profitable lender to small businesses (08-11-2024)

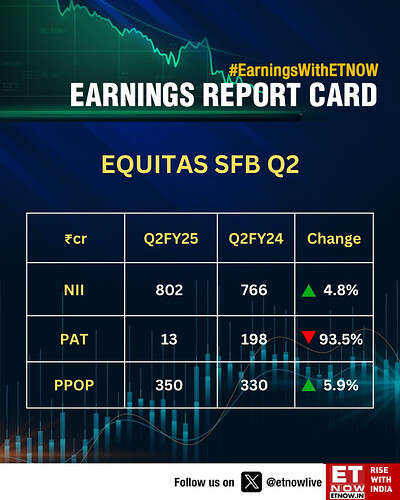

Equitas Small Finance Bank’s Q2 financial performance showed mixed results, with a sharp decline in net profit but solid growth in interest earned year-over-year.

Key Points from Q2 Results:

- Net Profit: The bank’s net profit fell drastically to ₹13 crores, a ~93.4% year-over-year (YoY) decline from ₹198 crores. This sharp drop was well below the market’s estimate of around ₹158 crores and was largely impacted by an increase in provisioning for potential loan defaults.

- Interest Earned: On a positive note, the bank saw a YoY growth of ~14.7% in interest earned, reaching ₹156 crores, up from ₹136 crores in the previous year. This increase suggests a growing loan book or higher interest rates that boosted the interest income.

- Asset Quality: The bank’s asset quality weakened, with Gross Non-Performing Assets (GNPA) rising to 2.95% from 2.73% quarter-over-quarter (QoQ), and Net Non-Performing Assets (NNPA) increasing to 0.97% from 0.83%. The rise in NPA levels signals a deterioration in loan quality, possibly due to macroeconomic challenges affecting borrowers’ ability to repay.

- Provisions: Equitas increased its provisions for potential loan losses to ₹33 crores, up from ₹30 crores in the previous quarter. This conservative approach to provisions may be in response to the rise in NPAs, which often indicate higher risk in the loan portfolio.

The decline in net profit despite an increase in interest income reflects the pressure from rising NPAs and higher provisioning costs. The positive growth in interest earned shows that the bank’s core lending business is growing, but the increase in provisions and deterioration in asset quality suggest challenges in maintaining profitability amidst economic uncertainties. Equitas’s conservative provisioning could help safeguard against future risks, but it will be important for the bank to improve asset quality to stabilize earnings.

This Q2 performance may also affect investor sentiment, given the gap between actual and estimated net profit, and the rising NPA levels are likely to remain a key area of focus in the coming quarters.