https://www.financialexpress.com/market/embassy-reit-may-approach-sat-against-sebi-order-3657349/

Posts in category Value Pickr

Yatharth Hospital & Trauma Care Services Limited (07-11-2024)

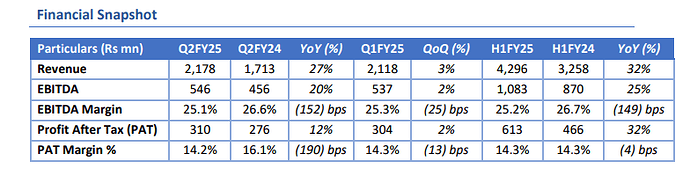

Good Quarterly Result –

Source – https://www.bseindia.com/xml-data/corpfiling/AttachLive/514ca299-f654-4c53-ad9c-8a39393e3a2a.pdf

Great articles to read on the web (07-11-2024)

Projections should capture our imagination, sure, but here they seem to be over the top ![]() ! Corporate Profits cannot be ~ 90% of GDP in 2047 from say less than 5% of GDP in FY 2024 as stated.

! Corporate Profits cannot be ~ 90% of GDP in 2047 from say less than 5% of GDP in FY 2024 as stated.

From 2001 until 2014, India’s GDP (at > 11% pa) grew by more than 4 times from $ 485 billion to $ 2T. However it grew by just ~ 85% from $2T in 2014 to about $ 3.6 – $3.7T in FY 24 (~ 7% pa). That is a considerable slow down in the rate of compounding, for whatever reason, including possibly base effect.

To get to $ 30T by 2047 means a far higher rate of compounding at 9.6% p.a. And that too for 25 continuous years! This is a nearly impossible feat achieved by no country, including China. Even China’s miraculous growth of 9% for about 25+ years was achieved by a fortuitous global environment, among other things.

Much as I am hesitant to be a party pooper to “bandwagon” investment; there are just too many presentations extolling India, and Indian markets peppering with overworked phrases like Amrit Kaal etc. So it may be good, nay, a duty even to provide a balancing view, so we may know if we are unconsciously wearing the cloak of false pride with not much underneath!

I am living in Singapore currently, and have been investing in and travelling to US / Australia / Japan / UK / Vietnam and Singapore ofcourse. I subscribe to and read business newspapers from these countries, regularly interact with management and investors. I am also very meaningfully invested in India equity markets.

So what do I see from here?

From an markets standpoint (equity / debt etc), money has been retreating from China but is not coming into India. Of course some small money will always, but it is puny in comparison. Foreign money is flushing into money markets / equity in US, equity markets in Japan even though they get single digit returns / FX volatility. The perception has worsened over the past many months; and papers write about how the Indian regulator chief is in many cross hairs. Which foreign fund manager wants to take a career risk then?

We all have heard big money is in private equity. Out here I can see that it is terrifyingly big. Just one firm Blackrock has $ 11 T in AUM (all inclusive). 11 T is just one firm with two times India’s market cap! Reading headlines of newspapers will tell you that they are just gobbling up assets all over the place, in all industries,…but very very little in India. KKR says of their Asia Pacific investments 17% of the assets in India, same as their assets in Australia – whose population is smaller than Chattisgarh!!!. 40% of their assets is in a country which has among the world’s fastest ageing and declining population, Japan. Not in the country with the highest population, best demographic dividend and with an opportunity to grow in Amrit Kaal ![]() ! Foreign investors in start-up ventures are smarting heavily with losses (ask Prosus) battling a legal system that is labyrinthine.

! Foreign investors in start-up ventures are smarting heavily with losses (ask Prosus) battling a legal system that is labyrinthine.

If you look at India’s Net FDI in FY 2023 – 24 from RBI’s Bulletin, you will see that it is only $ 10.129 billion! A country of Vietnam’s size gets more.

So foreign investors may do all the great PR that we want to listen; but give very little from their purse. (We may want to think about why Hyundai Parent listed their Indian arm in India and took their money out)

Many business men / investors feel India is not easy to do business, so better to do it in other places even if expensive.

Simple matters like transacting between an Indian entity and forieign entity in foreign currency requires paperwork that takes days. To provide payment to a foreign entity without deducting TDS, one has to get a TRC, file 10F, hope the bank’s back office does not create problems etc etc. It gets too much for a new overseas entity. Managing currency risk of the Rupee without easy convertibility is another headache. All this when world had moved towards much simpler ways of doing business gives the perception that India is a business island. So when AK presentation says exports will be 14 – 15% of Global Trade from 4% today, when our exports have not even kept pace with GDP (peaked as %age of GDP in 2013), it feels like a bad joke.

India is behind on many many other counts that are important to investors. For eg the legal infrastructure is creaky, leaky and takes a lot of time. Centralized systems are unable to create quick resolutions. Something as important as harmonising accounting standards are not done. IFRS 9 for eg, which provides for ECL, adopted by banks wef 2018, is not yet adopted by Indian Banks and keeps getting deferred. Similarly IFRS 17 – a whole new accounting revamp for insurance companies has not yet been adopted by India – which again makes it difficult to evaluate and judge for investors.

Regulators in these countries understand that for businesses any delay is lost money, so as quick a resolution as possible is adopted as an attitude. Not here.

Our pride may hurt enough to ask, “does this mean that other countries are very clean, fast and perfect”. True, but they don’t keep saying we are in Amrit Kaal!

Make no mistake India offers great potential, but real work has to be done to convert that potential into reality, not by the bluff of figures like $ 30 T by 2047.

Xpro India – getting bigger? (07-11-2024)

Ahh okay thanks. Anyone attending the meet pls share the notes.

NCC: Extremely undervalued (07-11-2024)

Does anyone know the reason behind subdued topline growth (yoy) and de-growth (qoq)?

Q2 of last year also had an one-time net impact of 200 crores. If we consider that, then topline de-growth yoy as well.

Share prices have gone up looking at the non-adjusted numbers and see the profits have doubled.

All E Technologies, making businesses ready for AI (07-11-2024)

Thank you. I concur with your views. Listening to their concalls somehow gave me a lot of confidence about the sincerity of the management (subjective opinion – I could be wrong).

Theoretically there should be a huge scope to service MSMEs, digitalise their business processes, implement ERPs, etc. What Mr Mian mentioned on the calls was that their ‘consultants’ do consulting and BPR work and not just implement products from the MS suite. Now what kind of value added consulting, BPR kind of work they are able to do would depend on the calibre of their personnel. I imagine it would be a challenge for a tiny company in this space to get high calibre consultants, so that would be a key constraint for them to go up the value chain. But yes, he kept emphasising that a larger share of US client mix would be the key driver for margin expansion.

Sanghvi Movers (07-11-2024)

Any inputs on this ?

Pricol limited – OEM automotive (07-11-2024)

Now there will be some consolidation for pricol in terms of business and there is also uncertainity whether company could achieve 3200 cr revenue as guided earlier by 2026 as exports just contributed 6.5 percent of revenue in this quarter

MSTC Ltd.: Growth through to E-Commerce (07-11-2024)

Hi Akshay,

What are the opportunities we see for MSTC to grow from here?

Just Govt sell-side ecommerce – MSTC seems to be charging very small amounts – What can we factor/project?

Vehicle scrapping – Seems to be taking sweet time (Further other players like Tata motors are also in the market I guess).

New initiatives – Is there a clarity on what the new initiatives are ?

Anything else?

Pl share the info/factors if possible . Will be very helpful

Disc: holding – decent portion of pf and evaluating whether to hold or get-out.