Impact can now be seen in the numbers, reduction in margins due to hiring for new capex and increased depreciation giving double blow to bottomline.

Posts in category Value Pickr

Hitesh portfolio (04-11-2024)

Hi @hitesh2710 Sir, would appreciate your views on the below aspect:

At a time when quite a few chemical companies are exhibiting signs of delivering a strong upward momentum in the near future (for example, OAL – Oriental Aromatics), Manali Petrochemicals, after giving a glimmer of hope couple of weeks back, is lagging behind.

I would be grateful to you if you could please share your thoughts on Manali Petrochem esp. from a techno-funda aspect.

Sugar Cycles: 7-8 years of losses followed by 2-3 years of super gains! (04-11-2024)

ethanol was supposed to be better than sugar. but at current prices sugar makes more margin than ethanol. thats why ISMA is pushing for higher prices. govt is in a fix as they have raised cane prices (cane prices in India are 15% more than Brazil) and so will have to raise ethanol prices. currently price of ethanol is 8 to 10% more than petrol… and inflation is increasing due to fuel !!

Balrampur has a lower % of revenue from ethanol compared to other sugar companies so ethanol leading to better valuation doesnt hold good. even then it is getting higher valuation… because their recovery has improved and sugar prices are high.

Forensics and the art of triangulation (04-11-2024)

Every bull market creates excesses… However, in India, every time the perpetrators remain same.

Perhaps, it is embedded in genes, hence cannot be modified.

Those who wish to ride Anil Ambani comeback should take notice.

I congratulate BS to have courage to publish this.

Business Standard Article.pdf (130.8 KB)

Companies With First ever concalls OR Investor Presentations (04-11-2024)

(post deleted by author)

Great articles to read on the web (04-11-2024)

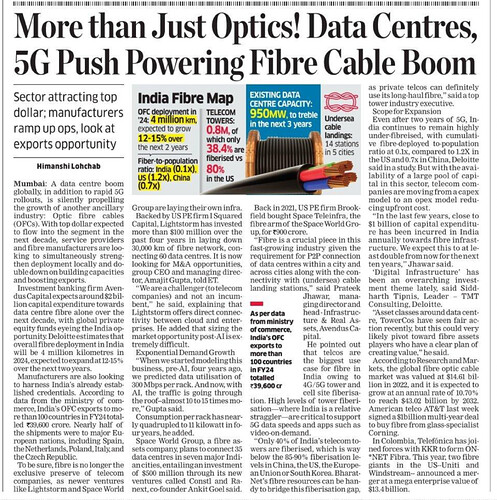

Article in ET on the potential of optical fiber. Some stats are interesting.

India has about 8 lakh cell sites with less than 40% fiberised. It requires almost 80-85% fiberisation for 5g and high speed broadband services .

Connnecting data Centers using standalone enterprise networks is catching up . AI Data centres need much bigger pipes

Shree Ganesh Remedies Limited (SGRL) – A pioneer in API intermediaries and Speciality chemicals? (04-11-2024)

First ever Concall on 8th November:

EFC – Entrepreneurial Facilitation Centre (04-11-2024)

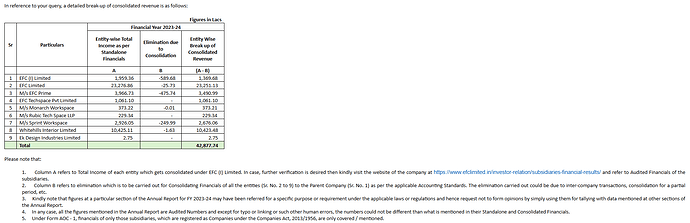

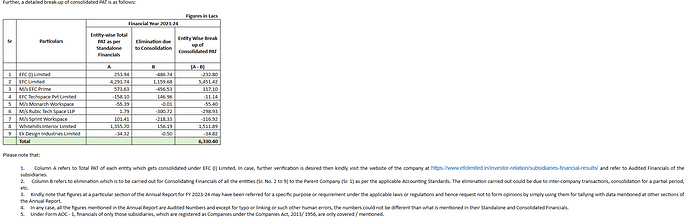

I have sent an email to the company with similar queries and have also asked them about the total number of employees working with the company. I have received a response for the breakup of revenue and PAT numbers. The question on employee count was not answered (may be missed). Below is the response that I have received on their numbers.

Jindal Drilling – Beneficiary of a sustained offshore upcycle? (04-11-2024)

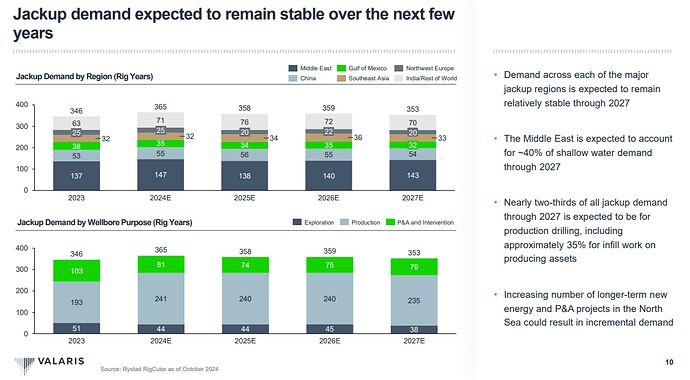

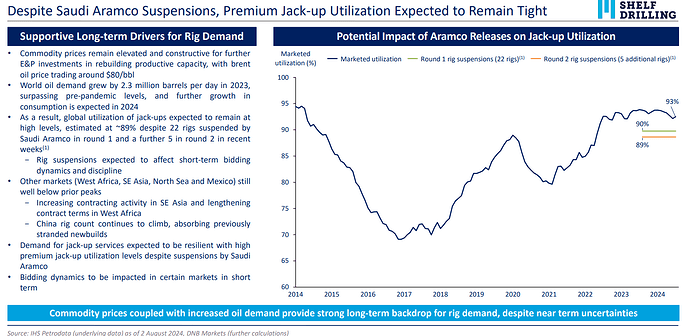

I don’t have a view beyond the commentary of global jack-up operators. What is clear and should have a bearing on the cycle, is that new supply is almost non existent.

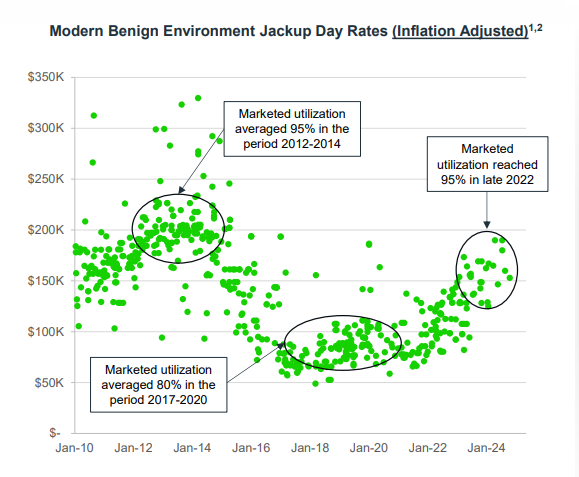

And as you rightly pointed out, even at current day rates, justifying ordering a new jack-up rig is not sensible because return on capital is well below cost. Newbuild jack-up rig quotes range from 200mn-300mn USD depending on specifications and at 90k USD/day jack-up rates and even assuming aggressive EBITDA margins of 50%, the return on capital employed ranges between 5.5%-8.5%, significantly below any reasonable estimate of cost of capital.

This is why you see offshore asset managers like Valaris talking about returning cash to shareholders rather than deploying them on new assets. This is why the orderbook to fleet ratio is as low as it is and thinking logically, this supply crunch should continue for the foreseeable future. Also time to build a new rig ranges between 2-3 years, so even if new orders come in, for the rig to add to fleet supply, there will be a delay of 2-3 years.

Some data on current jackup outlook, utilisation and day rates from Valaris’s Q3 PPT and Shelf Drilling’s Q2 PPT.

So the global cycle looks robust judged in terms of the supply side. The jack in the box is of course global demand which nobody can predict. But as long as oil prices are above 60$/barrel, industry research seems to suggest that there will be no significant cutdown in offshore drilling volumes by E&P companies.

Some near term risks specific to Jindal Drilling which should be closely tracked

- Further suspension of rigs by Saudi Aramco can sour the mood for the entire jackup market (27 rigs dehired by them so far in CY24)

- ONGC has been trying hard to bring down day rates for their contracts as seen by them playing hardball by cancelling/postponing two tenders for 7 jackups in June and Sep. How that resolves will be critical for Jindal Drilling in the medium term. In the near term (8-12 Qs) it may not matter as much because the three rigs coming off contract in CY25 and CY26 all have present operating day rates in the range of 38k-48k/day and any new contracts in CY25 and CY26 should be at higher prices as things stand.

Jindal Drilling – Beneficiary of a sustained offshore upcycle? (04-11-2024)

Very good post @nirvana_laha

- Given that this is a rental business of sorts, what has caused the extreme volatility in earnings over the last decade? Ex of covid, margins have varied -40% to +38%.

I would have assumed a more gradual change in margins as old contracts run-off and new ones come with market pricing prevalent.

In this context, in what scenarios can we see margins collapsing? (given that pricing is fixed for 2-3 years)

- How should one think of economics of rigs if one had to put up fresh capex? if I spend $100mn in putting up a rig, what kind of ROIC/IRR should I build in and how? @Deepesh_Punetha has touched up on it, but would be good to double click.

- What is your sense of the use of the large cashflows? Will they return or are there relevant reinvestment opportunities?