they have met the guidance on growth and EBITDA – one at the higher end of the range and other at the lower end of the range

Posts in category Value Pickr

Jubilant Foodworks (23-10-2024)

If they get the coca cola bottling deal, will it impact jubilant food?

Par Drugs & Chemicals Ltd (23-10-2024)

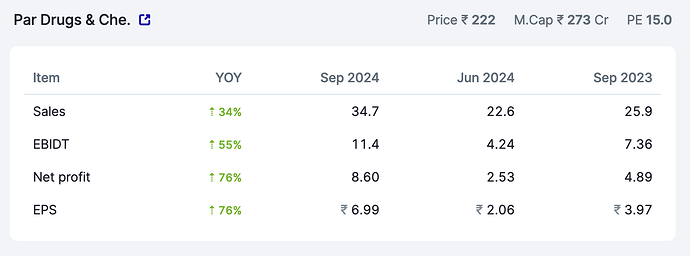

Results – Q2 FY’25

Some fabulous numbers posted by Par!

If we take a closer look at the quarterly numbers, we can point at:

- Highest ever OPM at 33%

- Other income of 1Cr

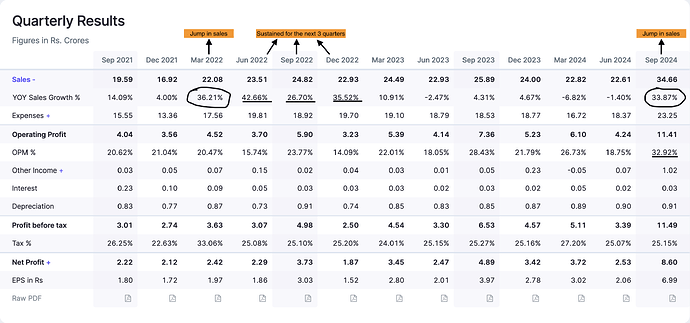

- Is this one-off growth? Well, the last time Par saw a jump in revenue of a similar scale (marked in the diagram below), the revenue was sustained for the next quarters too. Can we assume a few good quarters ahead?

Margins

Highest ever margins, and that is a testament of Par’s focus on constantly improving their product quality and efficiency. In their annual report, they mentioned introducing high-value products that might have helped boost their margins.

Over the past year, we have continued to expand our product portfolio, targeting new application segments and introducing high-value products that resonate with diverse market needs.

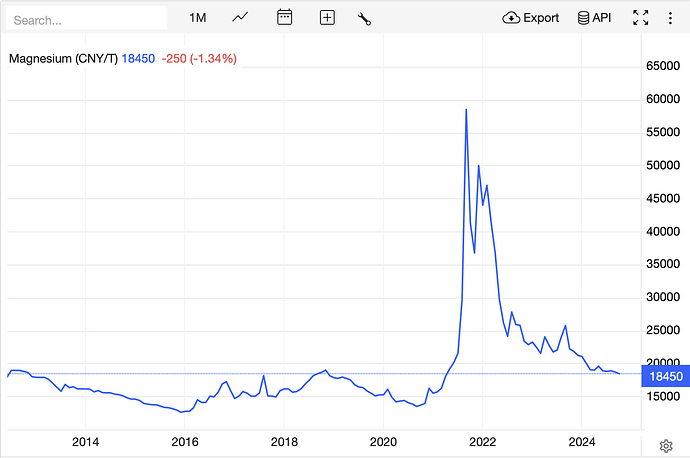

Another reason could be that magnesium prices are at a 3 year low!

Par’s API portfolio primarily consists of magnesium salts, and their margins are directly linked to fluctuation in magnesium price. The price of magnesium can be correlated to their margins in the past as well. This was also mentioned by the company in their annual report (you may check my previous post on this thread).

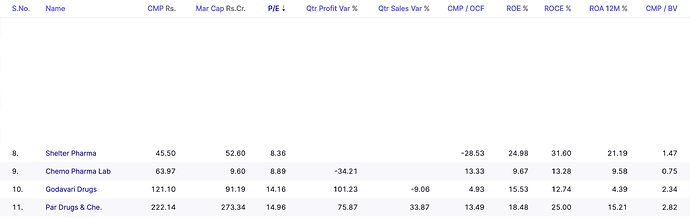

Valuation

Currently on Screener, in Pharmaceuticals – Indian – Bulk Drugs companies, there are only 3 profitable companies (out of 34) with a lower PE than Par (PE-15), and none of them are as financially sound.

Under the radar currently, with markets looking relatively week. Could we see a possible re-rating after these results?

Great articles to read on the web (23-10-2024)

Smart money’s take on Generative AI and the investment opportunities in that space.

-

RAGs are passé, agentic workflows (cognitive architectures) is the next stage in evolution…as they have the capability to solve the messy real world problems.

-

Two years ago apps on top of GPT3 were derided as thin “wrappers” but this is where moat is and most value will be created (multiple Unicorns in the last couple of years and many more to come)

-

From an investment standpoint, stay clear of investing in companies that are competing in Infra (Nvidia) and foundational model (Open AI, Meta) space

Dynamic Cables – Much more dynamic in 2022? (23-10-2024)

Block buster results yesterday…and first time call today

Capacity taken up from 20k km to 25k km

Indiabulls Housing – A compounder from here? (23-10-2024)

I hope so… When do you see we will get clarity on Legacy book ? Kind of valuation this company has it also seems it is an easy target for acqusition by big player. Only two points which are concerning me a) Quality of legacy book & b) No skin in the game (This matters most for small to mid size company)

Setting up a new investment fund. Would like to ideate on the customised screeners I need to build to filter out investment ideas (23-10-2024)

Started my mini fund thanks to the corpus contribution from my IIMA batchmates. To start with I would like ideate with the community to build my own customised list in screener to filter out stock ideas .

A brief background of mine – CA (work ex with SEBI, Aavas Financiers Ltd and Shopkirana( a portfolio start up of Infoedge, Sixth Sense Ventures and OIJIF) . Currently post my MBA I have joined a management consulting firm Arthur D. Little

Thanks in Advance to the community for all the inputs

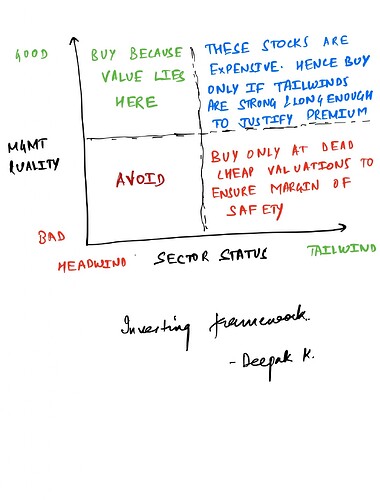

This is the broad investment framework I would like to stick to

The harsh portfolio! (23-10-2024)

Although it’s on the higher side, Eureka provide optionlaties not only on the consumer products, also fast growing PLI electronic sector too

The management is incentivised Directly proportional to the growth, almost all of the senior management that is

Their compensation is directly tied to the growth of the company

If I m not wrong, it’s 2.5X minimum growth upto 5-6X growth within next upcoming 6-7years , something like this as target for management

Chennai petroleum (23-10-2024)

Will this loss be one off or going to show up in next few quarters?

Hyundai Motor India Limited – HMIL (23-10-2024)

KIA is partly owned by Hyundai Korea & not by Hyundai India, hence its a competitor here.