Where do Bhagiradha Chemicals fall in the value chain of Agrochemicals . Are they Generic Active Ingredient manufacturers or they market their own products directly?

Posts in category Value Pickr

Sandeep Kamath Portfolio | Momentum Investing (27-01-2024)

Can you elaborate on the selection criteria, holding period, stop loss, target expectation if any, inclusions and exclusions etc?

Sandeep Kamath Portfolio | Momentum Investing (27-01-2024)

It is high risk game considering the expected volatility / wild swings due to pre-post budget events and loksabha elections. Also Q3 so far has been a mixed bag.

Akash Portfolio (27-01-2024)

Very roller coaster type journey. So currently how much % into stocks and MFs?

Also whats ur opinion about Flexicap funds who have given arpund 20% CAGR in last 10 years and some small cap funds who have given 25-28% CAGR in last 10 years?

Jupiter Wagons Ltd (previously CEBBCO) (27-01-2024)

Where is JWL headed?

I see they are now venturing into new businesses, aside from just the wagon’s.

- railway brakes

- EV commercial pickups

- marine containers

What are your views on this?

Is it positive and will it open new growth avenues and potentially build JWL towards a solid player. (Will it overtake TWL/Texrail)

Ideally, if they max out on their wagons production 8-10K / year – then these new businesses should propel the company into new directions and new revenue streams.

Wondering why the broader market hasn’t valued these developments, it’s not seen in price action/volumes.

What does the market know – that’s preventing it from jumping in on Jupiters wagon?

Invested at lower levels, and in thoughts.

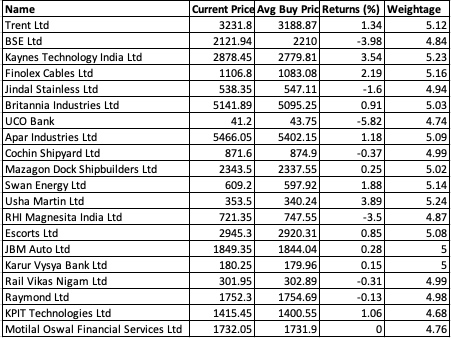

Sandeep Kamath Portfolio | Momentum Investing (27-01-2024)

Hi All,

Although I have been around for a while on this forum, I haven’t actively contributed/participated and in fact this is the first time I am initiating a thread.

About Me → I trade for a living – am a full-time day trader. I also have started a Mutual fund advisory service. Prior to trading, spent 17 years in the IT industry during which I got into the markets in 2013. Used to buy/sell stocks purely on the basis of fundamental analysis. Liquidated everything in 2018-2019 to close out my home loan…post-that, I quit the IT industry to become a full-time trader. Now, its pretty much everything in mutual funds ( that I pledge to get the required margin for intraday trading ).

So while this being in place, I got interested in Momentum investing sometime last year. Over the last few months, I spent a lot of my free time to write backtesting programs to try and close on a framework. Idea was to drill down to a strategy that has the combination of optimal returns and controlled drawdowns. Just last week, I did manage to close on this and have initiated a portfolio for myself.

This portfolio has been initiated just this week so nothing to report on its performance. This is purely price-based at the moment. Going forward, want to add a couple of filters from a fundamental standpoint as well but havent yet been able to close on the same. Kicked off the 20-stock portfolio nevertheless. Universe I have chosen is Nifty 500 and I essentially look at 6-12 month returns to rank the stocks.

From a timing standpoint, this is probably a bad time for momentum investing considering the run-up we have had but then I also thought the next few months will test out the resilience of the portfolio. Lets see how it goes.

Will be happy to get more insights on Momentum style if there are any practitioners here.

Piccadily Agro Industries Ltd (27-01-2024)

In the thread above, I couldn’t find any place where it has been stated that the revenue based on Indri alone would be thousands of crores. At best, it is implied that the EBITDA could be 300cr from Indri based on 25% margins for single malt (which implies a revenue of 1200cr) which is based on 20,000 bottles per day capacity the management is aiming for.

Also, please bear in mind:

- the domestic Indian single malt market has been growing at >20% for last few years which means market doubles every 3yrs

(in fact, Indian SMW market grew by CAGR ~50% over the last 5yrs – Piccadily Agro Industries Ltd – #79 by anon ) - a large portion of production – almost 25-70% based on brand – of Indian single malts is exported so it wont come under domestic market size

- in 2023 Indian single malt sold more than the foreign scotch whisky.

- There is a growing trend from mass market to premiumization as was stated by Diageo in their recent earning call.

Finally, please note that Indri is only a small part (at least currently) of Piccadily Distillery segment – they have a number of other products/brands as well as malt spirit, ENA and ethanol biz and also setting up a new dual feed distilley in Orissa which will be operational by Sep 2025 under GoI’s ethanol programme.

Rain Industries – An oversold de-leveraging play (27-01-2024)

I was just checking balance sheet where I can see Goodwill as % to Networth (82%) is really very high, Any big headwinds in overseas business can result in Impairment of goodwill, this could be the reason of Low P/B, Mr. Market is quite smart to value the business mostly.

Any thoughts on this?